“Shipboard Autonomous Firefighting Robot Test Aboard USS Shadwell (LSD-15) in November 2014” by U.S. Navy/John F. Williams. Public domain.

The tech world’s buzz surrounding the topic of autonomous vehicles has been growing in recent years. Major automakers like Ford Motor Company (NYSE:F) have announced plans to develop self-driving cars for consumer release within five years. Transportation services company Uber has recently unveiled a fleet of cars with self-driving capabilities, some of which are currently operating in Pittsburgh, PA. As of this January, traditional automakers like Toyota Motor Corp. (NYSE:TM) and Robert Bosch GmbH (NSE:BOSCHLTD) held the largest portfolios directed towards autonomous vehicles despite tech industry advances made by Google and Tesla Motors (NASDAQ:TSLA).

And yet autonomous robotics have many applications outside of the automotive industry, making the sector valuable to many companies other than those manufacturing cars. Recently, American retail giant Wal-Mart Stores, Inc. (NYSE:WMT) filed a patent application that would protect a self-driving shopping cart technology. Home improvement retail company Lowe’s (NYSE:LOW) will reportedly start to roll out robotic store associates at San Francisco-area stores this fall. Over at Harvard University, researchers have been developing autonomous robots constructed of soft, flexible materials for additional safety and a greater ability to fit into awkward spaces. Autonomous robots are even utilized for spectator sports in Japan, where such robots compete in sumo-style events.

To get a better idea of the scope of the autonomous robot market, intellectual property analysis firm Innography recently released a trends report focusing on the autonomous robot technology sector. The report takes an in-depth look at use cases for autonomous technologies, the top companies filing patent applications in the field as well as the countries which are seeing the greatest number of such patent applications being filed.

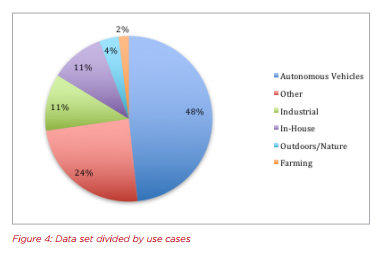

Unsurprisingly, the study of 27,148 autonomous robot patent grants and patent applications found that the greatest number of use cases for those technologies were in the autonomous vehicle sector. However, self-driving cars only accounted for 15,558 use cases, a little more than half of all patent grants and patent applications surveyed for the report. A large number of use cases were reported in the industrial (3,566), in-home (3,380) and outdoors/nature (1,216) sectors. 7,841 use cases, about one-quarter of all those surveyed, fall into an “other” category for general and niche applications.

Unsurprisingly, the study of 27,148 autonomous robot patent grants and patent applications found that the greatest number of use cases for those technologies were in the autonomous vehicle sector. However, self-driving cars only accounted for 15,558 use cases, a little more than half of all patent grants and patent applications surveyed for the report. A large number of use cases were reported in the industrial (3,566), in-home (3,380) and outdoors/nature (1,216) sectors. 7,841 use cases, about one-quarter of all those surveyed, fall into an “other” category for general and niche applications.

Chris Huffines, co-author of the Innography autonomous robots report, said that it’s fair to expect that these robotic technologies will eventually affect every possible sector of the global economy and not just vehicles. “A lot of patents talk about applying the software as general pathfinding or general sensing, not focused on specific instances,” Huffines said. “We’re seeing so much variety.” Some of the patent grants and patent applications cited in the autonomous robots report do a good job of exploring this variety. For example, the report references U.S. Patent Application No. 20140136414, entitled Autonomous Neighborhood Vehicle Commerce Network and Community, filed in January 2014 to protect an autonomous robot providing home delivery of retail products. The report also points to a series of patent applications protecting medical robots for use inside of a patient’s body which have been developed by the Massachusetts Institute of Technology, including U.S. Patent Application No. 20160040657, titled Self-Folding Machines.

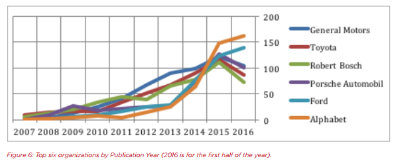

A survey of the top companies receiving patent grants reinforces the idea that the vehicle sector is currently investing the most into research and development in autonomous robots. The top five companies holding patents related to autonomous technologies are automakers, led off by American vehicle manufacturer General Motors (NYSE:GM) with 514 patent grants. GM is followed by Toyota (458), Bosch (448), Porsche Automobil Holding SE (ETR:PAH3) (379) and Ford (357). Sixth-place is Google parent Alphabet Inc. (NASDAQ:GOOGL) which holds 349 patent grants in the sector. However, in 2015 Alphabet became the top filer of autonomous robot patents and the company extended this lead in 2016. Should this trend continue, Alphabet will undoubtedly surpass GM as the top holder of autonomous robot patents in the coming years.

A survey of the top companies receiving patent grants reinforces the idea that the vehicle sector is currently investing the most into research and development in autonomous robots. The top five companies holding patents related to autonomous technologies are automakers, led off by American vehicle manufacturer General Motors (NYSE:GM) with 514 patent grants. GM is followed by Toyota (458), Bosch (448), Porsche Automobil Holding SE (ETR:PAH3) (379) and Ford (357). Sixth-place is Google parent Alphabet Inc. (NASDAQ:GOOGL) which holds 349 patent grants in the sector. However, in 2015 Alphabet became the top filer of autonomous robot patents and the company extended this lead in 2016. Should this trend continue, Alphabet will undoubtedly surpass GM as the top holder of autonomous robot patents in the coming years.

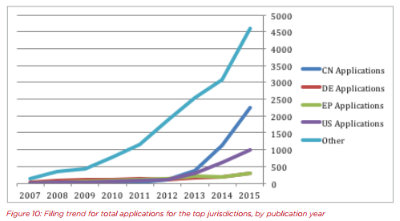

Perhaps one of the more unexpected findings in Innography’s autonomous robot patent report is the fact that China has leapt ahead as the top jurisdiction for receiving patent applications in this sector. In 2015, China patent application filings represented 44 percent of all global filings in the realm of autonomous robots. According to Huffines, it’s not likely that China’s spike in patent applications filing will prove to be sustainable. “We’re guessing that will level off,” Huffines said. “Right now, we’re still in an explosive growth stage for China filings.”

Perhaps one of the more unexpected findings in Innography’s autonomous robot patent report is the fact that China has leapt ahead as the top jurisdiction for receiving patent applications in this sector. In 2015, China patent application filings represented 44 percent of all global filings in the realm of autonomous robots. According to Huffines, it’s not likely that China’s spike in patent applications filing will prove to be sustainable. “We’re guessing that will level off,” Huffines said. “Right now, we’re still in an explosive growth stage for China filings.”

Interestingly, the university system has proven to be incredibly important to China’s lead in autonomous robot patent filings. The Innography report reveals that the top 10 patenting universities in China have accounted for 665 patents, led by Beihang University (116) and Harbin Engineering University (104). China is also seeing an influx of patent application filings from foreign entities. For example, GM has increased its China patent activities related to autonomous robots 15-fold between 2011 and 2015.

Because robotics are involved in such a wide array of economic sectors, it’s entirely possible that companies holding strong patent portfolios in this field will be able to pivot effectively and enter entirely new sectors. One interesting example of this can be seen in the case of American robotics developer iRobot Corporation (NASDAQ:IRBT). The Innography report contains a PatentScape graphic showing where companies involved in the domestic robot space have focused their R&D efforts. Although iRobot is well known for its robotic vacuum cleaners like the Roomba, the PatentScape graphic shows that its patented technologies are directed more towards mobile robots; the vacuum cleaner sector is dominated more by electronics developers Samsung Electronics (KRX:005930) and LG Electronics (KRX:066570). Huffines said that it’s fair to conclude that iRobot could move outside of the vacuum cleaner sector based on its patents. “A lot of these patents involve figuring out where you are within a space or pathfinding,” he said. “It seems like they applied that tech to the autonomous vacuum space even though the patents themselves are not focused there, they’re focused on general applications.”

Because robotics are involved in such a wide array of economic sectors, it’s entirely possible that companies holding strong patent portfolios in this field will be able to pivot effectively and enter entirely new sectors. One interesting example of this can be seen in the case of American robotics developer iRobot Corporation (NASDAQ:IRBT). The Innography report contains a PatentScape graphic showing where companies involved in the domestic robot space have focused their R&D efforts. Although iRobot is well known for its robotic vacuum cleaners like the Roomba, the PatentScape graphic shows that its patented technologies are directed more towards mobile robots; the vacuum cleaner sector is dominated more by electronics developers Samsung Electronics (KRX:005930) and LG Electronics (KRX:066570). Huffines said that it’s fair to conclude that iRobot could move outside of the vacuum cleaner sector based on its patents. “A lot of these patents involve figuring out where you are within a space or pathfinding,” he said. “It seems like they applied that tech to the autonomous vacuum space even though the patents themselves are not focused there, they’re focused on general applications.”

The growing wave of autonomous robotic technologies will create an incredibly lucrative industrial sector in just a few years’ time. The Innography report itself cites data from the International Data Corporation which projects a $135 billion market for robotics by 2019, two-thirds of which will be fueled by purchases from Asia. By the year 2021, robotics could displace an entire 6 percent of the American workforce by automating work from customer service to taxi driving. If the narrative that every company is actually a software company has been true in recent years, the near future could reflect a new reality in which every company is actually a robotics company if they want to compete in high tech markets.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Lawrence Lockwood

September 21, 2016 07:36 pmImpact of robots should be more consequential than the industrial revolution to the millions of unskilled workers. What does a society do with millions of persons who will never hold a job ?

http://www.marketwatch.com/story/the-robots-are-coming-for-jobs-that-pay-20-an-hour-or-less-white-house-finds-2016-02-22