Over the course of nearly two decades, the rising strength of electronic commerice in America has been dealing death blows to the brick-and-mortar big-box stores which have driven the retail industry in this country for more than fifty years. Much of this Internet catabolization of the retail industry is symbolized by the incredible dominance of Amazon.com (NASDAQ:AMZN). A corporate tendency to invest in its own long-term value has resulted in a nearly $200 billion market capitalization and a place for Amazon among the top ten retailers in America.

The growing shift towards American consumers engaging with e-commerce applications to conduct their shopping activities has made for some abysmal times for retail businesses across the country. Sales per retail employee has increased from $12,000 to $25,000 over the past twenty years but employment levels are growing fastest at supercenters like Walmart which realize cost savings through low employee wages. The retail industry employed one out of every nine working Americans as of June 2013, but job growth has been much slower in recent years and there have been worries that a major source of low-skill jobs in our country will start to decline slowly.

And yet, one of the big-box retailers that has suffered mightily during Amazon’s ascendence is giving off signs of life, or at least indications that it won’t go down without a fight. Best Buy Co (NYSE:BBY) recently released its financial earnings report for the first quarter of FY2015, which shows signs of life for the brick-and-mortar consumer electronics retailer. Indeed, financial analysts were stunned to see that Best Buy’s adjusted earnings from continuing operations actually rose from 35 cents per share in 2014’s first quarter to 37 cents per share; earnings estimates expected that figure to drop to 29 cents per share. Best Buy also posted a year-over-year increase in domestic revenues of about $100 million, an incredible feat during a year in which e-commerce continued to increase its take to 7 percent of all American retail sales.

The big-box retail store cemetery is already populated with headstones of many retail giants which have fallen, especially electronics stores. Circuit City had nearly two decades of successful sales results in the 1980s and 1990s but filed for bankruptcy in November 2008 after losing its consumer base and failing to develop a new one. In February of this year, RadioShack finally tapped out after four years without a profit, filing for Chapter 11 bankruptcy and announcing plans to sell 2,400 of its remaining 4,000 locations. Poor quarterly earnings reports have been hounding Best Buy for a couple of years, giving many critics reason to believe that this retailer will be among the next to expire.

Yet a series of significant spurts of life were revealed in Best Buy’s latest earnings report. The gains in the company’s domestic revenues are largely the product of stronger credit card and investment billing portfolios. Higher installment billing revenues are a product of Best Buy’s decision to begin offering two-year mobile carrier contract plans, drawing in both higher proceeds from devices and a higher cost of sales as a result of lower subsidies for devices.

[Companies-1]

The quarterly earnings report also indicates that Best Buy is achieving some success in the Internet realm, helping to stave off the death knell that Amazon has planned for big-box retail. Best Buy’s online sales in the United States, which Amazon is supposed to be siphoning, actually increased by 5.3 percent over 2014’s first quarter. The company experienced a jump in e-commerce traffic as well as higher conversion rates for the traffic visiting Best Buy’s online stores. The $673 million in domestic online revenues is a drop in the bucket compared to Best Buy’s quarterly enterprise revenue of $8.558 billion, but it is a growing drop in a bucket with seemingly fewer leaks than in past years

Overall, the company’s total quarterly revenue did drop from the $8.639 billion figure posted by the company a year ago. This, however, was mainly due to a vastly diminishing international business that the company is currently in the process of consolidating. Quarterly international revenues dropped from $858 million one year ago to $668 million in the most recent earnings report, a drop of almost $200 million. In Canada, decisions to merge the Best Buy brand with Future Shop, a retail chain purchased by the company in 2001, have led to the closure of 66 Future Shop locations; the remaining 65 locations will be converted to Best Buy stores in the coming months. Costs incurred by Best Buy during this process include employee severance, lease exit costs and asset impairments. The negative impact of foreign exchange rates caused by a strong U.S. dollar, which has been hitting internationally-operating countries like McDonald’s incredibly hard, is another reason cited for the decrease in international revenues.

A reduction in overall revenues typically isn’t a good sign for any company but Best Buy has been able to outperform pessimistic financial forecasts well enough that some analysts are expecting this retailer to recover from the blows of the Internet Age. The company’s ability to deliver multiple levels of service in-store, online and in-home, such as in the case of appliance installation, has allowed Best Buy to achieve great customer satisfaction levels leading towards a high rate of customers returning to make another purchase within 90 days.

If you’re like us and you hear that a company is “building a leading multi-channel customer experience,” you’ll probably start to wonder about the kind of research and development investment has been made by a company over the past few years. Best Buy has only received seven U.S. patent grants from the U.S. Patent and Trademark Organization since the beginning of this year, which we learned thanks to Innography’s patent portfolio analysis tools. Best Buy may be lagging well behind Amazon’s 413 U.S. patent grants earned since the beginning of 2015 but it is clear that they are trying to innovate in the retail space.

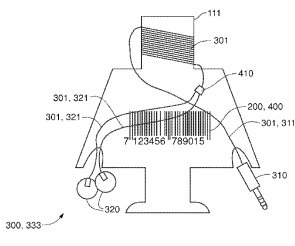

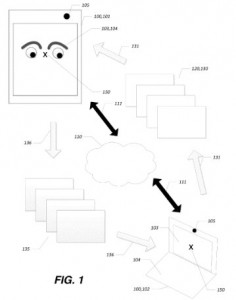

If you’re like us and you hear that a company is “building a leading multi-channel customer experience,” you’ll probably start to wonder about the kind of research and development investment has been made by a company over the past few years. Best Buy has only received seven U.S. patent grants from the U.S. Patent and Trademark Organization since the beginning of this year, which we learned thanks to Innography’s patent portfolio analysis tools. Best Buy may be lagging well behind Amazon’s 413 U.S. patent grants earned since the beginning of 2015 but it is clear that they are trying to innovate in the retail space.  Some of these technologies are meant to improve the customer experience within the brick-and-mortar store, as we can see in U.S. Patent No. 9004357, titled Headphones Holder with Indicia of Stored Value. The company is also working to improve its digital telecommunication services as is evidenced by U.S. Patent No. 8957943, titled Gaze Direction Adjustment for Video Calls and Meetings. Make no mistake, Best Buy is an electronics retailer and not a technology developer but it is responding to market challenges with innovation which is a great way to build long-term value in a business that plans on sticking around for at least a little while.

Some of these technologies are meant to improve the customer experience within the brick-and-mortar store, as we can see in U.S. Patent No. 9004357, titled Headphones Holder with Indicia of Stored Value. The company is also working to improve its digital telecommunication services as is evidenced by U.S. Patent No. 8957943, titled Gaze Direction Adjustment for Video Calls and Meetings. Make no mistake, Best Buy is an electronics retailer and not a technology developer but it is responding to market challenges with innovation which is a great way to build long-term value in a business that plans on sticking around for at least a little while.

It’s been clear for a few years now that major retailers will have to make great structural changes if they wish to stay afloat thanks to the new realities posed by electronic commerce. A fresh new take on the in-store experience and the development of a seamless multi-channel retail experience have been suggested as meaningful steps that retailers can take to stay in business well into the future. If Best Buy can continue building upon this slight turnaround and continue to maintain the consumer perspective that this company’s stores are the best for purchasing electronics and major appliances, we might see more of a pushback by brick-and-mortar retail against Amazon’s e-commerce empire.

UPDATED Monday, June 1, 2015 at 11:14am ET (see comment #1)

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

2 comments so far.

Gene Quinn

June 1, 2015 11:15 amSteven-

Thanks for reading the article and catching that mistake. I’ve updated the article to reflect the correct percentage of Americans working in retail according to the article cited.

-Gene

Steven

June 1, 2015 09:55 amHi,

This article says:

“The retail industry employed nine out of every ten working Americans as of June 2013”

Which is 90%

But the linked article says:

“Retail still employs one in nine working Americans” -June 2013

Which is 11%