“Patent filings for the FinTech industry have been dramatically changing. Filings decreased by 24% from 2007 to 2009, increased by 58% from 2009 to 2013 and decreased by 27% from 2013 to 2018.”

This is the third in a 13-part series of articles authored by Kilpatrick Townsend that IPWatchdog will be publishing over the coming weeks. The series will examine industry-specific patent trends across 12 key patent-intensive industries.

In yesterday’s article, we discussed patent trends in the Internet of Things (IoT) industry, as part of our patent-trends study (performed in a collaboration between Kilpatrick Townsend and GreyB Services). To quickly summarize the study:

- The goal of the research was to characterize recent patenting trends and statistics for each of 12 industries (and technology clusters within those industries) to inform applicants’ filing decisions of tomorrow.

- The study was conducted at an industry level (not at an art-unit or class level). This was achieved by designing and implementing various queries and iteratively manually reviewing a large number of search results to refine the queries.

- The study is further unique in that we used proprietary data from recent years and data-science techniques to estimate statistics for recent time periods (which would otherwise have poor data as a result of the non-publication time window).

Today’s article pertains to the Financial Technology (FinTech) industry, which is defined as technology used to support banking and financial services. In June 2014, the Supreme Court decided Alice v. CLS Bank, which nearly immediately made it much harder to patent a FinTech invention. This resulted in fewer FinTech patent application filings. Nonetheless, the use of bank accounts, credit/debit cards and money-transfer systems is ubiquitous, and protected innovations in this area offers a high potential value. Thus, it is essential to understand the industry and the patenting prospects, which can inform both R&D investments and patenting strategies.

Our study not only identified a set of applications that pertained to this industry, but also – for each application in this set – it was determined whether the application pertained to one or more of the categories shown in the topology below. If so, the application was appropriately tagged, such that it could be included in one or more category-specific data subsets for subsequent analysis.

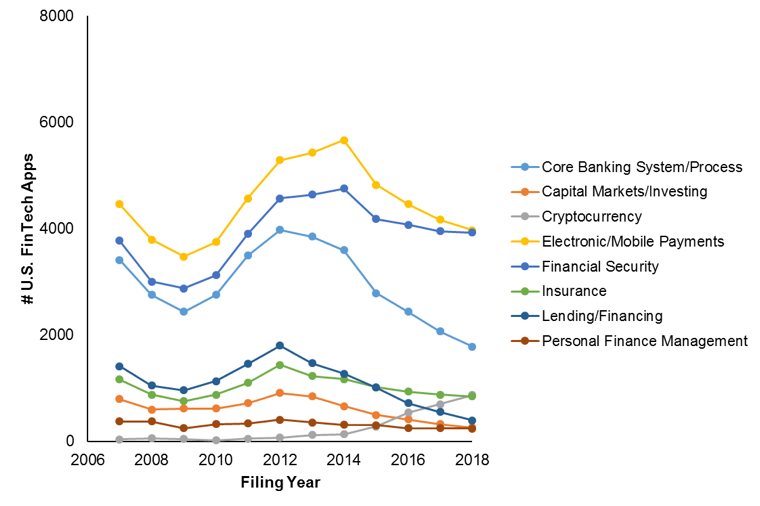

As reported in our initial patent-trends article, filings for the industry have been dramatically changing. Filings decreased by 24% from 2007 to 2009, increased by 58% from 2009 to 2013 and decreased by 27% from 2013 to 2018. Figure 1 shows the filing trends for each cluster within the industry.

Figure 1

Each cluster followed the general up-and-down trends of the industry, with the exception of cryptocurrency. Filings within this cluster have been steadily increasing, and filings in 2018 were over 20 times the filings in 2007.

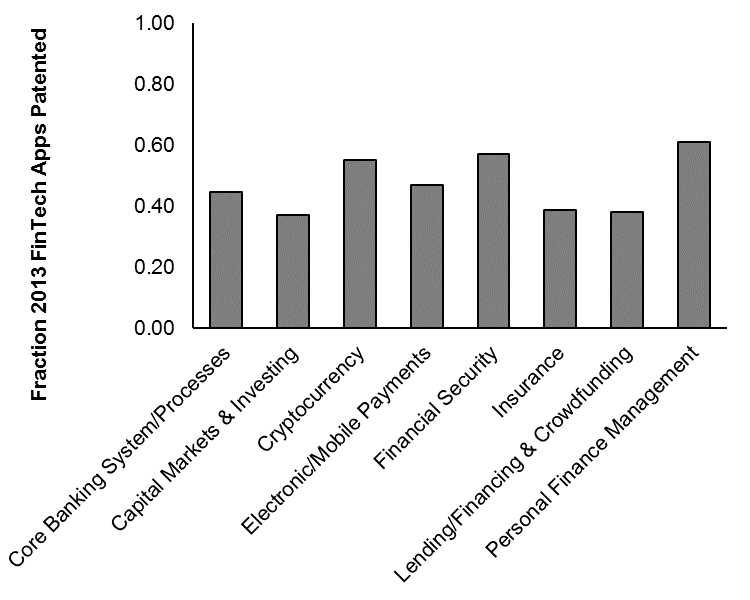

Figure 2 shows, for each of the clusters, the fraction of the applications that were filed in 2013 and are now patented. The percentages range dramatically: from 37% (capital markets & investing) to 61% (personal finance management). The allowance-rate discrepancies may be due to art-unit-assignment discrepancies: approximately 80% of applications in the capital markets & investing cluster were assigned to a business-method art unit, as compared to approximately 45% of the personal finance management. Business-method art units have long been associated with low allowance rates and even more so since Alice.

Figure 2

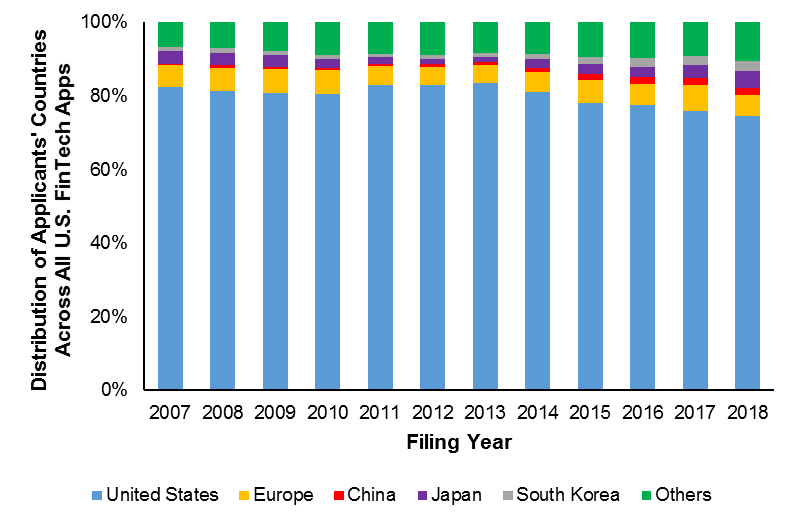

Figure 3 shows a time-series breakdown of applicants’ countries. The contribution of U.S. applicants to U.S. filings in the FinTech industry has slightly decreased (from 82% in 2007 to 75% in 2018). The contribution of filings from Chinese applicants has increased more than five-fold, and the contributions of filings from South Korean applicants has increased more than three-fold. FinTech innovation is strengthening overseas.

Innovating in the FinTech industry has the potential to immediately improve the financial security and transaction-efficiency of hundreds of millions to billions of people. Nonetheless, case law has made it complicated to ensure that these innovations can be protected by patents. Tracking filing data and allowance data is thus all the more essential in this industry to inform patent strategies. A copy of the full published study is available with additional detail here.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.