Mobile payment schemes and digital wallets have been a major topic of discussion in tech circles this year. In early December, Walmart (NYSE:WMT) became the first American retailer to announce its own mobile payment system that will be rolled out next year. According to Walmart executives, it will be compatible with both the Android and iOS platforms as well as major credit and debit card providers. This announcement bucks the trend of tech companies getting involved with digital wallets, including Apple (NASDAQ:AAPL), Google (NASDAQ:GOOG) and Samsung Electronics (KRX:005930).

Mobile payment schemes and digital wallets have been a major topic of discussion in tech circles this year. In early December, Walmart (NYSE:WMT) became the first American retailer to announce its own mobile payment system that will be rolled out next year. According to Walmart executives, it will be compatible with both the Android and iOS platforms as well as major credit and debit card providers. This announcement bucks the trend of tech companies getting involved with digital wallets, including Apple (NASDAQ:AAPL), Google (NASDAQ:GOOG) and Samsung Electronics (KRX:005930).

We’ve been profiling the growing mobile payment trend here on IPWatchdog this year and have noticed a growing amount of intellectual property being held by those companies in that field. This is interesting because software based payment systems, specifically for financial services, have been the target of much derision in recent months since the Supreme Court’s decision in Alice Corp. v. CLS Bank found a financial service implemented in software to be unpatentable. As our readers will see in more detail below, we noted an interesting increase in the amount of patent filing activity for mobile payment systems from each of the three largest banks as valued by assets. This is a peculiar about-face from a sector that, until tech companies started encroaching on financial services, had rallied against strong patent rights for software for quite some time.

JPMorgan Chase Developing Chase Pay with Few Mobile Pay Patents

JPMorgan Chase & Co. (NYSE:JPM), headquartered in New York City, has been seeing its mobile platform grow in recent months. At the end of 2015’s third quarter, the financial institution had the largest mobile banking base of 22.2 million customers. It’s also reportedly looking to take on Apple, Google and the rest of the digital wallet sector with the development of its own Chase Pay mobile payment system, despite its decision to make its consumer financial accounts available through Samsung Pay and other platforms.

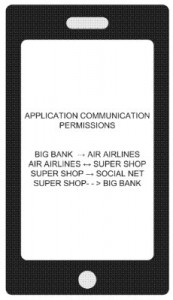

It does not appear that JPMorgan Chase is devoting much time to filing patent applications for such mobile payment systems, however. The banking corporation was recently issued U.S. Patent No. 9152477, which is titled System and Method for Communication Among Mobile Applications. It claims a method for controlling interaction using a mobile device by receiving a request to interact with a third party, retrieving a plurality of personas indicating an action in response to the request and selecting one of the personas by a computer processor of the mobile device based on the identification of another electronic device within the vicinity of the first mobile device. This invention provides a mobile banking application with the ability to make payments via smartphone or tablet and which users can customize with modes which could encourage users to make business purchases with a corporate credit card or vacation purchases with loyalty program points. Going a little bit back in time, we did find an intriguing early patent in the field held by JPMorgan, U.S. Patent No. 7103576, entitled System for Providing Cardless Payment. First issued to First USA Bank in 2006, it protects a system for completing a transaction relating to an account in the system wherein an account holder is not required to know an account number and is not required to have an account card physically present during the transaction. This system is capable of being implemented in store settings, Internet catalogs as well as phone ordering systems.

It does not appear that JPMorgan Chase is devoting much time to filing patent applications for such mobile payment systems, however. The banking corporation was recently issued U.S. Patent No. 9152477, which is titled System and Method for Communication Among Mobile Applications. It claims a method for controlling interaction using a mobile device by receiving a request to interact with a third party, retrieving a plurality of personas indicating an action in response to the request and selecting one of the personas by a computer processor of the mobile device based on the identification of another electronic device within the vicinity of the first mobile device. This invention provides a mobile banking application with the ability to make payments via smartphone or tablet and which users can customize with modes which could encourage users to make business purchases with a corporate credit card or vacation purchases with loyalty program points. Going a little bit back in time, we did find an intriguing early patent in the field held by JPMorgan, U.S. Patent No. 7103576, entitled System for Providing Cardless Payment. First issued to First USA Bank in 2006, it protects a system for completing a transaction relating to an account in the system wherein an account holder is not required to know an account number and is not required to have an account card physically present during the transaction. This system is capable of being implemented in store settings, Internet catalogs as well as phone ordering systems.

We did stumble across a patent application in the field which it appears Chase acquired from Neology, Inc. of Poway, CA. U.S. Patent Application No. 20150287023, which is titled System and Method for Providing Secure Transactional Solutions, would protect a mobile device having radio frequency (RF) circuitry, a memory storing biometric authentication information and payment information, a biometric module for reading biometric information, an authentication module authenticating that biometric information is associated with the payment information and a transaction module providing the payment information when the biometric information is successfully authenticated. According to the technology’s description, this invention could be implemented in cellular telephones, license plates or passports.

Citigroup Expands on Early Citi Wallet Development with IP

It’s a different story over at Citigroup (NYSE:C), another Wall Street giant headquartered in NYC. Quietly, the financial institution and Chase rival became the first global bank to offer a digital wallet to consumers in 2014; the Citi Wallet is designed solely for online transactions, however, and not to be implemented through a smartphone at the point-of-sale. Still, the system is expanding globally and recently opened operations in India, a country where 41 percent of transactions using Citi cards occur online.

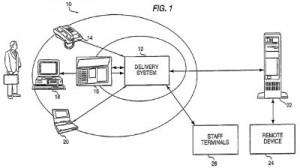

In August, Citigroup earned a patent for the delivery of banking services to personal computers and smartphones alike with the issue of U.S. Patent No. 9129279, which is titled Delivering Financial Services to Remote Devices. It protects a system for delivering financial services having a computer with mini-app dialog components, each of which presents information and choices to a user through a remote device, receives a request for a financial service function from the customer; the system further has a session component that receives a start session request identifying the remote device type and requested financial service function, a transaction executor component carrying out the requested financial service function and a presentation manager component that selects a template compatible with the type of remote requesting device. This system is designed to handle the complexity of providing digital financial services to consumers that is responsive to the wide array of computing devices accessing the digital financial services.

In August, Citigroup earned a patent for the delivery of banking services to personal computers and smartphones alike with the issue of U.S. Patent No. 9129279, which is titled Delivering Financial Services to Remote Devices. It protects a system for delivering financial services having a computer with mini-app dialog components, each of which presents information and choices to a user through a remote device, receives a request for a financial service function from the customer; the system further has a session component that receives a start session request identifying the remote device type and requested financial service function, a transaction executor component carrying out the requested financial service function and a presentation manager component that selects a template compatible with the type of remote requesting device. This system is designed to handle the complexity of providing digital financial services to consumers that is responsive to the wide array of computing devices accessing the digital financial services.

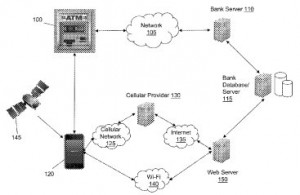

Greater access to banking platforms through mobile devices is also the focus of U.S. Patent No. 8972297, titled System and Method for Conducting a Transaction at a Financial Transaction Terminal Using a Mobile Device. It discloses a method for conducting a transaction using a mobile device by receiving a request from a user to conduct a transaction, determining a location of a user, transmitting to a bank server the user’s location and the requested transaction, receiving the determination of a location of the nearest financial transaction terminal capable of conducting the transaction, establishing a communication session with that terminal and receiving a prompt from the terminal for the user to complete the transaction. This innovation automates the process of finding the closest automated teller machine (ATM) for initiating a transaction made at a location away from the ATM, such as a retailer point-of-sale. A novel technology for encrypting information sent by mobile applications related to banking services is at the center of U.S. Patent No. 8904195, titled Methods and Systems for Secure Communications Between Client Applications and Secure Elements in Mobile Devices. It protects a method for secure communication between a client application on a mobile device and a secure hardware element on the mobile device which involves providing a physical tamper-resistant integrated circuit chip having a secure hardware element with a secure processor coupled to secure memory and usable to encrypt communication. This innovation provides encryption through a secure element, like a near-field communication (NFC) chip, so that secret keys don’t have to be stored on a client application.

Greater access to banking platforms through mobile devices is also the focus of U.S. Patent No. 8972297, titled System and Method for Conducting a Transaction at a Financial Transaction Terminal Using a Mobile Device. It discloses a method for conducting a transaction using a mobile device by receiving a request from a user to conduct a transaction, determining a location of a user, transmitting to a bank server the user’s location and the requested transaction, receiving the determination of a location of the nearest financial transaction terminal capable of conducting the transaction, establishing a communication session with that terminal and receiving a prompt from the terminal for the user to complete the transaction. This innovation automates the process of finding the closest automated teller machine (ATM) for initiating a transaction made at a location away from the ATM, such as a retailer point-of-sale. A novel technology for encrypting information sent by mobile applications related to banking services is at the center of U.S. Patent No. 8904195, titled Methods and Systems for Secure Communications Between Client Applications and Secure Elements in Mobile Devices. It protects a method for secure communication between a client application on a mobile device and a secure hardware element on the mobile device which involves providing a physical tamper-resistant integrated circuit chip having a secure hardware element with a secure processor coupled to secure memory and usable to encrypt communication. This innovation provides encryption through a secure element, like a near-field communication (NFC) chip, so that secret keys don’t have to be stored on a client application.

Bank of America Develops Mobile Checking, Retail Shopping Tech

The Bank of America Corporation (NYSE:BAC) of Charlotte, NC, has been seeing a good deal of success in converting a portion of its customer base towards using its mobile financial services app. In early December, Bank of America executives reported that the amount of mobile transactions it processes would be enough to keep 700 different bank branches busy. Just under half of all Bank of America customers make use of the mobile platform for financial services, although 59 percent of millennials who are BofA customers use the app.

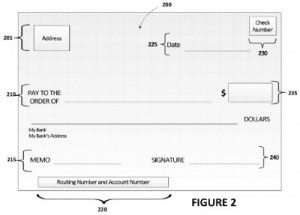

Bank of America made a big jump into the digital wallet waters with the issue of U.S. Patent No. 9177451, entitled Mobile Device as Point of Transaction for In-Store Purchases. It discloses a system for conducting purchase transactions within a retail location including a product selection application that uses a camera to capture computer-readable indicia for a product a user wishes to purchase and a purchase transaction application that receives information on products queued for transaction and conducts transactions. This system would enable a consumer to track items they wish to purchase throughout the course of a shopping trip in such a way that allows them to see exactly how much they’ll spend without having to manually calculate those results. Mobile checking  services are another area of focus for Bank of America, as is evidenced by the issue of U.S. Patent No. 9171296, which is titled Mobile Check Generator. It claims a mobile device for generating a virtual check using a digital wallet module running on the user’s mobile device which includes a processor and a memory storing a digital wallet module that can be executed to receive a request to perform a transaction with a merchant, generate a virtual check, initiate display of the virtual check on the device and receive information that the virtual check has been scanned by the merchant to complete the transaction. This system is designed to integrate checks and related services into mobile devices to serve as an additional payment option.

services are another area of focus for Bank of America, as is evidenced by the issue of U.S. Patent No. 9171296, which is titled Mobile Check Generator. It claims a mobile device for generating a virtual check using a digital wallet module running on the user’s mobile device which includes a processor and a memory storing a digital wallet module that can be executed to receive a request to perform a transaction with a merchant, generate a virtual check, initiate display of the virtual check on the device and receive information that the virtual check has been scanned by the merchant to complete the transaction. This system is designed to integrate checks and related services into mobile devices to serve as an additional payment option.

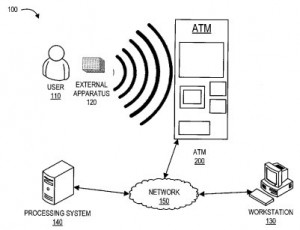

We were also intrigued to explore an intriguing contactless technology that could be implemented in mobile devices and outlined in U.S. Patent No. 9098846, entitled Contactless Automated Teller Machine. It protects a contactless ATM with a user interface, a memory device, a communication interface with a contactless interface and a processing device with circuitry specific to an ATM and configured to identify a communication sticker associated with a user on an external apparatus and establish a connection with the external apparatus. The invention is designed to overcome issues with security and data transmission which can enable the further use of contactless ATM technology.

We were also intrigued to explore an intriguing contactless technology that could be implemented in mobile devices and outlined in U.S. Patent No. 9098846, entitled Contactless Automated Teller Machine. It protects a contactless ATM with a user interface, a memory device, a communication interface with a contactless interface and a processing device with circuitry specific to an ATM and configured to identify a communication sticker associated with a user on an external apparatus and establish a connection with the external apparatus. The invention is designed to overcome issues with security and data transmission which can enable the further use of contactless ATM technology.

Conclusion

Over the years representatives from banks and other financial services companies have openly questioned at numerous industry events why they would ever want or even need patents. It seems that they have to some extent finally figured out why they might need patents; namely, to insulate their business from stiff competition from some of the largest corporations in the world, most of who are sitting on tremendous amounts of cash reserves and are itching to exploit new markets and opportunities. Payment platforms and associated financial offerings to consumers have long been the sole province of the banks, and highly profitable. Whether any of these patents the banks are obtaining can or will withstand challenge remains to be seen, and whether the banks will have any means to fend off competition from tech giants and now retailers is an open question.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Benny

December 22, 2015 05:21 amSteve,

You did not address the question of standards. For any of the myriad, unique possible digital payment methods, only one which is common to all platforms can be commercially successful or useful (as in the present day, a common standard exists for magnetic strip readers). The industry will be keen to take up the options with the least cost and legal strings, in other words, anyone who wants their own system to become the dominant standard would do well to offer the lowest licensing fee, and by lowest I mean free.