Bank of America Corporation (NYSE:BAC) of Charlotte, NC, is a multinational banking and financial services corporation and the second-largest American holding bank by assets. Recently, we focused on innovations in mobile payment programs, such as digital wallets, developed by major banking institutions in response to Silicon Valley’s encroachment on financial services in that sector. Recently, Bank of America has been increasing its patenting activities in cryptocurrencies like blockchain instead of paper-based operations; on December 17th, the U.S. Patent and Trademark Office published 10 patent applications filed by BofA for technologies related to blockchain. CEO Brian Moynihan recently commented in an interview with The Charlotte Observer that the corporation invests about $3 billion per year on technology development.

Bank of America Corporation (NYSE:BAC) of Charlotte, NC, is a multinational banking and financial services corporation and the second-largest American holding bank by assets. Recently, we focused on innovations in mobile payment programs, such as digital wallets, developed by major banking institutions in response to Silicon Valley’s encroachment on financial services in that sector. Recently, Bank of America has been increasing its patenting activities in cryptocurrencies like blockchain instead of paper-based operations; on December 17th, the U.S. Patent and Trademark Office published 10 patent applications filed by BofA for technologies related to blockchain. CEO Brian Moynihan recently commented in an interview with The Charlotte Observer that the corporation invests about $3 billion per year on technology development.

The most recent quarterly earnings report for Bank of America, released in mid-October, saw the banking corporation beat analyst expectations as it posted an earnings per share (EPS) of 37 cents, four cents greater than expected EPS of 33 cents. BofA continues to claw back from the global recession but got a break this year from a ruling in New York state court on the statute of limitations for faulty mortgage or mortgage-backed security claims which allowed it to reduce its outstanding claims estimate by $7.6 billion. In early December, the Federal Reserve approved a capital plan allowing BofA to continue paying its 20-cent annual dividend and complete the buyback of 4 million shares of stock.

state court on the statute of limitations for faulty mortgage or mortgage-backed security claims which allowed it to reduce its outstanding claims estimate by $7.6 billion. In early December, the Federal Reserve approved a capital plan allowing BofA to continue paying its 20-cent annual dividend and complete the buyback of 4 million shares of stock.

The research and development investment made by Bank of America has paid off fairly well in recent years. In 2014, the corporation ranked 152nd overall among companies earning patents from the U.S. Patent and Trademark Office, gaining 232 patents in that year, a decrease of 11.5 percent over its 2013 totals. Through the end of 2015, Bank of America had added another 228 U.S. patents to its IP portfolio with one week left for new patents to be issued by the USPTO. As the text cluster available through Innography’s IP portfolio analysis tools will show readers, computing and mobile devices made up a great deal of the company’s recent R&D focus, along with data stores and user interfaces.

Bank of America’s Recently Issued Patents: Rhythm-Based User Authentication and Vehicle Navigation Tech

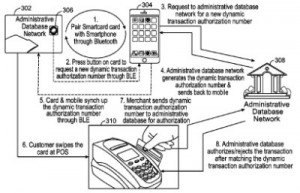

Many of the patents we noticed in our recent survey of BofA technologies are related to enhanced security methods for financial transactions, such as the innovation protected by U.S. Patent No. 9218596, entitled Method and Apparatus for Providing Real Time Mutable Credit Card Information. It discloses a smartcard apparatus having a microprocessor chip, a button, a dynamic transaction authorization number and a Bluetooth low energy device (BLE) that works to transmit an instruction to a smartphone for a request for a dynamic transaction authorization number when the button is depressed and receive the number from the smartphone; the smartcard further has a battery and a dynamic magnetic strip comprising a digital representation of the dynamic authorization number. This technology is designed to enhance security measures in smartcards having magnetic strips without requiring a banking institution to issue new cards. Enhanced security for banking transactions taking place on cloud infrastructures is featured within U.S. Patent No. 9184918, entitled Trusted Hardware for Attesting to Authenticity in a Cloud Environment. It claims an apparatus having a processor and a memory storing instructions executable to cause the apparatus to store a first measurement of a visualization platform in a trusted protection module (TPM), store a second measurement of a virtual machine in a TPM, generate a TPM quote based on both measurements using a key and provide the TPM quote for attesting to authenticity of the platform and the machine; the TPM quote is uniquely tied to an individual piece of physical infrastructure hardware on which the platform runs. This innovation is intended to address security issues in cloud computing environments where trust for multiple computers may need to be verified. We were also intrigued to take note of a novel authentication method for executing transactions which is the focus of U.S. Patent No. 9213819, issued under the title Rhythm-Based User Authentication. It protects an apparatus for authenticating a user based on a rhythmic pattern, the apparatus having a processor and a module stored in memory and executable to receive a user indication to execute an action associated with an online banking application, initiate a presentation of a predetermined series of musical notes pre-selected by a user to be associated with an action and played on a speaker associated with a wearable computing device; a plurality of rhythmic inputs are then processed to determine rhythm, tempo, velocity and pitch. This inventive user authentication process is designed for musically-inclined users as well as sight-impaired users who require auditory authentication techniques.

Many of the patents we noticed in our recent survey of BofA technologies are related to enhanced security methods for financial transactions, such as the innovation protected by U.S. Patent No. 9218596, entitled Method and Apparatus for Providing Real Time Mutable Credit Card Information. It discloses a smartcard apparatus having a microprocessor chip, a button, a dynamic transaction authorization number and a Bluetooth low energy device (BLE) that works to transmit an instruction to a smartphone for a request for a dynamic transaction authorization number when the button is depressed and receive the number from the smartphone; the smartcard further has a battery and a dynamic magnetic strip comprising a digital representation of the dynamic authorization number. This technology is designed to enhance security measures in smartcards having magnetic strips without requiring a banking institution to issue new cards. Enhanced security for banking transactions taking place on cloud infrastructures is featured within U.S. Patent No. 9184918, entitled Trusted Hardware for Attesting to Authenticity in a Cloud Environment. It claims an apparatus having a processor and a memory storing instructions executable to cause the apparatus to store a first measurement of a visualization platform in a trusted protection module (TPM), store a second measurement of a virtual machine in a TPM, generate a TPM quote based on both measurements using a key and provide the TPM quote for attesting to authenticity of the platform and the machine; the TPM quote is uniquely tied to an individual piece of physical infrastructure hardware on which the platform runs. This innovation is intended to address security issues in cloud computing environments where trust for multiple computers may need to be verified. We were also intrigued to take note of a novel authentication method for executing transactions which is the focus of U.S. Patent No. 9213819, issued under the title Rhythm-Based User Authentication. It protects an apparatus for authenticating a user based on a rhythmic pattern, the apparatus having a processor and a module stored in memory and executable to receive a user indication to execute an action associated with an online banking application, initiate a presentation of a predetermined series of musical notes pre-selected by a user to be associated with an action and played on a speaker associated with a wearable computing device; a plurality of rhythmic inputs are then processed to determine rhythm, tempo, velocity and pitch. This inventive user authentication process is designed for musically-inclined users as well as sight-impaired users who require auditory authentication techniques.

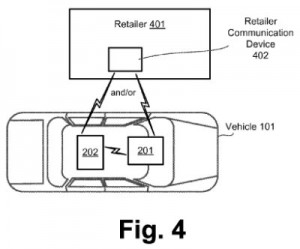

It seems like every company with active R&D operations is getting involved with some form of automotive tech and BofA is no different, as readers can see evidenced by the issue of U.S. Patent No. 9131376, titled Proximity-Based Dynamic Vehicle Navigation. It protects a method that involves wireless receiving an indication of a first navigation route of a vehicle from an origin to a destination transmitted by a portable device, determining the proximity of each of a plurality of third-party devices to determine points of interest in the first navigation route, wirelessly transmitting an indication of the determined points of interest to the portable device and receiving a second navigation route from the origin to the destination modified to include a first point of interest. This innovation enables the pairing of electronic devices, like smartphones, to a vehicle’s on-board computer to provide additional security in transaction while also providing information on points of interest, such as modifying a navigation route so as to pass an ATM if funds are needed. Even fuel transactions for vehicles have been the focus of Bank of America tech developments as is reflected by the issue of U.S. Patent No. 9177308, which is titled Readable Indicia for Fuel Purchase. It discloses an apparatus for purchasing fuel for a vehicle from a fuel station and having a computer module executable by a processor to receive pre-configured information associated with a fuel station and fuel pump, initiate in a mobile communication apparatus to present a user interface displaying an address associated with a user interface and identification information associated with a fuel pump, determine identification information associated with the fuel pump that will be used to fuel a vehicle and transmit a purchase authentication request to an external server. This innovation enables a vehicle owner to pay for fuel at a gas station without having to swipe a payment card at the station.

It seems like every company with active R&D operations is getting involved with some form of automotive tech and BofA is no different, as readers can see evidenced by the issue of U.S. Patent No. 9131376, titled Proximity-Based Dynamic Vehicle Navigation. It protects a method that involves wireless receiving an indication of a first navigation route of a vehicle from an origin to a destination transmitted by a portable device, determining the proximity of each of a plurality of third-party devices to determine points of interest in the first navigation route, wirelessly transmitting an indication of the determined points of interest to the portable device and receiving a second navigation route from the origin to the destination modified to include a first point of interest. This innovation enables the pairing of electronic devices, like smartphones, to a vehicle’s on-board computer to provide additional security in transaction while also providing information on points of interest, such as modifying a navigation route so as to pass an ATM if funds are needed. Even fuel transactions for vehicles have been the focus of Bank of America tech developments as is reflected by the issue of U.S. Patent No. 9177308, which is titled Readable Indicia for Fuel Purchase. It discloses an apparatus for purchasing fuel for a vehicle from a fuel station and having a computer module executable by a processor to receive pre-configured information associated with a fuel station and fuel pump, initiate in a mobile communication apparatus to present a user interface displaying an address associated with a user interface and identification information associated with a fuel pump, determine identification information associated with the fuel pump that will be used to fuel a vehicle and transmit a purchase authentication request to an external server. This innovation enables a vehicle owner to pay for fuel at a gas station without having to swipe a payment card at the station.

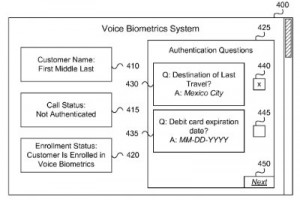

Large banking institutions like Bank of America, especially those which operate globally, would benefit from the customer service innovation outlined within U.S. Patent No. 9215321, titled Utilizing Voice Biometrics. It protects a computing device having a memory storing computer-readable instructions executable by a processor to receive a voice sample associated with a phone call including utterances responsive to customer service prompts, determine a voice biometric confidence score based on the sample, determine to route the phone call to a first endpoint based on the confidence score and determine to initiate recording and analysis of a phone call to a specialized customer representative for handling as a potentially illegitimate call. This innovation is designed to provide an efficient means to authenticate individual customers within a large customer base to prevent illegitimate transactions.

Large banking institutions like Bank of America, especially those which operate globally, would benefit from the customer service innovation outlined within U.S. Patent No. 9215321, titled Utilizing Voice Biometrics. It protects a computing device having a memory storing computer-readable instructions executable by a processor to receive a voice sample associated with a phone call including utterances responsive to customer service prompts, determine a voice biometric confidence score based on the sample, determine to route the phone call to a first endpoint based on the confidence score and determine to initiate recording and analysis of a phone call to a specialized customer representative for handling as a potentially illegitimate call. This innovation is designed to provide an efficient means to authenticate individual customers within a large customer base to prevent illegitimate transactions.

Patent Applications of Note: From Secure Cryptocurrency Systems to Wearable Payment Devices

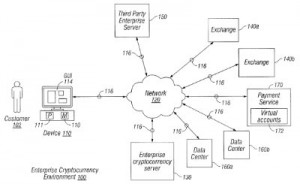

With all of Bank of America’s recent developments into blockchain and cryptocurrency tech, we wanted to make sure to take a close look at a collection of these innovations to get a better idea of where BofA expects to have an impact. U.S. Patent Application No. 20150363778, which is titled Cryptocurrency Electronic Payment System, would protect a system having a memory storing a customer account and a processor coupled to the memory to execute instructions for communicating with an electronic payment service providing a virtual account associated with the customer, determining that the customer initiated a request for a financial transaction to transfer an amount of currency from a virtual account to a destination, validating the financial transaction based on data received from the electronic payment service, determining a quantity of cryptocurrency equivalent to the amount of currency and transferring the quantity of cryptocurrency to the electronic payment service. This invention provides a cryptocurrency storage solution for enterprises which require secure storage while engaging in a large number of financial transactions on a daily basis. The conversion of cryptocurrency into other forms of currency is the goal of the technology detailed within U.S. Patent Application No. 20150363769, entitled Cryptocurrency Real-Time Conversion System. It would protect a system having a memory operable to store a set of conversion rules and a processor executing instructions on the memory causing the system to receive an electronic request for a cryptocurrency conversion from a first currency into a cryptocurrency, retrieve price data associated with both currencies, determine whether the conversion is optimal based on the price data and the conversion rules, determine a plurality of exchange rates associated with the conversion, determine an optimal exchange rate of the plurality of rates and initiate converting the first currency into the cryptocurrency. This technology is capable of effecting a simultaneous conversion of cryptocurrencies upon the determination that a conversion is optimal. The secure storage of blockchain currencies is targeted by the technology discussed within U.S. Patent Application No. 20150365283, filed under the title Cryptocurrency Real-Time Conversion System. It discloses a system having a memory storing customer account information and a processor coupled to the memory to execute instructions for receiving a request to deposit a quantity of cryptocurrency into the customer account, associating the quantity of cryptocurrency with the customer account, deposit the cryptocurrency quantity into a vault connected to a network, determine a total quantity of cryptocurrency deposited into the vault and facilitating disconnection of the vault from the network if it is determined that the amount of cryptocurrency deposited into the account exceeds a threshold. The invention is intended to establish a secure storage system for cryptocurrencies that can be implemented at the enterprise level without relying on third-party exchanges.

With all of Bank of America’s recent developments into blockchain and cryptocurrency tech, we wanted to make sure to take a close look at a collection of these innovations to get a better idea of where BofA expects to have an impact. U.S. Patent Application No. 20150363778, which is titled Cryptocurrency Electronic Payment System, would protect a system having a memory storing a customer account and a processor coupled to the memory to execute instructions for communicating with an electronic payment service providing a virtual account associated with the customer, determining that the customer initiated a request for a financial transaction to transfer an amount of currency from a virtual account to a destination, validating the financial transaction based on data received from the electronic payment service, determining a quantity of cryptocurrency equivalent to the amount of currency and transferring the quantity of cryptocurrency to the electronic payment service. This invention provides a cryptocurrency storage solution for enterprises which require secure storage while engaging in a large number of financial transactions on a daily basis. The conversion of cryptocurrency into other forms of currency is the goal of the technology detailed within U.S. Patent Application No. 20150363769, entitled Cryptocurrency Real-Time Conversion System. It would protect a system having a memory operable to store a set of conversion rules and a processor executing instructions on the memory causing the system to receive an electronic request for a cryptocurrency conversion from a first currency into a cryptocurrency, retrieve price data associated with both currencies, determine whether the conversion is optimal based on the price data and the conversion rules, determine a plurality of exchange rates associated with the conversion, determine an optimal exchange rate of the plurality of rates and initiate converting the first currency into the cryptocurrency. This technology is capable of effecting a simultaneous conversion of cryptocurrencies upon the determination that a conversion is optimal. The secure storage of blockchain currencies is targeted by the technology discussed within U.S. Patent Application No. 20150365283, filed under the title Cryptocurrency Real-Time Conversion System. It discloses a system having a memory storing customer account information and a processor coupled to the memory to execute instructions for receiving a request to deposit a quantity of cryptocurrency into the customer account, associating the quantity of cryptocurrency with the customer account, deposit the cryptocurrency quantity into a vault connected to a network, determine a total quantity of cryptocurrency deposited into the vault and facilitating disconnection of the vault from the network if it is determined that the amount of cryptocurrency deposited into the account exceeds a threshold. The invention is intended to establish a secure storage system for cryptocurrencies that can be implemented at the enterprise level without relying on third-party exchanges.

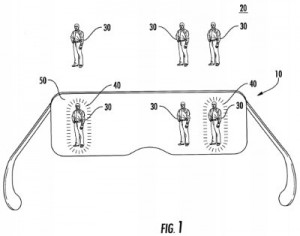

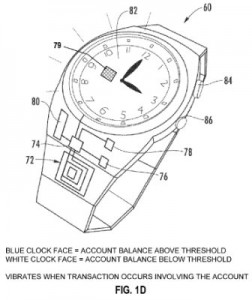

We took note of some interesting technologies involving electronic devices, including the wearable device innovation described within U.S. Patent Application No. 20150293356, titled Customer Recognition Through Use of an Optical Head-Mounted Display in a Wearable Computing Device. It claims an apparatus for recognizing and identifying established customers within a business location comprised of a wearable computing device including a memory, a processor and a head-mounted display in communication with each other and a customer recognition and identification module executable by the processor to provide a user a view of a business location occupied by individuals, determine which of the individuals are established customers of the business by receiving an electronic token communicated from a mobile communication device possessed by an individual and present customer identifiers of established customers within the view. This innovation is designed to provide associates or employees of a business with beneficial knowledge of pre-existing relationships with certain customers in a way that does not require customer intervention. Another intriguing piece of wearable tech meant to facilitate

We took note of some interesting technologies involving electronic devices, including the wearable device innovation described within U.S. Patent Application No. 20150293356, titled Customer Recognition Through Use of an Optical Head-Mounted Display in a Wearable Computing Device. It claims an apparatus for recognizing and identifying established customers within a business location comprised of a wearable computing device including a memory, a processor and a head-mounted display in communication with each other and a customer recognition and identification module executable by the processor to provide a user a view of a business location occupied by individuals, determine which of the individuals are established customers of the business by receiving an electronic token communicated from a mobile communication device possessed by an individual and present customer identifiers of established customers within the view. This innovation is designed to provide associates or employees of a business with beneficial knowledge of pre-existing relationships with certain customers in a way that does not require customer intervention. Another intriguing piece of wearable tech meant to facilitate  financial transactions is at the center of U.S. Patent Application No. 20150294303, titled Wearable Device as a Payment Vehicle. It claims a system configured to facilitate a financial transaction using a wearable device as a payment vehicle comprised of the wearable device having features securing the wearable article to a person or an item associated with the person and a portion having machine-readable indicia that can be read to provide payment information for facilitating the financial transaction; the system also utilizes a mobile communication device with a memory storing a module executable by a processor to read the readable indicia associated with the wearable device, receive a first user input assigning the readable indicia to a financial payment account and receive a second user input a limit to the readable indicia. The use of this wearable device is designed to provide customers with a vehicle for completing payment transactions in certain locations, such as beaches or resorts, where wallets or smartphones may not be carried because of hazardous conditions posed by water or other environmental factors.

financial transactions is at the center of U.S. Patent Application No. 20150294303, titled Wearable Device as a Payment Vehicle. It claims a system configured to facilitate a financial transaction using a wearable device as a payment vehicle comprised of the wearable device having features securing the wearable article to a person or an item associated with the person and a portion having machine-readable indicia that can be read to provide payment information for facilitating the financial transaction; the system also utilizes a mobile communication device with a memory storing a module executable by a processor to read the readable indicia associated with the wearable device, receive a first user input assigning the readable indicia to a financial payment account and receive a second user input a limit to the readable indicia. The use of this wearable device is designed to provide customers with a vehicle for completing payment transactions in certain locations, such as beaches or resorts, where wallets or smartphones may not be carried because of hazardous conditions posed by water or other environmental factors.

We’ve been seeing a lot of developments into digital wallets in recent months and while Silicon Valley giants like Apple and Google have been stealing the spotlight from financial institutions in that sector, BofA is trying to fight back by developing technologies like the one outlined within U.S. Patent Application No. 20150254638, which is titled Online Banking Digital Wallet Management. The patent application would protect an apparatus for digital wallet management, including a comprehensive platform for managing multiple digital wallets, having a processor and a memory storing a module which is executable to initiate presentation of a digital wallet management interface involving presentation of at least one digital wallet and presentation of at least one payment credential. This digital wallet service is intended to help users aggregate multiple digital wallet accounts onto a single device while providing tools for secure authentication.

Finally, we took some time to explore a Bank of America innovation intended to help improve advertising operations for companies, explained within U.S. Patent Application No. 20150332308, which is titled Predicting Swing Buyers in Marketing Campaigns. It claims a method of determining a first model corresponding to a first likelihood that a member of a control group is a buyer of a product based on a plurality of observations corresponding to the control group, determining a second model corresponding to a second likelihood that a non-buyer of a product belongs to the control group and determining a score using both models corresponding to a probability that a customer is a swing buyer. This invention is designed to enable marketing campaigns to better identify and reach out to swing buyers, or consumers who will buy a product if an advertising campaign reaches out to them.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-2024-banner-938x313-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

H. Anatomi

January 1, 2016 09:35 pmHowever nicely designed and implemented, physical tokens, cards and phones are easily left behind, lost, stolen and abused. Then the remembered password would be the last resort.

And, in a world where we live without remembered passwords, say, where our identity is established without our volitional participation, we would be able to have a safe sleep only when we are alone in a firmly locked room. It would be a Utopia for criminals but a Dystopia for most of us.

Incidentally, biometrics are dependent on passwords in the cyber space. So are multi-factor authentications and ID federations like password-managers and single-sign-on services. Passwords will stay with us for long.

It is too obvious, anyway, that the conventional alphanumeric password alone can no longer suffice and we urgently need a successor to it, which should be found from among the broader family of the passwords (= what we know and nobody else knows).