On Thursday, June 15th, legal data analytics site Lex Machina released a 2017 Patent Trial and Appeal Board (PTAB) Report highlighting trends and findings regarding the behavior of the administrative body since its establishment in September 2012 through May 2017. Some of the reports most interesting findings involve which entities are most active at the PTAB as well as the law firms representing parties most frequently during PTAB proceedings.

On Thursday, June 15th, legal data analytics site Lex Machina released a 2017 Patent Trial and Appeal Board (PTAB) Report highlighting trends and findings regarding the behavior of the administrative body since its establishment in September 2012 through May 2017. Some of the reports most interesting findings involve which entities are most active at the PTAB as well as the law firms representing parties most frequently during PTAB proceedings.

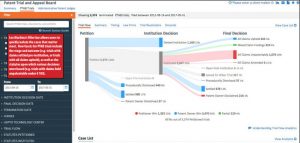

The most frequent resolution for PTAB petitions seeking proceedings, whether inter partes review (IPR) or covered business method (CBM) review, was denial of institution, which has been the result of 22 percent of all petitions filed at PTAB. Readers at this site might note that a denial of institution isn’t necessarily a clear win for a patent owner as serial petitions can wind up invalidating all claims without a 100 percent institution rate on the petitions for those claims. “There’s a difference between winning and not losing, that’s how I see it,” said Brian Howard, a data scientist for Lex Machina and author of the PTAB report. “There’s a hard win, and then there’s a soft win where you’re living to fight another day.” Howard notes that this is the conclusion Lex Machina reaches because it looks at the resolution of trials; it’s not trying to determine whether a patent has been “blessed” by PTAB. He added that, at a webcast presentation of the PTAB report, he was asked why Lex Machina counts proceedings in terms of petitioned proceedings and not the patents involved. “If patents are what you really care about, there’s a way you can do that,” Howard said. “But that’s not the question litigators are asking.”

The most frequent resolution for PTAB petitions seeking proceedings, whether inter partes review (IPR) or covered business method (CBM) review, was denial of institution, which has been the result of 22 percent of all petitions filed at PTAB. Readers at this site might note that a denial of institution isn’t necessarily a clear win for a patent owner as serial petitions can wind up invalidating all claims without a 100 percent institution rate on the petitions for those claims. “There’s a difference between winning and not losing, that’s how I see it,” said Brian Howard, a data scientist for Lex Machina and author of the PTAB report. “There’s a hard win, and then there’s a soft win where you’re living to fight another day.” Howard notes that this is the conclusion Lex Machina reaches because it looks at the resolution of trials; it’s not trying to determine whether a patent has been “blessed” by PTAB. He added that, at a webcast presentation of the PTAB report, he was asked why Lex Machina counts proceedings in terms of petitioned proceedings and not the patents involved. “If patents are what you really care about, there’s a way you can do that,” Howard said. “But that’s not the question litigators are asking.”

The top technology centers seeing patents challenged at PTAB include communications (17 percent of terminated petitions) and semiconductors (15 percent). Transportation (13 percent) and computer architecture (12 percent) form a second tier with mechanical engineering (10 percent) and biochemistry (9 percent) following behind. At a broad level, Howard notes that such findings are useful when trying to determine the risk of PTAB exposure among companies within those industries.

Statistics on administrative patent judges (APJs) at PTAB also render some interesting findings. The four most experienced APJs at PTAB each have more than 400 trials’ worth of experience while some APJs have far fewer cases in which they’ve served. Although the concentration of patent cases in the dockets of a few judges in U.S. district courts has been a topic of much discussion, statutory rules on requests for joinder in IPR proceedings may be naturally causing a concentration of PTAB cases in terms of judges deciding those cases. The PTAB report notes that it’s not unusual for judges to have 20 to 50 cases open at one time.

Statistics on administrative patent judges (APJs) at PTAB also render some interesting findings. The four most experienced APJs at PTAB each have more than 400 trials’ worth of experience while some APJs have far fewer cases in which they’ve served. Although the concentration of patent cases in the dockets of a few judges in U.S. district courts has been a topic of much discussion, statutory rules on requests for joinder in IPR proceedings may be naturally causing a concentration of PTAB cases in terms of judges deciding those cases. The PTAB report notes that it’s not unusual for judges to have 20 to 50 cases open at one time.

The three most experienced law firms representing petitioners at PTAB are, in order, Fish & Richardson, Finnegan, Henderson, Farabow, Garrett & Dunner, and then Sterne, Kessler, Goldstein & Fox. These are also the top three firms in terms of experience representing patent owners challenged at PTAB, with Sterne Kessler taking the top slot, followed by Fish & Richardson and then Finnegan. Howard noted that the specialized nature of PTAB as a forum for challenging patents, especially the differences between practicing at PTAB and practicing at district court, might be a reason why we’d be seeing so much representation of either side in a proceeding among only a few firms. “The way you present things and the procedural expectations are very different,” Howard said. While Fish & Richardson represented the greatest number of petitioners among law firms in both 2015 and 2016, it had dropped to fourth through the first five months of 2017. On the other hand, Fish & Richardson went from second-place in patent owner representation in 2016 to first-place so far this year. Other law firms which are active at PTAB in recent years include Baker Botts, WilmerHale and Sidley Austin.

The three most experienced law firms representing petitioners at PTAB are, in order, Fish & Richardson, Finnegan, Henderson, Farabow, Garrett & Dunner, and then Sterne, Kessler, Goldstein & Fox. These are also the top three firms in terms of experience representing patent owners challenged at PTAB, with Sterne Kessler taking the top slot, followed by Fish & Richardson and then Finnegan. Howard noted that the specialized nature of PTAB as a forum for challenging patents, especially the differences between practicing at PTAB and practicing at district court, might be a reason why we’d be seeing so much representation of either side in a proceeding among only a few firms. “The way you present things and the procedural expectations are very different,” Howard said. While Fish & Richardson represented the greatest number of petitioners among law firms in both 2015 and 2016, it had dropped to fourth through the first five months of 2017. On the other hand, Fish & Richardson went from second-place in patent owner representation in 2016 to first-place so far this year. Other law firms which are active at PTAB in recent years include Baker Botts, WilmerHale and Sidley Austin.

The top five petitioners at PTAB are a collection of the world’s largest consumer tech firms including Apple Inc. (NASDAQ:AAPL), Samsung Electronics Co. (KRX:005930), Samsung Electronics America, Google (NASDAQ:GOOGL) and Microsoft Corporation (NASDAQ:MSFT). Through this May, Apple has filed a total of 370 petitions at PTAB. Both Samsung entities have filed more than 250 petitions each, Google has filed 180 petitions and Microsoft has filed 124 petitions. Far and away, Zond has been the patent owner challenged by the most petitions, targeted in a total of 124 petitions; places two through ten feature entities who have been named in anywhere from 44 to 71 petitions. These numbers are likely influenced by the amount of activity in U.S. district courts involving these parties, Howard noted. “I think the top petitioners look a lot like the top defendants in district court while the top patent owners look shockingly like the top plaintiffs in district court,” he said.

The top five petitioners at PTAB are a collection of the world’s largest consumer tech firms including Apple Inc. (NASDAQ:AAPL), Samsung Electronics Co. (KRX:005930), Samsung Electronics America, Google (NASDAQ:GOOGL) and Microsoft Corporation (NASDAQ:MSFT). Through this May, Apple has filed a total of 370 petitions at PTAB. Both Samsung entities have filed more than 250 petitions each, Google has filed 180 petitions and Microsoft has filed 124 petitions. Far and away, Zond has been the patent owner challenged by the most petitions, targeted in a total of 124 petitions; places two through ten feature entities who have been named in anywhere from 44 to 71 petitions. These numbers are likely influenced by the amount of activity in U.S. district courts involving these parties, Howard noted. “I think the top petitioners look a lot like the top defendants in district court while the top patent owners look shockingly like the top plaintiffs in district court,” he said.

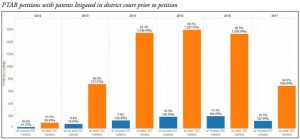

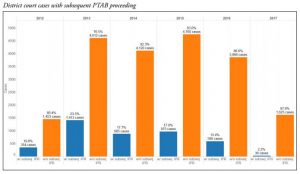

Other graphs included with the PTAB report look at the overlap between patent validity challenges at PTAB and patent litigation in U.S. district courts. In the past few years, the percentage of patents challenged at PTAB which were first asserted in district court infringement proceedings have ranged from about 85 percent through the first five

Other graphs included with the PTAB report look at the overlap between patent validity challenges at PTAB and patent litigation in U.S. district courts. In the past few years, the percentage of patents challenged at PTAB which were first asserted in district court infringement proceedings have ranged from about 85 percent through the first five  months of 2017 to as much as 92.4 percent in 2014. The patents challenged at PTAB which don’t spring from district court proceedings could either the result of a proactive alleged infringer who has received a demand letter or the activities of groups or companies like Unified Patents.

months of 2017 to as much as 92.4 percent in 2014. The patents challenged at PTAB which don’t spring from district court proceedings could either the result of a proactive alleged infringer who has received a demand letter or the activities of groups or companies like Unified Patents.

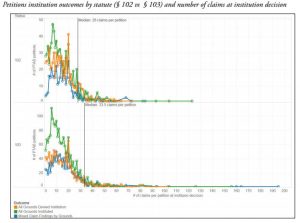

The PTAB report also includes data on claim level findings and IPR institution decisions at the claim level. According to Howard, this data was broken out in the Lex Machina report in order to answer questions which some have had about mixed claim finding figures in previous Lex Machina reports. “There’s nothing magic or crazy going on when you look under the surface of the water,” Howard said. “It’s consistent with earlier charts in terms of institution decision.” Other than the fact that Section 103 challenges for nonobviousness tend to result in more mixed findings by ground than Section 102 challenges for novelty, nothing in the numbers is out of the ordinary said Howard.

“Especially with Oil States being taken up by the Supreme Court, it’s an interesting time to look at the PTAB now that the court’s going to make it or break it based on policy,” Howard said. “After TC Heartland, now’s an interesting time to pay attention to PTAB based on policy, effectively sort meritorious petitions from non-meritorious ones.” Data on IPR institution decisions by the number of claims included in the petition also highlighted a unique trend. Both Section 102 challenges and Section 103 challenges see a high number of decisions to institute on all claims when just less than 10 claims are challenged; the discrepancy is especially noticeable with Section 103 challenges. Once petitions reach 20 claims or more, there seems to be an even split between petitions with all claims instituted and petitions with all claims denied. “There seems to be a sweet spot where they converge,” Howard said.

“Especially with Oil States being taken up by the Supreme Court, it’s an interesting time to look at the PTAB now that the court’s going to make it or break it based on policy,” Howard said. “After TC Heartland, now’s an interesting time to pay attention to PTAB based on policy, effectively sort meritorious petitions from non-meritorious ones.” Data on IPR institution decisions by the number of claims included in the petition also highlighted a unique trend. Both Section 102 challenges and Section 103 challenges see a high number of decisions to institute on all claims when just less than 10 claims are challenged; the discrepancy is especially noticeable with Section 103 challenges. Once petitions reach 20 claims or more, there seems to be an even split between petitions with all claims instituted and petitions with all claims denied. “There seems to be a sweet spot where they converge,” Howard said.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.