Technology Center 3600 covers a wide variety of technologies, from surface transportation to nuclear systems, and from animal husbandry to acoustic wave communication. The 3600s are also home to art units that concern “e-commerce.” These are commonly known as the business methods art units and are found in the 3620s, 3680s, and 3690s. Patent professionals have been watching these art units closely in the wake of last year’s Supreme Court decision in Alice Corp. Pty. Ltd. v. CLS Bank Int’l, 573 U.S. ___, 134 S. Ct. 2347 (2014). After that decision, many feared that business method patents had met their demise.

The Supreme Court held in Alice that claims directed to abstract ideas must have additional elements that are capable of rendering them “significantly more” than the abstract ideas themselves and that recitation of implementation on a generic computer is not sufficient for this purpose. This decision has had a particularly strong effect on software and business method patents, many of which, like those at issue in Alice, concern economic activities implemented on computers. These patents are still being granted after Alice, but are being granted at lower rates than before, and some assignees are better at obtaining them than others.

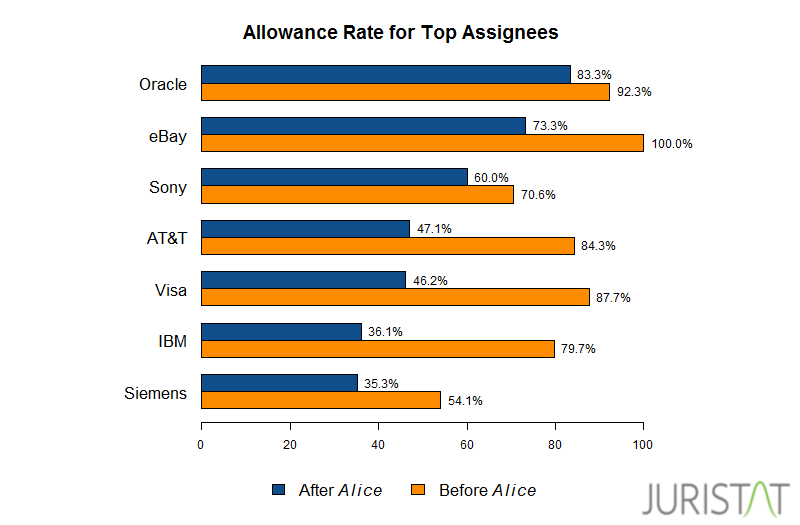

Using Juristat’s custom analytics, we found the most and least successful assignees in the business methods art units of TC 3600. We defined “assignee” as the assignee at the time of an application’s disposition. We defined “disposition” as the point at which an application was either allowed or abandoned; we did not consider pending applications. We then filtered out lien assignees and assignees that had fewer than ten disposed applications in the relevant art units. When calculating pre-Alice and post-Alice allowance rates, we measured applications that were disposed within one year prior to Alice and within one year after Alice.

First, a look at the most successful assignees.

The top assignees in the business methods art units have a wide range of allowance rates, from Oracle at 83.3% to Siemens at 35.3%, resulting in a difference of 48 percentage points. Even among the most successful assignees, only three have allowance rates of over 50%. This demonstrates what many practitioners and observers had suspected: Post-Alice allowance rates trend downward. Before Alice, the top assignees had a collective average allowance rate of 79.8%, which dropped to 44.7% after Alice. While some top assignees saw declines of almost half, others were more modest, with an overall decline among all top assignees of 44%. When looking at the top assignees, this decline does not appear to be extreme enough to announce the death of business method patents quite yet.

Now for a look at the least successful assignees.

The range of allowance rates among the bottom assignees is not as wide as the top, with only one assignee having an allowance rate of more than 30%. Even the most successful, General Electric, has a rate of only 33.3%. The least successful, Fujitsu, has had only 6.7% of its applications allowed since Alice. Among the least successful assignees, Bank of America registered the greatest decline, at 88.5%. Before Alice, the bottom ten assignees had a collective average allowance rate of 62.4%, which dropped to a collective rate of only 18.1% after Alice, a 71% decline. Given that these steep drops are affecting major industry players like Google and Microsoft, the impact of Alice is more alarming here.

One notable member of the least successful assignees is Intellectual Ventures, widely regarded as one of the largest NPEs in the industry. One possible theory for why it appears here is the nature of its business. Given that its activities largely consist of patent litigation rather than prosecution, it would not be surprising if prosecuting these types of applications in the current legal climate were not a high priority. Intellectual Ventures is also among the least successful assignees in TC 3600 overall, with an allowance rate of only 41% across all art units. This seems to confirm the theory that it invests significantly more resources into patent litigation than prosecution.

Overall, the allowance rate for all assignees with at least ten disposed applications in the business methods art units one year prior to Alice was 71%, which subsequently dropped to 31.2% one year after Alice, a 56.1% decline. Of course, these allowance rates vary widely depending on the assignee, from modest declines among the top assignees to an almost 90% decline for Bank of America in the bottom assignees. These figures also do not take IPR challenges into account, which have resulted in widespread invalidation of many patents from the 3600s. While business method patents are not dead yet, allowance rates in those art units dropped precipitously after Alice and there is no indication that the decline is slowing.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

5 comments so far.

RandomAssignment

August 13, 2015 11:55 amApplications are manually assigned to art units and rarely reassigned if an error was made in the assignment process… some of the patents in TC 3600 could actually be software patents that ended up in the business method art unit. Without actually reading the patents, it is hard to tell whether they actually are business method patents. That should have a far higher impact on allowances than who the patent was assigned to.

Smithy

August 5, 2015 12:17 pmSounds like Alexander works at Fujitsu. You’ll get ’em next year, Alexander.

Alexander

August 5, 2015 10:15 amAnother article that combines Juristat data with an embarassingly facile analysis. I hope Juristat isn’t paying for this advertising!

Business methods are in a holding pattern right now. Applicants and examiners alike aren’t entirely positive what is and isn’t eligible. By removing pending applications, you only consider the most obviously junk patents and the most obviously “significantly more” patents. This “analysis” doesnt even show how representative the extremes are of an applicant’s portfolio because the majority (“in between” patents) are excluded!

Curious

August 5, 2015 08:04 amAs always, the first question to be asked is what actually is being claimed? There are a lot of different flavors of “business methods” — or at least applications that get shunted into 3600. Some are what I call “pure” business methods and others are more computer applications that have a business purposes. I believe that has more impact on the allowance rates (or 101 rejection rate) than who is filing the application.

David Stein

August 4, 2015 01:53 pmHmm. I agree with the premise of this article – that different assignees are experiencing a much different reaction from the PTO post-Alice. And some of the data matches up with my expectations (e.g., GE’s portfolio is unaffected, while IV is encountering much more resistance).

But I don’t really agree with the data processing methodology. The critical metric (cases allowed vs. cases abandoned, disregarding still-pending) seems far too attenuated and remote to be useful.

Consider this: Abandonment is an easy choice when the subject matter has no hope of surviving Alice or reaching allowance. But what about claims that recite actual technology with strong value – yet the examiner feels compelled to reject under 101, perhaps repeatedly, based on the art unit’s overall policy… or the examiner’s skittishness about any allowance that a SPE or QAS or OPQA representative might later criticize? Those cases might need some extended time to work through the system (possibly with a trip to the PTAB), yet will eventually reach an allowance anyway (possibly with extensive patent term adjustment or extension).

The metric that’s been chosen leads to some clearly weird results. GE is identified as a “bottom” assignee – yet, the fact that GE’s metrics are almost completely unchanged should characterize them as a hugely positive sign. conversely, IBM is characterized as “winning” even though its allowance rate has dropped from 80% to 35%! Very strange conclusions arising from this statistical categorization.

At most, the article supports the conclusion that the effects of Alice vary significantly by assignee. That is a valuable observation, and until we can post-mortem the data from several years, we should just leave it at that.