To keep pace with competitors, businesses must constantly monitor, adjust, and streamline their patent portfolios. Doing so ensures that portfolios deliver the maximum potential return on investment by staying aligned with corporate goals, industry and technology developments, and growth areas across industries and businesses. This process requires managers to adjust the makeup their portfolios to maintain effective coverage in specific areas and eliminate or reduce low-value patents to minimize maintenance.

To keep pace with competitors, businesses must constantly monitor, adjust, and streamline their patent portfolios. Doing so ensures that portfolios deliver the maximum potential return on investment by staying aligned with corporate goals, industry and technology developments, and growth areas across industries and businesses. This process requires managers to adjust the makeup their portfolios to maintain effective coverage in specific areas and eliminate or reduce low-value patents to minimize maintenance.

The most effective way to accomplish these goals is through regular portfolio audits that help assets remain aligned with overall business objectives. Remember, a good portfolio protects the technology behind a company’s key products, but a great portfolio protects technology used across the company’s ecosystems and can provide leverage in a number of business situations.

Types of Audits

In general, there are two types of IP audits: event driven audit and active portfolio management audits.

An event-driven audit takes place when something occurs or is about to occur that can impact a company’s IP or where the IP can be leveraged. For example, before a third party invests in or purchases a company they may conduct an IP portfolio audit to assess the financial, commercial, and legal risks associated with the portfolio. The audit results can provide information that may affect the price or other details of the transaction. Event-driven audits are instigated most often when a financial transaction involving IP is contemplated. These may include buying or selling a division or product line, licensing, IP disputes, outsourcing and bankruptcy.

Active audits are part of integral portfolio management activities. Regular audits ensure the portfolio is being cultivated and managed to meet the continually changing needs of a company from the evolving business environment, technology, industries, and/or financial markets. Ideally, companies incorporate ongoing audits as best practices inot their regular IP business process, and as part of their business strategy review and update to maintain alignment of the IP and business strategy.

Identifying Patent Portfolio Objectives

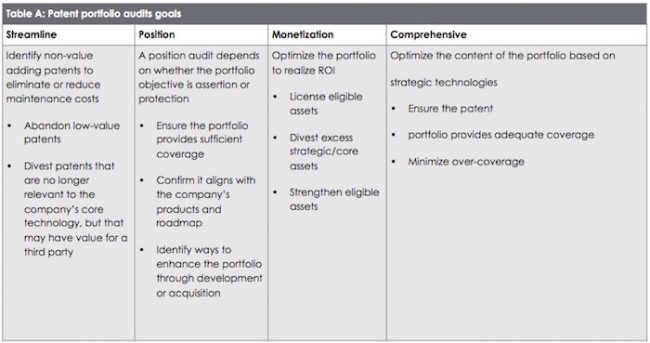

Prior to starting, it is essential to establish specific goals for the portfolio audit. In general, there are four goals that can be achieved through portfolio audits: streamlining portfolios; ensuring portfolios are well-positioned, positioning portfolios for optimal monetization, and ensuring the portfolio provides sufficient coverage without excess. These are detailed in Table A. Companies may opt to focus on any one of these, or a combination. Additionally, portfolio audits may help companies identify strengths and gaps.

The Audit Evaluation Framework

A portfolio audit methodology must be consistent so that patents can be examined, compared, and acted on appropriately. This ensures the company’s needs are met with every audit completed. As part of this methodology, companies should determine when to use software tools in the process and when a Subject Matter Expert’s knowledge is critical (internal resources and 3rd party experts as necessary). Ultimately, reading patents to map them to specific products is the most important step in most IP portfolio audits. The reality is that no matter how experienced a Subject Matter Expert (SME) is, SME’s can’t afford to read hundreds, or thousands, of patents in a cost effective and timely manner. Today’s innovative IP strategies have heightened the need to cull a list of patents quickly and effectively. To maximize efficiency, the short-list should only contain patents likely to support your IP strategy: those that are likely to read on your targets. Tools play an indispensable role on two fronts: First, they help SME’s sort, filter and understand a pool of patents quickly and efficiently – far better than what can be done manually. Second, analytical tools help SME’s and owners alike visualize their patents, or those of other assignees, to formulate, vet and communicate their IP strategies.

Tools can only get you so far. Even the data-driven portion of the patent mining activity should involve SMEs. Many organizations use automated tools to develop portfolio taxonomies, but this approach results in the establishment of groupings that lack relevance to the business, and more specifically, to the opportunity at hand. Instead, employ the use of SMEs to determine relevant groupings, and then use automated tools to classify patents into those groupings.

The most common areas evaluated by SME’s include provable use, workaround, economic value, and validity. Patent use, and the ability to prove it, is probably the most important attribute to generating patent value. There are other motivations that go beyond the value of individual patents, such as filling white space, consolidating patents into a pool, or improving a company’s innovative reputation.

Developing an evaluation framework that is specific to your business is the first step. This ensures that patents are being evaluated against specifically identified criteria, and that the results and recommendations will be reported uniformly. Table B outlines the steps required to develop the evaluation framework. These are also the steps used to conduct the audit itself.

Patent Assessment Criteria and Rating

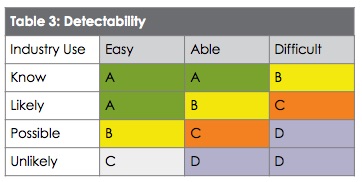

The criteria used to assess patents varies from business to business based on a company’s objectives and industry focus, the use of patents within the industry, and their ability to detect use. Two important criteria to consider are the use of the technology within the industry and the ability to detect such use of the invention. In addition, some or all the following are important to evaluate as well:

- Strength of the invention

- Commercial merit of the technology

- Quality of the claims construction

- Novelty of the claimed invention

- Remaining life span of the patent

- Strategic value to the core business

- Licensing or assertion history

As patents are evaluated, they should be assigned a rating, A through D as shown in Tables C and D, which provide a high-level overview of what each rating means.

Patent Monetization

As patents are evaluated, some will fall easily into defined categories. For example, patents that are not detectable and not known to be used in the industry would be considered low-value that may be abandoned. Another category is key portfolio drivers that are easily detected and known to be used. These will be kept and maintained.

There is usually a grey area, however. Here are found potentially very good patents that have not yet been adopted by the industry, but which may become foundational patents in the future as technology evolves. Patents in this area take a higher degree of skill to evaluate appropriately, and can be candidates for strategic patent-strengthening programs.

Evaluated Patents: What’s Next?

After a patent portfolio audit, individual patents may be classified into five groups: keep, license, strengthen, divest, or abandon, based on their potential value to the company. This classification allows companies to define the action that needs to be taken for each patent.

- Keep: These are assets that generate revenue or strengthen the portfolio. They should be maintained appropriately.

- License: Patents in the classification require action for infringement and/or licensing opportunities.

- Strengthen: These are usually patent families identified by the prosecution team that, from a technical perspective, may have applications beyond what has already been examined. They could be candidates for continuations and claims improvement based on unclaimed subject matter. With augmented or improved claims construction, for example, a C-rated patent can become an A-rated patent that is targeted at an industry segment, which is strategically significant to the company.

- Divest: The audit may have identified over-patented areas of the portfolio, typically groups of patents in a narrow area of focus. These have been patented to the point where divesting a few would not impact the company’s ability to use the portfolio to achieve its In addition, the audit may have identified patents that have value, but that do not align to corporate strategy. These include, for example, non-core loner groups of patents produced through R&D programs that are not part of the client’s core technology. They may still have value to a third party.

- Abandon: Finally, there will be patents that have no value. These include patents that are known not to be used, not likely to be used, and not detectable. They have no licensing or defensive potential, so most likely they will not be of interest to a third party. Additionally, they may be patents in a geographic region not important to the company.

Portfolio Audits Inform Decisions

Thorough audits based on consistent, well-defined criteria can help a business make well-informed decisions about their assets in a range of scenarios. These include:

- Mergers and Acquisitions: An audit will identify whether or not a newly acquired portfolio provides patents in areas that aren’t covered by a company’s existing portfolio. If so, the audit will determine if they are ready to be used and in what ways. If not, the audit will help you decide whether to divest or abandon the patents.

- Portfolio Strategic Alignment: Through an audit, a company can determine if the portfolio aligns with the company’s strategy. If so, the portfolio may provide an effective counter-assertion against the company’s competitive threats and align with the competition’s product roadmap. If not, the company should develop a plan to align it through acquisition, targeted R&D development and other programs.

- Patent Culling: Information from the audit may show that the company is paying maintenance fees that don’t provide value to the company. If this is the case, the company should determine the best way to cull patents. If not, then well done!

With the big questions answered and the patent portfolio optimized, experts can help develop a best practices strategy to maintain and grow the portfolio value moving forward.

Active Portfolio Management

A portfolio audit can be a significant undertaking. To maximize the value of the results after an audit, a company should adopt best practices that support proactive portfolio management moving forward. With the portfolio streamlined, the company must make sure that its IP teams and business units can identify areas of invention for patenting that align well with the product roadmap. This should be an active task with teams working to pull technology inventions that align with the corporate strategy and product roadmap, as opposed to waiting passively for disclosures.

When the team pulls a technology invention, it should go through the normal review process to determine whether to invest in the prosecution of the invention, and how broadly to prosecute it.

This plan will prevent portfolio bloat from reoccurring, can lead to strategic filing, ensures that evolving business needs and product roadmaps will be aligned with the IP portfolio strategy and enable the company to react to a changing competitive landscape quickly.

Moving to active portfolio management often requires a fundamental change in behavior between the business units and the IP groups to enable proactive information sharing. Additionally, staffing augmentation may be required. The IP group, for example, will need a technically savvy individual with good IP knowledge, who is also connected to the strategic decision-makers. This person should be empowered to enable IP and business unit groups to connect and work together in a much more strategic and proactive manner.

Patent Portfolio Audit Promotes Effective Portfolio Maintenance

A patent portfolio is like any other high-value business asset in that if it isn’t proactively maintained, it will become less effective at serving the needs of the business. A portfolio audit realigns that asset with shifting organizational requirements. It streamlines the portfolio to ensure optimal performance, and it enables the establishment of effective maintenance best-practices moving forward. A good portfolio is essential in protecting the technology behind a company’s key products. Regular live audits, however, ensure that a company’s portfolio is exceptional and that it is poised to work across its ecosystems to provide leverage in a wide range of business situations. By establishing a culture of identifying and cultivating IP assets and strategically using them, an enterprise can increase its revenue, have an edge over its competitors, and position itself well in the market.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.