In early August, legal data analytics firm Lex Machina released its first Commercial Litigation Year in Review report, which identifies trends and highlights in commercial litigation filed in U.S. district courts between 2009 and 2017. Although the recent Lex Machina report focuses mainly on cases involving breach of contract or business torts, there appears to be a significant overlap between commercial litigation and intellectual property claims, which may help inform IP counsel on what to expect when engaging in such cases at the district court level.

In early August, legal data analytics firm Lex Machina released its first Commercial Litigation Year in Review report, which identifies trends and highlights in commercial litigation filed in U.S. district courts between 2009 and 2017. Although the recent Lex Machina report focuses mainly on cases involving breach of contract or business torts, there appears to be a significant overlap between commercial litigation and intellectual property claims, which may help inform IP counsel on what to expect when engaging in such cases at the district court level.

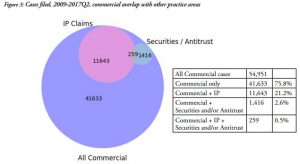

One of the first few interesting takeaways from the Lex Machina report is that one-fifth of all commercial cases filed since 2009 include at least one intellectual property claim. All told, of a total of 54,951 commercial cases filed since 2009, 11,643 of those cases included at least one IP claim. That’s less than the percentage of commercial cases including a breach of contract claim (44 percent) or business tort claim (38 percent), but that still represents a significant subset of all commercial litigation filed in the U.S.

One of the first few interesting takeaways from the Lex Machina report is that one-fifth of all commercial cases filed since 2009 include at least one intellectual property claim. All told, of a total of 54,951 commercial cases filed since 2009, 11,643 of those cases included at least one IP claim. That’s less than the percentage of commercial cases including a breach of contract claim (44 percent) or business tort claim (38 percent), but that still represents a significant subset of all commercial litigation filed in the U.S.

The total number of intellectual property claims included in all commercial cases is higher than the figure of 11,643 commercial cases including at least one IP claim. “It turns out to be incredibly hard to build a Venn diagram that reflects the types of IP claims included in these commercial cases,” said Brian Howard, Lex Machina data scientist and the author of the commercial litigation report. “It turns out to be its own mini-Venn diagram within a Venn diagram, some of the cases are patent and trademark and commercial, so there’s overlap within that IP circle.”

Of the different types of intellectual property claims which are included in commercial litigation, trademark claims are by far the most common, occurring in a total of 8,277 commercial cases; that’s 15 percent of all commercial cases filed since 2009. Copyright claims were brought in a total of 3,260 commercial cases filed since 2009, a total representing about 6 percent of all commercial cases. Patent claims were brought in 2,219 commercial cases, or only about 4 percent of the total.

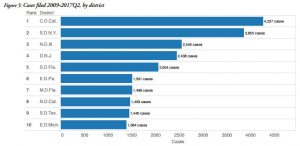

Although there may be a significant overlap between IP claims and commercial litigation, there are some trends in IP litigation which aren’t repeated in overall commercial litigation, such as a heavy concentration of caseloads in relatively few districts. The Central District of California saw the greatest number of commercial cases filed since 2009 (4,257 cases). Central California does not have a huge lead over the Southern District of New York, which has seen the filing of 3,855 commercial cases since 2009. Other jurisdictions where at least 2,000 commercial cases have been filed since 2009 include the Northern District of Illinois (2,546 cases), the District of New Jersey (2,438 cases) and the Southern District of Florida (2,054 cases). Readers of this website will note that commercial litigation doesn’t experience the same type of concentration of case filings as is seen in patent litigation, where the Eastern District of Texas has been a preferred venue for patent plaintiffs. Of course, given the heavier correlation between commercial cases and trademark claims, and the relative calm in that sector of litigation when compared to patents, it’s not surprising to see less volatility in overall commercial case filings.

Although there may be a significant overlap between IP claims and commercial litigation, there are some trends in IP litigation which aren’t repeated in overall commercial litigation, such as a heavy concentration of caseloads in relatively few districts. The Central District of California saw the greatest number of commercial cases filed since 2009 (4,257 cases). Central California does not have a huge lead over the Southern District of New York, which has seen the filing of 3,855 commercial cases since 2009. Other jurisdictions where at least 2,000 commercial cases have been filed since 2009 include the Northern District of Illinois (2,546 cases), the District of New Jersey (2,438 cases) and the Southern District of Florida (2,054 cases). Readers of this website will note that commercial litigation doesn’t experience the same type of concentration of case filings as is seen in patent litigation, where the Eastern District of Texas has been a preferred venue for patent plaintiffs. Of course, given the heavier correlation between commercial cases and trademark claims, and the relative calm in that sector of litigation when compared to patents, it’s not surprising to see less volatility in overall commercial case filings.

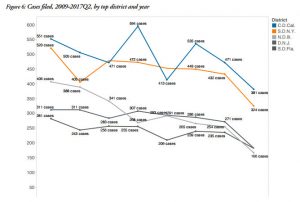

Interestingly, levels of commercial litigation appear to be down in U.S. district court across the board since 2009. Central California has seen some litigation spikes in recent years but the top five districts are all down overall over the past eight years. One plausible theory for this decline, according to Howard, could be that the United States has rebounded at least somewhat from the economic hard times of the Great Recession. “It stands to reason that, as we’ve moved into a better economy since 2009, it seems like there ought to be less squabbling over contract breaches,” Howard said. “Commercial litigation has an inverse relationship with economic good times.” So it would seem that, much like the business of liquor stores, the business of commercial litigation doesn’t thrive when the market is flush with cash.

Interestingly, levels of commercial litigation appear to be down in U.S. district court across the board since 2009. Central California has seen some litigation spikes in recent years but the top five districts are all down overall over the past eight years. One plausible theory for this decline, according to Howard, could be that the United States has rebounded at least somewhat from the economic hard times of the Great Recession. “It stands to reason that, as we’ve moved into a better economy since 2009, it seems like there ought to be less squabbling over contract breaches,” Howard said. “Commercial litigation has an inverse relationship with economic good times.” So it would seem that, much like the business of liquor stores, the business of commercial litigation doesn’t thrive when the market is flush with cash.

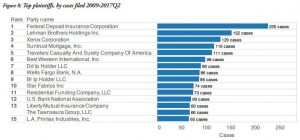

Looking at the top parties among plaintiffs and defendants in commercial litigation, many of the firms involved in cases belong to the financial services and insurance industries. The top plaintiff in commercial litigation since 2009 has been the Federal Deposit Insurance Corporation (FDIC), which brought 225 cases during the period covered by the report. According to Howard, the FDIC’s position as the top plaintiff in commercial litigation makes a great deal of sense because the federal agency will bring cases on behalf of others as well as itself.

Looking at the top parties among plaintiffs and defendants in commercial litigation, many of the firms involved in cases belong to the financial services and insurance industries. The top plaintiff in commercial litigation since 2009 has been the Federal Deposit Insurance Corporation (FDIC), which brought 225 cases during the period covered by the report. According to Howard, the FDIC’s position as the top plaintiff in commercial litigation makes a great deal of sense because the federal agency will bring cases on behalf of others as well as itself.

There were two industry groups which Howard found it odd to see represented among the top parties on either the plaintiff or defendant side. One was the textile industry, represented by such firms as Star Fabrics Inc. (74 cases since 2009) and L.A. Printex Industries, Inc. (65 cases) With these textile companies, almost all of the commercial cases overlap with copyright claims, according to Howard. The other unique group represented among the top plaintiffs were food brand holding companies like DD IP Holder LLC (89 cases) and BR IP Holder LLC (85 cases). These companies, respectively the brand holding companies for Dunkin’ Donuts and Baskin Robbins, often bring commercial cases which include trademark claims.

Case timing statistics included in the report shows that there is an effect on the length of commercial cases when they include an intellectual property claim. For all commercial cases filed since 2009, the median time to summary judgement was 531 days. When a commercial case includes a patent claim, the median time to summary judgement increased by about two months to 594 days. Similar increases were seen in the median time to trial and the median time to termination for commercial cases including patent claims. “I think it’s fair to say that, across the board, cases where commercial and patent claims overlap take longer,” Howard said.

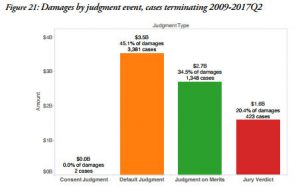

Since 2009, 45.1 percent of all damages handed out in commercial cases, amounting to $3.5 billion, were awarded through default judgements. As Howard noted, such judgements were rare in the patent world. “It’s not often that you sue someone for patent infringement and they just don’t show up,” Howard said, adding that such default judgements were seen much more often in copyright and trademark litigation. The second-greatest amount of damages in commercial cases were handed out via judgement on the merits ($2.7 billion, 34.5 percent) whereas the great brunt of the remainder of commercial case damages were handed out in consent judgements ($1.6 billion, 20.4 percent).

Since 2009, 45.1 percent of all damages handed out in commercial cases, amounting to $3.5 billion, were awarded through default judgements. As Howard noted, such judgements were rare in the patent world. “It’s not often that you sue someone for patent infringement and they just don’t show up,” Howard said, adding that such default judgements were seen much more often in copyright and trademark litigation. The second-greatest amount of damages in commercial cases were handed out via judgement on the merits ($2.7 billion, 34.5 percent) whereas the great brunt of the remainder of commercial case damages were handed out in consent judgements ($1.6 billion, 20.4 percent).

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.