So, what happens when you are negotiating patent peace with Intellectual Ventures (IV) and they cannot guarantee peace?This post provides a practical approach for companies to handle the licensing of Intellectual Venture’s (IV’s) smaller in-house funds (ISF & IDF) during a negotiation with IV. These two smaller, in-house funds together represent approximately 20% of IV’s total portfolio. In a typical negotiation with IV, all of the patents in the IIFs (described below) are available for license without exclusions. But, the ISF and IDF patents are more restrictively licensed. Additionally, IV may have presented evidence of use (EOU) materials from patents in ISF and IDF, or otherwise highlighted, some of these assets during negotiations, further heightening the risks. For the two smaller funds, IV will provide a list of assets specifically excluded from a patent license. How can you cost-effectively assess the patent risk from these smaller funds?

So, what happens when you are negotiating patent peace with Intellectual Ventures (IV) and they cannot guarantee peace?This post provides a practical approach for companies to handle the licensing of Intellectual Venture’s (IV’s) smaller in-house funds (ISF & IDF) during a negotiation with IV. These two smaller, in-house funds together represent approximately 20% of IV’s total portfolio. In a typical negotiation with IV, all of the patents in the IIFs (described below) are available for license without exclusions. But, the ISF and IDF patents are more restrictively licensed. Additionally, IV may have presented evidence of use (EOU) materials from patents in ISF and IDF, or otherwise highlighted, some of these assets during negotiations, further heightening the risks. For the two smaller funds, IV will provide a list of assets specifically excluded from a patent license. How can you cost-effectively assess the patent risk from these smaller funds?

In our article analyzing IV’s patent portfolio, “How Intellectual Ventures is Streamlining its Portfolio” (the cover article of IAM Magazine Issue 77; May/June 2016), we recommended paying close attention to the risks presented by unlicensed ISF and IDF patents—and could be sued on excluded assets. The analysis problem with the excluded assets is that there can be a lot of them, and the vast majority will not have anything to do with your current or future business. One technique we have used with clients to is to first selectively sample and test the applicability of the assets and integrating this information back into the negotiations (described below).

Context: IV, IV’s Portfolio and IV’s Funds

IV was founded in 2000 with the stated purpose of reducing the patent risk for its corporate investors and assisting companies and individual inventors in monetizing their inventions. Since its founding, it has reportedly raised over $6 billion in capital. A significant portion of the capital came from corporate investors in the high-tech space, such as Microsoft, Intel, Sony, Nokia, Apple, Google, Yahoo, American Express, Adobe, SAP, NVIDIA and eBay. Of note, Google did not invest in IV’s second or third funds. As in our prior studies of IV, our fact-driven analysis is based on information supplied by IV about its monetization portfolio and intentionally avoids offering opinions on IV’s business model.

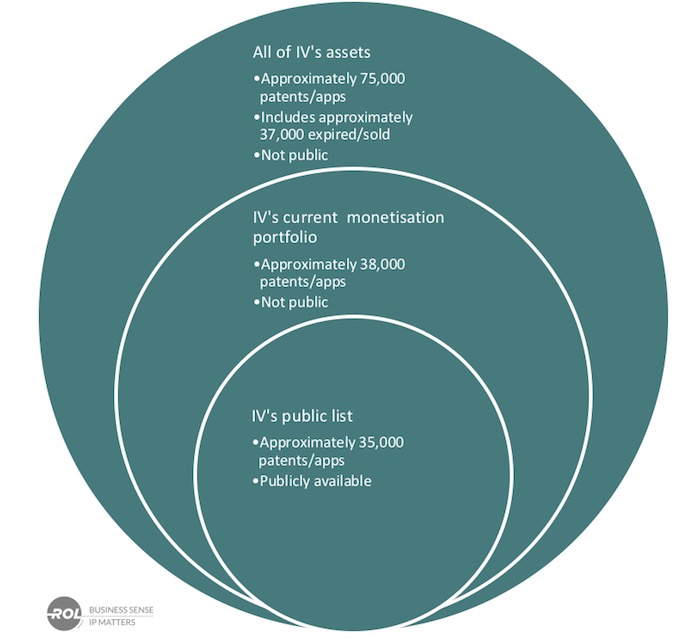

The figure, below, shows the relationship between the patent assets which IV reports that it has purchased or developed (approximately 75,000), its current asset monetization portfolio (approximately 38,000) and the list of assets that had been made public as of 2016 (35,000).

The numbers in the figure are based on data from IV’s buying, selling and pruning since 2013, together with extrapolations. IV’s website shows a similar figure with different numbers but has not been updated since 2013.

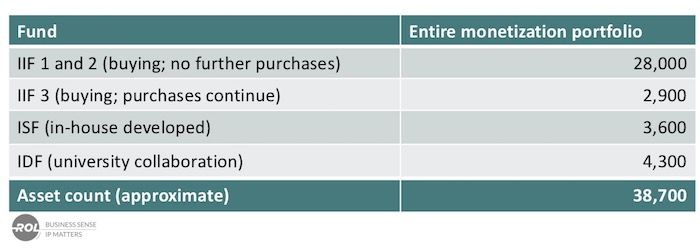

Further, the IV monetization portfolio is spread across different fund categories, see table below. The IIFs primarily represent IV’s purchased patent assets. We have also categorized patent assets to include applications, pre-grant patent publications, and patents. Patent buying for IIF1/2 stopped years ago, buying for IIF3 has begun. The ISF contains patent assets that IV has developed in-house. The IDF contains patent assets created through R&D funded by IV in exchange for the right to license any resulting patent assets. Interestingly, IDF assets tend to be university-licensing deals. These three fund groups make up approximately 80%, 10% and 10% of the monetization portfolio respectively.

Dealing with ISF and IDF in Negotiations

As we indicated, the smaller ISF and IDF funds present complications. In a typical negotiation with IV, all of the patents in the IIFs are available for license without exclusions. But, the ISF and IDF patents are more restrictively licensed. IV will provide a list of excluded assets under NDA. How can you cost-effectively assess the excluded asset lists and the associated risk?

As noted, since your company will not be licensed to the excluded assets there is a risk that your company could be sued on them. Thus, it is important to gain an understanding of the technologies represented by the excluded patents (and the funds as a whole) and your company’s risk of exposure to the patents. The vast majority of these assets will have nothing to do with your business, now or in the future. One way to understand the exposure or overlap is a technology taxonomy that links the excluded patents to technology areas that in turn can be correlated to your company’s product technology areas.

A focused sampling of the excluded asset lists based on a technology taxonomy can, therefore, be quite helpful. One ready-made taxonomy comes from the IPC patent classifications assigned to patents; further, the complexity of the IPC can be simplified into 36 technology fields using a mapping developed by WIPO (WIPO IPC Technology Concordance). While there are limits to using IPC codes, there are advantages as well: codes are pre-assigned, so no added work is necessary, and the IPC concordance only uses the first few digits of the IPC code, which is over-inclusive reducing the risks of skipping over assets of interest by taxonomy category.

While the WIPO IPC technology taxonomy based on IPC codes is one solution we have used, other taxonomies or approaches for identifying overlap could be used. For example, to identify potential technology overlap, semantic similarity comparing the excluded assets to your company’s own portfolio could be performed.

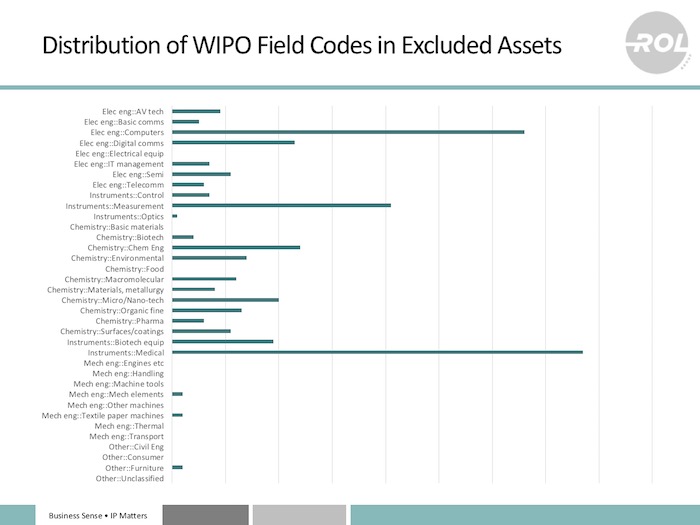

Here are the sample results for WIPO Field distribution for an excluded asset list (note numbers have been constructed for example purposes – click to enlarge):

Once this distribution is determined, it is worth pausing here for some initial analysis. For example, if your company is primarily operating in the biotechnology space, this distribution of exclusions might be acceptable. Most of the excluded assets are in the information and communications technology (ICT) space. In contrast, an ICT-focused company, e.g. a high-flying, recently public company might have more concerns about the risk remaining after licensing. This ICT-focused company would then analyze a smaller set of the most ICT relevant WIPO fields:

Within this chart, the assets within the excluded asset list to focus on become more apparent. In particular, if our client is in the digital communications space, sampling assets in that field would be the highest priority. Additionally, a client might be reasonably concerned about the computer field assets. The remainder of this example will focus on those two WIPO fields for more detailed review. Another approach to identifying focus areas is to analyze the WIPO fields for your patent portfolio to identify the highest overlapping fields, e.g. between your portfolio and the excluded assets. The premise being that the WIPO fields for your company’s patents align with your company’s products and thus if the excluded assets overlap heavily with those same WIPO fields there is a higher risk from those excluded assets.

Detailed Asset Review

While a manual review of all of the assets in the two fields is often the best option for determining their relevance, this is not always feasible due to the time available and associated costs. In this example, about 150 assets are in the two fields down from approximately 1000 initially. Assuming is not possible to manually review all 150 assets, we recommend looking at a subset of the assets.

One technique that can be used is prioritizing the review of high ranking assets as determined by our ranking system. This system is described in a two-part blog post (Part 1: “Finding the Best Patents – Forward Citation Analysis Still Wins”; Part 2: “High Value Patents: Does family size matter when looking for better patents?”). We have made the system available under the Creative Commons Attribution ShareAlike 4.0 license for others to adapt and improve. Using that approach, the top N assets by rank in each field could be reviewed.

Another approach is random sampling. Random sampling may be more appropriate here because there is a greater concern for understanding the breadth of excluded assets falling into the focus fields. Depending on your particular concerns, additional options exist. It may make more sense to proportionally sample the fields based on the number of assets in each field or based on relative concern, e.g. communications field may be of greater concern than computer field. Alternatively, care can be given to distributing the sampling across ISF and IDF excluded assets in proportion to the number of excluded assets in each.

In this example, a random sampling approach was used to select 25 assets from the two fields at random. Each of the 50 sample assets is then manually reviewed and ranked for relevance to the client’s business. Once the review is completed, the number of assets of higher-potential concern can be reviewed with the client for decisions.

If after the review, all of the IDF sampled assets are of lower concern, then perhaps no further review of the IDF assets is merited. In contrast, after sampling and manual review, some ISF sampled assets are of higher concern, the assets can form the basis of a discussion with IV about the specific families as well as expanded sampling and/or manual review. For this example, after reviewing the results of the manual review with the client, one ISF patent family of greater potential concern might be identified.

Addressing Assets of Concern

For our clients’ business leads responsible for a negotiation with IV, often the in-house IP counsel, one significant concern is ensuring that they have achieved patent peace with IV by entering the license. It is unacceptable to have the client on the receiving end of a lawsuit for an excluded patent a few months after signing a deal with IV.

Thus, while IV may have limited ability to license the excluded assets because of the way they structured their funds. However, IV should bear the costs of that fund structure.

We recommend bringing the assets of concern to IV’s attention in the negotiation and working include the assets of concern in the deal—or get greater comfort, such as a standstill or covenant not to sue. A related checklist item in any IV license agreement is to ensure that any patents for which an evidence of use (EOU) materials were presented, or where the assets were otherwise highlighted, is explicitly listed as licensed.

Conclusion and Recommendations

Rather than evaluate all thousand-plus excluded assets, we have demonstrated a cost-effective process for companies to review assets excluded from a license negotiation with IV. The review enables companies to manage the associated risks of being unlicensed to excluded assets that might be a patent risk.

The sampling technique is scalable and adaptable to work in a short time by focusing the expensive manual review on a handful of assets of the highest potential concern. We also recommend that companies negotiating with IV work to obtain the excluded asset lists early in the negotiation process.

The sampling technique described above can also be used in a similar fashion in other contexts, e.g. corporate cross-licensing, large portfolio acquisitions, and merger-and-acquisition (M&A) portfolio reviews.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.