BRICS is an acronym for an association of five countries: Brazil, Russia, India, China, and South Africa. The building block for BRICS was laid more than a decade-and-a-half ago. In a paper that he authored in 2001, Jim O’Neill (the then-Chief Economist at Goldman Sachs) coined the term BRIC, labeling the first four economies as “emerging superstars most likely to dominate the 21st century globalized economy” (Ian Bremmer; 2017), with South Africa to be added later.

What began as informal annual meetings between the Foreign Ministers quickly transpired into formal meetings at the level of the Heads of States, with the holding of the First Summit in 2009 in Yekaterinburg, Russia. South Africa subsequently got inducted into the group in 2010, which led to the acronym being changed from BRIC to BRICS.

Though Goldman Sachs subsequently shut down its BRICS Investment Fund towards the end of 2015, the five economies continue to be prime and lucrative targets for investment.

Economic Potential and Significance

Over the last 25 years, the BRICS economies have been at the forefront of a paradigm shift in the sands of the global economy towards developing economies. This is exemplified by their share in the global economy, which has increased by more than two-and-a-half times during this period, and stood at approximately 30% in 2014 (Daniel Mminele; 2016).

As per the Organization for Economic Cooperation and Development (OECD), China and India are expected to sustain their growth this year as well, while Russia and Brazil are expected to bounce back after navigating the high seas of economic turbulence last year. In the words of Federico Bonaglia, Deputy Director of OECD Development Center, the “BRICS economies play a very important role by injecting dynamism into the world economy” (Financial Tribune; 2017).

Patenting in the BRICS Economies

The State Intellectual Property Office (“SIPO”) of China is part of the “IP5” group, which also includes the United States Patent and Trademark Office, the Japan Patent Office, the European Patent Office, and the Korean Intellectual Property Office. The group is a forum of the five largest Intellectual Property offices in the world and was “set up to improve the efficiency of the examination process for patents worldwide.”

For the last few years, the SIPO has been in the midst of a meteoric explosion in patent application filings which, in turn, has almost single-handedly been powering the global growth in patent applications. In 2015, it became the first ever Intellectual Property office to record more than one million patent application filings in a year.

This record in 2015 was further followed by a robust growth of 21% in 2016. As per the World Intellectual Property Indicators 2017 report published by the World Intellectual Property Organization, close to 1.47 million patent applications were collectively filed in the BRICS jurisdictions in 2016, with China alone accounting for 1.3 million patent applications.

Patent Grant Times and Patent Backlog

Of the five BRICS economies, Brazil and India hold large stocks of pending applications. In fact, the WIPO report referenced above-identified India and Brazil as among the slowest offices to reach a final decision on a patent application in 2016. On the other hand, patent backlog does not seem to be as serious an issue in China and Russia.

A variety of measures have been initiated in India and Brazil in recent times to tackle the patent backlog menace and to speed up patent grant timeframes. The recruitment of 458 new examiners at the Indian Patent Office is beginning to bear fruit and is resulting in the quicker processing of applications. Likewise, the year 2017 marked a 7.6% decrease in the backlog in Brazil due to the recruitment of 210 examiners and the simplification of processes.

Further, in January 2018, the Brazilian Patent Office commenced a pilot measure aimed at expediting the patent grant process. This pilot measure involves the issuance of a pre-examination opinion based on prior art indicated by other Intellectual Property offices (Di Blasi, Parente & Associados; 2018). In addition, the Brazilian Government also stirred the hornet’s nest with its announcement that it is considering the adoption of an emergency proposal to grant all pending, non-pharmaceutical patent applications (Ricardo Nunes & Rafael Salomão Romano; 2018).

Unlike the other four economies, South Africa follows a depository system and, thus, patent backlog is of no concern right now. However, the Department of Trade and Industry, in its draft Intellectual Property policy, has proposed the introduction of substantive search and examination, which could cause substantial delays in the patent grant process, especially in the early stages (Bheki Zulu, Maanda Phosiwa, and Mehluli Ncube; 2018).

The Costs of Patenting in the BRICS Economies

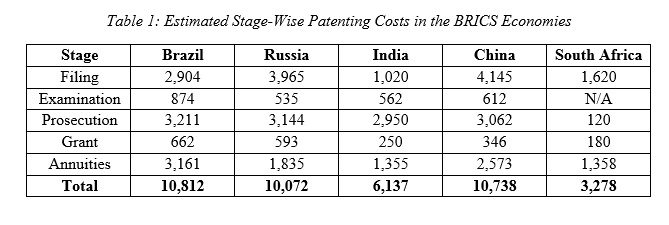

Let us now study the costs involved in obtaining and maintaining a patent in the BRICS economies. Since a patent is typically maintained for at least six to ten years, we shall consider the costs from March 2018 through March 2027. There are three categories of costs involved: official fees, attorney charges, and translation costs.

For the purposes of this article, we shall consider a patent specification drafted in English comprising 45 pages (including five pages of drawings), 15 claims, and three independent claims, which is to be filed electronically by a company (i.e. large entity) in Brazil, Russia, India, China, and South Africa.

For the above scenario, the total costs to file a patent application, get the patent issued, and maintain the patent are approximately $41,000. These estimates are based on the values found within the fee schedules supplied by at least five independent Intellectual Property law associates in each jurisdiction and are inclusive of Value Added Tax (added to the attorney charges and translation costs) in China and Russia.

As shown in Table 1, the estimated costs are spread across the five different stages of the patenting process: Filing, Examination, Prosecution, Grant, and Annuities/Renewal Fees/Maintenance Fees.

As shown in Table 1, the estimated costs are spread across the five different stages of the patenting process: Filing, Examination, Prosecution, Grant, and Annuities/Renewal Fees/Maintenance Fees.

Patent Filing and Translation Costs

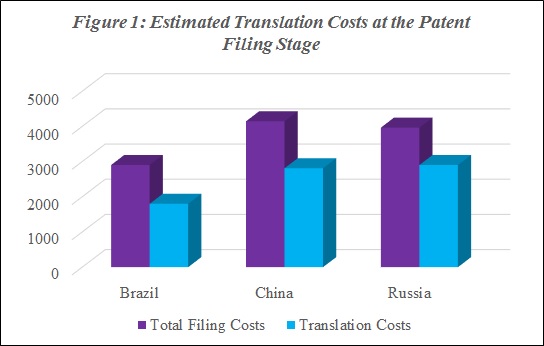

The estimated filing costs are inclusive of the official fees for each page of the specification in excess of 30 pages in China and India, and the attorney charges for handling the excess pages; the official fees for each claim in excess of 10 claims in China and India, and the attorney charges for handling the additional claims; Power of Authority stamping charges in India; and the official fees for each claim in excess of 10 claims in Russia.

Translation of the specification into the official language is mandatory in Brazil, China, and Russia. The costs of translating 40 pages of a patent specification into Portuguese, Chinese, and Russian constitute a handsome proportion of between 60% and 75% of the total filing costs.

Patent Examination Costs

The estimated costs of requesting a substantive examination are inclusive of the official fees for requesting an examination of each claim in excess of 10 claims in Brazil and the official fees for requesting an examination of each independent claim in excess of one independent claim in Russia. In Russia, where the official fee depends on the timing of the request for examination filing, it is assumed that the request is not filed at the time of filing the patent application.

Patent Prosecution, Translation, and Grant Costs

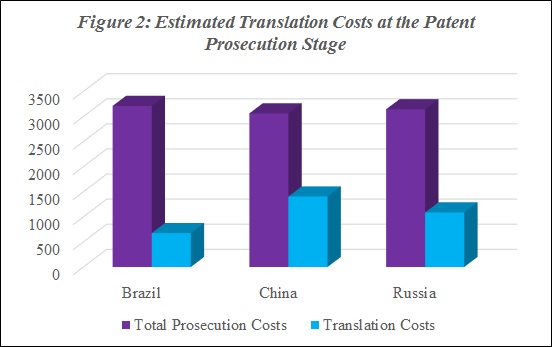

The estimated prosecution costs are based on a formal objection being issued in South Africa, and between 1.5 and 2.5 office actions with substantive objections being issued in Brazil, China, India, and Russia. These costs are inclusive of the attorney charges for reporting an office action, preparing a response, and processing the response.

As is the case with filing, translation is also required during prosecution in Brazil, China, and Russia. Assuming 10 pages of translation per prosecution action, the estimated translation costs constitute between 21% and 45% of the total prosecution costs.

With the exception of South Africa and India, an official grant fee (or registration fee or issue fee) is charged in the other three jurisdictions.

Patent Maintenance Costs

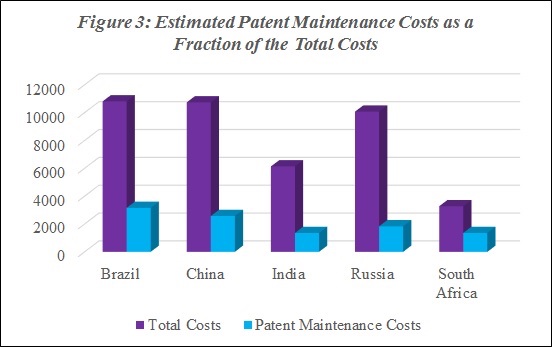

The estimated patent maintenance fees, when expressed as a percentage of the total estimated costs, are more or less similar in China, India, and Russia, and approximately vary between 18% of the total estimated costs in Russia, where the patent maintenance fees doubled with effect from October 6, 2017, to 23% of the total estimated costs in China.

In China, where patent maintenance fees begin at the grant stage, with the first patent maintenance fee being payable along with the official grant fee in respect of the year in which the patent has been granted, the estimated patent maintenance costs are based on a patent being issued in 2022. Likewise, in Brazil, where the quantum of patent maintenance fee to be paid depends on whether the application is pending or whether the patent has been granted, the estimated patent maintenance costs are based on a patent being issued in 2026.

In Brazil and South Africa, the estimated patent maintenance fees constitute approximately 29% and 41% of the total estimated costs, respectively.

Patenting is a game of strategy, one that involves a cocktail of considerations, including business considerations, market considerations, and last but not least, budget considerations. The world is a global digital village in which companies know no boundaries, with the entire world being their playground. In such a scenario, it is imperative that due deliberation be given for the inclusion of vibrant economies with high growth rates and high potential for growth, such as the BRICS economies, in the formulation of a global patent filing strategy.

However, developing a patent filing strategy that includes one or more of the BRICS economies could be highly challenging due to the presence of a bundle of varying national legislations, each mandating its own set of procedures. Having a precise idea of the stage-wise costs that could be incurred will go a long way in facilitating strategic decision-making and budget forecasting. This will also ensure that no major setbacks or shocks occur downstream during the patenting process, such as a high variance occurring between the budgeted spend and the actual spend, which could force the underlying teams to scramble back to the drawing board to determine cost-cutting avenues.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

2 comments so far.

Jeff Lindsay

May 27, 2018 09:26 pmThe China costs seem really high. Are these based on using a foreign firm like Finnegan versus the typical cost of working directly with a local Chinese patent firm? A patent written from scratch in Chinese can be done for roughly $1000 or less, and package deals with many good firms will include patent filing and prosecution for about $1000 total plus small filing fees. There are many ways to spend more, but patents in China can be surprisingly inexpensive.

Carl Hansmann

May 27, 2018 05:23 amVery interesting article, thank you. As an inventor if you are going the global IP route then don’t forget to apply for full national patents in Tiawan and Argentina within one year of your priority filing date along with a PCT application. Also look at countries like Maritius that have unique IP procedures. Fantastic that China is taking IP seriously with a massive increase in filings. Watch South Africa as a gateway to Africa as the country is currently looking very positive with political stability and economic potential. Carl Hansmann, South African inventor.