Recently, I interviewed Jennifer McDowell, Coordinator of the USPTO’s Patent Pro Bono Program. The Pro Bono Team at the USPTO are tasked with ensuring that the Patent Pro Bono Program is fully implemented in all 50 states and that qualifying inventors have access to patent pro bono services under the program.

Here are some highlights from that interview.

- The Patent Pro Bono Program provides free legal assistance to inventors of modest means who are interested in securing patents to protect their inventions. The Program is a product of the America Invents Act (AIA). Under this legislation the U.S. Patent and Trademark Office was called upon to begin working with intellectual property law associations across the country to establish programs to assist financially under-resourced independent inventors and small businesses. Then, in February 2014, the President issued an Executive Action calling for expansion of the pro bono programs originally set up under the AIA into all 50 states. As a result of the Executive Action, new pro bono programs have been created, and many of the existing programs have expanded their coverage to additional states.

- An inventor’s acceptance into the program is based upon the local needs in the community, and oftentimes, in consultation with the state bar. Generally, though, most programs require that an inventor have: (1) income below 300% of the Federal poverty level; (2) knowledge of the patent system; and (3) the ability to describe his or her invention so that someone could make and use the invention. The income threshold is based on how many people are in the inventor’s household. Right now, the Federal poverty level for a one person household is $11,670, so 300% would be $35,010. Because each regional program is operated independently, inventors are strongly encouraged to contact their program directly, review their program’s website, or check out the USPTO’s website to learn about the eligibility criteria. The link for the USPTO’s pro bono webpage is: http://www.uspto.gov/inventors/proseprobono/.

- Inventors who think they may qualify should apply directly to their regional program. A link to each regional program can be found under the heading of “Participating Patent Pro Bono Programs” on the USPTO’s website. Alternatively, an inventor may request assistance through the Federal Circuit’s National Clearinghouse Portal by filling out the Pro Bono Service Request Form.

- The USPTO expects to have nationwide coverage of the program by the end of 2015.

- There is no limited on the number of inventors that are accepted into the program each year.

- The program does not cover filing fees.

- A qualified inventor may participate in the program even if he or she lives in a state that is currently not participating. Some states have agreed to work with neighboring states to administer the program for those states.

- Registered patent attorneys who wish to volunteer in a regional Patent Pro Bono program can apply directly with their regional program. Most programs have a simple form that attorneys complete. Additionally, many programs provide training to their volunteer lawyers on how the inventor assistance program works for their region. Also, an attorney can sign up at the Federal Circuit’s National Clearinghouse Portal by filling out the Regional Volunteer Attorney Submission Form.

In the event an inventor may not qualify for the Patent Pro Bono program, he or she may want to consider filing under micro entity status based on gross income. This status enables the inventor or small business owner to receive a 75% discount on filing fees. Generally, any party filing under the micro entity status based on gross income must:

- qualify as a small entity under 37 CFR §1.27;

- not have been named as an inventor on more than 4 previously filed patent applications, other than applications filed in another country, provisional applications, or international applications for which the basic national fee was not paid;

- have not, in the calendar year preceding the calendar year in which the applicable fee is being paid, have a gross income, as defined in section 61(a) of the Internal Revenue Code of 1986, exceeding 3 times the median household income for that preceding calendar year, as most recently reported by the Bureau of the Census; and

- not have assigned, granted, or conveyed, and not be under an obligation by contract or law to assign, grant, or convey, a license or other ownership interest in the application concerned to an entity that would not qualify for filing under the micro entity status.

To obtain discounts under the micro entity status, an applicant must continue to show that he or she continues to qualify for the discount. Specific requirements for filing under micro entity status can be found in the MPEP 509.04.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

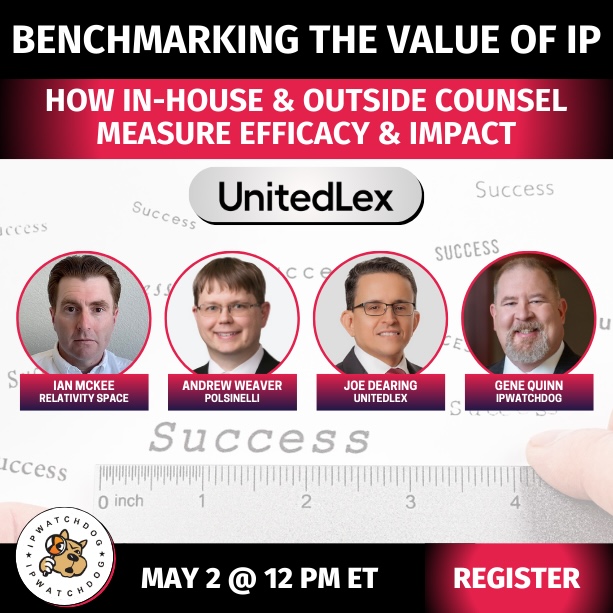

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Dan Klemer

December 28, 2014 07:27 amIt is important to note that additionally, for micro entity status, according to the USPTO, “applicants are not considered to be named on a previously filed application if he or she has assigned, or is obligated to assign, ownership rights as a result of previous employment.” Such applications would not count toward the 4 previous application limit.