Doug Croxall on panel at IP Dealmakers on Nov. 7, 2014.

Doug Croxall is Chairman and Chief Executive Officer of Marathon Patent Group (NASDAQ: MARA), which is a patent acquisition and licensing company. Prior to joining Marathon, Croxall was the CEO and Chairman of Firepond from 2003 – 2009. He acquired the public company in 2003, taking Firepond private in an all cash tender offer. While CEO of Firepond, the Firepond patents generated approximately $90 million in licensing revenues.

I met Croxall in New York City in November 2014, at the IP Dealmakers Forum. Croxall has been successful in the patent monetization business for years and had a unique prospective on patents as an asset. “If you are going invest your family’s fortune, I don’t think you will put all your money in one equity,” Croxall explained in a panel discussion at the event. “So it is the same thing with respect to an asset or a portfolio of assets.” He would go on to say that Marathon Patent Group has learned from “what worked in other asset areas and applied it to this one.”

While this philosophy may not be considered earth shattering within he investment community, talking about patents like they are similar to any other asset and applying tried and true investment principles struck me as quite enlightened. Yes, patents are becoming a more widely known asset class, but within the patent industry, or at least the day-to-day patent attorney industry, I haven’t heard many (if any) speak of patent assets in this way. I was immediately intrigued for many reasons, perhaps most directly because I always preach to inventors and entrepreneurs that they should look at what succeeds in business and apply those lessons to their own endeavors, which was at the heart of what Croxall was talking about. I knew right away I wanted to interview him.

Without further ado, what follows is my interview with Doug Croxall, which took place via telephone on November 21, 2014.

QUINN: I appreciate you taking the time to chat with me today, Doug. These are interesting times in the patent industry — and even more so with respect to the monetization industry. So with that in mind I thought it might be interesting to start with a broad general discussion about where the market is today. Where do you see the market heading versus where it was a couple of years ago?

CROXALL: I think the biggest change between today and three or four years ago is that then one of the favored strategies was aggregating a very large portfolio comprised of thousands of patents and using this to force settlements and ultimately a license. It was a game of numbers, although that was never my practice.

In the past, the more assets you had the better your “portfolio” was perceived. But I was never a believer in that strategy — I’m a “quality over quantity” kind of guy. And I think that today it’s not as important how many assets you have but the quality of the assets that you have.

And along the lines of quality, obviously with the different post-grant review procedures — as well as Supreme Court decisions, specifically Alice — certain patents are just not going to produce licensing revenue today.

QUINN: Now any time we talk about patent quality I always like to try and then follow up and ask about the definition of patent quality you are using, because that term can mean so many different things to so many different people. My guess is you mean all of those different things, but when you specifically talk about patent quality what is it that you look at?

CROXALL: It depends on the type of risk that I’m willing to take with a given asset. With some assets I’m willing to take a lot more risk — meaning if we see patents or a single patent that has never been litigated, has never been licensed, obviously that tends to have more risk because there’s more unknown about the asset. Compare that to an asset that’s survived an IPR or CBM or has already achieved licensing revenue. So the quality of the asset can also be based on the timing within the licensing life cycle.

Obviously, the quality of the asset can also be dictated by the inventor and/or the company that the inventor worked for, the technology area that the invention intends to cover, and all the way down to how the elements were drafted, the history of the patent, the specifications of the patent – there are so many characteristics that comprise “quality.” But generally speaking, if a quality patent is expected to generate licensing revenue we’re going to have to see clear infringement, we need to have the ability to create accurate (or what we believe are accurate) models with the information that we possess. And most importantly today, we have to know that it’s going to survive a validity challenge.

The other issue, getting back to your original question about the change in the market today from three to five years ago, is that it used to be that your patents were presumed valid and you really fought on infringement. I think that’s been turned on its head today. Now your patents are, for the large part, presumed not valid and you have to prove your validity if you get challenged through an IPR or CBM. And then you move on to the infringement argument.

QUINN: That makes a lot of sense because at the end of the day there’s really no way to value a patent unless it’s being infringed and until you have an idea whether or not it’s likely to stand the test of time if it’s challenged. But I wonder what this means long term. Are you a buyer? Maybe not in the strict sense of laying out cash, but would you be a buyer in the long term for these assets? Or would you be shorting the patent system now?

CROXALL: That’s a great question. There are certain assets that I don’t think stand a chance in an IPR proceeding. And there are other assets that I think are very strong in that regard. So it’s just like saying “do you short stocks or do you go long on stocks in the market?” There are certain stocks where you’re like, “yeah, that’s over-valued, I’m going to short that,” and there are other stocks where you say “wow, there’s tremendous value ahead of that, I’m a buyer, I’m long on that.”

So I look at the patent asset absolutely the same way other investors look at the fundamentals of whatever asset class that they’re investing in. I couldn’t give you an answer for the entire asset class, but on an individual portfolio-by-portfolio basis I think there are certain assets that I would short and there are other assets that I would go long on or I would buy.

Clearly Marathon is a pretty active acquirer or investor in patent assets and we’re going to continue to be so. Frankly, I’m a big believer in overreaction. And I think there may be some elements of an overreaction with respect to patents today. Just because one business method patent doesn’t survive it doesn’t mean they’re all going to be invalidated. So I do believe that there are some good buys.

QUINN: Are you making decisions based on a belief that the pendulum may swing back over the next handful of years towards a more patent-owner-friendly set of laws? It sounds like you’re not banking on that happening.

CROXALL: No, I’m not. I’m not a timer. That strategy would be one of trying to time when or if that movement occurs. I sure hope it does, but the great thing about a pendulum is it’s constantly moving. I don’t know when, but I suspect that at some point it starts to move back the other way. And actually we may already see the seeds of that being sown. A lot of the anti-patent rhetoric from some of the larger tech companies has gone away and has actually been replaced with support for some of the intellectual property laws and protections that they previously lamented.

So I don’t know. I don’t know when that swing would occur. I tend to think it will, but I’m not sure when. But we’re not making a decision to buy or not buy something based on timing or what the market thinks.

QUINN: Right. So you’re just a classic asset evaluator then?

CROXALL: Yes.

QUINN: And generally speaking, are you seeing assets that you like now? I suspect you’re probably seeing a lot more that you don’t like than just a few years ago.

CROXALL: Yes. I’ve been pretty finicky for a long time. The funnel got tighter, clearly. Actually, we tightened our funnel prior to Alice being decided, hedging on the side of conservatism. That probably turned out to be a good hedge in hindsight, but we still see a tremendous amount of opportunity.

I think there are fewer buyers probably today than there used to be. So we still see quite a bit of opportunity, but the standards of what we would invest in, or what we would acquire, have gotten tighter. Therefore, there’s a lot more that we may have invested in in the past but not today.

We’ve also started to see a broader base of assets that don’t just cover the high tech market — automotive, med tech, pharma…. A lot of the other industries that previously wouldn’t work with a company like Marathon have changed their positions and are looking at their patent portfolios purely as an asset class. They’re looking at the responsibility they have to their shareholders to do everything they can to monetize those assets. A broader opportunity in other technology areas would help to offset some of the tighter standards that we have.

QUINN: You know, that’s interesting because I don’t think a lot of these companies really looked at their patents as an asset class prior to last several years. I keep wondering whether the long-term legacy of the “patent troll,” whoever that is, will be to have woken up corporate America. They realize they’ve been sitting on a gold mine for a very long time and did nothing to capitalize on it.

CROXALL: The vast majority of the time that I’m in a discussion, meet someone, settlement talks, licensing talks, I always say, “You probably have assets.” Or I will actually identify some of their patent assets and say, “you know, we can help you make money with those assets.”

And a lot of times we’re persona non gratae in those conversations. But a lot of times my defendant/licensee becomes a client – a patent seller or a revenue sharing partner going forward. There’s no greater introduction or explanation of what I can do for an asset holder than to license an asset to them and draw capital for that license out of them. And we always conduct ourselves in that manner. I look at settlements as a sales call to get new assets.

I, like you, have not quite figured out what the definition of a “patent troll” is, because it seems to change all the time based on whoever’s writing about it. But I will say this: I remember when being a corporate raider was a horrible thing to be. But you know what? It made the market more efficient. It made management teams more efficient. It cut back on a lot of waste in corporate America. And now those guys are called “private equity” and they’re loved by all. Well, they’re loved by many, I should say.

So who knows what the legacy will be? History will write that. But I tend to think any time you make a market more efficient and cut waste you probably will be viewed beneficially in the future. I don’t really care what people say or write about us. It’s the people that invest in the company or the inventors that we work for that matter to us.

QUINN: Let me shift gears slightly and ask whether you are concerned about additional patent reform? Or would you view that as just another movement in the market that will create some opportunities while it may foreclose others?

CROXALL: I’m always concerned about potential reform, but I just don’t know if the “reform” is actually patent reform or litigation reform. Some of the things that were the subject of last year’s proposed reform have already been addressed. Fee shifting has changed quite a bit because of the recent Supreme Court rulings. The FTC is cracking down on some of the bad behaviors associated with mass-mailing/letter writing that some NPE’s have undertaken.

I don’t think you can say, “Hey, only you can own this asset.” Well, why? Why can’t I own it? Why do I actually have to produce something to own it? Or enforce it? I think that’s a slippery slope and I just can’t see us going down that path.

Reform or not, I just like things to be settled. The less uncertainty, the better for the capital markets. And whatever happens, typically we’ll adjust and handle it accordingly. But it’s hard to say what impact reform may or not have on our business.

QUINN: Yes, I don’t know what to think. We’ll have to take a look at what we see and what’s going to happen. I think some of the fear is now with the Republicans in charge it may wind up being even more onerous in terms of the patent owner and innovator side than what the Goodlatte bill was previously. And I agree with you that a lot of this has already been handled to some extent in the courts. And I also wonder whether the people who are pushing for even broader fee shifting language than what would be found in the Supreme Court decisions realize that at the end of the day if we have a loser pay system an awful lot of times it’s the big company that winds up being the loser in these cases that go all the way through.

CROXALL: I couldn’t agree with you more. As a matter of fact, just today we received notice in one of our cases where Apple, who’s our defendant, did some things that the judge felt were wrong and sanctioned them in the middle of the litigation process. We were just awarded a hundred and some thousand in fees. Obviously we’re not retiring off that, but it just goes to show you that knife can cut both ways.

QUINN: No, that’s exactly right. I actually did just see that decision and I think that one of the things that has been lost in this whole discussion about patent reform or litigation abuse is that so many of the people who have had to fight the large companies all the way through to the end do wind up getting fees in various stages for various transgressions. And so many times the big tech companies just fight this war of attrition and I think a lot of this is going to come back to haunt them. I think it’ll come back to haunt them on advocating for weaker patents, easier to challenge patents because they have such vast portfolios. I think a lot of people stood up and took notice when Alibaba got that crazy evaluation. And I’m hearing that people in Silicon Valley for the first time are more afraid of Chinese companies coming to America than they are of patent trolls.

CROXALL: I understand patent reform — you can’t send letters to coffee shops and ask for a thousand bucks. I get it. But of all the things to be concerned about, I’m not sure that NPE’s should be on that list. I mean Silicon Valley should be focused on their competitors more than on NPE’s. And for your example of Alibaba — I could go down the list of the tech sweethearts in Silicon Valley or elsewhere and find one or two challengers for each in China.

QUINN: I think the Chinese have all the ability in the world to come in and eat the lunches of big US tech companies.

CROXALL: I do, too. And you know what’s going to happen at some point? Those big tech companies are going to say, “You know what? They’re infringing our IP.

QUINN: Exactly right! For the life of me I don’t understand where are the shareholder derivative lawyers in all this?

CROXALL: Oh, I bet that’s coming.

QUINN: If I was running a pension plan for California or New York, or a teacher’s union or whatever, and I’m investing in these companies, I’d have some very, very difficult questions I’d want them to answer.

CROXALL: As I explained to someone recently, there are different tools for different things. If you get a blister and you want to pierce it, you don’t want to take a scalpel and cut your toe off.

It befuddles me. They must have a grand plan. But if the grand plan is “let’s weaken the patent system so guys like Marathon can’t force us to pay a fair licensing fee”? They’re playing checkers when they should be playing chess.

QUINN: Do you get involved in any kind of pharmaceutical or biotech issues?

CROXALL: Well, we own some assets and we have some cases in those industries. So to that extent, yes.

QUINN: I wonder if you were to literally apply the law of obviousness, as it developed after KSR, whether drugs are still patentable in the US — because so much of the way that the pharma companies work uses computer-assisted software to determine what the lead compound is. You can’t really expect to get much of a patent on that software now, by and large. And if the computer is the one doing the “thinking” to come up with the lead compound, then isn’t the drug obvious? It strikes me that when pharmaceutical companies wake up, that may be when we see the tide turn.

CROXALL: I can’t comment on when they may or may not wake up. But what’s interesting is that a lot of astute professors who were calling for reform are now saying maybe we should let the dust settle and see what happens.

And I know that in Congress they want to demonstrate to their constituents that they’re actually accomplishing something. I wonder if patent reform isn’t an easy target for some of the elected officials to say, “Hey look what we’ve done.”

QUINN: Yes, I know, that’s my cynical view too. We drew the short stick because this is the one thing that they don’t argue about. They seem to, in my words, equally not get it across the aisle.

CROXALL: [Laughter] I like that. Equally not get it. You know, whenever you see Congress completely agree on something we should be really concerned. That’s not how it was set up.

QUINN: No. No it was not. It’s funny how our system has progressed. A few years ago one Congressman shouted something out during the State of the Union and it was like, oh, my god everybody’s aghast. And to think about what would have happened back in the late 1700s or the early 1800s, I mean these people were shooting at each other when they disagreed.

CROXALL: Yes, right. Whenever you see 98% of Congress line up on the same side of the issue that involves our Constitution it tends to make me a little nervous.

QUINN: I agree with that as well. So, well, I’ve taken up a lot of your time. I really appreciate you chatting with me.

CROXALL: Of course, Gene.

QUINN: And hopefully over the next few years we’ll see some good news and good movement in the marketplace. Because the one thing I do think that gets lost, and maybe you can comment on this and we’ll wrap up here, is that these assets really matter for the economy. They matter for companies and job creation and far more than what your average citizen understands.

CROXALL: The long term effect of what we’re allowing — or potentially allowing — our politicians and big tech companies to do is going to be devastating to our kids’ or our grandkids’ generation. I think we’ve seen some effects already, but with Alibaba and some of the Chinese companies, it’s gonna be devastating. I don’t know how hard it is to look at history and understand that the strength of the patent system was directly correlated to the strength of our economy. It wasn’t the only cause, but there’s clearly a relationship. It’s kind of sad, and hopefully we’ll avoid making mistakes that history will teach us we made, but it’s a little bit like yelling into the wind. I know you get it, but I’m not sure the broader audience is really listening or even trying to understand.

QUINN: And that is very unfortunate but I think you’re exactly right. Hopefully this interview will help reach a broader audience. It is certainly our intention to continue to try and reach a broader audience moving forward. But it does seem we have our work cut out for us. Well, I really appreciate you taking the time to chat with me.

CROXALL: You bet, Gene. Keep up the good work I enjoy reading your website.

QUINN: Oh, good. Well, thanks. Keep doing that!

CROXALL: You bet.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

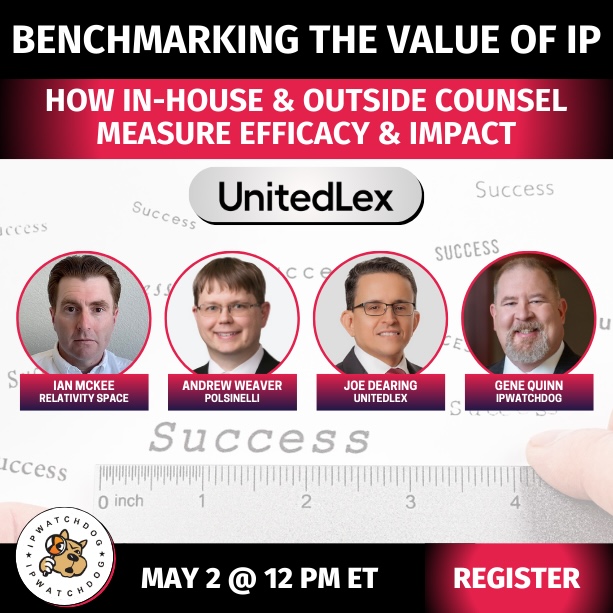

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.