Although many think of unmanned aerial vehicles (UAVs) or “drones” as a modern development, UAVs have an extensive history dating back to the original development of lighter-than-air flight. Initial attempts were limited by the technology of the age – an attempt by the Austrian empire to launch balloon bombs against the Venetian state failed when a shift in wind resulted in the balloon bombs returning toward the Austrian troops. Early engineering efforts to support unmanned aerial flight included the development of radio-based remote control by Serbian-American Nikola Tesla, an “Aerial Target” developed in 1916-17 by Englishman Archibald Low, and an “Automatic Airplane” developed in 1916-18 by Americans Elmer Sperry and Peter Cooper Hewitt. Early attempts often ended in failure – Low’s Aerial Target crashed during all three test flights before being abandoned; Sperry and Hewitt’s Automatic Airplane successfully completed a single successful test flight of 1000 feet, but all completed test airframes were destroyed in subsequent crashes resulting in abandonment.

Although many think of unmanned aerial vehicles (UAVs) or “drones” as a modern development, UAVs have an extensive history dating back to the original development of lighter-than-air flight. Initial attempts were limited by the technology of the age – an attempt by the Austrian empire to launch balloon bombs against the Venetian state failed when a shift in wind resulted in the balloon bombs returning toward the Austrian troops. Early engineering efforts to support unmanned aerial flight included the development of radio-based remote control by Serbian-American Nikola Tesla, an “Aerial Target” developed in 1916-17 by Englishman Archibald Low, and an “Automatic Airplane” developed in 1916-18 by Americans Elmer Sperry and Peter Cooper Hewitt. Early attempts often ended in failure – Low’s Aerial Target crashed during all three test flights before being abandoned; Sperry and Hewitt’s Automatic Airplane successfully completed a single successful test flight of 1000 feet, but all completed test airframes were destroyed in subsequent crashes resulting in abandonment.

Today, unmanned aerial vehicles are found throughout the world in fields as diverse as recreation (see example 1 and example 2), surveying (See example 1, example 2, example 3, and example 4), delivery (See example 1 and example 2), and photography. Further, a desire for military applications of UAVs has only increased since initial attempts ended in failure. The U.S. military has deployed numerous UAVs, such as reconnaissance UAVs, attack UAVs, target UAVs, and more. The U.S. is not alone in producing and deploying UAVs, other major producers and users of UAVs include Argentina, Australia, Brazil, Canada, France, Germany, India, Iran, Israel, Italy, Japan, Pakistan, Russia, Turkey, and the United Kingdom. All told, over 60 nations have deployed and/or developed UAVs for military or civilian law enforcement use.

Given the broad range of countries deploying UAVs and the large number of applications for UAVs, we took a look at patent data from the last 20 years (1997 to 2016) to determine whether any trends in UAV development could be identified. Our findings show some surprising results with regard to development and patenting of drone technology. In this analysis we focuses on the top-5 patent offices for obtaining UAV related patents, the State Intellectual Property Office (SIPO) in China, the United States Patent and Trademark Office (USPTO), the European Patent Office (EPO), the Korean Intellectual Property Office (KIPO) in South Korea, and the Japan Patent Office (JPO).

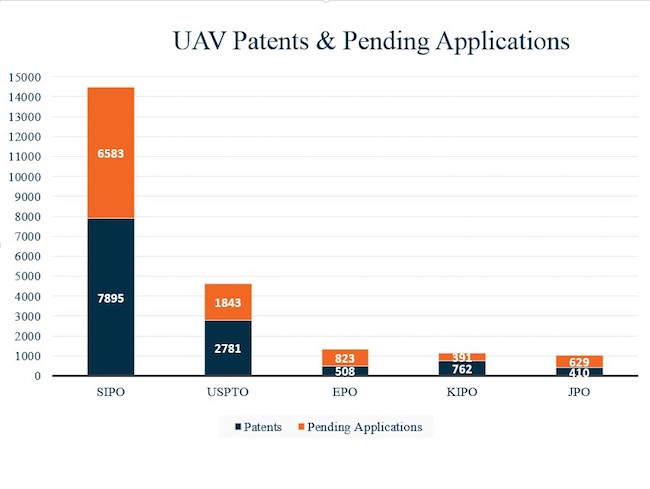

Figure 1, shows patents and pending applications. Currently, China far outpaces other jurisdictions as the preferred location for obtaining UAV patents. This is less than surprising, as discussed in more detail later, given the number of recreational (e.g., toy) UAV patents filed by Chinese companies, such as Da-Jiang Innovations Science and Technology Co., Ltd. (DJI). What may be more surprising to many in the patent field is that Japan is only fifth in terms of patent protection behind both Europe and South Korea.

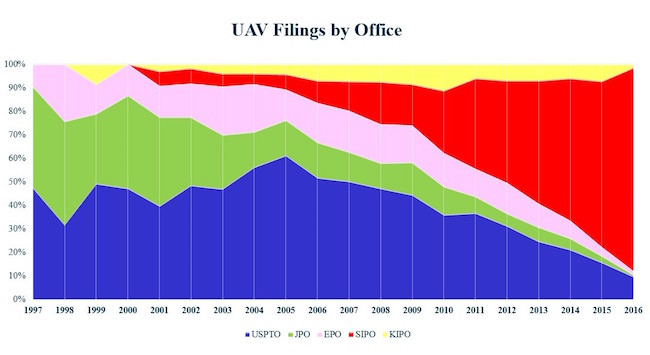

Figure 2 shows historical percentages for filings by jurisdiction; however. It should be noted that the depicted jurisdictions are not comprehensive. For example, patent filings at European national patent offices comprised approximately 5% of total filings and other, non-European, jurisdictions, such as Israel, India, Australia, the World Intellectual Property Organization (WIPO), etc. comprised approximately 12% of total filings over this period.

In the early years of the analyzed data set, the United States was the top location for UAV patent protection followed closely by Japan. Here, it should be noted that data for the State Intellectual Property Office in China was only available as far back as 2001, however, as of 2001, China was well behind the United States, Japan, and Europe as a preferred forum for obtain patent protection.

During the technology boom of the late 1990s and early 2000s, Japan rose to a near tie with the United States; however, by 2005 Japan had been overtaken by Europe and by 2008 China had passed them both. After 2011, the United States lost its primacy as a forum for patent protection, with China rapidly outpacing all other countries to the point that today, China is the forum for more UAV patent applications than all other jurisdictions combined.

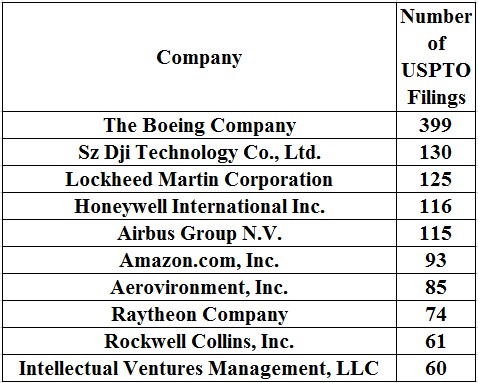

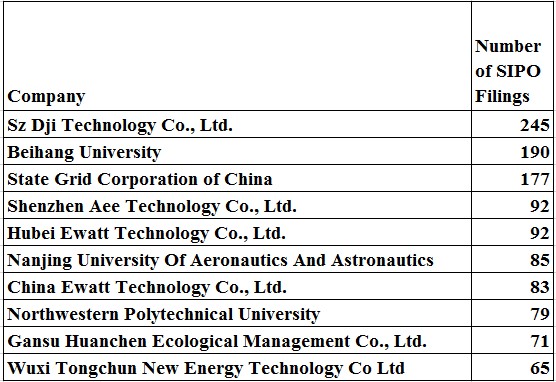

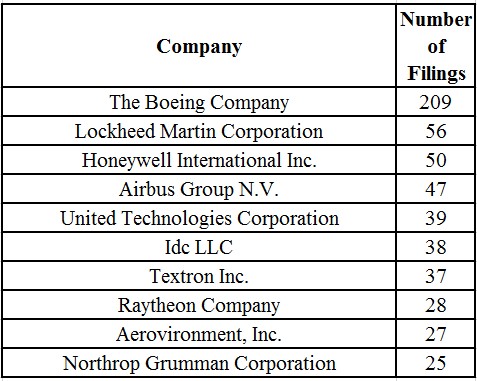

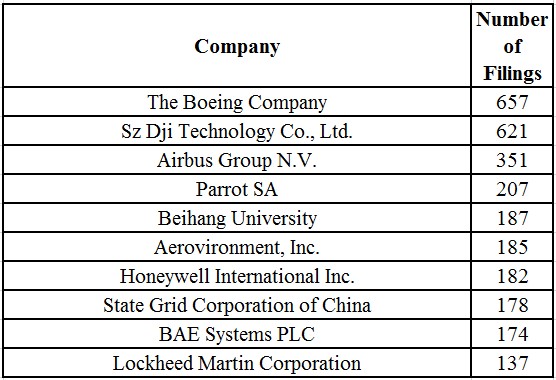

Tables 1 and 2 show the top ten filers for patent protection for UAV related patents at the United States Patent and Trademark Office (USPTO) and the State Intellectual Property Office (SIPO). As noted previously, UAV related patents include many toy UAVs, the largest patent-getter of which is DJI. At the USPTO, aviation specialists and defense contractors join DJI as the top patent-getters. Another notable name among the top USPTO patent-getters is Jeff Bezos’s Amazon.com, which has publically announced its intention to use UAVs for consumer deliveries. Finally, among the top USPTO patent-getters is controversial intellectual property developer Intellectual Ventures.

Tables 3 and 4 show the top 10 filers for patent protection for UAV related patents pre- and post-2008, respectively. Here, we see a shift from the traditional aerospace and defense companies, such as Boeing, Lockheed Martin, Honeywell, and Airbus, to new companies, such as DJI and Parrot, seeking patent protection for consumer UAVs.

It’s clear that the USPTO no longer receives the most filings or issues the most patents for UAVs, but is the United States slipping behind China as a preferred market for UAV technology? Or is the USPTO being more aggressive than SIPO in rejecting redundant and/or obvious patent filings, resulting in fewer filings and fewer issuances? What do you think?

Author’s note: This article would not have been possible without the assistance of Rocky Berndsen, and Gabriella Beaumont-Smith. The author also thanks Ryan Mock for his assistance in refining the ideas in this article.

The following query was used on 07/07/2017 to obtain patent data from Innography.com: (cpc_B64C2201* OR cpc_B64C2203* OR @(title,abstract,claims) (=uav OR =uas OR =uavs OR =rpav OR =rpas OR =mav OR =rpa OR =roa OR (unmanned aerial vehicle) OR =drone OR =drones OR (autonomous aerial vehicle) OR (unpiloted aerial vehicle) OR (unmanned aircraft system) OR (unmanned aircraft vehicle system) OR (remotely piloted aerial vehicle) OR (remotely piloted aircraft system) OR (micro air vehicle) OR (remotely piloted aircraft system) OR (remotely operated aircraft))) AND NOT (cpc_C* OR cpc_A01N* OR cpc_A23G* OR cpc_A61K* OR cpc_A61L* OR cpc_A61N* OR cpc_A62B* OR cpc_A63G* OR cpc_B01D* OR cpc_B60C* OR cpc_B60J* OR cpc_B60K* OR cpc_B60N* OR cpc_B60P* OR cpc_B60Q* OR cpc_B60R* OR cpc_B60T* OR cpc_B62*).

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Benny

July 27, 2017 05:57 amLet me guess: The biggest markets for RPVs (hence the available R&D budgets) have shifted in the last half decade from the military industrial sector to the consumer sector. The US and EU tend to invest in high value, vertical markets, leaving the high volume, low margin market to China, with whom the US cannot compete on labour costs. This being the emerging market, this is where you see the patent filings. It would have been interesting to include KR filings in the statistics, because this is where you will find a lot of of innovation in the hi-tech consumer market.