Finjan Holdings (NASDAQ:FNJN) is a developer of cybersecurity technologies holding a portfolio of patents related to hardware and software which can detect unknown threats on a real-time or behavior-based basis. On May 12th, it was announced that Finjan had secured $10.2 million in a round of Series A investment financing in a private transaction led by affiliates of Halcyon Long Duration Recoveries Management and Soryn Capital, an affiliate of Soryn IP Group. The financing agreement was disclosed to the U.S. Securities and Exchange Commission (SEC) in an 8-K form filed the day of the announcement.

The deal includes 102,000 shares of stock which Finjan will distribute at a cost of $100 per share. Terms of the deal require that the preferred stock issued by Finjan in this recent financing round cannot be converted into common stock, which would dilute the holdings of common shareholders. It is the first time that the company has gone out to raise capital since going public on the NASDAQ stock exchange three years ago. The placement agent for the transaction was B. Wiley & Company.

“Finjan continues to transform by introducing new products, investing in start-ups and establishing industry wide best practices for patent licensing,” said Michael Gulliford, the Founder & Managing Principal of Soryn Capital, an affiliate of Soryn IP Group.” We have been, and continue to be, extremely impressed with Finjan’s management, technology and intellectual property.”

“We believe this to be a deal of distinction in our industry,” said Finjan CEO Phil Hartstein in a conference call held to publicly discuss the details of the transaction. Hartstein noted that the deal does not include any evergreen revenue share which would continue after the securities are retired. Finjan’s long-term staying power as well as its patent licensing and enforcement activities were seen as reasons why Halcyon and Soryn entered into the investment round. “On a professional note, when you’re out in the market and considering raising money, you really have to appreciate that you’re interviewing financiers to become your partners, not just your investors,” Hartstein said.

The role that patents played in Finjan’s business activities was discussed heavily near the beginning of the conference call. Hartstein noted how Finjan had been successful in navigating changes to the patent landscape wrought by legislative, judicial and other changes, especially administrative changes at the U.S. Patent and Trademark Office. “These challenges are threatening a number of business models and we’ve recently seen several companies significantly pivot just to survive,” Hartstein said.

Inter partes review (IPR) processes at the USPTO’s Patent Trial and Appeal Board (PTAB) have been problematic for some patent owners and Hartstein cited the 80 percent of IPR filings which are instituted and the high likelihood that the claims will not come away unscathed and fully intact. Finjan itself has faced 40 IPRs, some of which are still pending decision. However, 70 percent of those filings have been denied institution, well above the 20 percent average. Hartstein also noted that 14 of the IPR filings, more than one-third of the IPRs Finjan faces, are joinders which Hartstein noted “generally contains nothing new” in terms of a challenge to patent validity. Of the 40 IPRs, 17 of 24 have already been denied institution and only one IPR joinder exists among the IPRs which have been instituted.

Hartstein also appeared confident on the results of reexaminations of Finjan’s patents performed at the USPTO. Out of nine reexaminations filed, five of the six which have been decided confirmed the patents. That 83 percent confirmation rate speaks to the strength of Finjan’s intellectual property. “As litigants exhaust their ability to challenge our patents, we continue to believe there will be an inflection point where licensing discussions and litigation settlement talks are less focused on an invalidity argument,” Hartstein said.

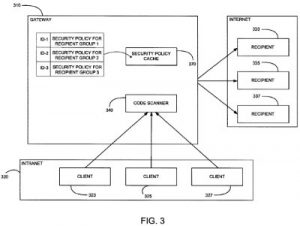

Though the company prefers a licensing pathway, it has been successful in asserting patent rights in recent years. Hartstein cited a few successful cases of litigation, including last August’s jury verdict in Finjan Inc. v Blue Coat Systems which awarded Finjan more than $39.5 million in damages. The lawsuit alleged that claims from a series of Finjan patents were infringed by several Blue Coat products, including Malware Analysis Appliance (MAA), Content Analysis System (CAS) and WebPulse. One of the patents-in-suit which the jury found Blue Coat infringed upon is U.S. Patent No. 6154844, entitled System and Method for Attaching a Downloadable Security Profile to a Downloadable. Issued in November 2000, it claims a method of receiving a downloadable, creating a downloadable security profile through an inspector that identifies suspicious code and linking the security profile to the downloadable before a web  server makes it available to clients. Finjan also successfully sued Blue Coat for infringing upon U.S. Patent No. 7418371, titled Method and System for Caching at Secure Gateways. It protects a computer gateway for a network of computers which has a scanner for scanning files coming from the Internet to derive security profiles for the files. The security profiles are indexed and cached and security policies for computers on the intranet network containing lists of restrictions for files are also cached. The innovation is designed to reduce latency caused by processing time at a gateway computer without sacrificing network safety.

server makes it available to clients. Finjan also successfully sued Blue Coat for infringing upon U.S. Patent No. 7418371, titled Method and System for Caching at Secure Gateways. It protects a computer gateway for a network of computers which has a scanner for scanning files coming from the Internet to derive security profiles for the files. The security profiles are indexed and cached and security policies for computers on the intranet network containing lists of restrictions for files are also cached. The innovation is designed to reduce latency caused by processing time at a gateway computer without sacrificing network safety.

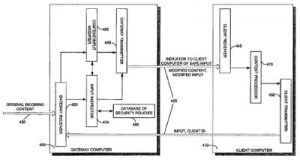

Two upcoming court cases were also briefly touched upon during the Finjan conference call. Hartstein noted that Finjan had an upcoming infringement case against cybersecurity solutions provider Proofpoint which had a scheduled trial start date of June 13th. However, on May 23rd, less than two weeks after the Finjan conference, the company announced that it had agreed to settle with Proofpoint after Proofpoint agreed to license Finjan’s global patent portfolio. On May 26th, Finjan released a litigation update in its infringement suit against security software and hardware company Sophos. Six of eight patents-in-suit for which Finjan alleges infringement on behalf of Sophos will  proceed to trial. One of the patents in the Sophos suit is U.S. Patent No. 8141154, titled System and Method for Inspecting Dynamically Generated Executable Code. It claims a system for protecting a computer from malicious content involving a processor processing content which calls to a function and invoking a second function if a security computer determines that such an invocation is safe. This technology addresses shortcomings in conventional desktop anti-virus software which is widely distributed and can be accessed by hackers; it would also allow for anti-virus protection without running the program on the computer to be protected, freeing up processor resources.

proceed to trial. One of the patents in the Sophos suit is U.S. Patent No. 8141154, titled System and Method for Inspecting Dynamically Generated Executable Code. It claims a system for protecting a computer from malicious content involving a processor processing content which calls to a function and invoking a second function if a security computer determines that such an invocation is safe. This technology addresses shortcomings in conventional desktop anti-virus software which is widely distributed and can be accessed by hackers; it would also allow for anti-virus protection without running the program on the computer to be protected, freeing up processor resources.

Remarks made by Finjan CFO Michael Noonan indicated that the company expects to see its cybersecurity consultation business CybeRisk, an Israel-based division opened by Finjan last June to increase its global activities in providing cybersecurity risk advisory services. Noonan acknowledged that the business has taken some time to ramp up but he added, “CybeRisk’s theme of the data room to the board room is resonating.” In this year’s second quarter, Finjan expects CybeRisk to land between $150,000 to $300,000 of business from new clients.

Noonan also laid out more details behind the Series A financing round which Finjan had successfully concluded. Shareholders holding the preferred stock class can liquidate shares within 90 days at 1.5 times the purchase price, within one year at 1.65 times the purchase price and between one and two years at 1.75 times the purchase price. Revenue sharing provisions could reach as high as 70 percent to investors in the case of a litigation event. Series A shareholders also receive 20 percent of licensing revenues within one year of closing, but that raises to a maximum of 40 percent if licensing deals take up to two years. Noonan indicated that the Series A funding would support licensing and enforcement activities as well as general day-to-day operations.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.