Over the next few years, the most interesting intellectual property trend to watch will be what happens with new patent applications. The number of utility patent applications filed in the United States declined in 2015 (compared with 2014) and again in 2017 (compared with 2016).

If the downward slide continues, will this be due to smarter filing strategies, or will it be because less emphasis is being put on patents? Will it be because more emphasis is being placed on trade secrets? Is it because of an unfavorable climate in the United States for certain types of inventions?

Filings in other parts of the world are on the rise at a time when U.S. utility applications are either stagnant or in decline. Could it be because patent applicants are moving elsewhere?

As stated by Erik Reeves, CTO of Anaqua, “What we will begin to see over the next few years is a counter trend to the massive patenting acceleration we saw from the 90’s to now, with varying regional timing,” he explained. “We will see some leveling off in patent applications around the world as patentees make smarter, more informed decisions when it comes to filing and renewals; and as there is increasingly a move from quantity to quality. It’s a trend that may well lead in years to come to a decrease in the overall number of new patents filed annually, together with an increase in the number of patents that can lapse.”

According to Reeves, there is a “portfolio effect” at play that complicates this calculus, but there is certainly a growing focus on quality over quantity and better stewardship overall of resources directed towards R&D and IP development. While the USPTO patenting statistics for 2017 showed a 5 percent increase in patent grants over 2016, there were 7,000 fewer applications published, continuing the slowing trend in patent applications seen in the US in recent years.

Internationally, the emergence of huge economies such as China on the IP scene in recent years has led to a significant global increase in patent applications, with China now well established at the top of the list of the world’s leading patent filers. In fact, as economies move from importing innovation to developing home-grown innovation, there is a natural tendency to cast a wide net to protect that innovation. “This can lead to something of a ‘patent for patent’s sake’ approach and a focus on quantity rather than quality,” Reeves said. “You could also see a bit of the ‘race to become an IP player’ here in some economies that haven’t historically been big IP players – much like we see in corporate IP governance in certain technology areas, you need a certain warchest of IP to “get in the game.”

However, Reeves says that over time, as more countries embrace modern IP management and analytics, the value of a more strategic approach to patent filing and renewals becomes apparent – and this tends to lead to a gradual switch in focus from quantity to quality. So, if the downward slide continues, is this due to smarter filing strategies, or is it a larger issue with less emphasis put on patents?

“Only time will tell, but the trend we identified last year of patentees making more informed filing and renewal decisions backed by insights gained from big data analytics, is still holding true,” he explained. “Going forward, we believe organizational focus will be on smaller, higher quality patent portfolios to better protect products, provide a good defensive stance, and maximize monetization potential via sales and licensing.”

He thinks we will also see a bigger focus on aligning IP with corporate strategy and product portfolio management. There are several ways to monetize or leverage IP assets, but at the end of the day, patents are there to maximize the ROI of R&D investment – the area where this has highest potential is in products. As cross-functional teams of IP legal experts, licensing professionals, product managers, and engineering/R&D coordinate better, we’ll see more alignment of product and IP roadmaps – leading to stronger alignment of IP strategy and product life-cycle management.

“The backbone of much of this is increasingly data, analytics, and decision support tools armed with AI – I think the potential for economic growth is potentially huge here,” he said. “I think we will see some of these innovations paired with emergent technologies that require a different way of thinking about IP because of either their foundational characteristics or the speed of innovation.”

Big data analytics and AI are transforming the IP industry – as smart analytics provide intelligence on the markets, competitor activity, etc. at a fraction of the time of traditional research methods. This is helping IP professionals make faster, more informed decisions and develop strategies that are better aligned with and more effective in supporting the broader business goals. In this way, they are underlining the critical importance to organizations of ensuring they have the right IP assets in place and a business-led approach to managing those assets. In fact, through big data analytics, there are vast amounts of information available now to help IP practitioners.

“Taken in isolation, data points can add limited value. It’s when such intelligence is assembled and delivered in an easily consumed format at the right time, that it has a direct and hugely beneficial impact on an IP organization and its internal or external clients,” Reeves explained. “Business executives, attorneys, practitioners, portfolio managers all gain from timely access to actionable intelligence. This applies to every stage in the innovation and IP lifecycles – as well as to many broader business decisions relevant to a company’s product strategy and market competitiveness.”

In today’s world, there is a balance to be struck between the protection of patent assets and the expense of maintaining portfolios that might be bloated with patents that are now of little or no value to an organization. For most IP professionals, their role involves a combination of innovation management and cost management. The patent process can be very expensive, son on a fixed annual budget, money spent on renewals is money not spent protecting new ideas. While, it is key to ensure that valuable IP assets are protected, the depth of research and evaluation of markets, competitors and patentability that analytics bring enables a more informed, strategic and cost-effective view of decisions.

According to Reeves, for patent-holding organizations, a key to success in protecting IP assets is how well they know themselves. The better that IP professionals know their own business, the better able they are to identify and protect the business against competitor threats. He said, “The bigger the portfolio, the harder it is to keep track and to truly know what you have… and why.”

“A major benefit of taking a more focused approach is that it allows for improved patent-product mapping, providing a clearer view of which patents protect which products or range of products,” he added. “That may seem obvious, but it can become complicated, especially where various products and their components are protected by multiple patents (and the reverse).”

Overall, by tracking patents and the products they protect, IP professionals have better information for making decisions. The intelligence gained through mapping and big data analytics will help determine which patents have most value to the business and should be kept; which may have value to other organizations and represent potential licensing or sale opportunities; and which have little or no value and can be abandoned.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

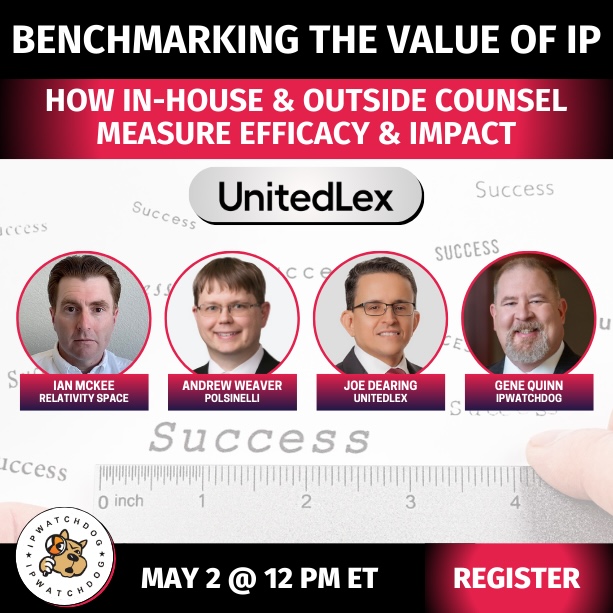

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

25 comments so far.

Night Writer

June 21, 2018 09:27 amHow many of these are filings from inventions made in the USA?

Peter

May 21, 2018 10:11 amToo expensive, too labour intensive too in effective.. for anyone other than the big boys.. Great money spinner for the lawyers though!

Fred

May 11, 2018 07:36 amEither the demand is falling because companies no longer consider a patent an effective device for protecting IP or the costs of acquiring, keeping and protecting a patent are considered too high in the current climate

What is interesting to see in the graph is that the ratio of applications vs. patents issued varies that much over time. Could the standards be slipping and is that causing the drop in applications?

Kevin R.

April 18, 2018 05:49 pmCan Anaqua determine if *new* patent filings are down? I expect that continuation patent applications are down and new patent applications are still growing.

Tiburon

April 16, 2018 07:55 pmIt’s more than just which patents to pay maintenance on and which to abandon – it’s also about alternative business models that may be more profitable.

Night Writer

April 12, 2018 11:40 am@15 what role Benny do you have in the patent filings/product development/R&D expenses?

You do not sound to me like you understand the functioning of the U.S. system.

Night Writer

April 12, 2018 10:10 am>> Improved analytics help us evaluate patentability and portfolio value, which translates to a reduction in the number of “junk” patent applications.

This is not a factor in the patent filing numbers and is obviously a red herring.

>Wouldn’t help, since many foreign players file first with the USPTO.

Yes it would. Let’s see the graph.

Anon

April 12, 2018 09:42 amBenny,

Given your ever-present display for a lack of understanding of patent law principles, your attempted denigration here is rather unsurprising (not to mention, ill-aimed, as you seek to impugn a position for me that you have not even bothered to establish that I have – I have always provided that patent law is a sovereign-centric type of law and that non-US sovereigns are free to design whatever system they may choose for their sovereign [without my denigrating those choices or callling similar elements better – because of US, or worse – because of non-US]).

You may like the quote – but it just does not fit here. So much like a lot of what you say, your “liking” is rather meaningless to the actual issues at hand.

Thanks again for the (continued) comfirmations of my positions.

Benny

April 12, 2018 09:33 amAnon,

Your position regarding the US patent system reminds me of a quote from the chief of RAF bomber command (Sir Arthur Harris) prior to world war 2, referring to the American people:

“…They have the money, enthusiasm, enormous potential, industrial resources, together with a vast reservoir of efficient personnel. The also have ideas, although their major obsession is that all their geese are swans and that everyone else’s are at best ducks.”

Anon

April 12, 2018 09:21 amBenny,

Your admission is a dagger to Greg’s position.

Thanks for the confirmation.

Benny

April 12, 2018 05:33 amNight @13,

Wouldn’t help, since many foreign players file first with the USPTO.

Eric Reeves has a valid point, typified by our own company. Improved analytics help us evaluate patentability and portfolio value, which translates to a reduction in the number of “junk” patent applications.

Filings in other parts of the world are a response to increased globalized trade. If a competitor opens a manufacturing facility in Burkina Faso, that’s where you will see me file for patent protection.

China patent applications are increasing partly because Chinese innovation is increasing, and not t’other way round.

Anon, from my viewpoint, Greg makes more sense than you.

Arrow

April 11, 2018 09:59 pmSince all the applications filed in 2017 are not yet published, that count cannot be accurate!

Night Writer

April 11, 2018 07:46 pm@12 Anon

We really need a chart that shows U.S. utility filings without a priority claim to a foreign filed application.

Anon

April 11, 2018 07:15 pmNight Writer,

I suspect that you may be correct in regards to the US share of the (already) falling filings.

I don’t have the data on hand, but I seem to recall that the share of US patent usage by those foreign entities had climbed over 50% (and was still climbing).

But to add a small additional view to the filing situation – small entities tend NOT to file in foreign countries where they will not have a presence. Greg appears to fall into the trap that anyone will choose to file anywhere based on the relative strengths of the different patent systems.

Such would only be true in a rather limited fashion. Those that can afford and those that have foreign markets may fall into Greg’s view point, but such do not cover those most protected by a US patent system.

Greg is not new “on the block” and likely knows this (or should know this). I suspect that he was merely trying to Tr011 (just a little).

Night Writer

April 11, 2018 05:44 pm@7 Anon The distinction that Night Writer is referring to though are US patent system filings by foreign entities (i.e., NON-US entities).

Yes. I think we need a chart with U.S. filing originating in the US. As opposed to a foreign entity filing in the US and claiming priority to patent already filed in a foreign country.

Actually, if this graph includes patents filed by foreign corporations that are claiming priority to a foreign filed application, then the US patents are WAY down–way, way, way down.

Night Writer

April 11, 2018 05:41 pm@6 Greg, if you have figured it out, the problem is that patents are also related to how much money corporations are willing to put into R&D. As patents become worthless, the corporations are less likely to spend money as whatever comes of it can just be copied.

Night Writer

April 11, 2018 05:39 pm@6 Greg DeLassus Presumably, if a corporation does not file in the U.S., it means that the corporation does not think that there is an adequate ROI to be expected from a U.S. patent. Why should anyone other than the shareholders of that corporation care about that business decision?

Wow. That level of ignorance is not even worth responding to.

Anon

April 11, 2018 02:28 pm(double mea culpa – the mea culpa should have been to your post at 5, not 6)

Anon

April 11, 2018 02:26 pmGreg @ 6,

Mea culpa – of course these are US patent system filings.

The distinction that Night Writer is referring to though are US patent system filings by foreign entities (i.e., NON-US entities).

I would have thought that such was clear for my remark, and apologize if your reading missed that.

As to your last comment: “Why should anyone other than the shareholders of that corporation care about that business decision?” – I certainly hope that YOU meant that as a tongue in cheek comment and understand the value that HAVING a patent system – and thereby the value in using that system – brings.

It matters very much – TO ALL – that a patent system is used, and in particular, that OUR US patent system is used.

Greg DeLassus

April 11, 2018 12:57 pm“If the downward slide continues…”

This is a pretty big IF, no?, The data show a decline in 2009 relative to 2008, but then things picked up again in 2010. Again, there was a decline in 2015 relative to 2014, but then things picked up in 2016. It seems a bit premature to look at the decline in 2017 relative to 2016 and to start speculating that this is the beginning of a meaningful slide.

“Filings in other parts of the world are on the rise at a time when U.S. utility applications are either stagnant or in decline. Could it be because patent applicants are moving elsewhere?”

What does it mean for patent applicants to “move elsewhere”? I cannot be in two places at one time, so if I am in China, then I cannot simultaneously be in the United States. A patent applicant can, however, very easily file in both the U.S. and China. To file in one does not mean that one has “moved” from the other.

Presumably, if a corporation does not file in the U.S., it means that the corporation does not think that there is an adequate ROI to be expected from a U.S. patent. Why should anyone other than the shareholders of that corporation care about that business decision?

Greg DeLassus

April 11, 2018 12:51 pm“I do not believe that the data presented here (showing a drop) has been compiled with only US-based filings.”

The second sentence of the article says that “[t]he number of utility patent applications ***filed in the United States*** declined in 2015 (compared with 2014) and again in 2017 (compared with 2016),” (emphasis added). The title on the graphs reads “Utility Patents ***at the USPTO***” (emphasis added). I am hard pressed to see any plausible reading that takes these data as reflecting filings world-wide. Surely, these are U.S.-only filing data, no?

Anon

April 11, 2018 11:17 amNight Writer,

I do not believe that the data presented here (showing a drop) has been compiled with only US-based filings.

In other words, even the “Lemley-ism” of inclusion of foreign filings shows a drop here.

Night Writer

April 11, 2018 10:32 am(Note that Lemley has been going around telling people filings are still going up because he includes foreign filings. The man has no limits to what he will misrepresent. Stanford Law School is a joke. They will back anyone for fame and money over ethics. A dirty bunch of scum.)

What is happening –from my perspective with large corporations–is that they simple do not see patents as valuable anymore and the prosecution budget is now on the table when they want to cut back. Patents are worth about 20 percent of what they used to be and the VPs know it. They just don’t want to pay for a piece of paper that has very limited value.

My guess–next big downturn will see patent filings drop by 20-50 percent.

Ternary

April 11, 2018 10:11 amInteresting analysis. If “quality” over “quantity” is the case, we should see fewer deals and litigation (which we do) with better outcomes (higher valuations and higher awards), which we don’t. It seems to me that there is an ongoing confusion about “quality of patents” with “quality of inventions.” I believe that there is a lack of confidence in the system to effectively use patents to defend an invention. I also believe many companies are turning to protecting only what they believe are the crown-jewels, because it is almost impossible (too expensive) to defend bread-and-butter developments. Which indicates a failure of the patent system.

Anon

April 11, 2018 07:31 amThere are those who would be MORE than happy if the new filings drop by half.