“Innovation effort in the cleantech space is whipsawed by government stimulus, hydrocarbon prices and geopolitical forces such as tariffs to make long term investment difficult.”

This is the eleventh in a 13-part series of articles authored by Kilpatrick Townsend that IPWatchdog will be publishing over the coming weeks. The series will examine industry-specific patent trends across 12 key patent-intensive industries.

Yesterday, we discussed patenting trends in artificial intelligence (AI). Today, we turn to the cleantech and green tech industries, which are changing many established industries in different sectors of the economy, as well as providing entirely new areas to innovate.

Yesterday, we discussed patenting trends in artificial intelligence (AI). Today, we turn to the cleantech and green tech industries, which are changing many established industries in different sectors of the economy, as well as providing entirely new areas to innovate.

To quickly summarize this series:

- The goal of the research was to characterize recent patenting trends and statistics for each of twelve industries (and technology clusters within those industries) to inform applicants’ filing decisions of tomorrow.

- The study was conducted at an industry level (not at an art-unit or class level). This was achieved by designing and implementing various queries and iteratively manually reviewing a large number of search results to refine the queries.

- The study is further unique in that we used proprietary data from recent years and data-science techniques to estimate statistics for recent time periods (which would otherwise have poor data as a result of the non-publication time window).

Cleantech innovation is relatively steady in recent years after a growth spurt that started nearly a decade ago. Those early growth trends were likely driven by government stimulus funds that have disappeared along with the growing innovation trend. The promise of a green revolution powered by cleantech may still be happening, but it simply is not a patent growth area in general except for a few areas explored below. Developing new products in this space takes years and there are many factors that interrupt this cycle to make product introduction difficult.

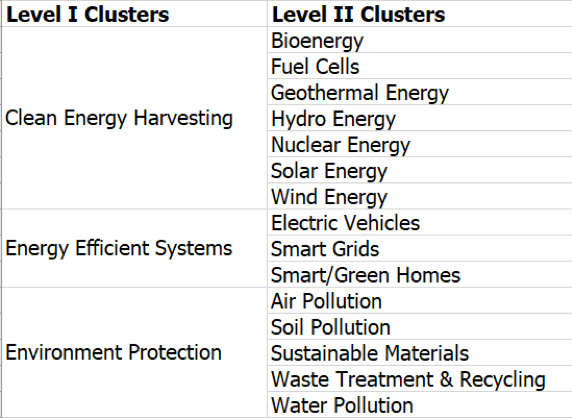

Our study broke down the limited number of cleantech patents in a number of ways to separate those for clean energy harvesting, energy efficient systems, and environmental protection. Each of those level one clusters was further divided into subcategories. We determined whether the patent application pertained to one or more of the categories shown in the topology below. If so, the application was appropriately tagged, such that it could be included in one or more category-specific data subsets for subsequent analysis.

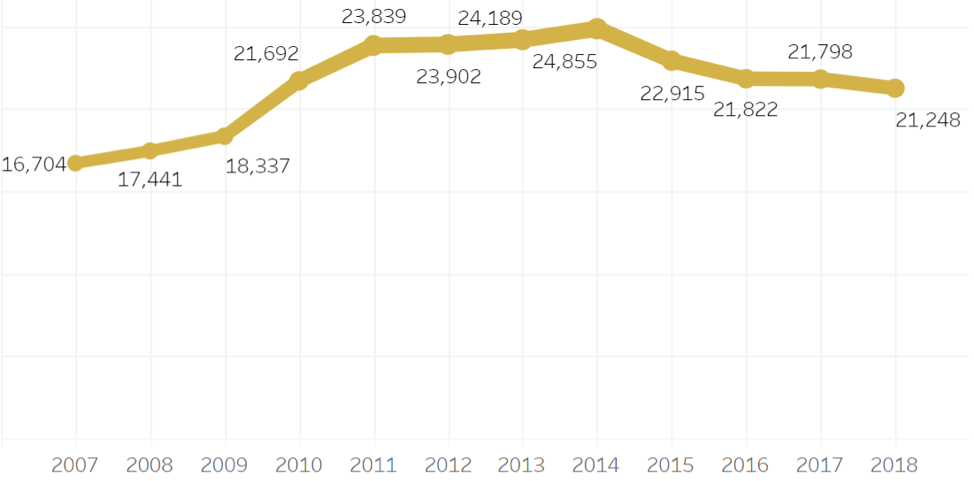

As mentioned above, there is little growth in the cleantech area as far as the total number of patents over the last decade, after an early growth trend shown in Figure 2A. Overall, the decade saw domestic patent filings growth of over 20% after a peak, but today we are in a multi-year falling trend. The prior administration provided easy loans under the American Recovery and Reinvestment Act to help businesses in the aftermath of the Great Recession. All loan funds were distributed in late 2011, which corresponds with the patent growth plateauing. The easy availability of capital would seem to be important for innovation in the cleantech industry.

Figure 2A

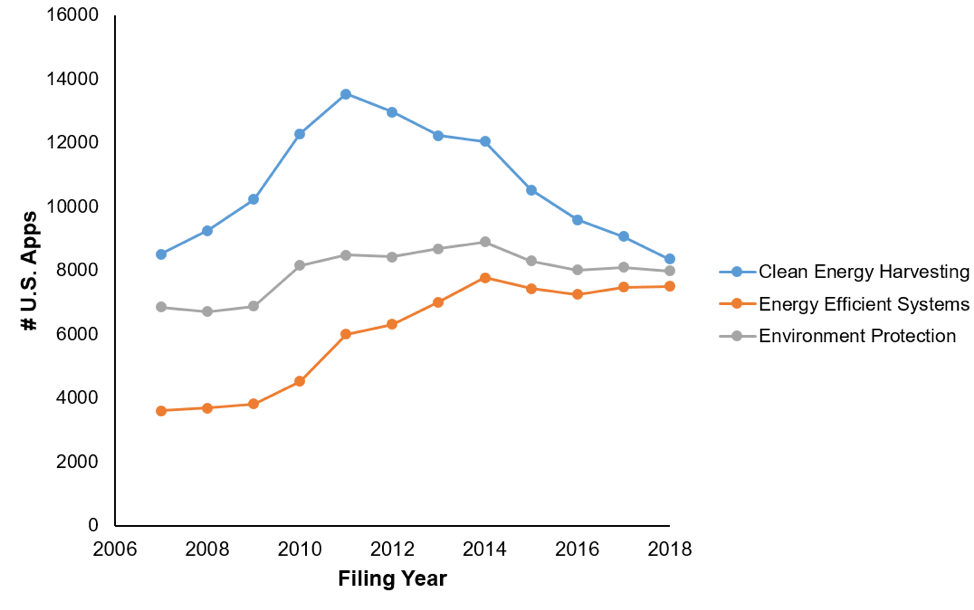

The Level I cluster trends are shown in Figure 2B. Clean Energy Harvesting has seen the steepest rise and subsequent fall finishing the decade where it started. Beyond the government stimulus disappearing, hydrocarbon prices also fell to undermine many business models.

Figure 2B

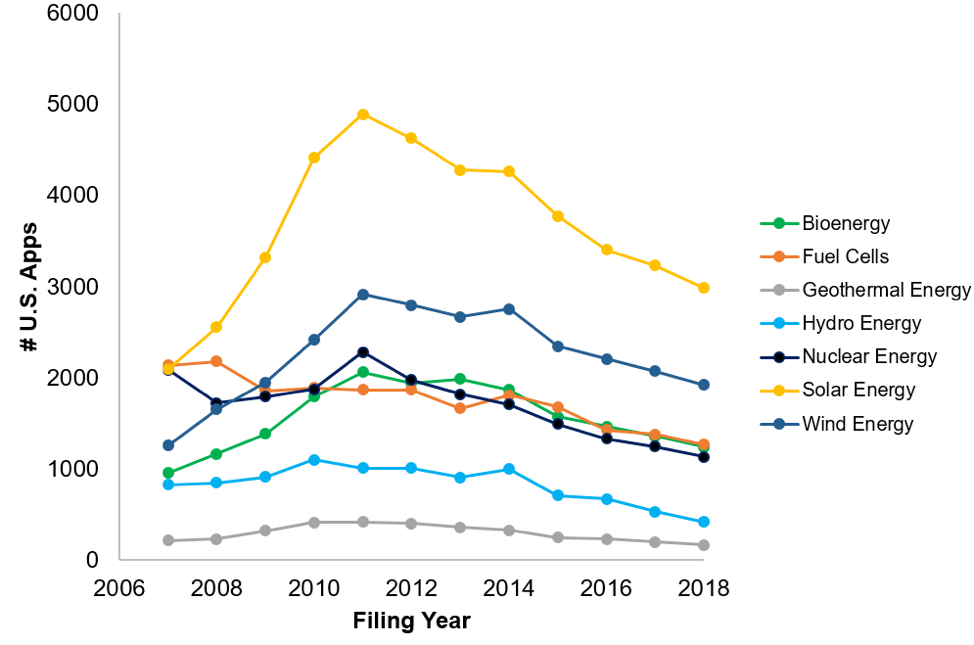

Drilling deeper into the clean energy harvesting cluster in Figure 2C, there are several interesting trends. Nuclear and fuel cell technology has been in a steady slide, apparently not benefiting from stimulus capital. Solar energy saw the largest bubble of any area in clean energy harvesting with the burst attributable the availability of cheap overseas solar panels from China that are now subject to tariffs. The protection of domestic industry with tariffs on solar panels did not interrupt the falling trend of innovation in that space.

Figure 2C

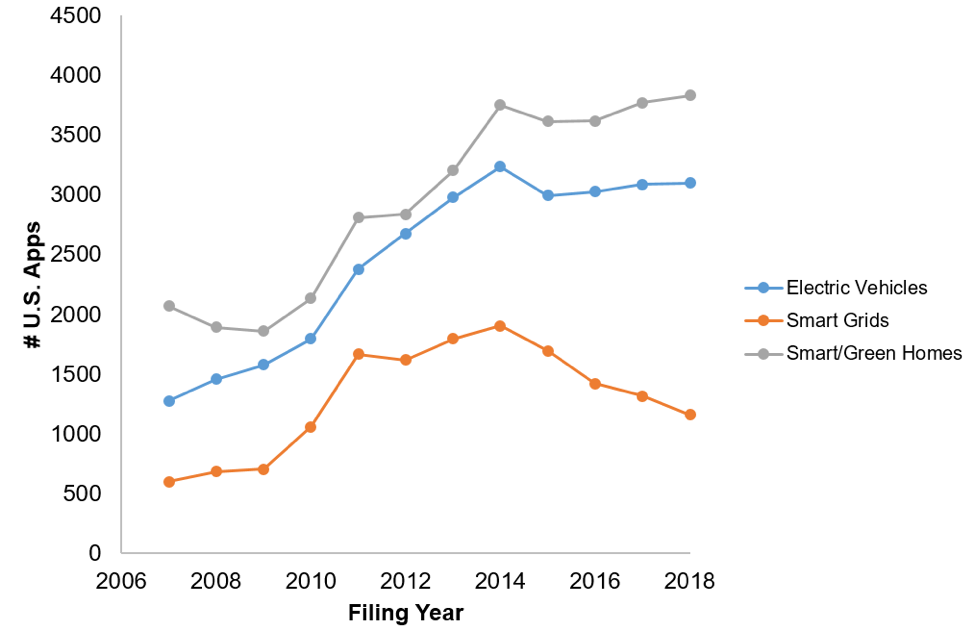

Figure 2D shows trends in the Energy Efficient Systems cluster. Despite the overall trends, there are bright spots such as electric vehicles and smart/green homes which both underpin a consumer-driven movement toward cleaner and greener enhancements when considering their largest purchases. With a recent falling trend in smart grids is surprising as these technologies are needed as power generation is spread out geographically to where the best wind, solar and other energy sources are located while allowing better control of and security for our aging power distribution infrastructure.

Figure 2D

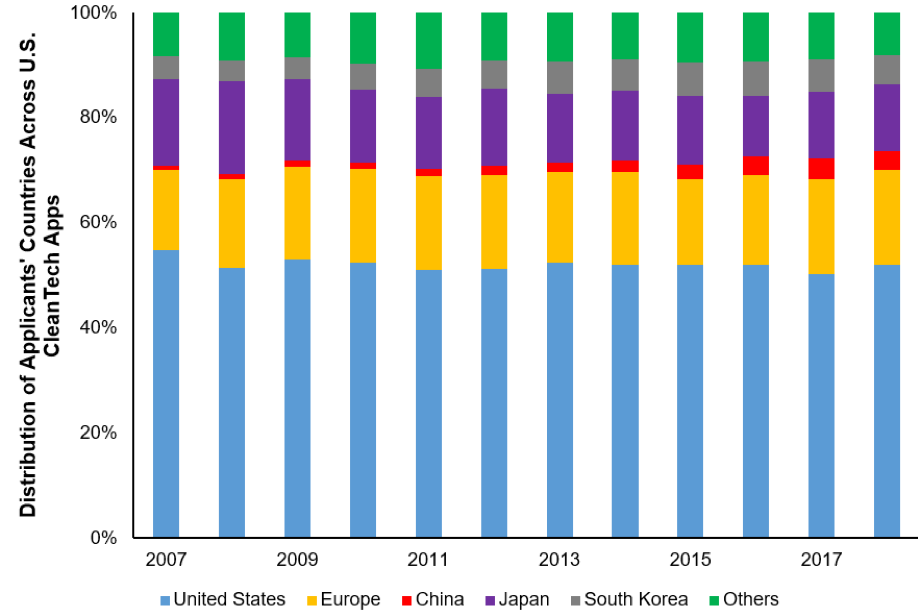

The proportion of US patents pursued by domestic companies in the cleantech area has remained relatively stable at fifty percent over the decade as shown in Figure 3. China has seen six fold growth in US patent filings largely at the expense of Japan who suffers from a falloff in scientific output.

Figure 3

Cleantech has been the darling of government stimulus programs both domestically and abroad. Most areas reacted favorably to the prior administration’s loan program after the Great Recession, but innovation fell away after the government money was exhausted. For example, solar energy saw more than double the amount of patent filings, but Chinese stimulus reduced panel pricing to such a great extent that tariffs US resulted. Hydrocarbon prices also fell away to further reduce the attractiveness of investing in new innovation in this space. Cleantech can allow for alternative and more efficient systems across many industries, but investment in those areas should take into account government stimulus and the geopolitical reality of tariffs. The level of investment required over many years to develop these alternatives can whipsaw those who innovate in this space and cause unpredictability in the marketplace.

A copy of the full published study is available with additional detail here.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.