Recently here on IPWatchdog, we discussed a liability shift towards businesses for fraudulent payments in the wake of the development of EMV chip cards. EMV, which stands for Europay-Mastercard-Visa and is named after the three companies who developed the technology, utilizes a computer chip implanted into a card to interact with a card reader at the point-of-sale in retail or other establishments. The technology is much more secure than typical magnetic stripes as the chip encrypts financial payment data multiple times which communicating with a terminal. Financial services providers all over the world will be replacing magnetic stripe cards with EMV cards to prevent cyber attacks at terminals to stem the growing tide of cyber attacks which had been greatly hurting banks. With the liability shift, if a customer presents an EMV card at a point-of-sale and there is no EMV card reader, the business may still use the card’s magnetic stripe to complete a transaction but are held liable for any fraud stemming from that transaction; banks won’t rush in to save Target and Home Depot as in years past.

Recently here on IPWatchdog, we discussed a liability shift towards businesses for fraudulent payments in the wake of the development of EMV chip cards. EMV, which stands for Europay-Mastercard-Visa and is named after the three companies who developed the technology, utilizes a computer chip implanted into a card to interact with a card reader at the point-of-sale in retail or other establishments. The technology is much more secure than typical magnetic stripes as the chip encrypts financial payment data multiple times which communicating with a terminal. Financial services providers all over the world will be replacing magnetic stripe cards with EMV cards to prevent cyber attacks at terminals to stem the growing tide of cyber attacks which had been greatly hurting banks. With the liability shift, if a customer presents an EMV card at a point-of-sale and there is no EMV card reader, the business may still use the card’s magnetic stripe to complete a transaction but are held liable for any fraud stemming from that transaction; banks won’t rush in to save Target and Home Depot as in years past.

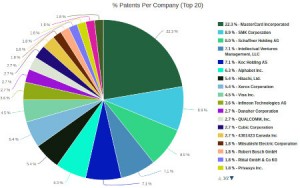

Following up our recent EMV coverage we took a look at EMV related patents using the patent portfolio analysis tools available through Innography, finding that Mastercard Inc. (NYSE:MA) has a dominant position in this field with 25 patents, almost a quarter of all patents related to EMV payments issued by the U.S. Patent and Trademark Office. Following up behind Mastercard is Japan-based SMK Corporation (TYO:6798) and Intellectual Ventures Management of Bellevue, WA. Below we profile the patent holdings of these top three patent holders in the EMV payment space.

Following up our recent EMV coverage we took a look at EMV related patents using the patent portfolio analysis tools available through Innography, finding that Mastercard Inc. (NYSE:MA) has a dominant position in this field with 25 patents, almost a quarter of all patents related to EMV payments issued by the U.S. Patent and Trademark Office. Following up behind Mastercard is Japan-based SMK Corporation (TYO:6798) and Intellectual Ventures Management of Bellevue, WA. Below we profile the patent holdings of these top three patent holders in the EMV payment space.

Mastercard’s EMV Portfolio: EMV Tech for Toll Payments, E-Commerce Security

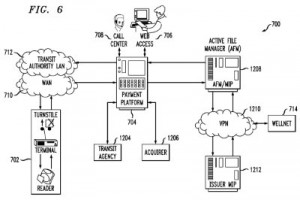

Mastercard’s large patent portfolio in EMV chip cards gives them a strong position in widespread EMV applications. The use of EMV cards for paying public transit fees is discussed within U.S. Patent No. 9098851, titled Method and Apparatus for Simplifying the Handling of Complex Payment Transactions. It protects a method for payment with a payment device when a final transaction amount is not known upon the first presentation of the payment device to a merchant, where the payment device is a smart card storing a monetary balance and where the merchant is a transit authority associated with a transit system. This innovation is intended to improve the use of EMV cards with transit authorities by calculating a final transaction amount at a central server to determine a toll amount charged based on entrance and exit locations. Multi-functional EMV cards which can be linked to a number of financial accounts are discussed within U.S. Patent No. 9010631, titled Combicard Transaction Method and System Having an Application Parameter Update Mechanism. It discloses a method of receiving an authorization request at an issuer, sending an authorization response including a script to be performed by an integrated circuit and sent from the issuer; the script is performed by a primary application in order to update a secondary application. This system provides a more flexible and convenient manner in which new applications, such as those enabling dual functionality as a debit and credit card, can be incorporated into a card’s integrated circuit.

Mastercard’s large patent portfolio in EMV chip cards gives them a strong position in widespread EMV applications. The use of EMV cards for paying public transit fees is discussed within U.S. Patent No. 9098851, titled Method and Apparatus for Simplifying the Handling of Complex Payment Transactions. It protects a method for payment with a payment device when a final transaction amount is not known upon the first presentation of the payment device to a merchant, where the payment device is a smart card storing a monetary balance and where the merchant is a transit authority associated with a transit system. This innovation is intended to improve the use of EMV cards with transit authorities by calculating a final transaction amount at a central server to determine a toll amount charged based on entrance and exit locations. Multi-functional EMV cards which can be linked to a number of financial accounts are discussed within U.S. Patent No. 9010631, titled Combicard Transaction Method and System Having an Application Parameter Update Mechanism. It discloses a method of receiving an authorization request at an issuer, sending an authorization response including a script to be performed by an integrated circuit and sent from the issuer; the script is performed by a primary application in order to update a secondary application. This system provides a more flexible and convenient manner in which new applications, such as those enabling dual functionality as a debit and credit card, can be incorporated into a card’s integrated circuit.

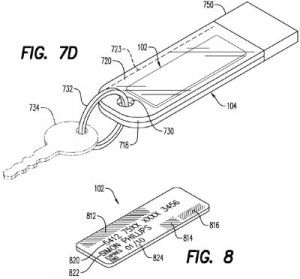

Greater flexibility in EMV risk parameters, which are used to reduce fraud and limit bad debt, is at the center of U.S. Patent No. 8794352, titled Methods and Apparatus for Use in Association with Identification Token. The method claimed here involves supporting an identification token issued to an account holder in a non-card shaped body of a device, communicating with a proximity coupling device via the identification token’s wireless interface, connecting a communication device to an electrical connector attached to the non-card shaped body and communicating with the device to reset a security parameter in the identification token; the communication device includes a counter indicative of a number of occasions that the security parameters for the identification token have been reset. This allows payment processors to adjust EMV parameters dynamically when the risk of bad debt is low or when an account associated with the device is in good standing. Diagrams attached to the patent indicate that this EMV tech could be implemented in a USB-style port attached to a keychain. Increased payment transaction security for integrated circuit cards (ICCs) when payments are made over the Internet is the focus of U.S. Patent No. 8909557, entitled Authentication Arrangement and Method for Use with Financial Transaction. The method for authenticating a transaction using an authentication token generated by a personal card reader claimed here involves requesting data from an ICC, receiving a response including an authentication cryptogram from the ICC, storing at least two default bitmaps in the personal card reader’s memory portion, selecting one of the bitmaps, building the authentication token including the selected bitmap and authentication cryptogram at the personal card reader and communicating the authentication token to a third party to authenticate a transaction. This invention was pursued in response to a need to increase financial security as a growing percentage of all transactions are conducted remotely.

Greater flexibility in EMV risk parameters, which are used to reduce fraud and limit bad debt, is at the center of U.S. Patent No. 8794352, titled Methods and Apparatus for Use in Association with Identification Token. The method claimed here involves supporting an identification token issued to an account holder in a non-card shaped body of a device, communicating with a proximity coupling device via the identification token’s wireless interface, connecting a communication device to an electrical connector attached to the non-card shaped body and communicating with the device to reset a security parameter in the identification token; the communication device includes a counter indicative of a number of occasions that the security parameters for the identification token have been reset. This allows payment processors to adjust EMV parameters dynamically when the risk of bad debt is low or when an account associated with the device is in good standing. Diagrams attached to the patent indicate that this EMV tech could be implemented in a USB-style port attached to a keychain. Increased payment transaction security for integrated circuit cards (ICCs) when payments are made over the Internet is the focus of U.S. Patent No. 8909557, entitled Authentication Arrangement and Method for Use with Financial Transaction. The method for authenticating a transaction using an authentication token generated by a personal card reader claimed here involves requesting data from an ICC, receiving a response including an authentication cryptogram from the ICC, storing at least two default bitmaps in the personal card reader’s memory portion, selecting one of the bitmaps, building the authentication token including the selected bitmap and authentication cryptogram at the personal card reader and communicating the authentication token to a third party to authenticate a transaction. This invention was pursued in response to a need to increase financial security as a growing percentage of all transactions are conducted remotely.

SMK Corporation’s Logomotion Partnership Results in Secure Contactless Payment Tech

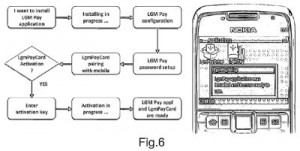

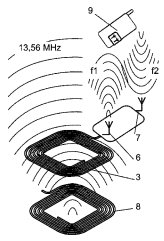

Much of SMK Corp’s IP portfolio in the field of EMV chip cards, as well as other secure methods of digital payments, comes to it through its partnership with Slovakian company Logomotion, a developer of Internet of Things (IoT) solutions. A system that can be incorporated onto EMV cards to offer a high level of security without increasing transaction costs or complexity of use is discussed within U.S. Patent No. 9098845, entitled Process of Selling in Electronic Shop Accessible from the Mobile Communication Device. It protects a method of purchasing from an electronic store via a mobile data network for download to a mobile communication device by sending an activation command to a removable memory card in the device in response to the selection of an item to purchase from an electronic store, transferring identification data associated with an acquirer from a configuration data store portion to a payment terminal data portion of the memory card, sending identification data via the mobile network, receiving a determination that the identification data corresponds to identification data associated with a permitted acquirer and receiving a set of payment parameters initialized for a transaction by the payment terminal. The use of the removable memory card in this invention makes the payment process run more smoothly by utilizing identification data found in EMV data stores. Removable memory cards for payment authorization are also at the center of U.S. Patent No. 9054408, titled Removable Card for a Contactless Communication, Its Utilization and the Method of Production. It protects a removable card adapted for insertion into a memory extension slot of a mobile communication device for creation of a contactless communication channel, the removable card having a flat card body made from electrically nonconductive material, an antenna made of at least one thread of a conductive path on a nonconductive surface and resonating at a certain frequency, a ferromagnetic material layer at least partially covering the antenna and electrical contacts disposed on the same surface of the card body for connection in the communication device’s slot. The use of the ferromagnetic layer accomplishes a more stable tuning for the antenna on the removable card.

Much of SMK Corp’s IP portfolio in the field of EMV chip cards, as well as other secure methods of digital payments, comes to it through its partnership with Slovakian company Logomotion, a developer of Internet of Things (IoT) solutions. A system that can be incorporated onto EMV cards to offer a high level of security without increasing transaction costs or complexity of use is discussed within U.S. Patent No. 9098845, entitled Process of Selling in Electronic Shop Accessible from the Mobile Communication Device. It protects a method of purchasing from an electronic store via a mobile data network for download to a mobile communication device by sending an activation command to a removable memory card in the device in response to the selection of an item to purchase from an electronic store, transferring identification data associated with an acquirer from a configuration data store portion to a payment terminal data portion of the memory card, sending identification data via the mobile network, receiving a determination that the identification data corresponds to identification data associated with a permitted acquirer and receiving a set of payment parameters initialized for a transaction by the payment terminal. The use of the removable memory card in this invention makes the payment process run more smoothly by utilizing identification data found in EMV data stores. Removable memory cards for payment authorization are also at the center of U.S. Patent No. 9054408, titled Removable Card for a Contactless Communication, Its Utilization and the Method of Production. It protects a removable card adapted for insertion into a memory extension slot of a mobile communication device for creation of a contactless communication channel, the removable card having a flat card body made from electrically nonconductive material, an antenna made of at least one thread of a conductive path on a nonconductive surface and resonating at a certain frequency, a ferromagnetic material layer at least partially covering the antenna and electrical contacts disposed on the same surface of the card body for connection in the communication device’s slot. The use of the ferromagnetic layer accomplishes a more stable tuning for the antenna on the removable card.

More mobile device point-of-sale transactions using near field communications techniques (NFC), another payment method which can be made more secure than magnetic stripe, are featured within U.S. Patent No. 9081997, titled Method of Communication with the POS Terminal, the Frequency Converter for the Post Terminal. The system for contactless payment via a mobile communication device protected here includes a point-of-sale (POS) terminal with an NFC antenna, a removable memory card with an antenna inserted into a mobile communication device and a frequency converter positioned between the card and NFC terminal that converts and communicates a first signal in a form suitable for reception by either antenna. The invention seeks to provide a more reliable NFC communication between a mobile device and a POS terminal for conducting secure payments.

More mobile device point-of-sale transactions using near field communications techniques (NFC), another payment method which can be made more secure than magnetic stripe, are featured within U.S. Patent No. 9081997, titled Method of Communication with the POS Terminal, the Frequency Converter for the Post Terminal. The system for contactless payment via a mobile communication device protected here includes a point-of-sale (POS) terminal with an NFC antenna, a removable memory card with an antenna inserted into a mobile communication device and a frequency converter positioned between the card and NFC terminal that converts and communicates a first signal in a form suitable for reception by either antenna. The invention seeks to provide a more reliable NFC communication between a mobile device and a POS terminal for conducting secure payments.

Intellectual Ventures Holds Patents for Smart Card Online Payments

Intellectual Ventures, an IP holding company whose tactics in enforcing its patent rights have drawn criticism, holds the third-most EMV-related patents that we could find. As with many companies holding EMV IP, some of these patents go back a decade or longer, such as is the case with U.S. Patent No. 6824064, titled Concurrent Communication with Multiple Applications on a Smart Card and issued in November 2004. This patent protects a smart card operable to hold a plurality of applications and having a memory partitioned into blocks and a control program having allocation program code for dynamically allocating memory blocks for a plurality of applications as well as scheduler program code which schedules application for execution if the declared memory needs have been satisfied. The technology is intended for use on smart cards, including smart credit cards, to allow simultaneous communication with a plurality of application programs communicating with the smart card.

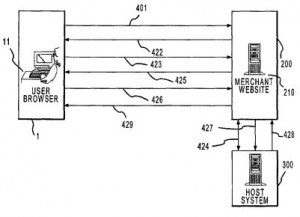

Remote payment methods involving online transactions were at the center of a couple of patents held by Intellectual Ventures, including U.S. Patent No. 8538891, titled Online Card Present Transaction. It protects a computer-based system comprising a client computer-based system and a merchant computer, the client computer-based system having a processor for facilitating transactions, a tangible non-transitory memory having instructions executable by the processor to transmit a request to facilitate a transaction with a merchant computer, send an indication of the presence of a smart card reader in communication with the client system, receive a payment option for using a smart card as payment and transmit the payment option selection to facilitate the transaction. This system is designed to provide traditional transaction automation techniques to the online marketplace so that a merchant can process a payment as card present, eliminating the cumbersome duties of setting up a digital wallet. A similar technology which has been acquired by Intellectual Ventures is at the center of U.S. Patent No. 7873579, titled Merchant Facilitation of Online Card Present Transaction. It discloses an online card present transaction method of detecting the presence of a smart card reader connected to a client computer by a merchant computer, presenting the client computer with a payment option for using a smart card for payment, redirecting the client computer to a website of a host computer receiving a digital certificate from the smart card, generating a secondary transaction account code valid for a single purchase transaction, associating the secondary transaction account code with a primary transaction account code and communicating the secondary transaction account code to the client computer for submitting a payment request. This innovation is designed to provide proper verification of a smart card being used for an online transaction to reduce the threat of fraudulent purchases.

Remote payment methods involving online transactions were at the center of a couple of patents held by Intellectual Ventures, including U.S. Patent No. 8538891, titled Online Card Present Transaction. It protects a computer-based system comprising a client computer-based system and a merchant computer, the client computer-based system having a processor for facilitating transactions, a tangible non-transitory memory having instructions executable by the processor to transmit a request to facilitate a transaction with a merchant computer, send an indication of the presence of a smart card reader in communication with the client system, receive a payment option for using a smart card as payment and transmit the payment option selection to facilitate the transaction. This system is designed to provide traditional transaction automation techniques to the online marketplace so that a merchant can process a payment as card present, eliminating the cumbersome duties of setting up a digital wallet. A similar technology which has been acquired by Intellectual Ventures is at the center of U.S. Patent No. 7873579, titled Merchant Facilitation of Online Card Present Transaction. It discloses an online card present transaction method of detecting the presence of a smart card reader connected to a client computer by a merchant computer, presenting the client computer with a payment option for using a smart card for payment, redirecting the client computer to a website of a host computer receiving a digital certificate from the smart card, generating a secondary transaction account code valid for a single purchase transaction, associating the secondary transaction account code with a primary transaction account code and communicating the secondary transaction account code to the client computer for submitting a payment request. This innovation is designed to provide proper verification of a smart card being used for an online transaction to reduce the threat of fraudulent purchases.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2023/01/2021-Patent-Practice-on-Demand-1.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Matt Herren

November 26, 2015 02:03 amOne clarification… if a bank is issuing EMV cards, and the merchant accepts EMV cards but for some reason there is an error, ‘technical fallback’ is an option for the merchant to ‘fall back’ to accepting the magstripe to complete the transaction. In such instances, the bank is still liable for the fraud.