On June 7th, San Antonio, TX-based reciprocal inter-insurance exchange United Services Automobile Association (USAA) filed a lawsuit alleging claims of patent infringement against San Francisco, CA-based financial services multinational Wells Fargo. The complaint, filed in the Eastern District of Texas, involves the assertion of patents in the field of mobile financial services which, at first glance, appear as though they may face some rigorous validity challenges thanks to precedent set by the U.S. Supreme Court in its 2014 decision in Alice Corp. v. CLS Bank International.

On June 7th, San Antonio, TX-based reciprocal inter-insurance exchange United Services Automobile Association (USAA) filed a lawsuit alleging claims of patent infringement against San Francisco, CA-based financial services multinational Wells Fargo. The complaint, filed in the Eastern District of Texas, involves the assertion of patents in the field of mobile financial services which, at first glance, appear as though they may face some rigorous validity challenges thanks to precedent set by the U.S. Supreme Court in its 2014 decision in Alice Corp. v. CLS Bank International.

USAA is asserting a series of four patents-in-suit in this case, including:

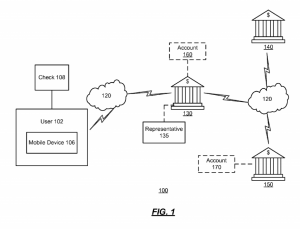

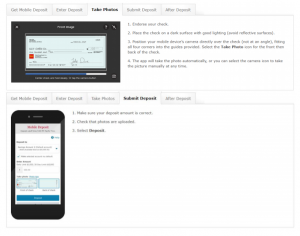

U.S. Patent No. 8699779, titled Systems and Methods for Alignment of Check During Mobile Deposit. Issued in April 2014, it covers a system for depositing a check using a mobile device having a camera, a display and a processor configured to project an alignment guide in the mobile device’s display, monitor an image of a check within the camera’s field of view, determine whether the check image aligns with the alignment guide, automatically capture the image of the check when aligned with the guide and transmit the captured image of the check to a depository.

U.S. Patent No. 8699779, titled Systems and Methods for Alignment of Check During Mobile Deposit. Issued in April 2014, it covers a system for depositing a check using a mobile device having a camera, a display and a processor configured to project an alignment guide in the mobile device’s display, monitor an image of a check within the camera’s field of view, determine whether the check image aligns with the alignment guide, automatically capture the image of the check when aligned with the guide and transmit the captured image of the check to a depository.- U.S. Patent No. 9336517, same title as the ‘779 patent. Issued in May 2016, it discloses a mobile device system wherein the alignment guide is associated with an information capture component to enable enhanced detection and extraction of information from a digital image of a check.

- U.S. Patent No. 9818090, titled Systems and Methods for Image and Criterion Monitoring During Mobile Deposit. Issued last November, it claims a system comprising an image capture device, a presentation device and a processor configured to monitor a target document in the image capture device’s field of view with respect to a monitoring criterion, control the presentation device to present feedback information describing an instruction for satisfying the criterion, determine whether that criterion is satisfied and capture an image of the target document upon satisfaction of the criterion.

- U.S. Patent No. 8977571, titled Systems and Methods for Image Monitoring of Check During Mobile Deposit. Issued in March 2015, it covers a non-transitory computer-readable medium comprising computer-readable instructions for depositing a check into a user’s bank account.

As USAA’s complaint notes, the ‘779 and ‘571 patents generally cover the use of an alignment guide to reduce error rates in mobile check depositing, and the ‘090 and ‘571 patents generally cover improved computer systems which are able to capture high quality check images. Such technology is critical to USAA, which serves members of the U.S. military and their families, because unlike traditional banks USAA reaches its customers remotely, not in brick-and-mortar bank facilities. USAA’s customers increasingly use the company’s website or mobile application to interact with the company’s services and the company developed these patents which cover the company’s Deposit@Home and Deposit@Mobile services.

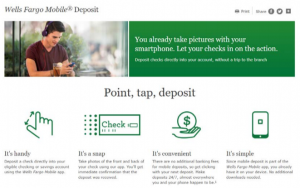

USAA alleges that Wells Fargo Mobile Deposit remote deposit capture system, which was released years after either of USAA’s remote deposit services were first offered, infringes upon the asserted patents. Wells Fargo Mobile Deposit has been downloaded more than 10 million times from the Google Play Store alone and by February 2018, Wells Fargo had 21 million users who were actively using a mobile banking account. Wells Fargo mobile check deposit system involves the use of alignment guides and feedback indicators which are designed to assist customers in orienting the camera, features covered by the USAA patents. Although USAA approached Wells Fargo last August to discuss the licensing of USAA’s remote deposit capture patents, Wells Fargo allegedly continues to practice the technologies without any compensation to USAA. Along with counts for infringement of each patent asserted, USAA is also seeking a finding of willful infringement to enhance the actual damages by three times.

USAA alleges that Wells Fargo Mobile Deposit remote deposit capture system, which was released years after either of USAA’s remote deposit services were first offered, infringes upon the asserted patents. Wells Fargo Mobile Deposit has been downloaded more than 10 million times from the Google Play Store alone and by February 2018, Wells Fargo had 21 million users who were actively using a mobile banking account. Wells Fargo mobile check deposit system involves the use of alignment guides and feedback indicators which are designed to assist customers in orienting the camera, features covered by the USAA patents. Although USAA approached Wells Fargo last August to discuss the licensing of USAA’s remote deposit capture patents, Wells Fargo allegedly continues to practice the technologies without any compensation to USAA. Along with counts for infringement of each patent asserted, USAA is also seeking a finding of willful infringement to enhance the actual damages by three times.

Considering the financial service that these patents cover, it’s not inconceivable that they might face challenges under the Supreme Court’s holding in Alice where it found that a computer system serving as a third-party intermediary for exchanging financial obligations was unpatentable as an abstract idea under 35 U.S.C. § 101. One could potentially argue that the patents only cover abstract ideas under Alice given that it covers the implementation of a traditional banking service (i.e.: check deposits) through a computer medium. Such issues in maintaining the validity of USAA’s patents are exacerbated by the prospects such patents could face at the Patent Trial and Appeal Board (PTAB), especially given the potential that these inventions could be deemed covered business methods (CBMs) subject to CBM review proceedings at the PTAB where Section 101 challenges are available to a patent-challenging petitioner.

Considering the financial service that these patents cover, it’s not inconceivable that they might face challenges under the Supreme Court’s holding in Alice where it found that a computer system serving as a third-party intermediary for exchanging financial obligations was unpatentable as an abstract idea under 35 U.S.C. § 101. One could potentially argue that the patents only cover abstract ideas under Alice given that it covers the implementation of a traditional banking service (i.e.: check deposits) through a computer medium. Such issues in maintaining the validity of USAA’s patents are exacerbated by the prospects such patents could face at the Patent Trial and Appeal Board (PTAB), especially given the potential that these inventions could be deemed covered business methods (CBMs) subject to CBM review proceedings at the PTAB where Section 101 challenges are available to a patent-challenging petitioner.

A search of patent prosecution documents available through the U.S. Patent and Trademark Office’s Public PAIR website indicates that these patents didn’t faced many issues on Section 101 grounds during prosecution, even after the Supreme Court decided Alice. In February 2017, the patent application for USAA’s ‘090 patent received a non-final rejection from the examiner on double patenting grounds in light of another USAA patent, U.S. Patent No. 8422758, System and Methods of Check Re-Presentment Deterrent. The ‘090 patent would eventually be issued after USAA filed amended claims last June. The patent application leading to the issue of the ‘517 patent also received a non-final rejection in February 2015 on 35 U.S.C. § 102(b) grounds for anticipation and then a final rejection in July 2015 for double patenting, but these challenges were also overcome during prosecution of the patent at the USPTO.

It will be interesting to see if any validity challenges under the Alice standard are brought by Wells Fargo to the district court.

Of course, if these patents are in fact deemed valid and enforceable in district court, it’s very possible that this suit against Wells Fargo could be just the start of a patent enforcement campaign against a series of banks offering mobile check deposit services. Wells Fargo is not the only major banking institution to offer mobile check deposit services via smartphone. Fidelity’s Mobile Check Deposit web page shows a smartphone taking an image of a check with the use of a rectangular feature on the phone’s display which seems to resemble the alignment guide covered by USAA’s patents. The same is true of mobile banking web pages found on the websites of PNC and Bank of America. So it appears that the result of USAA’s lawsuit against Wells Fargo will either result in USAA striking out big by losing its intellectual property, or USAA striking it rich in the incredibly valuable sector of mobile banking.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

4 comments so far.

anony

June 22, 2018 06:15 pmSteve @3, see below. The well written argument laid out in the appeal brief is on point with Berkheimer, even though the appeal brief was written before Berkheimer. (The text below was also posted in a comment on another article from this site titled “Senator Hatch files ….”)

PTAB Appeal decision dated 2018-05-30 for US App No. 12/852,224 at pages 4-5:

Appellant contends that the Examiner “failed to establish that claim 1 merely recites ‘computer functions that are well-understood, routine and conventional activities.”‘ App. Br. 7 ( emphasis omitted); see Reply Br. 2, 4–5. More specifically, Appellant asserts that “the Examiner has not provided any supporting evidence for asserting that all claimed functions are ‘well-understood routine, conventional activit[ies]. “‘ App. Br. 8; Reply Br. 2, 4. Appellant also asserts that “[ s ]imply because the general function of ‘analysis and storage of data’ is ‘well-understood, routine, and conventional’ does not of itself establish that claim 1 ‘s ‘engine [that] determines [a] payment hierarchy via an automated learning algorithm that analyzes subjective assessments’ is routine or conventional.” Reply Br. 3; see App. Br. 8.

…

Based on the record before us, we agree with Appellant

Steve

June 22, 2018 02:37 pmAnony — could you let us know to which PTAB ruling you’re referring to?

The ones I’m seeing are — so far at least — where the panels are either not applying what Berkheimer actually stands for, or are mistakenly relying on such “fact evidence” supporting 101 rejects as PTO examiner guidance (ex parte Ballout) and the inventor’s own specification (ex parte Howe).

anony

June 22, 2018 11:00 amIt can be argued that these patents landed in the right art units and in front of the right examiners to escape death by 101. ‘779 and ‘514 were examined in art unit 2667, ‘090 in art unit 2666. Surprisingly, ‘571 landed in a 3600 art unit (3691). But examinerninja shows 3691 is unlike most 3600 art units having only a slight dip from the average allowance rate (where several/most 3600 art units are significantly below the average allowance rate). Also, the examiner for ‘571 has a higher than average allowance rate.

The courts may still apply death by 101, but a recent PTAB ruling that is inline with Berkheimer indicates that death by 101 may not be as easy to get in the future.

Anon

June 22, 2018 09:49 amI do not think that “either/or” scenario is accurate.

Plenty of middle ground here (including the fact that Wells has their own arsenal of patents for a good old fashioned “nuclear” option.