While still waiting for additional data to come in, the analysis so far leads to a tentative conclusion that patent market may have survived the Alice storm, at least for now.

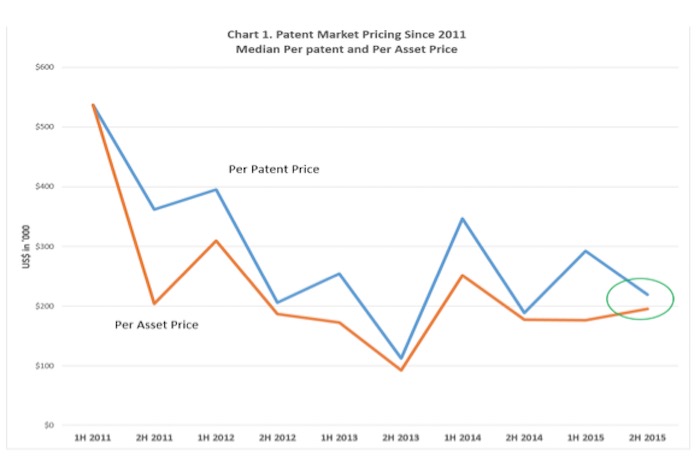

As shown in Chart 1 below, it seems that Alice had not set off another downward spiral seen over the three-year period of 2011-13. Actually, the median per patent and per asset price finished 2015 higher than their recent lows reached at the second half of 2014.

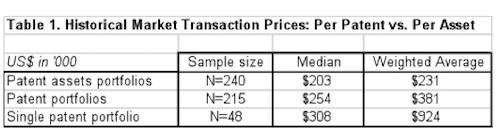

Also, compared to the historical medians, which are displayed in Table 1, the median per patent price of $292K in 2015 is higher than the historical median of $254K. So is the weighted average price per patent, which is $423K in 2015, as compared to the historical average of $381K. However, the median and average prices per assets in 2015 are lower than the corresponding historical data, which is caused mainly by a couple of large patent assets transactions resulted from distressed assets acquisitions in 2015.

For those first-time readers, the results presented above are from an on-going research project that collects and analyzes the market prices of patent portfolio transactions. For more information about the project, the process of data collection and processing, and the econometric methods for value decomposition and portfolio pricing, please refer to the 2015 update posted on IPWatchdog, and other papers published earlier.

As stated at the beginning of this article, extra samples of transactions will be collected as companies release more information and data in the next month or two. At this moment, the sample size of 2015 is still very limited, and the conclusions reached are deemed to be tentative.

Additional evidence from other segments of IP industry also indicate that things may be getting better.

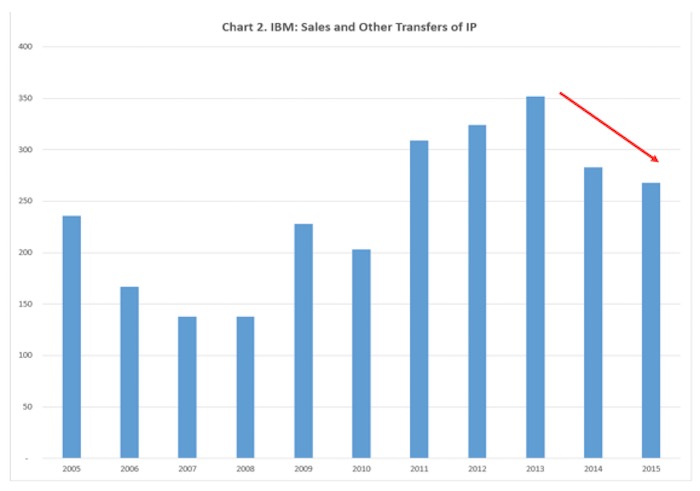

To begin with, Alice certainly has dealt a huge blow to patent market, reversing the growth momentum of most market players, big or small. Chart 2 vividly illustrates IBM’s experience in patent sales during the past years. While the enacting of AIA did not derail IBM’s growth path, Alice actually sent its patent sales revenue plummeting 20% in 2014. However, the decline in patent sales revenue has significantly decelerated to 5% in 2015, based on the estimated data.

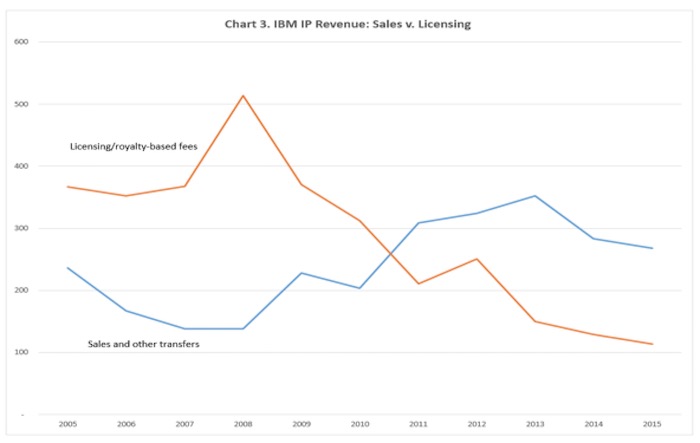

There are similar evidences from patent licensing market. From economics point of view, price in patent sales market shall be fundamentally consistent with royalty pricing in patent licensing market, because theoretically, the sales price simply reflects the NPV of the future stream of royalty payments. For IBM, the relationship of the two has been revealed in a very amazing way. As shown in Chart 3, IBM’s revenue from patent sales is highly negatively correlated with the licensing and royalty revenue, with a correlation coefficient of -0.795. Essentially, when IBM made more money upfront from patent sales, it racked in less in licensing revenue.

However, the pattern failed to sustain under Alice. Both licensing revenue and patent sales revenue declined for two consecutive years in 2014 and 2015. Such a comovement has never been seen in the past 10 years, which offers further testimony to the impact of Alice. While IBM’s licensing revenue has been declining since the peak in 2008, the estimated 12% drop in 2015 actually marks the lowest pace in the past three years.

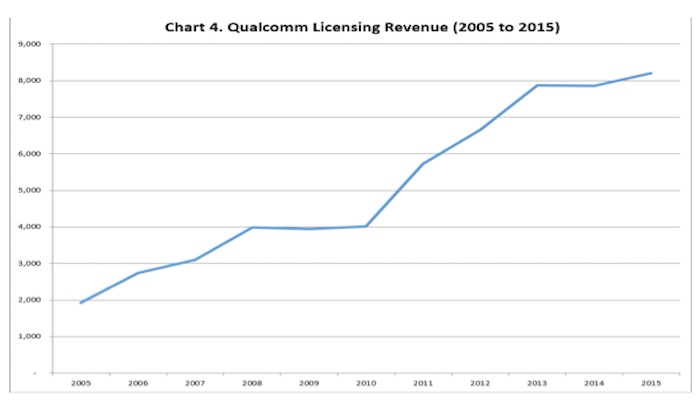

Finally, an analysis on Qualcomm’s licensing revenue tells a similar story, as demonstrated in Chart 4. Although Alice interrupted the growth momentum of a 25% CAGR from 2010 to 2013, Qualcomm managed to reach a 4.3% growth in 2015.

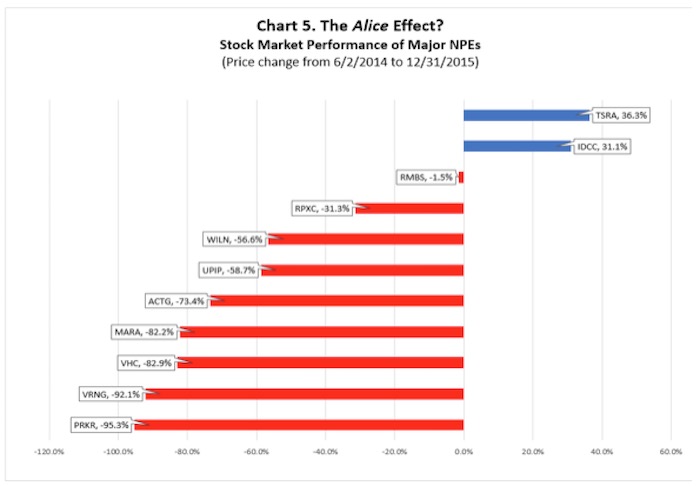

For some patent owners, especially those R&D-light patent acquiring and asserting companies, things may get worse before getting better.

However, not all segments of IP industry have weathered the Alice storm equally well. As shown in Chart 5, most NPEs have seen their share prices plunging half to nearly 100%. There will be more restructuring and further consolidation in NPE business in 2016. Some industry observers interpreted the selloff as financial market’s disavowal of the NPE business models. I disagree. A forward-looking financial market dislikes uncertainty, and the Alice decision has created just that, and a glut of; which puts huge downward pressure on NPE stock prices.

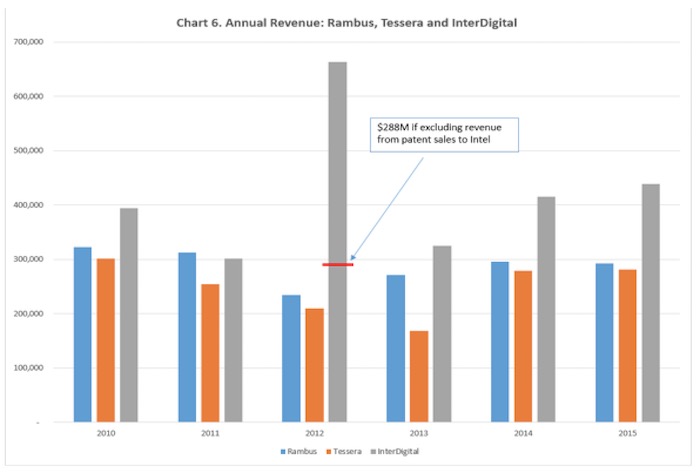

However, stock market has not oversold Rambus shares, and has even rewarded Tessera and InterDigital’s investors. These companies are all R&D-intensive IP companies with significant recurring licensing revenue, in contrast to those R&D-light patent acquiring and asserting companies that generate revenue mainly through litigation, which is usually fairly volatile even absent of Alice. As demonstrated in Chart 6, similar to the pattern seen in Chart 1, the revenue of these three companies bottomed in 2012 or 2013, and generally increased or remained stable during the three years from 2013 to 2015.

2016 will mark another milestone for IP industry, as indicated by recent court rulings, showcased by the legal and legislative campaigns, and shaped by major macroeconomic factors.

Today marks the end of lunar Year of Horse, and tomorrow will start the Year of Monkey. While monkey is perceived to be intelligent and agile, it can also be unpredictable and even naughty. Profiting in the Year of Monkey would require IP decision-makers to think creatively and act quickly to adapt the unsettling landscape of IP business.

Court rulings and legal campaigns. Gene Quinn published a very insightful article recently, implying that the IPR tide may be about to turn at PTAB. While the uncertainty overhanging IP industry is still quite high, the optimistic views presented in the article have been shared by many industry observers.

Rising interest rates. Fed raised interest rate later last year, the first increase in seven years. However, it is expected that interest rate will stay relatively low in 2016, because i) the current rates are still around the historically low levels, and ii) as US economic growth decelerates, Fed will not raise interest rate dramatically in a short period of time. Therefore, the liquidity condition should be favorable to a patent market expansion in 2016.

Merger and acquisition. As US economic growth slows down, consolidation will intensify, which will sustain an M&A boom. More and more companies enter M&A transactions simply to acquire a target’s patents and other IP. As a result, a strong M&A market can help to invigorate patent market.

____________________

- This short essay presents brief conclusions of two comprehensive research reports in the making, one about patent portfolio valuation as reflected by patent market transactions, and the other covering IP industry, NPEs’ economic and financial performance, and investment themes.

- The views expressed in this presentation are the author’s, not those of IPMAP, LLC or the data providers.

- I would like to thank ktMINE, IPOfferings, RoyaltySource, and several colleagues and friends for the help in data collection.

- Bound by NDAs, data of each individual transaction will not be disclosed. Analysis of the aggregate data will be released periodically.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.