The patent world is fundamentally in a different place than it used to be. Although the patent headlines still frequently focus on non-practicing entities (NPEs), sometimes using the pejorative term patent trolls, our innovation economy pushes forward despite the rhetoric and PR hype. During this time of public scrutiny and distrust it is time for innovation intensive companies to focus on something else: sound business practices. At the end of the day focus on sound business practices should always have been the cornerstone to an innovation strategy, but today returning to business 101 principles is absolutely essential.

The patent world is fundamentally in a different place than it used to be. Although the patent headlines still frequently focus on non-practicing entities (NPEs), sometimes using the pejorative term patent trolls, our innovation economy pushes forward despite the rhetoric and PR hype. During this time of public scrutiny and distrust it is time for innovation intensive companies to focus on something else: sound business practices. At the end of the day focus on sound business practices should always have been the cornerstone to an innovation strategy, but today returning to business 101 principles is absolutely essential.

In an earlier article in this Building Patent Success series I talked about the importance of a sound portfolio development regime. Today’s focus turns to management of a portfolio to build and sustain a successful patent operation.

Step II: Sound Portfolio Management

Although the job of developing the patent portfolio never ends, once the assets begin to reach a critical mass it becomes equally important to tactically manage the portfolio. Because if not managed properly, a patent portfolio will not only fail to generate revenue, it will also drain the company coffers.

Know Thy Portfolio

Yes, it is silly to suggest that a company should know its own patent portfolio. At the same time, many innovative companies have no idea what is actually in their patent portfolio. They don’t know what subject matter their patents cover. They don’t know which of their patents cover which of their products. And they usually don’t know which companies are infringing which of their patents. Unfortunately, these realities tend to manifest at the most inopportune of times, be it the threat of a competitor patent assertion, the sudden need for a portfolio valuation or an unexpected window to do a patent transaction.

So do the homework ahead of time, whether through analytics, competitor surveillance services, an IP advisor or good old sweat and tears. Know which of your patents cover which subject matter. Know which of your patents relate to which product lines. And know which of your patents are infringed, and by whom. Only once a patent owner is armed with such knowledge can it begin to unlock the revenue potential of a portfolio, or know which assets in the portfolio aren’t carrying their weight.

Prune Thy Portfolio

A portfolio undergoing prosecution really is like a fast growing tree. Before long, tens of patents become hundreds, and hundreds become thousands — many of which lose strategic value over time. And just as one should trim that overgrown tree in the yard, so too should a growing company actively trim its own portfolio. After all, why pay maintenance fees for patents that no longer add strategic value?

Which patents should be let go? Obvious candidates for pruning could include (a) patents that largely duplicate other patents in the portfolio, (b) patents with extremely long or overly narrow claims, (c) patents covering a technology or product line that never took off/witness market adoption, or (d) patents claiming aspects of a technology that cannot readily be identified in third party products, thus making it next to impossible to prove infringement. This necessary exercise can yield substantial cost savings — savings that can be reinvested into R&D, future portfolio development or monetization.

Monetize Thy Portfolio

While strategic abandonment can certainly yield cost savings, offensive use of the portfolio — be it monetization to raise revenues or assertion to stop copying — is necessary to generate revenue or license technology to adjacent markets. And much like one would approach the management a financial portfolio — by including, for instance, a mixture of equities, bonds and managed funds, each with its own risk/reward profile — so too should a company approach management of monetization efforts. Just like a financial portfolio, each patent monetization option has its own risk/reward profile, and where possible, diversification is wise.

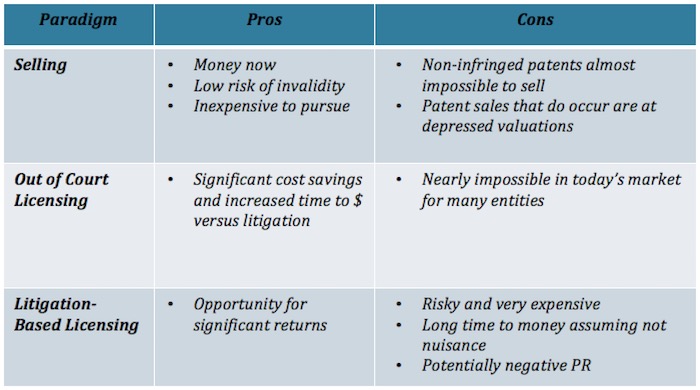

Below, we consider a sampling of the monetization models available to patent holders today, including the risks and rewards associated with each. We begin with a realistic overview of the traditional paradigms and then explore important and less litigation-centric options.

The Traditional Paradigms

When many think of patent monetization, patent sales and licensing (in and out of court) are what come to mind. But given the recent introduction of the patent killing Inter Partes Review proceeding, a slew of recent anti-patent court decisions, and a wealth of precedent making it harder to achieve large damages awards, all patent owners should understand that risks and potential rewards associated with these paradigms.

Patent Sales

Selling patents, whether to a NPE or operating company, is hands down the least risky and least expensive monetization approach. And the economics reflect as much. Gone are the days of portfolios selling for billions of dollars. Here instead is a market that looks very skeptically upon the validity of any patent, with pricing to reflect as much. Put simply, most patents are not salable, particularly “good idea patents” (e.g. patents that are not infringed but represent a good idea technology). The situation is also not very bright for many software patents in light of the Supreme Courts infamous Alice decision.

But if you’re holding patents that are infringed, and you have reputable evidence of use to prove as much, a sale is certainly a possibility. Although we don’t hear much about them, sizable portfolios are bought and sold among operating companies with steady frequency. Smaller entities, however, are having a bit of a tougher time.

Whether to a NPE — many of which have grown reluctant to advance substantial sums up front, instead preferring to share backend litigation proceeds — or an operating company, patent valuations in general, and particularly for smaller entities, reflect the largely anti-patent precedents of the past few years. If you are interested in selling your patent, you should also know that buyers appear more hesitant to acquire extremely large portfolios, but at the same time don’t look favorably upon single patent deals. It is also a huge selling point if patent prosecution of the asset you are looking to sell remains open.

The bottom line is that the patent market is beginning to thaw, which is fantastic news. If you are lucky enough to own non-software patents that are being infringed, a sale is certainly a possibility. But beware, because valuations are not what they used to be.

Licensing

Patent licensing has come to mean many things. It could mean out licensing technology to a company in an adjacent market, for commercialization. It could mean seeking compensation from a competitor copying your technology. And it could also mean pursuing the monetization of non-core patents to drive revenues.

Unfortunately, unless you are a billion dollar, multinational company, patent licensing today (in all but the technology transfer context) tends to mean one thing only: patent litigation. For a host of reasons, not to mention risk triage, many if not all of the most sophisticated technology companies do not respond to licensing offers unless they are sued.

And given the introduction of the America Invents Act, the economics of patent litigation have changed quite considerably. Prior to introduction of Inter Partes Review, defendants facing costs into the millions for defending a case were typically eager to settle good cases for reasonable sums. That is no longer the situation, as a defendant facing a district court patent assertion has a fairly high likelihood of invalidating the asserted patent in Inter Partes Review, at costs dwarfing full-scale patent litigation. Significant early stage settlements have thus become a rare phenomenon. To get there, a patent owner must prevail in IPR and taken the case deep, if not all the way to trial.

But when it comes to trial, things have not gotten easier, particularly from a damages perspective. Courts have become highly skeptical of damages theories tied to the sale price of an entire infringing product, when the asserted patent covers but a feature of the overall product. Injunctions have also become all but impossible unless the infringer is a competitor stealing your market share. While all is not lost, as significant patent verdicts do still occur, such verdicts are certainly not the rule. Patent owners would thus be wise to set realistic expectations before initiating potentially risky, and certainly very expensive, patent litigation.

In fact, there has never been a better time for innovation intensive companies, with valuable patent portfolios, to consider new paradigms for leveraging the value of those portfolios that do not involve litigation.

The New Paradigms

Crisis is often said to spawn opportunity and the patent world is no different. Uncertainty in the litigation arena has spawned new, non-litigation offerings to innovators desirous of leveraging the value of their patents. Below is a discussion of three such interesting paradigms.

IP-Based Debt Financing

As the recent $300 million Jawbone deal exemplifies, an interesting avenue now available to patent owners is IP-based debt financing. At its most basic, this transaction is essentially a patent mortgage wherein an IP specialized lender provides debt financing, with one or more patent families serving as the collateral for the loan. The loan is non-dilutive, can be utilized to finance the purchase of additional patent portfolios, or simply to cover operating expenses. In the event of default, the lender takes possession of the patents and likely looks to monetization to recover its loan.

Royalty Monetization

As the recent Jawbone deal, and a slew of pharmaceutical deals over the last decade, has also demonstrated, another attractive paradigm for patent holders to access non-dilutive capital is that of royalty monetization. Pioneered some time ago in the pharmaceutical space, a typical royalty monetization deal involves a technology company with contractual entitlement to a recurring, future royalty stream and an investor who acquires some, or all, of the future royalty stream in exchange for a significant upfront payment (or payments). And as more sophisticated investors enter the technology IP space, no longer are such deals only the purview of pharmaceutical companies. Where there are contractual, recurring royalty or cash streams, these transactions are a possibility. Depending on the royalty stream, the capital infusion can be substantial. It is also non-dilutive and an excellent potential source of revenue to further future R&D or expansion.

Equity For Patents

Finally, tapping into today’s start-up fervor is the concept of equity for patents. Appealing mostly to larger companies, with expansive patent portfolios, the gist here is for a company to transfer title of one or more patents to a smaller company in return for equity in that company. The smaller company gets a much needed infusion of relevant IP — particularly IP with preferable priority dates — and the seller gets not only the favorable press (after all, who doesn’t like companies helping start-ups?), but also an interesting avenue to potentially turn non-core assets into significant future revenue — and all without litigation.

CLICK HERE to CONTINUE READING… Up next will be discussion of best practices in building the right IP team and doing smart IP deals.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Robert Fletcher

November 3, 2015 05:36 pmWhile the author is quite correct in describing different ways of monetizing patents, at the end of the day it comes down to the fact that the only right a patent conveys the right to exclude others …. That right is enforceable in a court of law. Thus, fundamentally the issues are validity and scope of the claims both of which will be decided in court. Acquisition of patent enforcement and defense insurance will enhance your ability to achieve out of court licenses by making you a more formidable legal adversary. Also an IP collateral guarantee policy (yes, they exist) will make a lender more willing to make a non-dilutive loan.