C-suites and boards of operating companies around the world have recognized that patents can be a revenue generator rather than just a cost center. Increased competition and rising costs have led companies to the conclusion that they need to diversify their revenue streams and for many operating technology companies, patents have proven to be, as Mark Blaxhill and Kevin Rivette coined, Rembrandts in the Attic.

C-suites and boards of operating companies around the world have recognized that patents can be a revenue generator rather than just a cost center. Increased competition and rising costs have led companies to the conclusion that they need to diversify their revenue streams and for many operating technology companies, patents have proven to be, as Mark Blaxhill and Kevin Rivette coined, Rembrandts in the Attic.

Having said that, the patent licensing environment has unquestionably become more complicated and challenging since the 2006 eBay court ruling which impacted the values for single patents or small groups of patents. As a result of a combination of this and other key judicial decisions (2013 Samsung v. Apple, 2014 Alice Corp. v. CLS Bank) and legislative changes or threats of change such as various proposed “Innovation Acts,” many technology companies will not respond to licensing offers unless they are sued.

Despite these pressures, valuable patent portfolios with high-quality assets are still being successfully licensed for large royalties or other important benefits to the patent owners. Ericsson and Cisco’s recent partnership deal is a good example. One common feature across most highly successful licensing programs is thorough and extensive preparation. In today’s market, success in licensing requires the patent owner to be focused, diligent and aware of the risk. As the risks are higher than ever, operating companies are investing much more in the due-diligence, research and preparation phase of a patent licensing program to persuade potential licensees into serious negotiations.

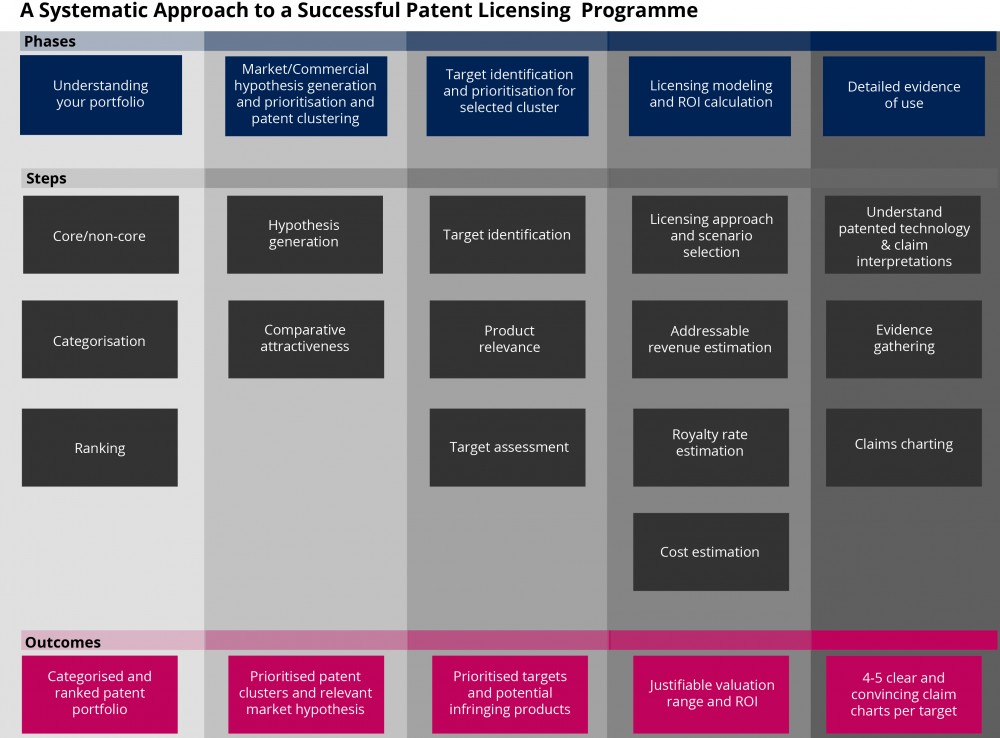

So, if you have decided to monetize your patents through licensing, how do you go about running an efficient, successful and cost-effective patent licensing program? The research and preparation work for a patent licensing program can be divided into the following five phases with helpful steps and intended outcomes:

The steps involved will vary based on whether your patents are already being infringed upon or if they protect a new technology that can extend market value or penetration. In this article, the focus is on the research and preparation for the licensing of patents that may already be in use.

A successful licensing program requires a systematic approach and uses different skills at different stages of the work. Many operating companies choose to outsource preparation which is research intensive, while managing the assertion phase within their existing licensing team. Outsourcing gives licensing teams an independent review of their patent portfolios. These reviews, if conducted by independent experts who deal on a regular basis with a variety of technologies, can also yield additional campaigns and revenue opportunities for the operating company that they themselves would not have identified.

Phase 1: Understanding your portfolio

It is important to distinguish your core assets from the non-core assets to identify the best candidates for licensing. Core patents cover technologies that are or will be embodied in current or future products. Non-core patents, on the other hand, cover technologies that are not being used in either current or planned products.[1] Companies have different strategies in terms of their preference for licensing their core or non-core patents based on the licensing program’s desired outcome. Identifying the candidates for licensing may require approval and involvement of other internal business units and their technical assistance to aid monetization.

Once the suitable assets for licensing have been identified and business clearances obtained, it is important to categorize these patents to identify clusters of similar patents that can be licensed as a package. It is often more useful to build a more valuable portfolio by packaging together patents with a broad range of technologies that contribute to numerous aspects of a company/product rather than only one or two.

Overall ranking is a reflection of the perceived strength and quality of the patent in a monetization setting. This analysis separates very good patents from the support patents. The ‘star’ patents are key to a successful licensing campaign. The rankings may need to be revisited after Phase 2, the market hypothesis generation phase, is completed because the choice of market will have a major influence on the value of the patent.

On the whole, the aim should be to have a detailed understanding of what you own and where the most value lies. It is also important to have an understanding of the technologies within your patent portfolio and how they are connected (a “taxonomy”).

Phase 2: Market/Commercial hypothesis generation & prioritization and patent clustering

A hypothesis is generated by considering specific commercial applications or product categories in which the patents are likely to be used. This is where a creative approach is needed, coupled with the ability to think broadly and beyond the licensor’s own industry. It is interesting how sometimes applications of a certain patented technology is found in a completely unrelated space. For example, in the 90’s CSIRO realized that their pioneering work in radio-astronomy had applications in the communication area. At the time, the communication companies were trying to introduce wireless networking technology, however they were struggling with a problem called reverberation. They found the solution to their problem from CSIRO’s patented technology and that led to the introduction of Wi-Fi.

Further you may want to aggregate various patent groups to develop a wider hypotheses to allow a more substantial offering. For example, endoscope, laser, ultrasound and other similar applications could be combined as medical technology/imaging to create a bigger commercial footprint on a potential licensee.

Comparative attractiveness of the market/commercial hypothesis is a crucial step in prioritizing the patents and identifying the appropriate markets that align with these patent clusters. A licensor may choose to run parallel campaigns with different patent clusters and target several markets simultaneously but each campaign requires dedicated resources of people, time, effort and money and over stretching may lead to reduced diligence.

This second stage of analysis provides further insights into the portfolio and indicates the best market hypothesis and relevant patent clusters. The complexity of the analysis and the charts will depend on the number of patents, technology spread, and the breadth of applicability of the patent portfolio. It may even make sense to break down the analysis to smaller clusters if a large portfolio is involved.

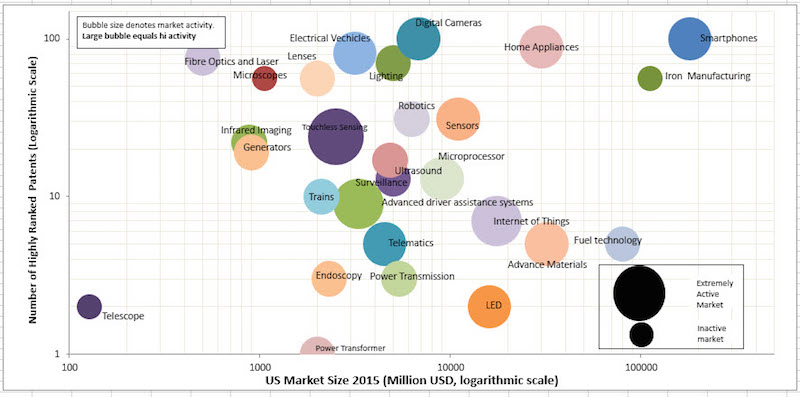

The diagram below illustrates the type of insights made possible by such an analysis. This example is from a large portfolio, however, on the basis of this diagram, smartphones, home appliances and digital cameras appear the most attractive and would lead one to a more detailed analysis of these patent clusters. In addition, the less attractive options can be eliminated, saving money in analysis and assertions with probability little financial reward.

Another variation of the data representation for a smaller patent portfolio is illustrated in the diagram below. This shows that each hypothesis in this portfolio has at least 10 highly-relevant patent families and the licensing hypotheses in the top right corner appears the most attractive.

Phase 3: Target identification and prioritization for a selected cluster

Once patent clusters and the corresponding applicable markets have been prioritized, the next step is to identify potential licensees and qualify their relevance to the hypothesis. This can be done through a number of investigative techniques.

Next, you will need to understand the product relevance of your potential licensees. This is a high-level assessment of each identified company’s products that may be relevant to the set of patents within the market hypothesis. Product relevance research will identify products in the potential licensee’s product range that may be infringing the patents and pin point specific features and assign a measure of infringement confidence related to each target.

Each potential licensee should now be assessed in terms of various risk and reward factors to help prioritize your top targets. To make the assessment quantitative, one often chooses to list these risk and reward factors, define a ranking criteria and rank all the potential licensees against each factor in a consistent way.

Whilst the steps are straightforward to define, implementing them is more difficult and not an exact science. It is best driven by the target’s past behavior, your market knowledge and objective analysis.

By combining the infringement confidence with the target assessment rankings, a prioritized list of companies to be approached can be generated. The choice of the best targets will be dictated by which factors are most important to the particular licensor or campaign and is critically linked to commercial goals, timescales and appetite for risk. A simple ‘dash-board’ visually representing the ranking assessment and therefore target prioritization can be a powerful tool for the boardroom or executive decision making.

Phase 4: Licensing models and Return on Investment

A viable licensing strategy provides a suitable Return On Investment (ROI). If there are several licensing scenarios, the choice depends on the patent owner’s objectives and the funding available for a licensing campaign. Different scenarios may result in different financial outcomes, because costs and success rates depend on the scenario chosen. Some examples of possible scenarios can be a combination of assertive or non-assertive licensing and programs run by in-house teams, contingency or non-contingency litigation law firms or contingency licensing firms.

It is important to model these scenarios in real financial terms to understand the risk/reward and ROI and hence choose the best approach for the patent owner in the particular industry environment. The financial modelling requires estimation of addressable revenues, possible royalty rate and costs involved. Whilst valuation is not an exact science the assumptions and multiple market development scenarios need to be tested and qualified to provide reliable valuation ranges and an objective view on the overall attractiveness of the proposition.

Phase 5: Detailed evidence of use analysis and claim charting

Now that the companies infringing your patents are known, the risks, rewards estimated, and an ROI calculated, is it time to approach potential licensees?

No! It is vital to have solid evidence in the form of strong ‘evidence of use’ or ‘claim charts’ to support the infringement contention before contact. A group of strong claim charts spread across products per target will increase likelihood of success. A ‘claim chart’ or ‘evidence of use’ is used to illustrate how a real-world product may be infringing the patent claim and maps each element of a claim to a corresponding step/feature in the physical product. With claim charts, it is an all or nothing game i.e every element of a patent claim must be matched by a corresponding technical feature in the product to prove infringement. This requires not only reviewing the patent specification and prosecution history to thoroughly understand the patented technology and an appropriate claim interpretation, but also extensive research and analysis to gather the best evidence and the ability to present it in a clear and convincing manner.

Preparing high-quality ‘evidence of use’ involves extensive and sometimes very time-consuming technical investigative analysis. In addition, it also requires relevant market or technical knowledge and familiarity with the various aspects of patent law. A good process combines legal skills and technical investigative analysis and results in a simplified, textual and graphical comparison of the claims and the potentially infringing use. A detailed claim chart showcasing compelling evidence of ‘patent – product’ mapping could persuade potential licensees into serious negotiations. You should have also thought about the commercial proposition that you are taking to the potential licensee before making contact.

Takeaways

A systematic approach ensures a comprehensive understanding of the costs and risks associated with your licensing program to maximize the value of your patents with an approach that is in line with your business goals, timescales and risk appetite.

Although this phased approach is both logical and straightforward, its implementation needs to be customized to your specific sector and corporate goals. The approach recommended requires striking a balance between the work done in each phase, to ensure and maintain financial viability and to ensure that time is not wasted assessing poor cases or strong cases where the target is losing money for example.

Patent licensing is becoming increasingly challenging and it requires thorough preparation on the licensor’s part to convince a potential licensee that a license is both required and inevitable and to persuade them into serious negotiations.

Ultimately any successful patent licensing program will require a mix of technical, legal, IP and market analysis skills, coupled with perseverance and insightful negotiation skills, but the key to all of this is PREPARATION, PREPARATION, PREPARATION!

_______________

[1] Rembrandts in the Attic: Unlocking the Hidden Value of Patents – By Kevin G. Rivette, David Kline – Page 137

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.