Multiple American industries will be shaken up by a merger between two of America’s largest, oldest and most research-oriented organizations: DuPont (NYSE:DD) of Wilmington, DE and Dow Chemical (NYSE:DOW) of Midland, MI. The merger, announced in early December, values the resulting company at $130 billion, with DuPont and Dow investors taking a 50/50 cut of the new company. Dow shareholders will receive the same number of shares in the newly formed DowDuPont that they already hold in Dow, while DuPont investors will receive 1.282 shares in DowDuPont per DuPont share held.

Multiple American industries will be shaken up by a merger between two of America’s largest, oldest and most research-oriented organizations: DuPont (NYSE:DD) of Wilmington, DE and Dow Chemical (NYSE:DOW) of Midland, MI. The merger, announced in early December, values the resulting company at $130 billion, with DuPont and Dow investors taking a 50/50 cut of the new company. Dow shareholders will receive the same number of shares in the newly formed DowDuPont that they already hold in Dow, while DuPont investors will receive 1.282 shares in DowDuPont per DuPont share held.

No one should get too used to seeing the name DowDuPont, however. Company executives plan on splitting DowDuPont into three separate companies, each with a specific industry focus. One will be a $19 billion company focused on the corporation’s combined properties in agricultural products, including fungicides, genetically modified seeds and herbicides. A $13 billion specialty products company will also be spun off to produce electronics materials, Kevlar, Tyvek, food additives and other biological products. The largest of the new companies, however, will be a $51 billion firm with a focus on construction materials, vinyl, packaging plastics and specialized chemicals for the automotive and pharmaceutical industries.

Before the spinoffs start to happen, however, DowDuPont will for a brief moment be one of the world’s intellectual property powerhouses in terms of patents. By the end of 2014, DuPont earned the 38th highest amount of patents in that year from the U.S. Patent and Trademark Office, taking home 1,039 patents according to information published by the Intellectual Property Owners Association. Dow wasn’t too far behind, earning 627 U.S. patents during that year to place 73rd among all patenting organizations seeking grants from the USPTO. The 1,666 combined patents earned in 2014 would have placed it 18th overall among all companies. Innography’s patent portfolio analysis tools are showing us

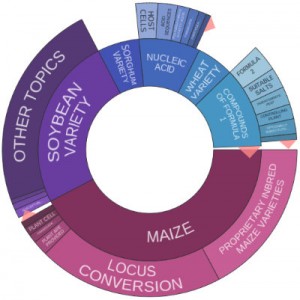

Before the spinoffs start to happen, however, DowDuPont will for a brief moment be one of the world’s intellectual property powerhouses in terms of patents. By the end of 2014, DuPont earned the 38th highest amount of patents in that year from the U.S. Patent and Trademark Office, taking home 1,039 patents according to information published by the Intellectual Property Owners Association. Dow wasn’t too far behind, earning 627 U.S. patents during that year to place 73rd among all patenting organizations seeking grants from the USPTO. The 1,666 combined patents earned in 2014 would have placed it 18th overall among all companies. Innography’s patent portfolio analysis tools are showing us  that, so far through 2015, Dow has earned 601 U.S. patents while DuPont has taken in 713 patents, so it’s clear that DuPont is seeing its R&D draw back just a bit. The DuPont R&D text cluster posted here shows us a lot of activity in maize and soybeans, underscoring its activities in agricultural development. By contrast, Dow’s IP portfolio this year is showing us a great deal of development in coating compositions, epoxy resins, photoresist compositions and carboxylic acids.

that, so far through 2015, Dow has earned 601 U.S. patents while DuPont has taken in 713 patents, so it’s clear that DuPont is seeing its R&D draw back just a bit. The DuPont R&D text cluster posted here shows us a lot of activity in maize and soybeans, underscoring its activities in agricultural development. By contrast, Dow’s IP portfolio this year is showing us a great deal of development in coating compositions, epoxy resins, photoresist compositions and carboxylic acids.

If anything, this major corporate merger showcases the growing power which activist investors are becoming more able to leverage. Here on IPWatchdog, we reported back in May on the activities of Nelson Peltz and his Trian Fund Management LP, which had advocated for splitting DuPont into two companies, one focused on DuPont’s more stable materials business and the other taking on the company’s agricultural and nutrition products. Reports from The Wall Street Journal indicate that Peltz was involved with behind-the-scenes talks with both Dow Chemical CEO Andrew Liveris and DuPont CEO Edward Breen in the days prior to the merger.

In agricultural products, the DowDuPont spinoff will compete heavily with seed developer Monsanto (NYSE:MON) as well as world-leading pesticide maker Syngenta AG (NYSE:SYT). Recently, Dow AgroSciences announced the development of a new herbicide for growers of spring wheat and durum which will become available to farmers in 2016. Dow’s agricultural sciences unit is also collaborating with Arcadia BioSciences to produce new yield traits and trait stacks for corn by incorporating Arcadia’s abiotic stress traits along with Dow technologies. DuPont itself is the world’s leading agriculture company and in 2014, half of the company’s research and development expenditures focused on innovation in agriculture. Some analysts looking at the DowDuPont merger expect that more acquisitions are likely on their way, further concentrating the small number of companies which hold powerful positions in the agriculture industry.

Dow and DuPont bring together some very robust development in electronics materials as well. DuPont recently unveiled its developments in producing stretchable inks that would be useful in wearable electronics applications. According to DuPont, the inks have shown the capability to withstand up to 100 wash cycles and can be easily incorporated into existing manufacturing processes. In October, DuPont announced the development of in-mold electronic inks designed to streamline the fabrication of rigid circuit boards for electronic devices. Dow is also focused on semiconductor packaging and was recently the recipient of an award from R&D Magazine for its SOLDERON BP TS 6000 Tin-Silver plating chemistry, which eliminates the lead used in chip packaging soldering while improving manufacturing performance. This summer, Dow Electronic Materials exhibited improvements to its line of electronic display technologies including TREVISTA Quantum Dots, a technology which can be precisely tuned to meet customer demands for wide color palette and color saturation.

Construction materials are another major focus area for both of these merging corporations. Dow’s STYROFOAM extruded polystyrene foam insulation product has been the focus of some innovative developments in sustainability; Dow recently received validation from global sustainability firm UL Environment that its foam insulation includes an average of 20 percent recycled content. Dow is also one of the companies which has agreed to participate in a White House-led initiative for private sector companies to reduce greenhouse gas emissions, especially hydrofluorocarbons used in its spray foam adhesive products. Meanwhile, DuPont’s construction material portfolio includes a wide collection of products such as Elvaloy resins, Sorona flooring and Tyvek weather barriers.

The merger brings together two of the major players in the plastics industry as well. Dow’s plastics business has recently collaborated with the Sustainable Packaging Coalition as well as Accredo Packaging towards the development of a recyclable polyethylene stand-up pouch for the packaging of dishwasher pods. Elastomers created by DuPont are used in a wide array of applications, including in the rubber, automotive and chemical industries. DuPont is also focused on thermoplastics, synthetic resins that become plastic upon heating, which are also used in a wide array of industries like automotive, cabling, cosmetics packaging and electronic plastics.

The act of combining both companies will not be entirely smooth, which is unsurprising given the massive size of either. The merger could impact headquarter locations like Midland, MI, which has been bolstered by Dow as other Michigan townships have seen industrial production decline. The integration process for merging the two organizations is expected to be complex and made even more complicated by the fact that this isn’t a situation where one larger company is acquiring a much smaller business; this deal has been billed as a merger of two equals. It will be interesting to see how the fallout affects the various industries of agriculture, materials and other sectors of research and development in which these two companies had previously competed against each other.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-banner-early-bird-ends-Apr-21-last-chance-938x313-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.