“IP risk is pervasive and inevitable. However, the financial impact can be managed: It’s a matter of knowing how much, what the potential costs are, and how to protect your organization and its assets.”

As an attorney and risk advisor who has spent the past 18 years assisting clients with managing intellectual property (IP) risk-related costs, I follow how shifts in IP law may impact companies’ business decisions. While movement is constant in our industry, several notable IP trends and changes are poised to have a particular influence on future decision making.

As an attorney and risk advisor who has spent the past 18 years assisting clients with managing intellectual property (IP) risk-related costs, I follow how shifts in IP law may impact companies’ business decisions. While movement is constant in our industry, several notable IP trends and changes are poised to have a particular influence on future decision making.

The rate of technological change is ever increasing, as is the pace at which companies in many sectors are becoming technology-driven and reliant on information, data and analytics. As technology advances, so do the rates at which IP rights are granted. And as markets grow and strengthen across the globe, more countries are moving to bolster IP laws and protect IP rights based on the awareness that companies won’t do business in countries where those rights are not respected and enforced. According to the World Intellectual Property Organization, from 2002 to 2016 the number of patents and trademarks granted nearly doubled. From 2015 to 2016, the patent grant rate in the European Patent Office increased by 40%, while the share of worldwide patent grants in Asia nearly doubled to 57%. These are not small shifts.

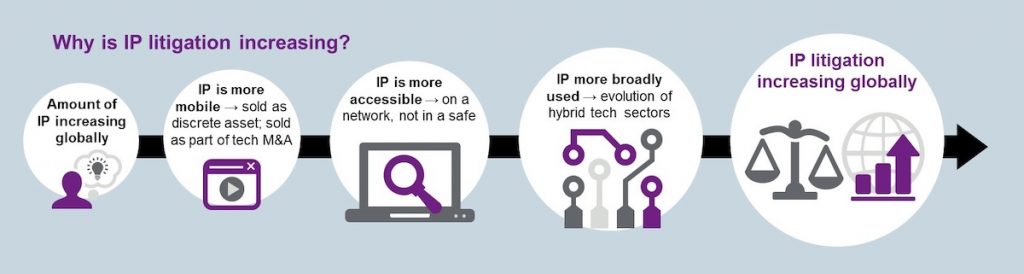

In this dynamic environment, IP is more mobile, more accessible and deployed in a greater variety of ways:

- M&A volume is up, and IP is transferred along with technology in those transactions.

- IP as a discrete asset is sold and licensed as a revenue source.

- Talent is more mobile, and when talent moves, so can IP.

- IP is more accessible; formulas, customer lists and other IP are more likely to be stored on a network than locked in a safe.

- The more IP there is, and the more valuable it is to companies as a way to compete in the marketplace and generate revenue, the more important it is for companies to protect it.

All of these changes translate to increased IP litigation.

Looking first at patent litigation, approximately 20,000 companies have been sued for patent infringement in the U.S. since 2010; even your neighborhood restaurant is at risk.

In fact, a particular global fast food chain is sued, on average, at least once a year for patent infringement. Those suits aren’t over hamburger recipes or kids’ meal toys: They’re over its mobile apps, point-of-sale technologies and other software that have nothing to do with food.

Even financial and management consulting firms find themselves in the middle of trade secret, patent and copyright disputes over issues ranging from talent acquisition to website display carousels to website functionality to software the firms themselves developed.

These organizations all rely on technology to continue to innovate, deliver and market their products and services. As one client said to me, “Every company is a technology company now.”

No organization, regardless of industry or global location, is immune from IP risk; therefore, we must shift our mindset to helping businesses continue to grow and evolve while understanding and managing the financial impact of IP risk. In the IP arena, this means quantifying your potential IP risk — in dollars — so you can evaluate options and make informed decisions.

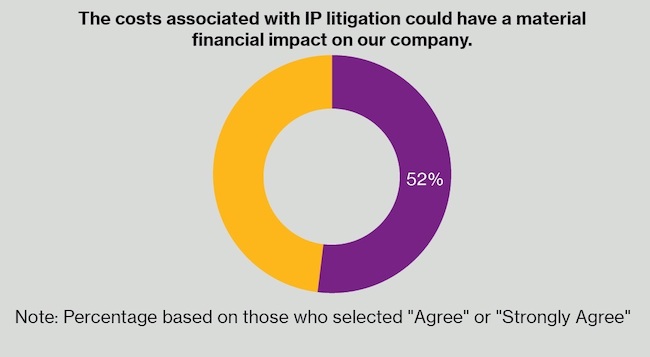

In the fall of 2017, Willis Towers Watson conducted an IP litigation cost survey; respondents represented companies of all sizes, global locations and market sectors, although most identified themselves as suppliers versus users of products/technologies/services. As the chart below indicates, the majority of companies surveyed considered IP litigation to be a key risk.

Rule #1: Don’t compartmentalize your IP risk

In my work, I’ve found that while companies want to protect themselves, they also tend to look at IP risks in isolation rather than stepping back to take a holistic view.

An organization’s R&D department is responsible for generating new ideas. The Legal department is responsible for protecting those ideas via patents, trade secrets and other IP rights and for enforcing those rights. HR develops and implements appropriate policies and procedures to ensure other company’s trade secrets don’t walk in the door with new employees and the organization’s trade secrets don’t walk out the door with departing employees. The Legal or Procurement departments are experienced at negotiating key risk-shifting provisions such as IP indemnification in technology and IP licenses as well as other agreements. Corporate Development is good at identifying acquisition targets and doing the requisite IP due diligence to buy technology to create or improve companies’ products and services. However, by compartmentalizing, companies miss the bigger picture and, in doing so, can leave themselves vulnerable.

A better way to protect your company is to quantify the combined financial impact of your company’s IP exposures.

Rule #2: Follow the money

To better map IP-related areas of exposure, it helps to categorize them using the insurance construct of property and casualty risk and calculate the costs associated with those exposures in order to quantify the potential financial impact. For example:

- IP ownership-related exposures

- How much do you spend annually on enforcing IP rights against infringers and protecting IP against third-party challenges?

- What would the lost asset value and revenue loss be if a key patent or trademark were found to be invalid or unenforceable, or if key trade secrets walked out the door with a departing employee?

- IP infringement liability exposures

- How much do you spend annually defending against IP infringement claims?

- How much do you spend annually on IP indemnification, and have you assessed your IP indemnification risk on an aggregated basis?

- What would the revenue impact be if your company were enjoined from selling a key product, technology or service?

Rule #3: Soften the financial impact

One tool for managing risk is insurance. Standard lines of business insurance such as general liability, professional liability, cyber liability and media liability offer limited coverage for IP exposures. For example, under a media liability policy, your company is covered if you are accused of copyright infringement due to an image used on your website. If your company develops a software app for a client, and the client is sued for software copyright infringement and sues you for negligence, your professional liability policy may provide coverage. However, if your business is sued for patent infringement or trade secret misappropriation, it will not have insurance coverage unless you have purchased a stand-alone IP infringement liability policy.

While the market for stand-alone IP insurance is the most robust it has been in 15 years, a limited number of IP insurance providers remain. For U.S.-domiciled companies, there are six. However, the underwriting process has become much more streamlined as providers have, over time, gathered more loss data and are using actuarial models based on those data to help them quantify and price the risk. As a result, coverage is more rationally and reasonably priced than ever before.

Pricing depends on the amount of limit, amount of retained risk, territorial scope and covered IP exposures. For example, a large technology company seeking $100 million to cover defense costs and damages/settlement for patent infringement liability can expect to pay at least $1 million in premium, depending on loss history, retention and whether IP indemnification coverage is provided. On the other end of the spectrum, an emerging technology company with under $20 million in revenue seeking $1 million in patent infringement liability coverage can expect to pay just $5,000 to $10,000 in premium.

The bottom line

In today’s world where “every company is a technology company,” IP risk is pervasive and inevitable. However, the financial impact can be managed: It’s a matter of knowing how much, what the potential costs are, and how to protect your organization and its assets.

To minimize your exposure in the changing IP landscape and business environment, consider:

- Shifting your perspective from IP management to IP risk management across your organization: Protecting yourself isn’t simply about managing your IP assets (though that, too, is important). It’s about managing the associated risk.

- Taking action to quantify the potential financial impact of IP exposures to your organization using hard numbers based on concrete data: It isn’t enough simply to go with instinct or an estimate. Take the time to find actual numbers across all departments and to evaluate hard data.

Image Source: Deposit Photos.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.