In January 1994 NAFTA (The North American Free Trade Agreement) came into force as the first international trade agreement to incorporate obligations on member states to protect intellectual property rights. As President Trump embarks on the renegotiation of NAFTA, it is critical that we seize the opportunity to make it the gold standard in intellectual property rights protections.

In January 1994 NAFTA (The North American Free Trade Agreement) came into force as the first international trade agreement to incorporate obligations on member states to protect intellectual property rights. As President Trump embarks on the renegotiation of NAFTA, it is critical that we seize the opportunity to make it the gold standard in intellectual property rights protections.

The link between international trade agreements and strong intellectual property provisions is a natural one: ensuring that intellectual property rights enforcement corresponds to free trade principles of market access and nondiscrimination. Member countries must protect the intellectual property of other member countries in order to facilitate and encourage trade. NAFTA’s Chapter 17 does this and should be strengthened to continue to do so.

The stakes are tremendous and cannot be ignored. In total, it is estimated that intellectual-property theft costs the United States approximately $600 billion per year. A recent New York Times article notes that this is the “greatest transfer of wealth in history”. While the protection of IP rights is essential to a wide variety of U.S. industries, the issue is perhaps most critical to the innovative biopharmaceutical industry, a vibrant contributor to U.S. jobs and economic growth. Estimates indicated that the innovative biopharmaceutical industry supported (directly and indirectly) more than 4.5 million jobs in the U.S. and contributed more than $1.2 trillion to the economy in 2014. Moreover, in 2016, the industry exported in excess of $52 billion in biopharmaceuticals, making the sector one of the top U.S. exporters among intellectual property-intensive industries.

Protecting U.S. jobs and growing the U.S. economy corresponds to safeguarding U.S. innovation and intellectual property. In the context of the biopharmaceutical industry, the provisions for a new NAFTA are clear. The renegotiation of NAFTA must: enforce intellectual property rights provisions, strengthen and uphold strong patent law, and demonize illegal trade barriers. Failure to do so creates uncertainty and instability, increasing risk and inhibiting innovation.

In particular, ambiguous laws governing pharmaceutical intellectual property in Canada have resulted in expensive litigation between innovative and generic drug companies. A recent study places the cost of this litigation at more than $100 million annually due to the legal uncertainty surrounding the period of market exclusivity. Accordingly, the renegotiation of NAFTA should include strong patents and regulatory data protection (RDP), in combination with explicit mechanisms to expeditiously remedy disputes. Notably, Articles 1711(5) and (6) of the NAFTA establish data protection provisions that require NAFTA state parties to grant at least five years’ protection to undisclosed test and other data, specifically that “no person other than the person that submitted [the data] may, without the latter’s permission, rely on such data in support of an application during” the next five years. “However, Canadian courts have interpreted the five-year data protection as applying only where Health Canada officials actually examine the data – that is, pull the file and review it. This overly narrow interpretation has opened the door for generic drug manufacturers to file copycat drugs that rely for their safety and efficacy on the previous filings and approvals of the innovative drug manufacturer.” Such predictability will strengthen the incentives to invest in the research and development that generates breakthrough treatments and cures.

In addition, the renegotiation of NAFTA should reinforce the obligations of member states to eliminate discriminatory and egregious localization barriers. Local content or production requirements violate international trade rules, impair market access, discourage innovation, and deny patients access to medicines. (“[T]he practice of Canada to allow certain investments subject to the Foreign Investment Review Act conditional upon written undertakings by the investors to purchase goods of Canadian origin, or goods from Canadian sources, is inconsistent with [GATT] Article III:4.” In an effort to prop up a non-competitive local industry, these provisions eliminate U.S. jobs and inhibit R&D investment. Restrictions of this nature disadvantage American biopharmaceutical companies and generate economic distortions that fundamentally hurt patients in both countries.

A renegotiation of NAFTA should also prohibit price controls, both explicit and de facto restrictions, a practice that amounts to a backdoor means of eviscerating intellectual property rights protections. While Canada is the tenth largest pharmaceutical market in the world, consistently undervaluing US innovation, instead employing ad hoc reductions in drug prices and onerous price controls. The result is a market characterized by a lack of transparency and increased uncertainty, conditions that increase both the risk and costs of innovating. Consider, for example, Canada’s potential expansion of price regulation mandate. In March 2016, the Patented Medicine Prices Review Board (PMPRB) initiated a stakeholder consultation on its Strategic Plan for 2015-2018 that contemplates an expansion of its price regulation mandate. (Patented Medicine Pricing Review Board, “Strategic Plan 2015-2018”) Accordingly, Canada’s IP and pricing practices have a significant impact on both U.S. biopharmaceutical innovators and US patients. For biopharmaceutical firms, Canadian practices reduce the incentives to innovate. For patients in the US and around the world, price controls inhibit additional investment to research and develop both better treatments and new cures.

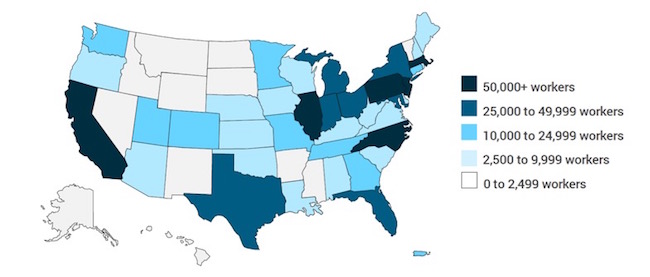

The incorporation of these recommendations will strengthen a vibrant scientific and economic ecosystem that both contributes significantly to the U.S. economy and delivers breakthrough medicines for patients. Specifically, the U.S. biopharmaceutical industry employs nearly 854,000 workers and supports a total of 4.5 million jobs across the country. Notably, every one of the 50 states, the District of Columbia, and Puerto Rico all have some direct biopharmaceutical industry employment. Moreover, the biopharmaceutical sector supports more than 250,000 jobs in six states: California, New Jersey, Illinois, Massachusetts, North Carolina, and Pennsylvania. The geographic distribution of U.S. biopharmaceutical industry employment (2014) is illustrated in the graphic below.

(Source: TEConomy Partners, 2017. Available here)

NAFTA has been good for the United States, and for Canada and Mexico as well. Despite the draft Executive Order that claims NAFTA cost U.S. workers 700,000 jobs, a majority of economists would dispute those claims and argue NAFTA has benefitted all three member states. A 2012 University of Chicago survey of 41 prominent economists shows that 85 percent believe that Americas are better off under NAFTA than under the previous trade rules. Moreover, NAFTA has fused the economies of the United States, Canada and Mexico, increasing regional trade and the jobs that depends on it. Recent estimates indicate that through NAFTA, regional trade has tripled to more than $1.1 trillion in 2016. In addition, research by the U.S. Chamber of Commerce provides that 14 million U.S. jobs depend on trade with Canada and Mexico.

Evidence of the positive impact is also reported in a recent report by the Cato Institute. According to their study, U.S. trade in goods and services with Canada and Mexico grew to more than $1 trillion in 2016, increasing 125.2% in real terms from 1993. Further, foreign direct investment (FDI) to the U.S. from Canada expanded from $40.4 billion in 1993, prior to the agreement, to $269 billion in 2015. In addition, FDI from Mexico grew from $1.2 billion to $16.6 billion.

Nevertheless, we have a chance to improve on the Agreement and negotiate precedent-setting protections for innovation and intellectual property rights, the lifeblood of the U.S. economy. The process of renegotiating NAFTA should not be rushed and under no circumstances should it shortchange American innovators. We can improve on a good thing, engineering the Gold Standard in IP protection. It is an opportunity that should not be missed.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

3 comments so far.

CR

October 18, 2017 11:17 amIt widely appreciated that the US prob has the least transparency re prices of pharmaceuticals. With rebates, formularies, and insurance company private dealings, it is murky, mafia-style extortion business. With this, Americans pay the most, for the same drugs. Canadian style price controls are needed in the US.

Paul Smith

October 18, 2017 02:09 amThis article is based on the premise that anything that makes more money for (preferably U.S.) pharmaceutical companies and keeps patented drug prices high for longer should be encouraged. Canada’s system grants a full 20 year monopoly on pharmaceuticals, to which there is otherwise no god-given right. The argument about data protection seems to be merely an excuse to extend that monopoly, thereby keeping the cost of drugs high and keeping health care more costly than your t needs to be. But that may be a superficial analysis of the author’s motives. The real culprit may be the attitude that market capitalism trumps all. Yet there exist more important principles such as democracy, humanism, compassion and social justice. Wouldn’t it be nice if those principles and a nation’s democratic right to apply them, were given precedence over free market principles in the NAFTA agreement?

Paul Johnson

October 17, 2017 08:56 amKristina, be careful what you wish more. There are just as many (if not more) ways that Canada can also say “we have a chance to improve on the Agreement.” Trump is the classic “negotiation bully” – just Google that term. He demands much, yet offers little in the way of concessions. But if you demand too much, eventually the other person will walk away because their BATNA is better than what you offer.