Most assaults on public/private sector R&D partnerships are launched by those who believe patents are inherently bad and that through some undefined magic publicly funded inventions will be developed if they were only made freely available. However, every couple of years attacks come from another, more threatening direction — claims by well placed, but inexperienced “experts” that if their pet theories were adopted technology transfer from the public sector would sky rocket. One idea being promoted is that universities should double or triple the number of their inventions to justify continued federal funding, thus triggering a spike in commercialization rates. In reality the only spike would be in patenting dubious inventions to pad the numbers, leading to depressed licensing rates as portfolios were filled with junk.

Most assaults on public/private sector R&D partnerships are launched by those who believe patents are inherently bad and that through some undefined magic publicly funded inventions will be developed if they were only made freely available. However, every couple of years attacks come from another, more threatening direction — claims by well placed, but inexperienced “experts” that if their pet theories were adopted technology transfer from the public sector would sky rocket. One idea being promoted is that universities should double or triple the number of their inventions to justify continued federal funding, thus triggering a spike in commercialization rates. In reality the only spike would be in patenting dubious inventions to pad the numbers, leading to depressed licensing rates as portfolios were filled with junk.

Such nostrums are particularly dangerous when peddled by those with sufficient clout to directly approach senior policy makers. The risk in adopting half baked theories is enormous.

It’s no accident that revolutionary breakthroughs like the CAR-T cell therapy for cancer are discovered and developed from publicly funded R&D in the United States of America far more than anywhere else in the world. Initially targeted for children, this new technology is so impressive it’s being extended to adult cancer patients. “Our data provide the first true glimpse of the potential of this approach in patients with aggressive lymphomas, who, until this point, were virtually untreatable” according to Dr. James Kochenderfer with the National Institutes of Health. Research partnerships between our universities, federal labs and entrepreneurial companies are unparalleled in taking discoveries like this from government supported research and turning them into products providing breath-taking benefits for humanity while driving our economy.

Policy makers should place a heavy burden of proof on those wanting to alter the Bayh-Dole system which decentralized the management of publicly funded inventions to the institutions creating them while providing incentives for their development. China is adapting their own Bayh-Dole model, recognizing that our university/industry partnerships helped pull the US out of the doldrums of the 1970’s, restoring our lead in every field of technology. They aim to surpass us. This isn’t a game, so we’d better be deadly serious before making any changes in what built our success.

Like seven year locusts, we’re again seeing instant experts buzzing around state and national leaders with cries that the current tech transfer system is failing. They say decentralization is too risky and we need more government guidance to boost commercialization rates. Others argue for metrics like a university’s revenue per patent or average royalty per license to judge performance. Because universities are managing early stage inventions, most of which by their very nature will never be commercialized, such measurements demonstrate a lack of understanding of the business. But since most policy makers have no background in technology management, real mischief can occur when well connected theorists get their ear.

The last time we went through this cycle the claim was that licensing negotiations with universities were slowing down tech transfer. The answer: “express licenses” with cookie cutter terms and placing deal making in the hands of academic inventors. With powerful interests pushing them, these ideas were initially embraced by some in the Obama Administration and Congress. Fortunately, the bubble burst before any policies were changed.

Unfortunately, some universities took their technology transfer offices apart as the consultants recommended, causing successful programs to unravel before the damage became apparent. Since we have a decentralized system the harm was limited to the schools involved, some of which still haven’t recovered.

To prevent anyone again falling prey to those claiming we have a “failed system,” let’s look at some numbers:

- A recent study by BIO and the Association of University Technology Managers found academic patent licensing contributed $1.33 trillion to the US economy while supporting 4.3 million jobs between 1996- 2015. The impact on US gross domestic product and jobs supported increased 14% and 12% respectively since the previous study of 1996- 2013;

- The US creates 2.75 new companies every day of the year while introducing 2.4 new products based on academic inventions;

- In FY 2015, 7,942 new licenses and options on academic inventions were completed, up 15% from FY 2014, with approximately 70% of licenses going to small companies.

- Academic/industry partnerships are a key factor for the US lead in biotechnology and the life sciences. A new BIO study finds bioscience employs 1.66 million people in the US, paying an average salary of $96,000, with more and more states creating programs to encourage biotech development. The study finds “Proximity to Academic Innovation is a Driving Influencer.”

Proximity to academic innovation is important because the resulting discoveries can be game changers. A study in the New England Journal of Medicine looked at new drugs approved by the FDA from 1990- 2007. Of the 1,541 drugs approved, about 9% came from public sector discoveries. However, 66% of the drugs granted “priority reviews” because of their significant potential impact were federally-funded inventions. Luckily, those institutions weren’t patenting junk to pad their disclosure numbers, but rather focused on licensing discoveries that could make a real impact if successfully developed. Many formerly desperately ill patients here and abroad are walking around today as a result.

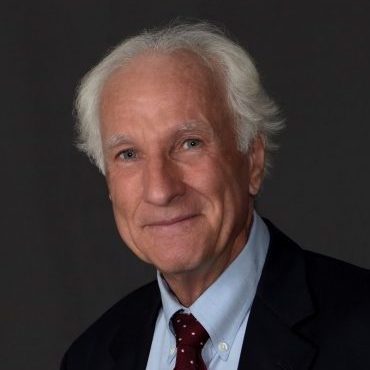

So how can national, state and local stakeholders know which programs are working and which are underperforming? I posed that question to Mark Crowell, former Executive Director of UVA Innovation at the University of Virginia which helped make Charlottesville, Virginia “the fastest growing venture capital ecosystem in the United States for 2010- 2015” according to the National Venture Capital Association. Impressively, “six of the nine top companies contributing to that growth trace their roots to UVA.” Mark also served as the VP for Business Development at the Scripps Research Institute and helped set up technology management programs in Saudi Arabia. He now advises institutions, regions, states and even nations on innovation and commercialization policy development. Here’s Mark’s advice:

The technology transfer function has grown in importance, visibility, and expectations on campuses, in regions, and in states. The words “innovation” and “economic development” are appearing prominently in mission statements, tag lines and communications strategies – but the availability of meaningful metrics to demonstrate impact and value creation has not kept pace with this increase in attention and expectations. All too often, those needing such metrics to make funding or investment decisions, or to measure impact and value creation, are forced to rely on unreliable and easily manipulated metrics like numbers of patents, numbers of agreements, amount of revenue, or even permutations of these – such as revenue per patent.

Technology transfer experts need to be leading conversations with legislative staff, university leadership, policy experts, economists and others to develop meaningful and reliable measures which can inform funding and policy decisions – and which can be used to demonstrate real value creation in translating discoveries from lab to market. As an example, one avenue worthy of consideration is to look at objective data for regions or localities in which universities and their funding partners are investing aggressively in new, targeted or expanded innovation and technology transfer activities – these metrics might include data documenting regional or local economic growth, new technology-based business startups, trends in professional venture capital investments, products launched and others.

As another example, rather than counting startup companies formed (a simple step which can easily be manipulated), a better metric might be startup companies raising rounds of institutional venture capital (since these usually involve an independent, market-based valuation exercise) – or those recruiting a full-time CEO. Measures might even be developed tracking numbers of undergraduate and graduate students who engage in innovation and entrepreneurship initiatives during their training and who remain in a region after graduation to work in technology companies – an outcome likely creating much more value for a region than revenue derived via a licensed patent where the product is manufactured and sold by a licensee in another state or country.

That’s advice worth pondering.

Those who pull the plug on systems they don’t understand are likely to plunge themselves— and others— into darkness.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.