“There’s a reason it’s called intellectual property. Ownership of inventions in the United States of America isn’t a gift from the king but the right of a free people to securely own what they create.”

While absorbing the impact of the Supreme Court’s Oil States decision, remarks from the Administration’s “Unleashing American Innovation” symposium kept coming to mind. The event kicked off the “Return on Investment” initiative designed to maximize the benefits taxpayers receive from the billions of dollars spent annually on federally funded R&D. Unfortunately, Oil States makes that task a lot harder.

While absorbing the impact of the Supreme Court’s Oil States decision, remarks from the Administration’s “Unleashing American Innovation” symposium kept coming to mind. The event kicked off the “Return on Investment” initiative designed to maximize the benefits taxpayers receive from the billions of dollars spent annually on federally funded R&D. Unfortunately, Oil States makes that task a lot harder.

Like rooting for the underdog in the Super Bowl, while we hoped for the best having the Supreme Court uphold IPR’s was not unexpected. But adding insult to injury was the Court’s assertion that rather than being personal property, patents are merely a franchise granted by the government. Entrepreneurs will have to wonder whether they will undertake the risk and expense needed to develop early stage technologies if that’s all a United States patent represents.

For almost 40 years, public/private sector R&D partnerships have been a bright spot in our economy. The passage of the Bayh-Dole Act extended the incentives of patent ownership to inventions made from federally-supported R&D. That was soon followed by Congress restoring confidence in the patent system through the creation of the Court of Appeals for the Federal Circuit and the Supreme Court ruling in Diamond v. Chakrabarty that genetically modified organisms can be protected. Taken together, these changes helped launch one of the greatest periods of innovation in human history. The keystone of that success is a strong, dependable patent system. But the keystone’s showing cracks and that has profound consequences.

The area of greatest impact of Bayh-Dole is in the life sciences. The combination of the government funding basic research coupled with entrepreneurial companies willing to risk billions of dollars developing resulting discoveries made us the world leader in fighting disease. But that doesn’t mean that taking a new drug to market got any easier.

At the symposium Dr. Chris Austin, Director of NIH’s National Center for Advancing Translational Research (NCATS), gave a sobering snapshot of the realities facing the industry.

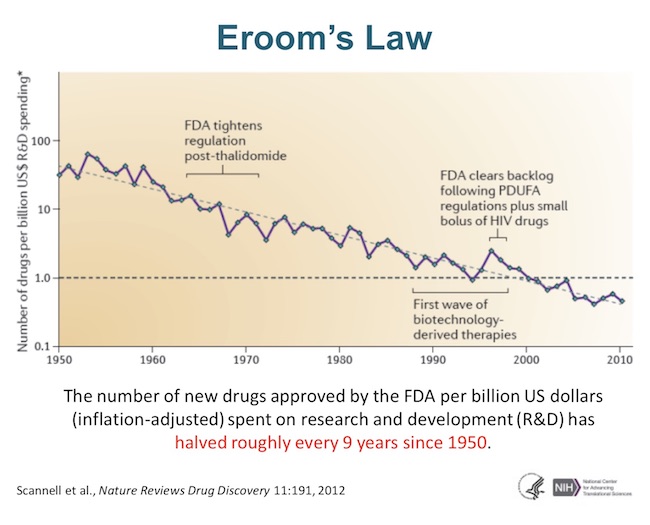

“In drug development we have Eroom’s Law, which is the exact opposite of Moore’s Law (i.e. that technologies get more efficient and cheaper over time). The number of new drugs per billion dollars spent in R&D has halved every 9 years since 1950. Think about that for a minute,” Austin said.

While you’re doing that, here’s a chart to consider:

Austin added that while this is an unprecedented time of medical advances, we face significant head winds, including:

Austin added that while this is an unprecedented time of medical advances, we face significant head winds, including:

- Of the thousands of diseases plaguing humanity, only about 500 have any treatments;

- Developing a novel drug costs more than $2 B over 10- 15 years with a 95% failure rate during human studies;

- Most NIH inventions are not licensed, even if they’re promising, because they are too early stage to attract industry developers.

Dr. Austin wasn’t spreading doom and gloom but made it easy to understand why drug development is so difficult. NCATS is working with industry to de-risk promising therapies by helping to take them further down the development pipeline. But the key ingredient remains finding a private sector partner willing and able to assume the burden of commercial development, which dwarfs the amount of money the government spent on the underlying research. This investment can only be justified if the technology has strong patent protection.

Gene Quinn’s coverage of the Unleashing American Innovation symposium captured the impressive support given to the patent system and public/private sector R&D alliances in the statements of Commerce Secretary Ross, Under Secretary Copan and PTO Director Iancu.

The success of the Bayh-Dole Act was widely praised. One reason why the law has been so successful is that industry has confidence that its rules are predictable. When you’re risking your own money on developing an early stage university or federal lab invention, you have to trust that the rules of the game won’t change if you beat the longs odds against success. That’s why all attempts to misuse the law’s march in rights provision to force the licensing of competitors when critics don’t like the price of a new drug have been rejected by Republican and Democratic administrations as contrary to Bayh-Dole.

While under attack, Bayh-Dole continues to function as intended. But the patent system hasn’t been as fortunate. The threat that patents protecting a successful product can be continually challenged through the IPR process coupled with a string of Supreme Court decisions weakened confidence in the reliability of U.S. patents. Now the Oil States ruling has thrown in a new wrinkle, undermining the historic understanding that patents are a form of personal property. The Court argues that patents are “the grant of a public franchise” and: “This Court has recognized that franchises can be qualified … For example, Congress can grant a franchise that permits a company to erect a toll bridge, but qualify the grant by reserving its authority to revoke or amend the franchise.”

Economist Hernando De Soto argues in his seminal book The Mystery of Capital that the difference between wealthy and impoverished nations is the existence of a stable rule of law guaranteeing the secure ownership of private property. I don’t recall De Soto saying anything about the benefits of having a government franchise.

An important result of the Bayh-Dole system is that 70% of university licenses go to small companies, many of which are start ups. Further, about half of our new drugs originate in small businesses. Such fledgling enterprises can only raise venture funding and compete in the marketplace if they have reliable patent protection. Hearing that they don’t own their inventions but only have a government franchise is bound to knock them for a loop.

While bad news for entrepreneurs, the Court’s reasoning hands a new weapon to the patent system’s critics. They have long claimed that patents and exclusive licensing are the reason why drugs are so expensive, urging the UN to encourage compulsory licensing while trying to undermine Bayh-Dole domestically. If patents are just publicly granted franchises, they can argue that government can tell those who’ve commercialized a revolutionary new drug: “OK, you’ve made enough. Now we’re giving the franchise to your competitors. After all, this isn’t your property. You just had a franchise through our beneficence– and now you don’t.”

Wouldn’t that argument get even more traction if the invention arose from government- supported research? Imagine the impact this would have on drug development. We’d have Eroom’s Law on steroids.

We can’t blame foreign powers for the problems of our patent system. These are self inflicted wounds. But perhaps there’s a glimmer of hope. As part of his Proclamation for World Intellectual Property Day, President Trump said:

While we continue to demand the protection of intellectual property rights abroad, my Administration will also take steps to strengthen our patent system here at home. A system that increases the reliability and enforceability of patents will encourage even more investment in creative and innovative industries, leading to job and wealth creation for all Americans. When the United States advances pro-growth policies of this form, we set an example of protecting economic competitiveness, promoting new engines of growth, and prioritizing the expansion of innovative and creative capacities overall.

The Administration seems to have a team in place that’s serious about achieving this vision as judged by their statements over the past few weeks. The central challenge will be making the United States patent system once again the world’s gold standard. That’s essential for insuring that taxpayers receive the highest possible return on investment for their support of federally funded R&D– and for the future of the nation.

There’s a reason it’s called intellectual property. Ownership of inventions in the United States of America isn’t a gift from the king but the right of a free people to securely own what they create. That’s the driver of American entrepreneurs, who with proper support will astound centralized governments run by dictators for life with what they can do when turned loose. Restoring our patent system removes the leash holding them back. After that, watch out if you’re in their way.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/03/IP-Copilot-Apr-16-2024-sidebar-700x500-scaled-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

7 comments so far.

Anon2

May 2, 2018 01:10 pmfollowing up on 6

It would appear that to the extent Errom’s law is true, it is completely natural and expected that compounds will cost more and more.

Moreover, simply assuming “perfect health” is as unattainable and as “asymptotic” as immortality or reaching the speed of light.. it should be abundantly and self-evidently obvious that pushing closer and closer will require more and more resources with fewer and fewer returns…

If rising drug prices is natural… to pretend there is a “problem” with rising drug prices is a gross error, and said problem is only “solved” by stopping drug development… or realizing that the problem is based on a false premise of the impossible.

Of course, Government can work on the premise of the impossible… as the impossible is simply another irrationality upon which it can base its decisions… which is familiar territory for them.

Anon2

May 2, 2018 12:57 pmAnon @5

Errom’s law likely says more about government processes than any measure of “innovation” as such. Explicitly measuring approval by the FDA it is not a direct indicator of “innovation”.

I submit the chart itself is not “trending the dearth of innovation (per dollar spend)” but the dearth of approvals by a government body.

I’m curious about why this trend exists. Certainly Pharma wants to be as efficient and profitable as possible, so it is likely not a voluntary phenomenon. It could just be the nature of the beast as we know more and more about the complexities of the human body, after all space exploration is more expensive than building airplanes, which are more expensive than coming up with a bicycle… but I suspect some of it has to do with all that government intervention and regulation.

Anon

May 2, 2018 10:01 amErrom’s law is more than a little frightening.

I suspect that my own views on some aspects of the “sanctity” afforded Big Pharma” (as opposed to the opposite views on protection for certain other innovation fields) are only exacerbated with the chart trending the dearth of innovation (per dollar spend).

To wit: by coddling the Pharma industry along the lines of not enforcing the possession requirement at the time of filing, we have “promoted” an entire industry that “does not care” about the process of innovation, and innovating in that innovation process in and of itself. Instead, as Big Pharma is continued to be lured into, they would rather play the “Big Bet” game of the one area in patent law that apparently remains strong. Further, Big Pharma is also the ONLY industry in which the tale end of the patent term brings the biggest boon (which has had its effects on such things as the “bargain” with the original Quid Pro Quo and how Patent Term Adjustment works – adding on ‘life’ at the end of the term. This “deal” “has wreaked havoc with most all other innovation areas, prompting the Office to be lazy in its efforts at examination (why bother, when your end of the Quid Pro Quo has already been obtained?).

Chris Gallagher

May 2, 2018 09:31 amOne very effective pro-patent argument to Hill staff and members who supported R&D funding, especially for NIH is that the funds they have voted to appropriate become stranded with research grantees who are unable to attract investors to commercialize the resulting findings and discoveries resulting form such grants. which means they are never developed.

Folks on the Hill who don’t understand patents can comprehend how weak and unreliable patents deter development investment in the promising research they voted to fund. The misguided Oil States franchise analogy has just made matters worse, particularly regarding life science commercialization which because of its inherent cost and uncertainty is already hard to commercialize.

Tesia Thomas

May 1, 2018 12:57 pmWell, you’re a uni lobbyist.

Issues with Bayh-Dole aside…why even have it now? Why bring up these points?

SCOTUS just told you that the government owns the IP. Period. Done.

Why finagle ownership with Bayh-Dole? – it’s an obvious ruse.

Whether the government supports the R&D or not, it owns the IF (not IP.)

Lucky for unis that they at least get some of their IF paid for by the ‘lawful’ owner.

Name withheld to protect the innocent

May 1, 2018 12:54 pmIts a government franchise intended to suck money out of inventors. First, the USPTO causes an inventor to spend tens of thousands of dollars in the hope of getting a patent. However, the first time an inventor tries to either license the technology to another (or prevent another from practicing the patented technology), they get sucked into an IPR, which causes the inventor to spends hundreds of thousands of dollars in the hope of saving the patent. If the inventor is (un)lucky enough to win an IPR, they get to be subjected to another IPR.

All the while the silicon valley gazillionaires are laughing their way to the bank knowing that they’ll never have to pay for technology they “co-opted” from others. Surely, Kennedy, Thomas, and Alito must be getting thank you cards from liberals everywhere.

Tesia Thomas

May 1, 2018 12:17 pmWell, you’re a uni lobbyist.

Issues with Bayh-Dole aside…why even have it now? Why bring up these points?

SCOTUS just told you that the government owns the IP. Period. Done.

Why finagle ownership with Bayh-Dole? – it’s an obvious ruse.

Whether the government supports the R&D or not, it owns the IF (not IP.)

Lucky for unis that they at least get some of their IF paid for by the ‘lawful’ owner.