A structured business approach to patent cross-licensing negotiations.

Intro

When managing many of cross-licensing negotiations it can be hard to prioritize your activities. In a recent case, the client experienced this very thing and felt they would benefit from a clear overview of their efforts. In this case study, we explore how you can model the expected cost and revenue of your ongoing cross-licensing negotiations to make it easier to prioritize your activities, and how doing that helps you run your cross-licensing program like a business.

We based our model on bottom-up analysis, assessing each negotiation individually down to the specific claim charts involved. From there, we assessed the potential risk and balancing payment of each ongoing negotiation. The bottom-up approach aligned well with the client’s workflow and provided a good basis for comparing progress in different negotiations.

Getting an overview of your cross-licensing efforts

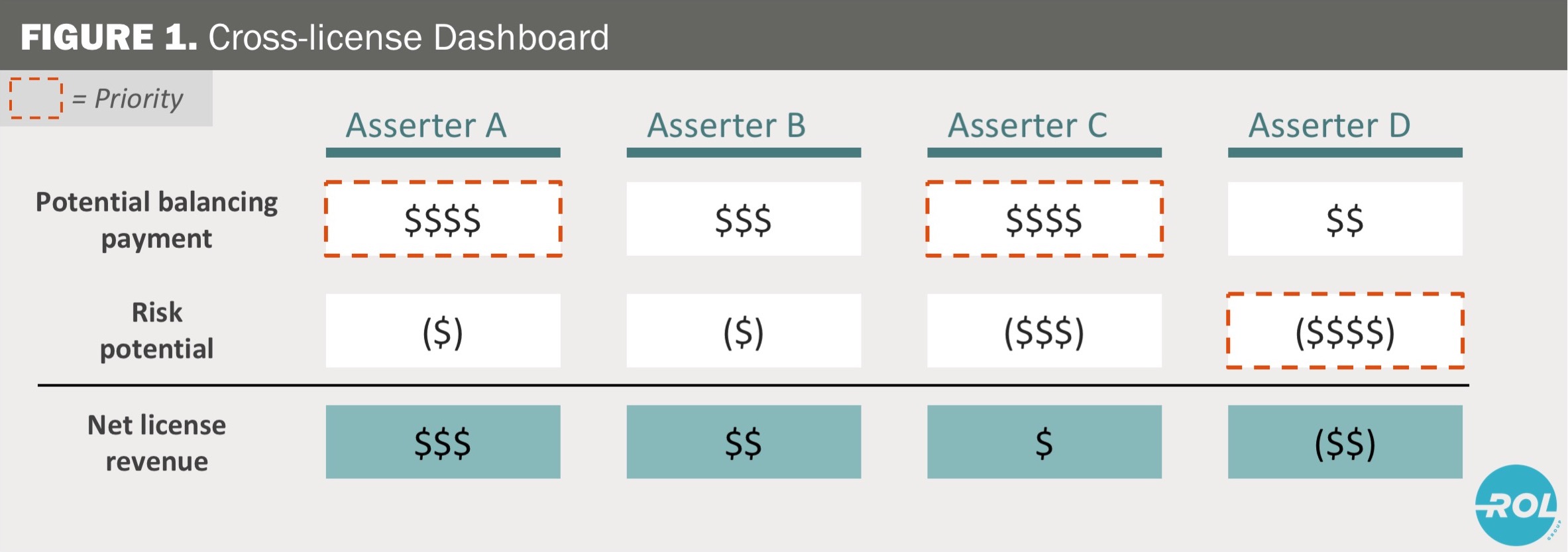

Imagine a simple dashboard with balancing payment potential, risk potential and net license revenue. This tool is both easy to imagine and a powerful way to decide where to allocate resources.

To be able to set up a structure for tracking and comparing we had to understand what the likely outcomes of each of our client’s ongoing negotiations were. For each negotiation, our client needed to assess: (1) their own potential risk and (2) the potential balancing payment that could come from the other party. By subtracting the risk potential from the balancing payment potential, you get the net licensing revenue. The challenge is in the difficulty of estimating these numbers.

How to determine the risk potential

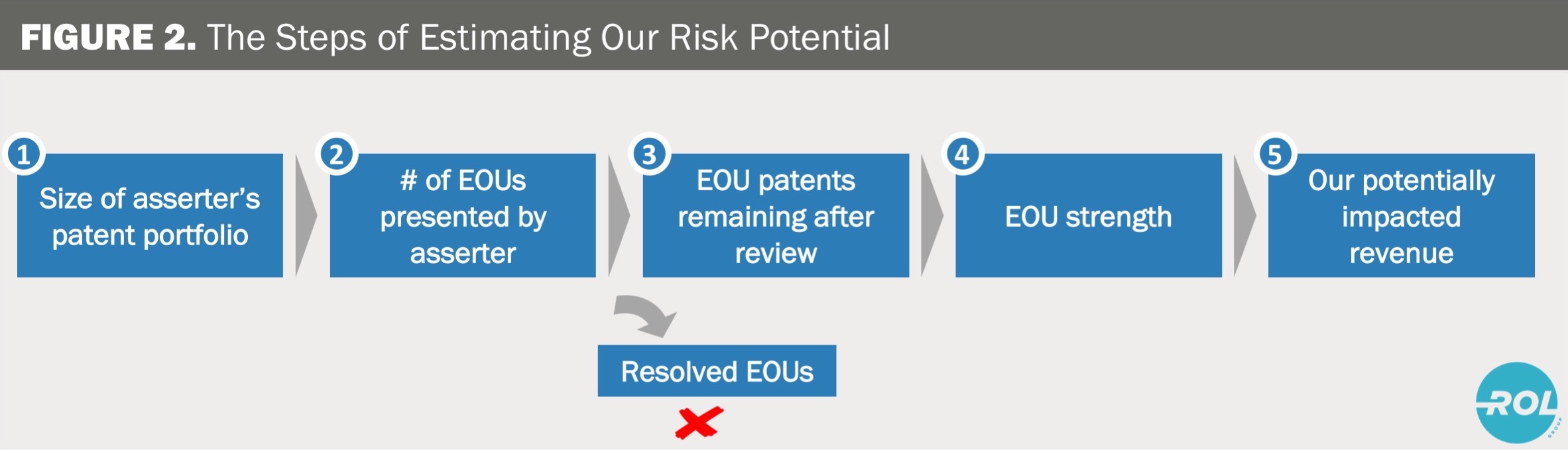

Determining the risk potential from a given licensor required us to look at several variables. Figure 2 summarizes our five-step approach.

Steps 1-4 of Figure 2 focus on assessing the strength of the infringement case presented by the opposing company. Finally, in step 5, we estimate the impact of that case on our client’s revenues based on the number of evidence of use (EOU) materials still in the case. Based on these assumptions, we calculate the total potential risk to our client. See our previous article here for more input on how to assess and quantify patent risk.

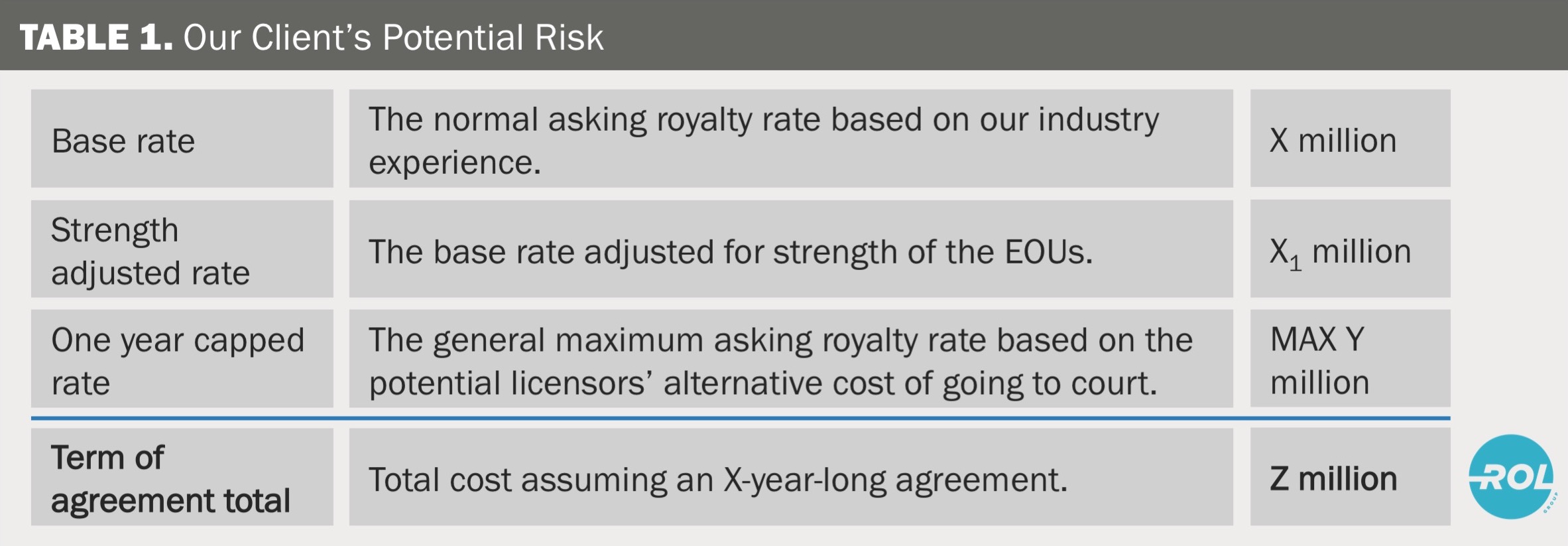

By looking at the royalty rate adjusted for the strength of the EOUs, we determined how much the cross-company might demand. In our experience, there is however usually a cap on how much an asserter can ask. The cap is equal to the point where the potential licensor gets a better ROI by challenging the patents in court. For cases where the strength-adjusted rate was higher than the one-year capped rate, we used the capped rate as the maximum. We then multiplied the chosen annual rate with the number of years of the agreement to get the total expected cost. The model generated an output number representing our client’s potential risk for that specific cross-licensing negotiation.

Determining our client’s potential balancing payment

The flip side is determining the potential balancing payment our client can get from the asserting company. Here, we used the same model (Figure 2), but reversed; instead of assessing our risk potential, we now looked at the asserter’s risk exposure to our client’s patents.

Steps 1-5 are directly parallel to those of Figure 2. Thus in analogous fashion to how we calculated the total potential risk, we calculate the total potential balancing payment.

At this point, we had what we needed to calculate the net license revenue our client could get from the negotiation. We added the client’s potential risk, and the potential balancing payment they could obtain, together to get the net potential license revenue. This allowed our client to compare their ongoing negotiations and to make more model-driven decisions on what activities to prioritize. The point of this method is not to arrive at an exact number, rather to give our clients an idea where to focus their resources.

Conclusions

When this methodology is applied across all active cross-licensing negotiations, the model provides a clear dashboard and process-oriented workflow for decision making within their cross-licensing program. When running many negotiations simultaneously, resources will always be scarce. For those situations, being able to prioritize your activities based on potential value (or risk) is tremendously helpful.

As a licensing team, keeping track of all the different cross-licensing negotiations can be challenging. Prioritizing your time and resources between those negotiations is even harder. In our experience, many companies would benefit from structuring their cross-licensing negotiations more extensively. In the end it makes sense: Why wouldn’t you spend a week to assess and compare your ongoing negotiations if your potential gain might be in the tens of millions of dollars?

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.