AST, a provider of proactive patent risk mitigation solutions, recently announced the results from IP3 2017, a fixed price, fixed term, collaborative patent buying program. Launched this past August, IP3 2017 gave sellers an easy way to access the secondary market by streamlining the process of selling patents with a fixed price, rapid response model. Through IP3 2017 patent sellers has the opportunity to offer their patents for purchase to AST’s full Membership, which includes dozens of the world’s most successful companies across multiple industries.

AST, a provider of proactive patent risk mitigation solutions, recently announced the results from IP3 2017, a fixed price, fixed term, collaborative patent buying program. Launched this past August, IP3 2017 gave sellers an easy way to access the secondary market by streamlining the process of selling patents with a fixed price, rapid response model. Through IP3 2017 patent sellers has the opportunity to offer their patents for purchase to AST’s full Membership, which includes dozens of the world’s most successful companies across multiple industries.

Like the inaugural IP3, IP3 2017 attracted strong interest from both patent sellers and Members. Participants in IP3 2017 included 15 operating companies including Google, IBM, Microsoft, Ford, Honda, and Cisco with nearly $2.5 million spent to acquire 70 active assets.

Unlike IP3 2016, which was open to AST and non-AST Members and sought patent submissions across all technologies, IP3 2017 was a narrower program and sought submissions limited to the following technologies: (1) Internet of Things; (2) Wireless; (3) Content Delivery; (4) Networking; and (5) Communications.

“We designed IP3 2017 to be a more focused program that attracts high quality submissions within a subset of technologies, and we are all very pleased by the number and quality of patent submissions we received,” said Russell W Binns, Jr., CEO of AST. “Interest among our Members in IP3 2017 also exceeded my expectations, with 15 global leaders in their fields collaborating to buy active assets.”

“We believe that fixed price programs like IP3 offer buyers an attractive, efficient model to purchase small, more straight-forward portfolios at good prices,” Binns explained. “We believe that buyers are better served by an approach like AST’s standard purchasing program when they are considering extremely high-value strategic deals where complex agreements and negotiations are required. Planning for IP3 2018 is underway and we are excited to work with our Members on this year’s program.”

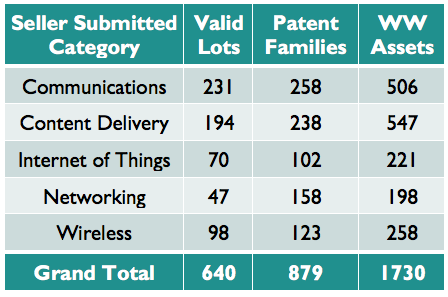

Patents and Patent Families Submitted

The category ‘Communications’ was the leading seller submitted technology category for IP3 2017 with 231 lots with 258 patent families. Communications covers technologies related to the transmission of data over a wire-based communication technology including telephone networks, cable television or Internet access, and fiber-optic communication.

Content Delivery had the most worldwide assets – 547 active assets in 194 lots. Networking lots were comparatively larger lots with over three families on average.

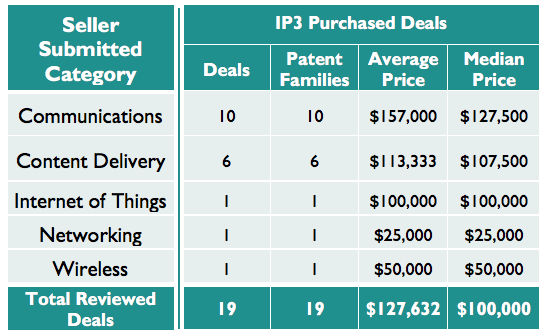

Purchase Summary

AST acquired 70 active patent assets, covering 19 families.

More than half of the purchased lots related to Communications technologies. There was an average of 3.68 assets per patent family, with 8 lots having a single U.S. patent, and 5 lots having two U.S. filings.

Prices paid by AST ranged from $25,000 to $390,000, with the average price paid $127,632 and the median price paid $100,000.

According to the Richardson Oliver Law Group, the 2016 the average sale price per asset where evidence of use (EOU) existed was $251,120, and the average price per asset without EOU was $197,000. The median in 2016 per asset with EOU was $166,670.

While apples to apples comparisons based on a single patent purchase effort that included only 70 assets is impossible, it is at least interesting to note that for these 70 assets AST paid what appears to be well below 2016 averages for the assets acquired.

“We received positive feedback from our Members regarding the new structure to the fixed price, fixed term program, particularly the specific technology focus which we believe encouraged a higher quality, concentrated set of patent submissions,” Binns said. “Further, the strong set of submissions we received indicates the continued desire to sell patents in an efficient manner with no hassles and minimal effort.”

There is no doubt that a fixed price, fixed term program is advantageous to buyers in today’s patent marketplace. Based on these numbers, however, it seems that it is still a buyer’s market with sellers starting to approach capitulation pricing. This would coincide with anecdotes about patent owners not even being able to sell for cost of acquisition (i.e., initial filing costs plus prosecution costs).

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

PT

February 13, 2018 02:31 pmGreat info! Thoughts on the effect the new tax treatment of patents will have on the patent marketplace? A fixed price as opposed to some sort of licensing agreement seems to disadvantage the seller.