Given the importance of intellectual property rights to economic growth and technological development, as well as the wider benefits of biopharmaceutical research, the provisions found in the recently negotiated Trans-Pacific Partnership (TPP) Agreement to protect biologic medicines are disappointing. The final and most controversial points of negotiation, leading up to the release of the full text, centered on the provisions for data exclusivity for biologic medicines. Moreover, it appears that the ratification of the TPP agreement may hinge on precisely this issue. Although Senator Orin G. Hatch (R-UT) allied himself with President Obama to help conclude the trade negotiations, he has more recently called for a renegotiation of the agreement due to the extent to which the TPP falls short in its protection for biologic medicines.[2]

Given the importance of intellectual property rights to economic growth and technological development, as well as the wider benefits of biopharmaceutical research, the provisions found in the recently negotiated Trans-Pacific Partnership (TPP) Agreement to protect biologic medicines are disappointing. The final and most controversial points of negotiation, leading up to the release of the full text, centered on the provisions for data exclusivity for biologic medicines. Moreover, it appears that the ratification of the TPP agreement may hinge on precisely this issue. Although Senator Orin G. Hatch (R-UT) allied himself with President Obama to help conclude the trade negotiations, he has more recently called for a renegotiation of the agreement due to the extent to which the TPP falls short in its protection for biologic medicines.[2]

While there are approximately 7,000 medicines globally in development for a wide variety of diseases, more than 5,000 are in development in the United States, illustrating the strength of the United States biopharmaceutical industry.[3] This strength is undeniably tied to the United States’ provision of the most effective, comprehensive, and rigorous intellectual property rights (IPR) protections for biopharmaceuticals. However, the rate of technological advance almost always outpaces the legal architecture that surrounds and protects it. This is certainly the case for biologics. The evolution of this architecture must be a priority and enshrined in the intellectual property protections of agreements such as the Trans-Pacific Partnership.

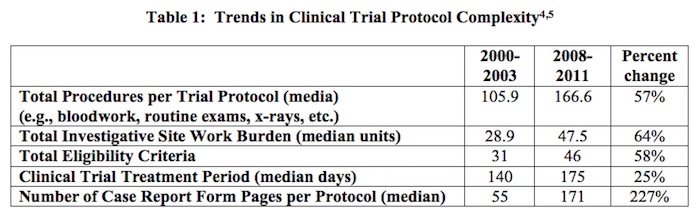

The data exclusivity provisions of the Trans-Pacific Partnership Agreement are at the heart of securing Congressional support for the trade agreement. As such, it is essential to understand why this protection is of utmost importance to the biopharmaceutical industry. Data exclusivity protection enables innovators to capture the returns on their investments, investments that may total well over a billion dollars over a dozen years. This investment is driven, in large part, by the clinical trials required for marketing approval by the U.S. Food and Drug Administration. As shown in Table 1, below, the number and complexity of clinical trials and the approval process has increased considerably.

In the drug discovery process, biopharmaceutical firms will examine between 5,000 and 10,000 experimental compounds over a ten to fifteen year period, in order to secure the approval of but one compound. Overall, 30 percent of drugs make it to Phase I trials, the percentages for Phase II and Phase III trials are 14 percent and 9 percent, respectively.[6] Further complicating this significant challenge is the increasing cost of clinical trials, primarily born by biopharmaceutical firms. Notably, clinical trials now account for the greatest share of drug development costs. A 2010 study by Adams and Brantner indicates that the 2010 average costs of Phase I, II and III clinical trials were calculated at $24 million, $86 million, and $61 million, respectively.[7] More recently, Roy (2012) finds that an average of 90 percent or more of a drug’s development costs are incurred in Phase III trials.[8]

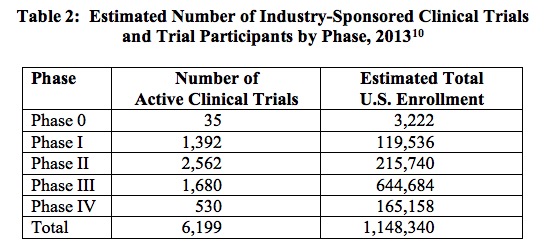

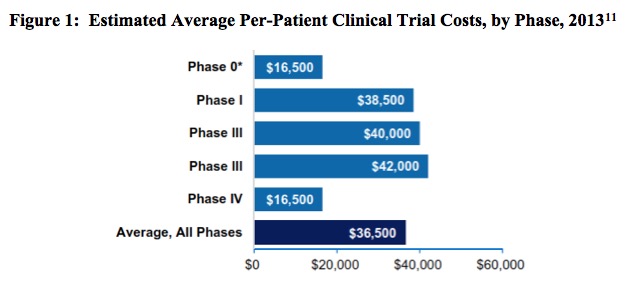

To put the magnitude of the clinical trial process in perspective, note that in 2013 the biopharmaceutical industry sponsored 6,199 clinical trials in the United States, an undertaking involving a total of more than 1.1 million participants.[9] The breakdown of these trials is described in Table 2, below. In the following figure, Figure 1, the estimated average per-patient clinical trial costs, by phase, are reported.

As clinical trials become increasingly costly, these costs are increasingly born by the biopharmaceutical industry. A recent study from the Johns Hopkins Bloomberg School of Public Health calculates that the biopharmaceutical drug and medical device industry now funds six times more clinical trials than the federal government.[12] Reporting on both industry-sponsored trials and trials funded by the National Institutes of Health (NIH) between 2006 and 2014, the study finds that the number of newly registered industry-sponsored trials rose by 43 percent in the intervening eight years, from 4,585 to 6,550, while the number of newly registered NIH-funded trials fell by 24 percent over the same period, from 1,376 to 1,048.[13] Importantly, this trend coincides with a 14 percent decrease (since 2006) in the budget for the National Institutes of Health.[14]

The bottom line is this: the biopharmaceutical industry conducts the lion’s share of clinical trials, and these trials are increasingly numerous and costly. Safeguarding the data these trials generate is a critical component of a rigorous, effective IP regime. It is essential to incentivizing the research and development investments that will bring us tomorrow’s treatments and cures. As such, sufficient data exclusivity protection must be included in the TPP Agreement. Without such protections, the incentives to invest in the risky, expensive, time-consuming drug development process erode. Clearly the Trans-Pacific Partnership Agreement must strike a balance between incentivizing innovation and ensuring access to medicines. While shortened periods of data exclusivity protection will speed the introduction of competing biosimilar drugs, greater access won’t mean much if innovation is stymied and new drug development stalls.

NOTE: I have documented the challenges surrounding clinical trials, in the wider context of the Trans-Pacific Partnership Agreement, in a recent article in The Journal of Commercial Biotechnology. Lybecker, Kristina M. “Intellectual Property Protection for Biologics: Why the Trans-Pacific Partnership (TPP) Trade Agreement Fails to Deliver,” The Journal of Commercial Biotechnology,” 2016, vol.22, no.1.

_______________

[2] Calmes, Jackie. Utah Senator, Crucial Ally for the Pacific Rim Trade Deal, Is Now Its Main Hurdle, New York Times, 12 November 2015.

[3] PhRMA (Pharmaceutical Research and Manufacturers of America). 2015 Biopharmaceutical Research Profile online post, 2015.

[4] The complexity of the clinical trials results from a variety of factors including a shift in focus from acute to chronic illness, collection of increasingly intricate data elements, closer attention to each element of trial design, and concern about potential requests from regulatory agencies. Source: Getz, K.A., R.A. Campo, and K.I. Kaitin. “Variability in Protocol Design Complexity by Phase and Therapeutic Area.” Drug Information Journal, 2011, vol.45, no.4, pp. 413–420.

[5] Source: PhRMA. Biopharmaceuticals in Perspective, Spring 2013.

[6] DiMasi, Joseph A., Ronald W. Hansen, and Henry G. Grabowski. 2003, The Price of Innovation: New Estimates of Drug Development Costs, Journal of Health Economics, vol.22,pp.151–85. As cited by FDAReview.org.

[7] Adams, C.P. and V.V. Brantner. “Spending on New Drug Development,” Health Economics, vol.19, no.2, February 2010, pp.130-141.

[8] Roy, A.S.A. Stifling New Cures: The True Cost of Lengthy Clinical Drug Trials, Project RDA Report, 24 April 2012.

[9] Battelle. Biopharmaceutical Industry-Sponsored Clinical Trials: Impact on State Economies, March 2015.

[10] Source: Battelle. Biopharmaceutical Industry-Sponsored Clinical Trials: Impact on State Economies, March 2015.

[11] Battelle. Biopharmaceutical Industry-Sponsored Clinical Trials: Impact on State Economies, March 2015.

[12] Desmon, Stephanie. Industry-financed clinical trials on the rise as number of NIH-funded trials falls: Researchers raise concerns about trends in research funding as commercial ventures run six times more trials than academic investigators, The HUB at Johns Hopkins, 16 December 2015.

[13] The authors searched ClinicalTrials.gov for trials identified as an “interventional study” and then identified the funder type for trials registered between 2006 and 2014. Registration on ClinicalTrials.gov is required for both industry-funded and NIH trials if the researchers intend to publish the results. The study notes that ClinicalTrials.gov is the largest online registry in the world.

[14] Cohn, Meredith. Industry funds six times more clinical trials than feds, research shows, The Baltimore Sun, 15 December 2015.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

3 comments so far.

anon2

May 23, 2016 02:37 amAccording to the references, in 2010 Phase II study costs were $86 mio, Phase III study costs $61 mio (i.e. less than Phase II), while in 2012, more than 90% of total development costs are incurred in Phase III trials. Either the biopharma industry stopped bringing new products into early stage clinical trials, or the cited data are seriously flawed.

Anon

May 12, 2016 07:30 pmIf you want to talk about a field of effort that is nothing more than (as might be parsed by ANY judge) those things that are “abstract” (of course, undefined) and “laws of nature,” bios “science” is the first that should fall.

(still holding the sign left by step back)

step back

May 12, 2016 04:15 pmNone of this is credible.

The true “friends” of the court (aka amicus curie) have informed “us” (the scoti) that bio science is nothing more than running up to a banana tree, spotting a banana, plucking it and peeling it (or alternatively lathing a baseball bat out of its trunk) See Assoc. v. Myriad.

/end sarcasm