“The computational-neuroscience cluster has exhibited the strongest and most stable growth in filings.”

This is the fourth in a 13-part series of articles authored by Kilpatrick Townsend that IPWatchdog will be publishing over the coming weeks. The series will examine industry-specific patent trends across 12 key patent-intensive industries.

In our fourth article studying patent trends data across industries, we turn to the computational biology and bioinformatics industry.

To quickly summarize this series:

- The goal of the research was to characterize recent patenting trends and statistics for each of twelve industries (and technology clusters within those industries) to inform applicants’ filing decisions of tomorrow.

- The study was conducted at an industry level (not at an art-unit or class level). This was achieved by designing and implementing various queries and iteratively manually reviewing a large number of search results to refine the queries.

- The study is further unique in that we used proprietary data from recent years and data-science techniques to estimate statistics for recent time periods (which would otherwise have poor data as a result of the non-publication time window).

Computers have transformed many aspects of our everyday lives. However, much of drug-discovery, treatment testing and biology research is performed using the same wet-lab techniques developed decades ago. Rather recently, biotech companies have begun to capitalize on the impressive computational power, sophisticated models and skilled workforce to integrate computers into their operation. This integration can facilitate generating more accurate hypotheses, conducting more efficient tests and more thoroughly evaluating results. For example, modeling can be used to identify a set of therapeutics that have a physical structure complementary to a target, to better define a screen. Given that this valuable technological area sits at the intersection of biology and computers—which traditionally are associated with very different types of applications, examination and applicants—it is important to be well informed about the patenting arena when identifying patenting strategies.

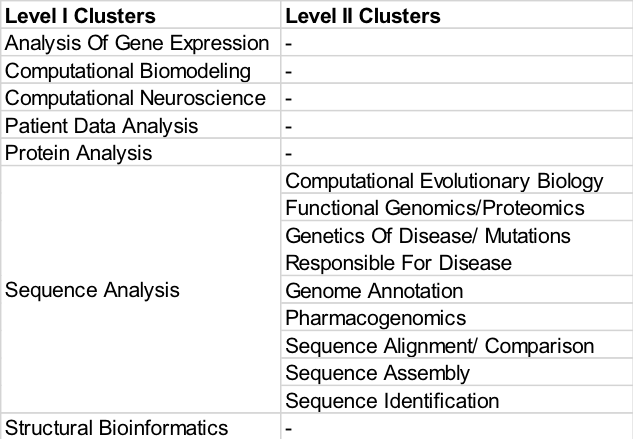

Our study not only identified a set of applications that pertained to this industry, but also—for each application in this set—it was determined whether the application pertained to one or more of the categories shown in the topology below. If so, the application was appropriately tagged, such that it could be included in one or more category-specific data subsets for subsequent analysis.

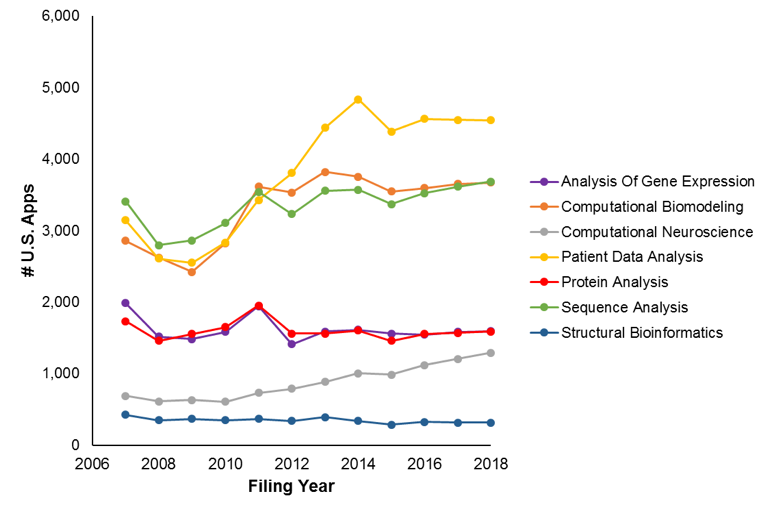

As reported in our initial patent-trends article, filings for the industry had been increasing (from approximately 9,900 in 2007 to approximately 12,400 in 2014) until 2015 (the year after Alice), after which filings dropped (to approximately 10,400 in 2018). Figure 1 shows the filing trends broken down by Level-I Clusters.

Figure 1

The computational-neuroscience cluster has exhibited the strongest and most stable growth in filings. It appears as though the category most responsible for the post-Alice filing drop is patient data analysis. Some effect may have also been seen in the sequence-analysis and computational-biomodeling clusters. The Alice case invalidated several business method patents, and nearly immediately the allowance prevalence in the business method art units and the bioinformatics art unit plummeted. With regard to the patient-data-analysis cluster, the top-ranked art unit in terms of the number of the cluster’s applications assigned to the art unit was art unit 3686 (a business-method art unit).The top-ranked art unit for the structural-bioinformatics and sequence-analysis clusters was 1631 (the bioinformatics art unit). Thus, potentially, applicants began to quickly recognize that they were far less likely to have patent applications allowed to issue as patents, so they cut back or stopped their filing.

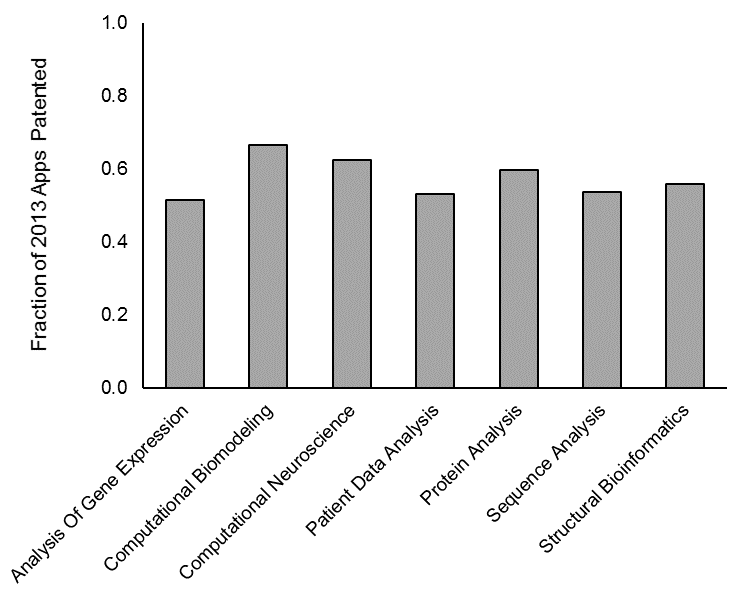

Figure 2 shows, for each of the Level-I clusters, the fraction of the applications that were filed in 2013 and are now patented. Notably, the percentages for the patient-data-analysis cluster, sequence-analysis cluster and structural-bioinformatics are amongst the lowest patenting percentages – consistent with the above hypothesis as to why the filings dropped.

Figure 2

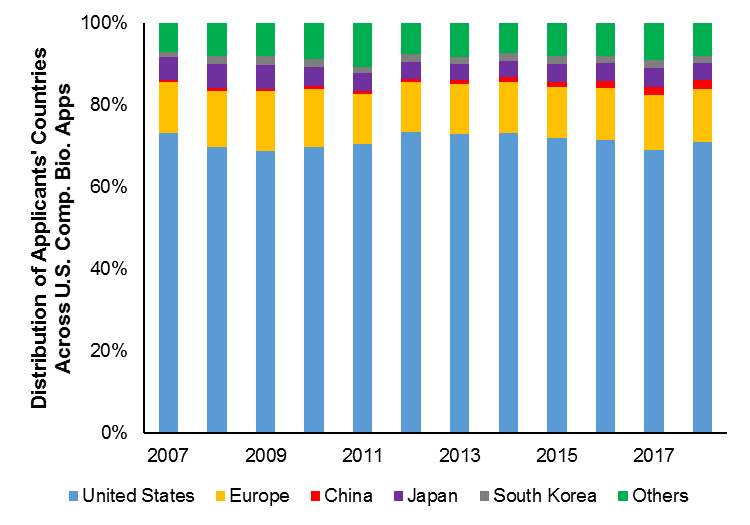

Figure 3 shows a time-series breakdown of applicants’ countries. The contribution of U.S. applicants to U.S. filings in the computational biology & bioinformatics industry has been quite steady, as have most other countries.

Figure 3

Patenting in the bioinformatics space is tricky and interesting. Each of biology and software have faced substantial patent-eligibility challenges, and it is possible that both must be navigated in this space. Further, a bioinformatics may be assigned to any of a variety of different types of art units (e.g., a business-method art unit, a bioinformatics art unit, a biology art unit or a chemistry art unit) – each of which has different allowance prospects. Understanding the combination of patenting trends and allowance prospects can present an opportunity to secure valuable protection this emerging field. A copy of the full published study is available with additional detail here.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.