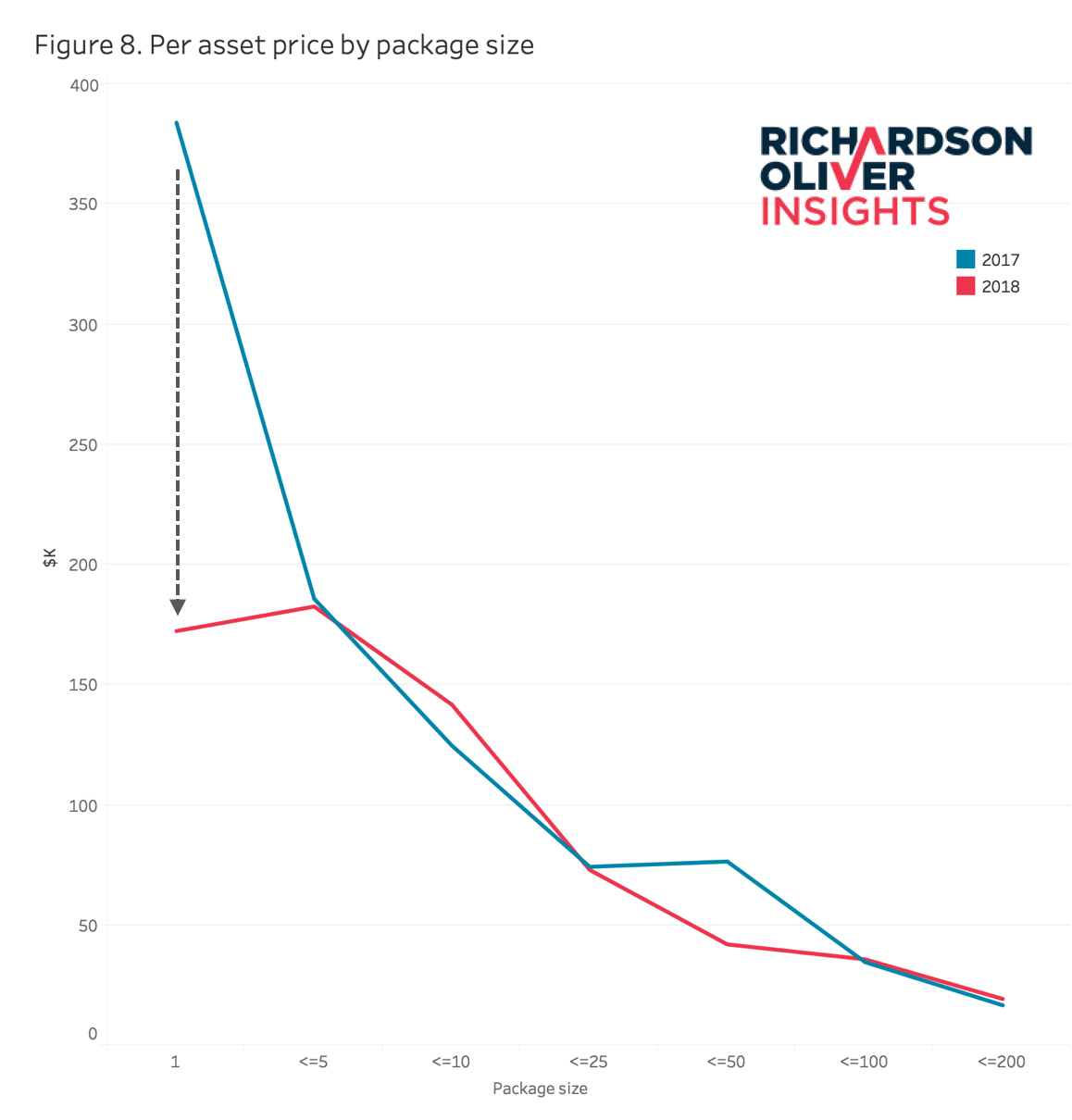

“In 2018, the price for single-asset packages dropped by 56% and came more in line with the pricing for other package sizes.”

This is part three of a six-part series on our 2018 Patent Market Report.

In any market, pricing is where the rubber meets the road. As a buyer, you will not be taken seriously if you significantly underbid, yet you want to get a fair price. Conversely, if you are a seller who will not negotiate near the market price, it will be almost impossible to close a deal. We understand that patents are definitionally unique, have varying relative strengths and market applicability, and also that the demand for patents varies by technology area and many other factors. But when it comes down to it, you have to have a place to start. This is where average pricing statistics become useful. And to every seller who says: “My patents aren’t average, so average pricing should not apply to me,” we respond by saying: “We’ll accept that as true, you just have to show us why.” In the vast majority of cases, starting with the average price and moving up or down from there is an effective way to set a price for buyers and sellers.

We believe that the availability of pricing data creates liquidity in the market and the more visibility there is into pricing, the easier it is for both new and established participants to participate in the market. The average asking price is a guide, not an absolute rule. We have helped clients buy patents priced at around $1 million per asset, which is well above the average market price, and have also negotiated deals for a small fraction of market price. In both of these cases, we think the prices were justified, and importantly, the deviation from the average was supported by business models, market data, and other factors that were specific to that deal.

In 2018, the average price per asset shifted significantly: it fell by 30%, from $176,000 per asset to $123,000. The asking price per U.S.-issued patent also dropped by 30% from $251,000 to $176,000. If you are a seller and these were the only facts you had, it would look like it’s time to panic. But this is not the whole story. The drop was primarily due to an adjustment in the asking price for single-asset packages. For most package sizes, the asking price did not change at all. Figure 8 shows the asking prices per asset across packages of different sizes. In the 2017 market, there was a massive premium on single-asset packages. In 2018, the price for single-asset packages dropped by 56% and came more in line with the pricing for other package sizes. This drop in single-asset prices accounts for 48% of the overall drop in per-asset prices. The asking price in the 26-50 asset range also dropped significantly, while the price for 6-10 asset packages went up.

Additionally, among the single-asset packages listed in 2018 that have already sold, a small dataset, have an average asking price of $272,000 versus $129,000 for unsold, a price difference of $142,000 per asset. In 2017, that price difference was only $56,000. It appears that buyers are still willing to pay a premium for some single-asset packages, and sellers dropped the price on others where they could not reasonably support the premium.

Our takeaway from this pricing data is that the premium for single-asset packages seen in all of the previous market years has reduced rapidly. This may have happened now because of the increased interest in international counterparts, which single-asset packages do not have. This price drop also caused standard deviations in the asking price per asset to drop by 24% (to $107, 200) for per asset asking prices and 23% (to $143,100) for per U.S.-issued assets, thereby further normalizing pricing data.

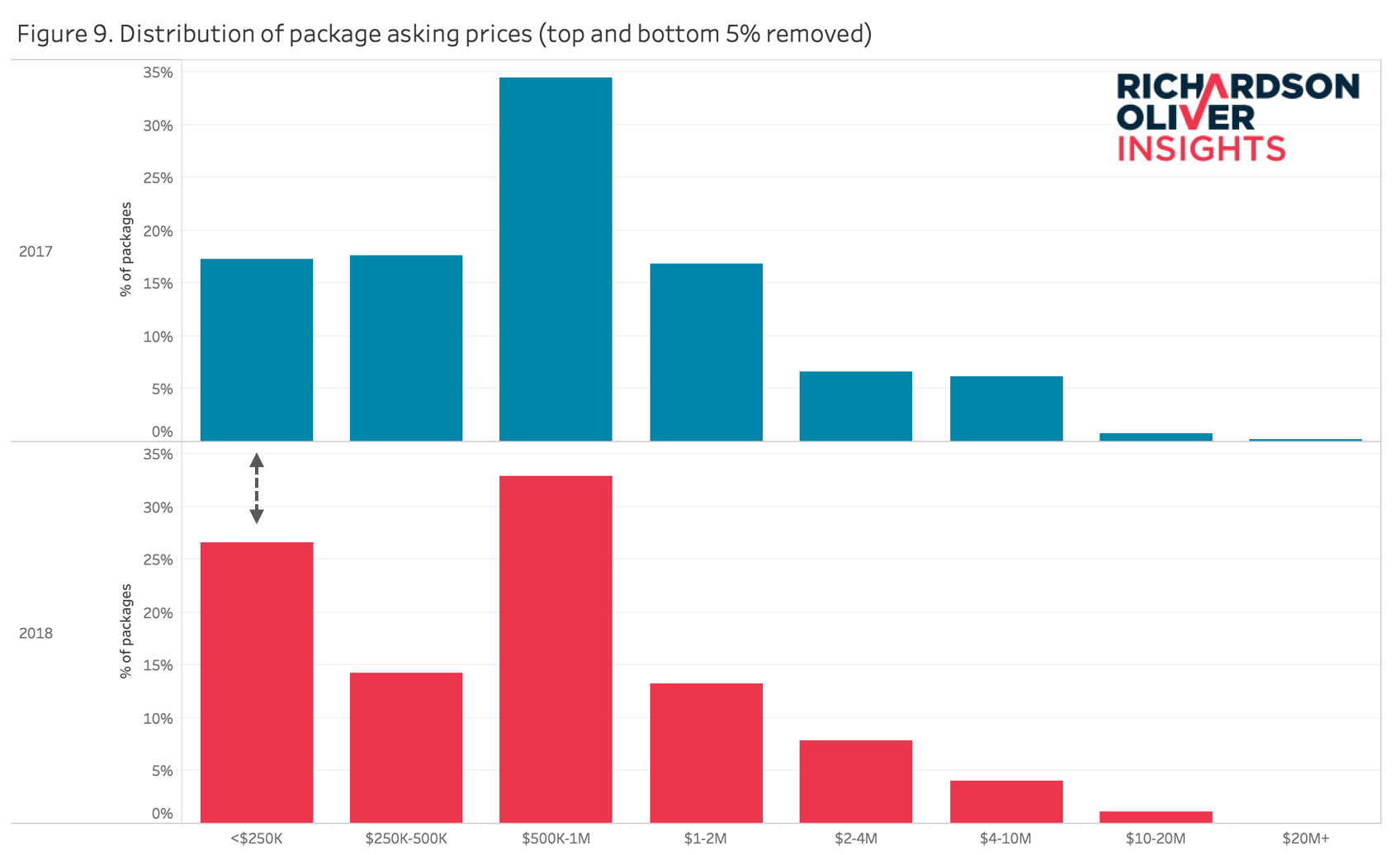

Figure 9 shows the distribution of asking prices. The data shows a continued focus on packages priced between $250,000 and $2 million; 60% of packages fall into this range, down from 69% last year. Here, brokers are able to be profitable, as packages are sufficiently expensive for them to make a significant commission while still keeping purchases within buyers’ budgets. But we also see a large increase in the sub-$250,000 listings, which corresponds to the drop in single-asset package prices that now fall into this price range.

We also continue to track the sub-$250,000 price range separately; we began doing this three years ago. This price range is interesting in that it represents low margins for the brokers. Assuming a 25% commission for brokers, a maximum $62,500 commission is possible for these packages. Additionally, when one takes into account the overall low sales rate of packages (more on this below), the margins look thin, thus causing brokers to find ways to lower their costs.

Evidence of Use materials (EOUs) were delivered for only 13% of packages priced at or below $250,000, in contrast with 61% of packages priced above $250,000. In the 2017 market, those numbers were 44% versus 50%, respectively. Brokers are spending much less on the marketing of these lower-priced packages than in the past. In buying these types of packages, we advise clients to scale down the resources used in diligence and negotiating the patent purchase agreement, unless the buyer has significant plans for the patents. See below for further discussion of EOUs.

Packages with Pricing Guidance

We saw that 76% of packages came with pricing guidance, down from 78% last year. We believe that pricing guidance clarifies expectations for both buyers and sellers. Additionally, 48% of packages with pricing guidance had precise asking prices; this is up from 34% last year. Clear pricing guidance helps buyers to make decisions; without guidance, the risk of no decision (meaning no sale) is higher simply because the seller is signalling a potential lack of understanding of where the market is.

Per-Asset Pricing by Package Size

We analyzed the interaction between pricing guidance and the number of assets in a package (see Figure 8). On average, asking price per asset drops considerably as the size of the package increases; from $172,000 all the way down to under $19,000. This is consistent with last year’s data, although the fall-off is far less without the single-asset premium. Last year, the smallest packages were asking $384,000 and the largest packages $17,000 per asset.

If you are a seller, in most cases it makes sense to take the time to find and highlight key patents and to group those into smaller packages in order to increase the overall price per asset (Figure 8). But this can be time consuming if you have a very large portfolio and breaking up a group of patents into smaller packages may leave a pile of unrelated, undifferentiated and, ultimately, unsellable assets. In these specific cases, bulk packages may provide a better selling opportunity. This calculation continues to be difficult and benefits from up-to-date knowledge of the market and in-depth knowledge of the specific portfolio. If you are a buyer and presented with a bulk package, do not assume that you have to accept the package as is. It is likely that the seller will allow you to “cherry pick” assets out of the bulk lot. But in that case, the price for these differentiated assets may go up. When approached by a buyer looking to purchase one family from a large lot, we have seen sellers say that they have a minimum package price to make a deal worthwhile. In these cases, the parties often add assets to the deal in order to make the price per asset palatable to both sides.

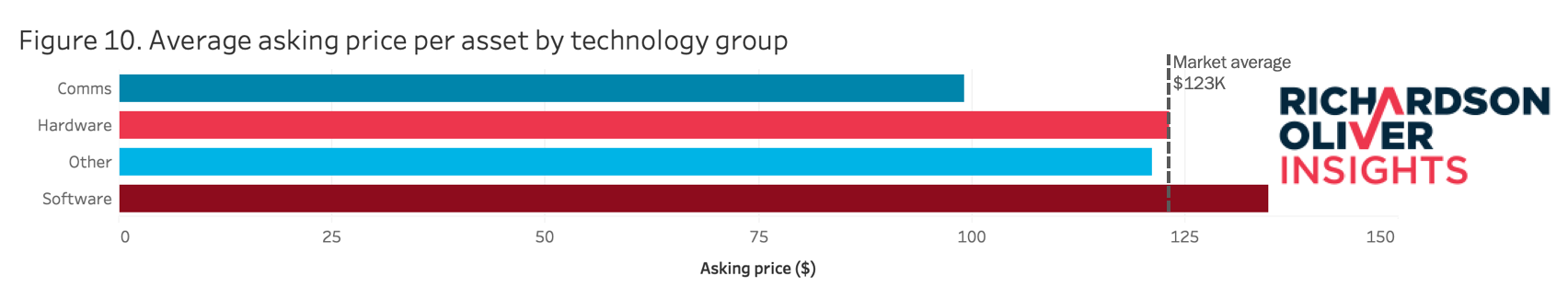

Asking Price by Tech Category

Technology categories continue to drive asking price variations, but less so than in the past. We are starting to see technology areas fall into the category of “selling or not selling” rather than price adjusting. When it comes to top asking prices, software has regained its throne as the top pricing area and “other” has dropped from the top price down below hardware (see Figure 10). But overall, there is less price variation between hardware, software and “other” technologies than in previous years. Notably communication packages have fallen farther behind that pack. The lowest priced tech category was imaging, demanding only 39% of the average asking price. Financial patents had the highest asking price at 170% of the average. Surprised? Us too. Last year, the automotive category demanded 365% of the asking price per asset, so, as with other factors, price variation is decreasing across technology categories.

Alice-Affected Technologies

Sellers never stopped listing Alice-affected technologies, but the price for technology areas relating to internet computing finally dropped to market average in the 2017 market. That drop, combined with buyers getting over their fear of Alice created a boom in sales relating to these technologies (discussed further in the sales section below). Due to increased sales, the per asset asking price for these technologies in 2018 is back to a 10% premium above the market average, $135,000 vs a market average of $123,000. In 2017 the price was $177,000, which was effectively the market average of $176,000.

Asking Price and Impact of EOU

As discussed above, there are ways a seller can show that their package should fetch a higher price than average. EOUs are a great way to do that. Overall, the percentage of deals with EOU was consistent, with 42% in 2018 versus 43% last year. And we observed a 43% price premium over the average for packages with a seller-supplied EOU. This is the largest premium we have seen. We also know that sales rates are much higher for deals with EOU (see below) so the value of writing an EOU is compounded. We did not see a premium for EOU packages last year, but we did all other years, so we believe 2017 to be an anomaly.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

6 comments so far.

Kent Richardson

June 4, 2019 03:09 pm@Josh

1. Your use of patents is not the same as everyone’s use of patents. We have clients who are open source companies who get patents, and we have clients that are consumer products companies who get patents. Their uses are fundamentally different and are very industry specific. I recommend that you take a look at our article describing how different industries use patents differently (and what happens when people don’t understand this). https://ipwatchdog.com/2019/03/07/when-strategies-collide-freedom-to-operate-vs-freedom-of-action/id=107084/

2. Using the term “fake patents” brings the entire patent system into disrepute. You have no knowledge of the specific technology areas and you choose to use that language without any basis. Have you reviewed any patents that are for sale?

I would have hoped that you would be more of a champion for the system especially now that you’ve won. (BTW, congratulations on your balloon fight win. I saw you speak in Silicon Valley and it’s a great story. It’s the kind of story I tell my start-up clients because the little guy can win.)

One final thought is it that the promise of the exclusivity is “fake” or are the expectations misaligned? As an example, you won and won big. But it was hard, really hard. There is no way I have seen to properly prepare a client for a patent fight if they have never been in one. Now, think about it from the infringers’ side. You took the infringers out of business (for your invention), even though they were wrong, why would they not fight to the death? How hard would you fight to stay in business if the alternative was simply to pack up the business?

Exclusivity has never been easy. The problem is setting expectations properly.

Kent

angry dude

May 17, 2019 09:35 amJosh Malone@4

I feel your pain, dude

With your stuff (Bunch-of-Balloons) you have no other choice but patenting, manufacturing, selling AND litigating to death (or just go fishing) – its all out there for everybody to replicate instantly once they see it

With my stuff however (embedded software) there are copyrights and trade secrets – no one can replicate what I do – and even if they do the cost of reverse-engineering will be well into 6 or even 7 figures – so its cheaper to buy

But I was duped years ago (including by some of the same dudes posting on this blog) into believing that US Patent can protect valuable algorithm and have some value on its own – without manufacturing (in China) /distribution (in US) hassle

And it did for a while, until they turned the deck upside down

Sick

Josh Malone

May 16, 2019 05:51 pmAngry Dude, your costs are a digit shy.

But it did get me to thinking. These bundles of fake patents are valuable only because they create a plausible cause of action and can inflict 6 figures of litigation expense on their target. Even if they get thrown out on a motion to dismiss, the target will have to spend $100K. So the that is where these junk patents get their value – nothing at all to do with the fraudulent promise of exclusive rights printed on their face.

This is sick. I am starting to think these traders are to blame as much as the infringers for destroying the integrity of the patent system.

angry dude

May 16, 2019 02:51 pmDo you guys realize that with the cost of a single IPR well into 6 figures and any district court patent litigation well into 7 figures those asking prices per patent you cite are a sign of complete collapse of the US Patent system ?

Congrats

Josh Malone

May 16, 2019 11:33 amI will have a 10-pack please. Will the seller warrant that the purchaser has the “right to exclude others from making, using, offering for sale, or selling the invention throughout the United States”?

Shameful. Scam.

Josh Malone

May 16, 2019 11:20 amIs this a joke? People are trading stacks of fake patents? Charles Ponzi and Bernie Madoff would be impressed.