On June 13th, the Redmond, WA-based multinational tech company Microsoft Corporation (NASDAQ:MSFT) announced that it had agree to acquire LinkedIn (NYSE:LNKD) in a $26.2 billion cash transaction which values LinkedIn stock at $196 per share. In its press release on the announcement, Microsoft touted the size and value of LinkedIn’s social network of professionals including the company’s 433 million worldwide members, its 101 percent year-over-year growth towards 7 million job listings as well as a 49 percent year-over-year growth in mobile users towards 60 percent of LinkedIn users accessing the network on mobile platforms. According to Microsoft, LinkedIn “will retain its distinct brand, culture and independence,” and Jeff Weiner will remain as CEO for LinkedIn.

On June 13th, the Redmond, WA-based multinational tech company Microsoft Corporation (NASDAQ:MSFT) announced that it had agree to acquire LinkedIn (NYSE:LNKD) in a $26.2 billion cash transaction which values LinkedIn stock at $196 per share. In its press release on the announcement, Microsoft touted the size and value of LinkedIn’s social network of professionals including the company’s 433 million worldwide members, its 101 percent year-over-year growth towards 7 million job listings as well as a 49 percent year-over-year growth in mobile users towards 60 percent of LinkedIn users accessing the network on mobile platforms. According to Microsoft, LinkedIn “will retain its distinct brand, culture and independence,” and Jeff Weiner will remain as CEO for LinkedIn.

According to news reports, this is Microsoft’s largest corporate acquisition ever. It greatly outpaces the company’s $8.5 billion Skype acquisition and the $7.6 Nokia purchase, both of which happened prior to the tenure of current CEO Satya Nadella. In the words of Nadella, in an open email to employees regarding the acquisition, “this deal brings together the world’s leading professional cloud with the world’s leading professional network.”

Microsoft’s portrayal of itself as the world’s leading professional cloud deserves a bit of scrutiny. As of last May, Fortune was reporting that Amazon Web Services, the cloud computing division of Internet giant Amazon.com, Inc. (NASDAQ:AMZN), was providing ten times the cloud computing resources compared to the combined total of its next 14 cloud rivals. Around the same time, we were reporting on the $7.7 billion in revenues from cloud computing which American patenting giant IBM (NYSE:IBM) earned in one year’s time.

To judge by Microsoft’s earnings reports, however, the tech mogul is certainly keeping pace and perhaps even pulling ahead of the pack. Microsoft’s earnings report for the third quarter of its 2016 fiscal year, released in late April, pinned the company’s commercial cloud annualized revenue rate at more than $10 billion. That same earnings report release pegged Microsoft’s operating income from its intelligent cloud business at nearly $7.2 billion in the nine months ending March 31st, 2016. So it would appear that there is plenty of bite to Microsoft’s bark about its cloud operations.

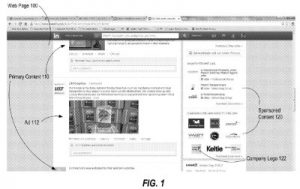

Recent innovations in social networking among business professionals can be seen in LinkedIn’s recently issued U.S. Patent No. 9336333, entitled Searching and Reference Checking Within Social Networks. The computer-implemented method claimed here involves a series of user interfaces on a social network which allows a social network user to identify important information related to a reference, such as employment history. This inventions is designed to help social network users to vet individuals who have no connections to their own network in such a way that can foster a business relationship.

Recent innovations in social networking among business professionals can be seen in LinkedIn’s recently issued U.S. Patent No. 9336333, entitled Searching and Reference Checking Within Social Networks. The computer-implemented method claimed here involves a series of user interfaces on a social network which allows a social network user to identify important information related to a reference, such as employment history. This inventions is designed to help social network users to vet individuals who have no connections to their own network in such a way that can foster a business relationship.

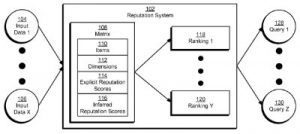

The ability to ascertain a person’s professional reputation is made more flexible for LinkedIn users by the technology outlined within U.S.  Patent No. 9330125, which is titled Querying of Reputation Scores in Reputation Systems. It protects a computer-implemented method for querying a reputation system to rank a set of users based on a set of desired skills associated with weights which specify the importance of those skills. The invention is a mechanism designed to improve the accuracy and coverage of reputation querying systems for better decision-making among users of the reputation system.

Patent No. 9330125, which is titled Querying of Reputation Scores in Reputation Systems. It protects a computer-implemented method for querying a reputation system to rank a set of users based on a set of desired skills associated with weights which specify the importance of those skills. The invention is a mechanism designed to improve the accuracy and coverage of reputation querying systems for better decision-making among users of the reputation system.

There’s a potential synergy that could develop from the various business services offered by both Microsoft and LinkedIn. Microsoft has long offered a suite of professional office software tools which is now marketed as Office 365 and provided via cloud servers. Microsoft’s third quarter 2016 earnings report indicated that the Office 365 subscriber base grew to 22.2 million members and the company saw Office 365 revenues grow 63 percent since 2015’s third quarter. The recent acquisition could allow Microsoft to incorporate LinkedIn’s database of professionals into its document creation and editing software programs to connect a user with experts in a field when writing on a given subject, for example.

LinkedIn had been developing its own intellectual properties in the realm of document-related software to judge by the recent issue of U.S. Patent No. 9367532, titled Cross Document Communication. It protects a method of creating processes for multiple documents that creates a hierarchy of communication between a parent document and any child documents. This technology reduces the time and computing resources necessary to load a web page containing a large document by nesting a child document page within the parent document and only loading those nested pages which are relevant to the user.

LinkedIn had been developing its own intellectual properties in the realm of document-related software to judge by the recent issue of U.S. Patent No. 9367532, titled Cross Document Communication. It protects a method of creating processes for multiple documents that creates a hierarchy of communication between a parent document and any child documents. This technology reduces the time and computing resources necessary to load a web page containing a large document by nesting a child document page within the parent document and only loading those nested pages which are relevant to the user.

Recent financial woes at LinkedIn have placed doubt in some heads as to the actual value of this transaction for Microsoft, which paid $9 billion more than LinkedIn’s market value in the acquisition. This February, LinkedIn executives told shareholders that it was dropping its revenue forecast for the first quarter down to $820 million, down from the $867 million expected by analysts. Shares of LinkedIn plunged by 24 percent on the news. Later reports indicated that the company expected total revenues for the year to reach the $3.65 billion to $3.7 billion range, which was more in line with analyst expectations but was still down. In actuality, LinkedIn announced quarterly revenues of $861 million for 2016’s first quarter, but the signs of financial turbulence are there. Linkedn’s most valuable business division is its talent solutions sector, which earned more than $557 million through 2016’s first quarter. LinkedIn’s talent solutions division includes premium services such as LinkedIn Recruiter, employment advertising service Job Slots, employment availability service Job Seeker and employer branding platform Career Pages.

There’s also an issue regarding difficulties Microsoft has experienced in turning acquisitions in recent years into profitable ventures. In the wake of the LinkedIn acquisition, Fortune was reporting on the combined $13.9 billion in writedowns which Microsoft has taken on its 2007 purchase of digital marketing firm aQuantive and its 2014 acquisition of phone maker Nokia. There’s also little evidence that Microsoft has been able to turn any profitable numbers from video service Skype after acquiring that company in 2011 with a cash deal worth $8.56 billion. It should be noted that these deals happened during the tenure of Microsoft’s previous CEO Steve Ballmer but it does invite more shareholder scrutiny of large corporate deals.

With Microsoft’s acquiring LinkedIn at such a high premium, there has been talks that mergers and acquisitions may increase in the social network sector. At the center of this discussion is Twitter Inc. (NYSE:TWTR) That social networking giant has been experiencing turnover in its executive suite, including January’s departure of two prominent executives in media and product development. As of mid-June, Twitter’s stock was trading at 78 percent less than it’s all-time high according to financial publication TheStreet.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2023/01/2021-Patent-Practice-on-Demand-1.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.