Contrary to popular believe, the number of U.S. patents sold in 2015 relative to 2014 was up. So were the number of patent suits filed. 2016 is expected to be a record year in terms of patents sold and suits filed. Still, completing patent sales for a respectable return has become more difficult than ever, as has licensing U.S. patents for a fair price. The shift in the market is due largely to the changing economics of perceived patent value as a result of the American Invents Act and the establishment of the Patent Trial and Appeal Board (PTAB). It also is a carry-over from eBay, which made obtaining an injunction in a patent dispute almost impossible.

Contrary to popular believe, the number of U.S. patents sold in 2015 relative to 2014 was up. So were the number of patent suits filed. 2016 is expected to be a record year in terms of patents sold and suits filed. Still, completing patent sales for a respectable return has become more difficult than ever, as has licensing U.S. patents for a fair price. The shift in the market is due largely to the changing economics of perceived patent value as a result of the American Invents Act and the establishment of the Patent Trial and Appeal Board (PTAB). It also is a carry-over from eBay, which made obtaining an injunction in a patent dispute almost impossible.

The time required to close a patent transaction today is longer because of increased due diligence – weeding out patents of value and quality – and the larger size of some of the portfolios. Additionally, few companies are willing to have a business discussion about a license or purchase without first having a suit filed against them. Some deals are not closing at all, and both buyers and investors are willing to walk away if they don’t see a sufficiently high level of quality, or if the terms do not account for the current higher risk environment.

Not to be discouraged, there is light shining through the recent transaction haze. Capital for patent sales and monetization is available for those with a supply of high quality patents who wish to work with a financial partner.

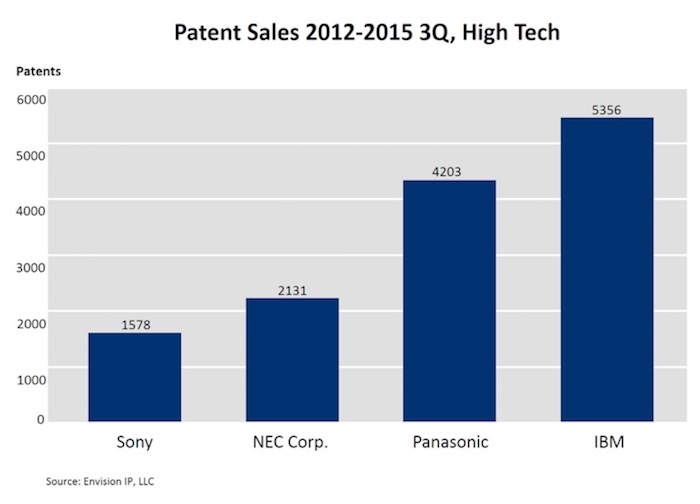

Operating companies are more willing to sell good patents and many are working with third parties (some are PIPCOs, or public IP licensing companies) to achieve financial objectives and mitigate licensing risk. Operating company sales (and purchases) have become a larger part of day-to-day IP management, and a company does not have to be “desperate” to decide to fine tune its portfolio with a sale, purchase or license. There is less stigma today associated with patent transactions and out-licensing. Operating company buyers are now outpacing NPEs, and many, such as Japanese companies, have definitely stepped up their selling activity. For example, Panasonic, Sony and NEC are behind only IBM in US patent sales since 2012.

“The financing aspect of patent transactions has become more sophisticated, with better risk analysis of larger portfolios and more realistic timelines about payout and damages,” says Ashley Keller, Co-Founder of Gerchen Keller Capital.

There are more financial entities willing to share risk on larger portfolios, the purchase price for which can range from a few million dollars to tens of millions. More corporate sellers are willing to accept fewer clients and vendors be excluded from a potential buyer’s licensing targets, a major change from just a few years ago.

Inter partes reviews challenging the validity of a patent are pretty much assured for patent holders who wish to out-license their rights, so the number and quality of assets included in a sale need to be more carefully considered when projecting returns. More than ever, portfolio size and quality count, and it is clearer that financial entities are often in the best position to assess patent transaction risks and opportunities because of their experience and focus on the bottom line.

Lenders and investors like Gerchen Keller and Fortress, among others, have provided capital to or are partnering with private and public NPEs. These business are well suited to assessing market conditions, especially value, and calculating risk for given rights in a specific industry. That they are still willing to fund activities and co-invest in this climate is a testament to the durability of good patents. Also, there is some expectation that we are at or near bottom, and that there are more opportunities now.

The experience, capital, patience (time to money) and contacts of IP financiers can go a long way to facilitating monetization success. Gathering as many relevant data points as possible helps. Sometimes combining two or more licensing programs or families of assets for sale can improve a holder’s chance of a higher return.

Patent monetization risks include: invalidity, capital, time, lack of experience and a well-capitalized defendant who digs in its heels. It is crucial to assess risk soberly in the context of the current market for a given patent or family. Whatever litigation lawyers might tell clients, most are poorly equipped to assess patent value and market conditions as effectively or efficiently as capital providers who see literally hundreds of opportunities per month. Some law firms simply go out and retain patent market experts to provide clients the lay of the land. Patent holders of all sizes with strong patents that read on the right products can even in today’s adverse environment be sitting on significant high value assets. Unfortunately, most don’t have the experience, capital or time to realize it. Finding a reputable partner who does can make a huge difference.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.