Network-1 Technologies, Inc. (NYSEMKT:NTIP), is a company whose activities are focused upon the licensing and protection of its intellectual property assets, which include 28 patents covering various areas of technology including data networking, telecommunications, media content identification and document stream operating systems. Along with licensing the IP assets it owns, Network-1 also works with independent inventors to aid them in the development and monetization of their own patent assets.

On Tuesday, October 4th, Network-1 announced a settlement with San Jose, CA-based telecom firm Polycom, Inc. (NASDAQ:PLCM) which successfully ended a patent infringement case involving a remote power technology owned by Network-1. Under the terms of the settlement, Polycom will pay Network-1 a license initiation fee of $5 million for past sales of Polycom’s “Power over Ethernet” products. $2 million of the licensing fee is due within 30 days of the settlement and the rest is to be paid in installments until October 2020, unless all claims of Network-1’s patent are deemed invalid.

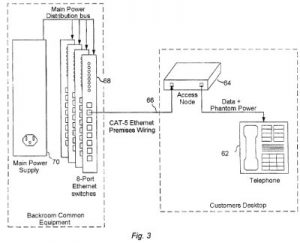

Network-1’s patent-in-suit was U.S. Patent No. 6218930, titled Apparatus and Method for Remotely Powering Access Equipment Over a 10/100 Switched Ethernet Network. It claimed an apparatus for powering equipment in a data network which includes a data node adapted for data switching, an access device adapted for data transmission, a data signaling pair transmitting data between the data node and the access device, a main power source supplying power to the data node, a secondary power source supplying power via the data signaling pair from the data node to the access device, sensing means for delivering a low level current from a main power source while sensing a resulting voltage level on the data signaling pair and control means adapted to control the power supplied by the secondary power source to the access device in response to the determined voltage level. The innovation is designed to provide high power levels to data communications equipment which may be widely distributed from a centrally powered system which can be protected during a power outage and determine if a remote piece of equipment is accepting power. The patent, issued in April 2001 and assigned to Merlot Communications, was transferred to Network-1 in November 2003.

Network-1’s patent-in-suit was U.S. Patent No. 6218930, titled Apparatus and Method for Remotely Powering Access Equipment Over a 10/100 Switched Ethernet Network. It claimed an apparatus for powering equipment in a data network which includes a data node adapted for data switching, an access device adapted for data transmission, a data signaling pair transmitting data between the data node and the access device, a main power source supplying power to the data node, a secondary power source supplying power via the data signaling pair from the data node to the access device, sensing means for delivering a low level current from a main power source while sensing a resulting voltage level on the data signaling pair and control means adapted to control the power supplied by the secondary power source to the access device in response to the determined voltage level. The innovation is designed to provide high power levels to data communications equipment which may be widely distributed from a centrally powered system which can be protected during a power outage and determine if a remote piece of equipment is accepting power. The patent, issued in April 2001 and assigned to Merlot Communications, was transferred to Network-1 in November 2003.

Anyone who has followed recent developments in the U.S. patent landscape, however, might note something interesting occurring in this particular case. According to the recent patent assertion entity (PAE) report put out by the Federal Trade Commission (FTC), Network-1’s business activities would seem to put it in the category of what the FTC calls a “litigation PAE.” All PAEs are businesses that acquire patents from third parties and generate revenues by asserting those patents against alleged infringers. As per the FTC’s study, litigation PAEs have a much higher tendency to file a patent infringement suit before reaching settlement than what the FTC calls “portfolio PAEs,” entities which license large patent portfolios without first filing suit in U.S. district court.

However, the terms of the licensing agreement Network-1 negotiated with Polycom flies in the face of the FTC’s key findings on litigation PAE activity. In its report, the FTC claimed that, while litigation PAEs account for 96 percent of PAE patent lawsuits and 91 percent of PAE patent licenses, they only accounted for 20 percent of the total revenue earned through these licenses. The FTC also claimed that the majority of litigation PAE licenses were for $300,000 or less, leading directly to the following declaration: “Given the relatively low dollar amounts of the licenses, the behavior of Litigation PAEs is consistent with nuisance litigation.”

Unfortunately for the FTC, Network-1’s license agreement with Polycom is horribly inconsistent with the agency’s findings on the exact business model that Network-1 seems to employ. And the Polycom settlement isn’t the only multi-million license on the ‘930 negotiated by Network-1 this year alone. In early August, the company announced the successful negotiation of a $6 million license initiation fee for the ‘930 patent with American information technology firm Dell Inc. (NYSE:DVMT). In June, Network-1 announced another license agreement with Japanese tech giant Sony Corporation (NYSE:SNE), although the exact money amount of that agreement seemed to be undisclosed. As of the recent Polycom license agreement, Network-1 reports that the ‘930 patent alone has generated more than $90 million in revenues between May 2007 and June 2016.

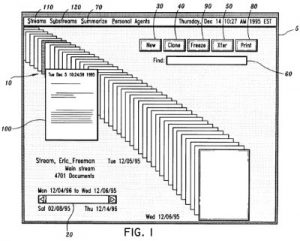

Network-1 has negotiated multi-million dollar amount licenses for other patents it owns. In July, the company announced the settlement of patent litigation against Apple, Inc. (NASDAQ:AAPL) for a $25 million license fee agreement to practice technology covered by U.S. Patent No. 6006227, which is titled Document Stream Operating System. The patent protects methods which allow for unified search, indexing, displaying and archiving of documents, which can include text, pictures, animations or other types of data, in a computer system. Last November, Network-1 announced a settlement to its patent litigation against Microsoft Corporation (NASDAQ:MSFT) in which Network-1 received $4.65 million from Microsoft to license the technology covered by the ‘227 patent.

Network-1 has negotiated multi-million dollar amount licenses for other patents it owns. In July, the company announced the settlement of patent litigation against Apple, Inc. (NASDAQ:AAPL) for a $25 million license fee agreement to practice technology covered by U.S. Patent No. 6006227, which is titled Document Stream Operating System. The patent protects methods which allow for unified search, indexing, displaying and archiving of documents, which can include text, pictures, animations or other types of data, in a computer system. Last November, Network-1 announced a settlement to its patent litigation against Microsoft Corporation (NASDAQ:MSFT) in which Network-1 received $4.65 million from Microsoft to license the technology covered by the ‘227 patent.

Despite Network-1’s tendency to enter into litigation before licensing patents through settlements, its corporate revenues are strong, again undermining the FTC’s assertion that highly litigious PAEs necessarily reap lower revenues. In mid-August, Network-1 announced strong earnings results for the second quarter of 2016, during which it earned revenues of $20.4 million. Patent licensing revenues increased year-over-year from $1.7 million during the second quarter of 2015 up to $2.9 million during the most recent quarter, an increase of 69 percent. Network-1’s press release on the earnings report indicates that this increase in licensing revenues is due mainly to a settlement reached in June, the same month in which the company announced it had settled its aforementioned litigation against Sony for the ‘930 patent.

The FTC’s recent study attempts to describe the activities of an entire sector of the U.S. economy, but it only looks at data from 22 corporate entities responding to the survey. One of the FTC’s key findings is that litigation PAEs reap low-money licenses from small portfolios and thus it tags all litigation PAEs with this concept of “nuisance litigation.” However, it should be clear to anyone looking at the recent successes of Network-1, which has asserted few patents in cases which have earned multi-million dollar settlements, that something in the FTC’s methodology could very well be misinforming the overall conversation on PAE activities.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

9 comments so far.

Anon

November 1, 2016 03:41 pmANY focus on an attribute that remains legally “of choice” to a proper patent holder smacks of manipulation for a desired End.

The so-called “Tr011”. Boogeyman mantra just won’t die.

Steve Brachmann

November 1, 2016 11:36 amPaul F. Morgan @2: The fact that Network-1 is obviously not in the subset of PAEs earning settlements of $300,000 is exactly what makes this inconsistent with the FTC’s finding on PAEs. The FTC divided all PAEs into two models: litigation PAEs, which “typically sued potential licensees and settled shortly afterward” (FTC’s words quoted) on small portfolios of 10 or less patents, and then portfolio PAEs, which “negotiated licenses covering large portfolios, often containing hundreds or thousands of patents, frequently without first suing the alleged infringer.” In Network-1’s case, we’re seeing multiple cases where a single patent has been asserted and settlements are made after patent infringement litigation is pursued. That’s the FTC’s definition of a litigation PAE. So where the two diverge is in the amount of the settlement. The FTC makes a clear judgement that litigation PAEs typically licensed patents for $300,000 or less. And yet Network-1 is earning multi-million dollar settlement after multi-million dollar settlement. So yes, I’m forced to conclude that this situation is horribly inconsistent with the FTC’s findings, at least where the business model of litigation PAEs is concerned. It’s probably not the only company where this inconsistency exists, either, given the small sample size of the FTC’s study.

Anon

October 28, 2016 05:33 pmMr. Morgan,

You may have said it “second,” but you still carry the banner of the efficient infringement crowd “first.”

It is you that remains backwards with your penchant for defeating granted patents.

Paul F. Morgan

October 28, 2016 05:16 pmNo one is disputing that “a legitimate patent holder” can charge whatever they want, at [like any other product] whatever price the market will bear, and that is what I said in my second sentence above.

Anon

October 28, 2016 03:40 pmMr. Morgan,

No, I do not have anything backward, and I am deliberately taking a different “vantage point” here because the driver for what anyone legally can do with their personal property of a patent right is NOT driven by the vantage point of the efficient infringer.

If a legitimate patent holder wants to “charge” at a certain level – whatever that level is – that is her business.

Paul F. Morgan

October 28, 2016 03:05 pmAnon, I did not use the word “nuisance,” and you have the economics backwards. The cost of litigation does not set any upper limit on what a patent owner can recover for infringement. Especially with the newly enhanced opportunity for up to treble damages. It provides a minimum for the settlement recovery of the patent owner, since almost all sued companies direct their patent attorneys to settle if the settlement cost will be less than discovery and other litigation costs. Note that defendant settlement decisions are normally made by rational management on financial considerations, not made by patent attorneys wanting to conduct costly personal litigation crusades at their clients expense, as perhaps you would like? Of course now the better educated defendant clients also know there are are additional options: IPRs, CBMs, Alice 101 preliminary motions, and/or potential attorney fee sanction recoveries.

Anon

October 28, 2016 11:22 amBeware the false implications.

What the owner of a property that is a patent wants should not be constrained by the costs of defense.

To “tar” otherwise – no matter what desired Ends is to take improper Means to those Ends. Such a view of “nuisance” is merely a subset of the “Efficient Infringer” paradigm.

Paul F. Morgan

October 28, 2016 11:05 amBTW, is this example really that inconsistent with the FTC conclusions? This PAE is obviously not in the FTC-alleged separate class of PAEs seeking small settlements [$300,000 or so] from large numbers of companies.

Paul F. Morgan

October 28, 2016 10:48 amThat is good news for patent licensing revenues for these particular patents. But note that: “$2 million of the licensing fee is due within 30 days of the settlement and the rest is to be paid in installments until October 2020, unless all claims of Network-1’s patent are deemed invalid.” That is a very strong incentive for an IPR or reexamination attack on the patent to avoid paying the other, as yet uncollected, $3 million. The $2 million to be paid now is not more than normal full litigation defense costs for a patent like this.