This May, auditing and consulting firm PwC released a 2017 patent litigation study which identifies trends taking form over the past few years of U.S. patent infringement suit filings, including litigation numbers, damages and case appeals. The report is further proof of the drop in patent litigation across the U.S. federal court system in recent months and it provides additional analysis on the legal developments that have impacted damages awards.

This May, auditing and consulting firm PwC released a 2017 patent litigation study which identifies trends taking form over the past few years of U.S. patent infringement suit filings, including litigation numbers, damages and case appeals. The report is further proof of the drop in patent litigation across the U.S. federal court system in recent months and it provides additional analysis on the legal developments that have impacted damages awards.

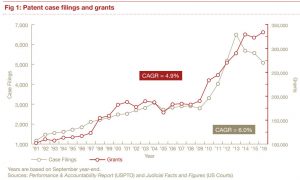

About 5,100 patent infringement cases were filed in the U.S. during 2016, according to the PwC litigation study. This represents a 9 percent drop in lawsuits from 2015’s totals and the third straight year of decline since 2013, when more than 6,000 patent suits were filed. As the PwC study notes, this decline stands in stark contrast to the 6 percent compound annual growth rate (CAGR) for patent case filings since 1991. It’s also the largest deviation between the rate of case filings and the rate of U.S. patent grants since that time.  As figure 1 shows (below right), there has been a 4.9% compounded annual growth rate for patent grants since 1991, which would lead one to anticipate increasing, not decreasing patent litigation if the patent marketplace were truly vibrant and healthy.

As figure 1 shows (below right), there has been a 4.9% compounded annual growth rate for patent grants since 1991, which would lead one to anticipate increasing, not decreasing patent litigation if the patent marketplace were truly vibrant and healthy.

The PwC report suggests that this lower rate of case filing may be due in large part to the abolition of Form 18 used to plead patent infringement in U.S. district courts, requiring patent counsel to rely on the higher pleading standards upheld by the U.S. Supreme Court in decisions such as 2007’s Bell Atlantic Corp. v. Twombly and 2009’s Ashcroft v. Iqbal.

Interestingly, these recent patent litigation numbers reported by PwC differ from litigation totals we’ve gathered from studies released by legal data analytics firm Lex Machina. The most recent annual IP litigation report released by that company pegged the year-over-year drop in patent infringement cases at 22 percent, down from 5,823 cases in 2015 down to 4,520 cases in 2016. According to Lex Machina data scientist Brian Howard, one reason for the discrepancy could result from a difference in how the two reports define a year’s end; Figure 1 of the PwC study posted here indicates that their years are based on a September year-end whereas Lex Machina utilizes a January-to-December calendar year for its reports. There may also be some difference in the methodology used to count cases; PwC’s methodology section explains that the report included decisions from Lexis Advance databases which might survey decisions using different nature of suit (NOS) codes than Lex Machina, which searches for patent claims outside of NOS code 830.

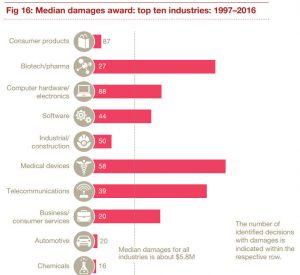

2016 saw the largest damages award for a single patent infringement case in U.S. history when Merck pharmaceutical subsidiary Idenix was awarded $2.54 billion against Gilead in a case over treatments for the hepatitis C virus. Despite this case, median damages in patent infringement cases fell year-over-year from $10.2 million in 2015 down to $6.1 million in 2016, according to the PwC study. Since 1997, annual median damages amounts have ranged from $2 million up to $17.8 million. Overall, the median damages award in patent infringement cases since 1997 has been $5.8 million when including damages awarded before trial. This median damages figure for all patent cases going back to 1997 increases to $8 million when excluding pre-trial damages awarded on either summary judgment or default judgment.

2016 saw the largest damages award for a single patent infringement case in U.S. history when Merck pharmaceutical subsidiary Idenix was awarded $2.54 billion against Gilead in a case over treatments for the hepatitis C virus. Despite this case, median damages in patent infringement cases fell year-over-year from $10.2 million in 2015 down to $6.1 million in 2016, according to the PwC study. Since 1997, annual median damages amounts have ranged from $2 million up to $17.8 million. Overall, the median damages award in patent infringement cases since 1997 has been $5.8 million when including damages awarded before trial. This median damages figure for all patent cases going back to 1997 increases to $8 million when excluding pre-trial damages awarded on either summary judgment or default judgment.

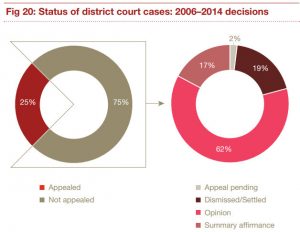

Pharmaceutical products contributed to a significant portion of the most valuable damages awards since 1997, accounting for four of the top ten initial adjudicated damages awards over the past two decades. The PwC study notes that each of the top ten damages awards were either vacated, remanded or reduced on appeal. Indeed, 75 percent of all

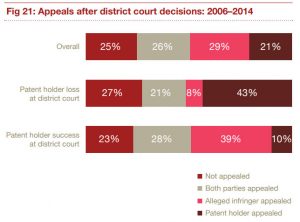

Pharmaceutical products contributed to a significant portion of the most valuable damages awards since 1997, accounting for four of the top ten initial adjudicated damages awards over the past two decades. The PwC study notes that each of the top ten damages awards were either vacated, remanded or reduced on appeal. Indeed, 75 percent of all  patent infringement cases reaching a decision in district court are appealed, and more than half of those appeals lead to the Federal Circuit (Fed. Cir.) overturning some aspect of the lower court’s decision. Alleged infringers were more likely to appeal cases than patent owners but slightly more than one-quarter of all patent infringement case decisions are appealed by both parties

patent infringement cases reaching a decision in district court are appealed, and more than half of those appeals lead to the Federal Circuit (Fed. Cir.) overturning some aspect of the lower court’s decision. Alleged infringers were more likely to appeal cases than patent owners but slightly more than one-quarter of all patent infringement case decisions are appealed by both parties  according to PwC.

according to PwC.

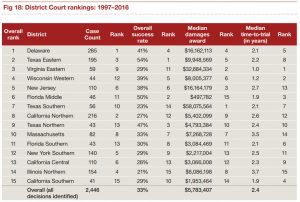

Another point of comparison between the PwC study and patent litigation surveys published by Lex Machina is the contrast in viewpoints on important district court venues. Despite the high concentration of patent caseloads in the Eastern District of Texas (E.D. Tex.), PwC ranks the District of Delaware (D. Del.) as the number one venue for patent infringement cases in the U.S. when looking at the number of decisions, success rates, median awards and median time-to-trial. PwC identified 285 D. Del. decisions since 1997,leading to a median damages award level of $16.1 million. E.D. Tex., ranked second in the  PwC study, returned 195 decisions leading to a $9.9 million median damages award. Although decisions and median damages were lower in E.D. Tex., that district saw the highest success rate for patent holders alleging infringement, finding for the plaintiff in 54 percent of decisions compared to the 41 percent success rate in D. Del. Median time-to-trial in both E.D. Tex. and D. Del. were greater than two years while the Eastern District of Virginia (E.D. Va.), the district ranked third by the PwC study, had a one year median time-to-trial since 1997, the lowest among any venue in the study. The venue with the greatest median damages level is the Southern District of Texas (S.D. Tex.), where 56 identified decisions returned a median damages level of $58 million.

PwC study, returned 195 decisions leading to a $9.9 million median damages award. Although decisions and median damages were lower in E.D. Tex., that district saw the highest success rate for patent holders alleging infringement, finding for the plaintiff in 54 percent of decisions compared to the 41 percent success rate in D. Del. Median time-to-trial in both E.D. Tex. and D. Del. were greater than two years while the Eastern District of Virginia (E.D. Va.), the district ranked third by the PwC study, had a one year median time-to-trial since 1997, the lowest among any venue in the study. The venue with the greatest median damages level is the Southern District of Texas (S.D. Tex.), where 56 identified decisions returned a median damages level of $58 million.

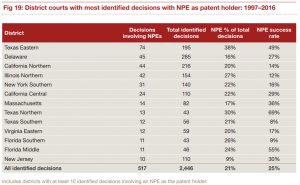

The PwC litigation study also looks at patent cases brought by non-practicing entities (NPEs) to identify trends specific to those firms. Although the study found that cases brought by NPEs are concentrated in fewer districts, there was no clear correlation which PwC drew between the number of identified NPE decisions and the relative success rates for NPEs. E.D. Tex. was was the top venue in terms of both number of decisions involving NPEs (74 decisions) and success rates for NPEs (49 percent). D. Del. had the second largest docket from NPEs, who had a 27 percent success rate over 45 decisions. The Northern District of California (N.D. Cal.) and the Northern District of Illinois (N.D. Ill.) both saw nearly 45 decisions but NPE success rates in those two districts were less than 15 percent. NPEs saw the best success rate in the Northern District of Texas (N.D. Tex.), where those firms were successful in 69 percent of 13 decisions.

The PwC litigation study also looks at patent cases brought by non-practicing entities (NPEs) to identify trends specific to those firms. Although the study found that cases brought by NPEs are concentrated in fewer districts, there was no clear correlation which PwC drew between the number of identified NPE decisions and the relative success rates for NPEs. E.D. Tex. was was the top venue in terms of both number of decisions involving NPEs (74 decisions) and success rates for NPEs (49 percent). D. Del. had the second largest docket from NPEs, who had a 27 percent success rate over 45 decisions. The Northern District of California (N.D. Cal.) and the Northern District of Illinois (N.D. Ill.) both saw nearly 45 decisions but NPE success rates in those two districts were less than 15 percent. NPEs saw the best success rate in the Northern District of Texas (N.D. Tex.), where those firms were successful in 69 percent of 13 decisions.

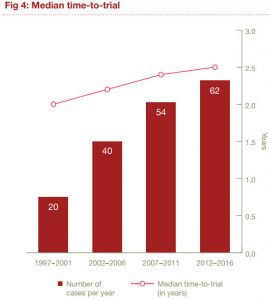

Other major findings from the PwC study include an overall slowdown in median time-to-trial, which has steadily grown towards 2.5 years over the past two decades. Increased case volumes and time added to cases through Patent Trial and Appeal Board (PTAB) review proceedings are cited as reasons for this slowdown. Also, the consumer products industry has accounted for 16 percent of all patent infringement decisions since 1997 although median damages award levels are much lower in that industry than the medical device, biotech/pharmaceutical and telecommunications industries.

Other major findings from the PwC study include an overall slowdown in median time-to-trial, which has steadily grown towards 2.5 years over the past two decades. Increased case volumes and time added to cases through Patent Trial and Appeal Board (PTAB) review proceedings are cited as reasons for this slowdown. Also, the consumer products industry has accounted for 16 percent of all patent infringement decisions since 1997 although median damages award levels are much lower in that industry than the medical device, biotech/pharmaceutical and telecommunications industries.

[Correction: An earlier version of this story incorrectly said that Lex Machina does not include ANDA cases in its year-end litigation reports when discussing the discrepancies between their reports and PwC’s study.]

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2023/01/2021-Patent-Practice-on-Demand-1.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

2 comments so far.

Eric Berend

May 16, 2017 02:00 pmN.B.:

“Increased case volumes and time added to cases through Patent Trial and Appeal Board (PTAB) review proceedings are cited as reasons for this slowdown.”

Gee, I wonder why? Not only are fees charged to inventors diverted to fund PTAB kangeroo court infinite-bites-at-the-apple patentee-antagonistic treatments of their valid patent claims, but the overall process of proper Article III review has become burdened with this abomination of an infringer’s delight.

The classic, traditional Constitutional bargain of disclosure for a chance of enjoying benefit from initial industrialization; as proffered to U.S. inventors for some 220 years until passage of the America Invents Act; is broken. For the sake of a very few already absurdly wealthy intellectual property pirates sometimes known as “infringers”, the U.S. is now motivating a massive ‘reverse’ “brain drain” to other nations – especially China.

Also: why do we lump together enormous leviathan patent disputes with small entity and individual inventors? For similar reasons as Lex Machina’s bifurcation of reporting their study’s results, I would argue that pharmaceutical actions in general (not just ANDA related), by their industrial nature, have even less relevance to small entity patentees.

Anon

May 16, 2017 09:09 amI would disagree with the point concerning Form 18 as a driver, as I was one of the first in the patent blogosphere to draw attention to the need to normalize lawsuit data by the number of patents (actually claims) in play, and I pointed out that such normalization yielded declining trends well before the Form 18 change.