“The mobile phone as we know it isn’t even a teenager, but we already see flattening of patent trends across most industries who support the technology.”

This is the twelfth in a 13-part series of articles authored by Kilpatrick Townsend that IPWatchdog will be publishing over the coming weeks. The series will examine industry-specific patent trends across 12 key patent-intensive industries.

Yesterday, we discussed patenting trends in the cleantech industry. Today, we turn to the mobile phone industry, which has matured with fewer reasons for frequent consumer upgrades while standards drive toward better efficiency and data rates to find even more uses for the platforms.

Yesterday, we discussed patenting trends in the cleantech industry. Today, we turn to the mobile phone industry, which has matured with fewer reasons for frequent consumer upgrades while standards drive toward better efficiency and data rates to find even more uses for the platforms.

To quickly summarize this series:

- The goal of the research was to characterize recent patenting trends and statistics for each of twelve industries (and technology clusters within those industries) to inform applicants’ filing decisions of tomorrow.

- The study was conducted at an industry level (not at an art-unit or class level). This was achieved by designing and implementing various queries and iteratively manually reviewing a large number of search results to refine the queries.

- The study is further unique in that we used proprietary data from recent years and data-science techniques to estimate statistics for recent time periods (which would otherwise have poor data as a result of the non-publication time window).

The mobile phone industry has exploded over the last decade with nearly all U.S. consumers owning a smart phone. Additionally, many Internet of Things (IoT) devices have gained cellular modems, along with modern heavy equipment having a data connection for telemetry. The wireless standards have innovation that comes in waves, with 3G and 4G/LTE reaching maturation, while 5G has a solid upward trend. The supply chain for mobile phone manufacture has largely moved overseas and many brands have disappeared or moved overseas. Even though the two mobile operating systems are just over a decade old, we are seeing the pace of software innovation plateau with a couple million apps in the respective platform stores. The ubiquity of cellular data will bring the underlying technology to many different industries in the years to come, as the maturity of the industry allows the focus to move away from the platform itself.

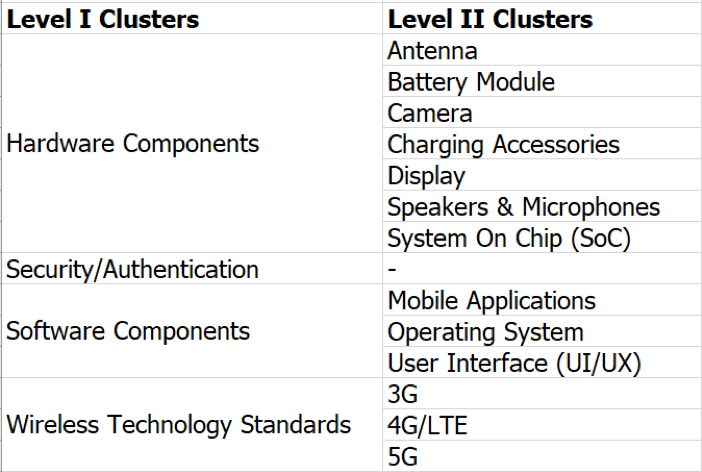

Our study broke down the window of mobile phone patents in a number of clusters, dissecting the hardware components, security and authentication, software components and wireless standards. Each of those level one clusters was further divided into subcategories so we could track those trends too. We determined whether the patent application pertained to one or more of the categories shown in the topology below. If so, the application was appropriately tagged, such that it could be included in one or more category-specific data subsets for subsequent analysis.

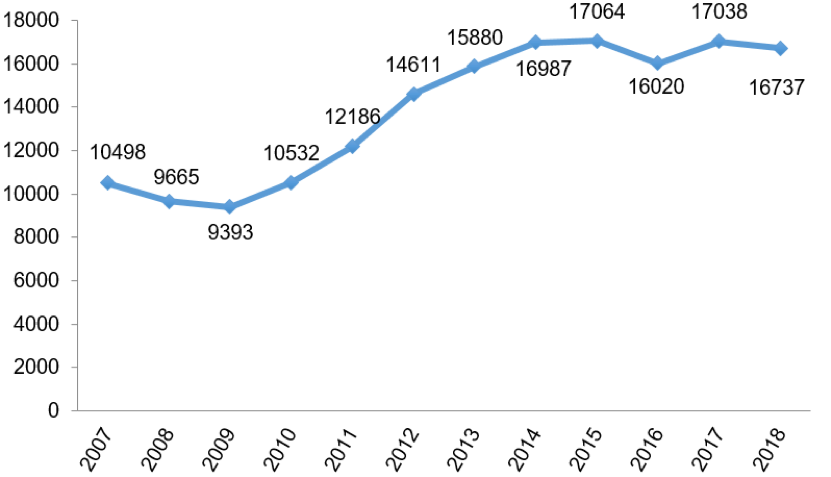

Our study filtered down the patents published at the USPTO to those related to mobile phones. There is a downtrend going into the Great Recession, but then significant growth before plateauing about five years ago, as shown in Figure 2A. Still, the pace of patent filing has increased 70% in the decade. With the supply chain moving overseas, along with some of the brands disappearing or moving while the software matures, the industry is not seeing gains in patent filings.

Figure 2A

The top-level cluster trends are shown in Figure 2B, with all having similar trend profiles. The amplitude of the trend was greatest in hardware components, followed by wireless technology standards, software components, and security/authentication. The standards race keeps evolving along with the competitive pressure to add features, but in the last half of the study we find the pace of patent filings falling in the software and security/authentication areas, perhaps due to difficulty getting software patents allowed at the USPTO.

Figure 2B

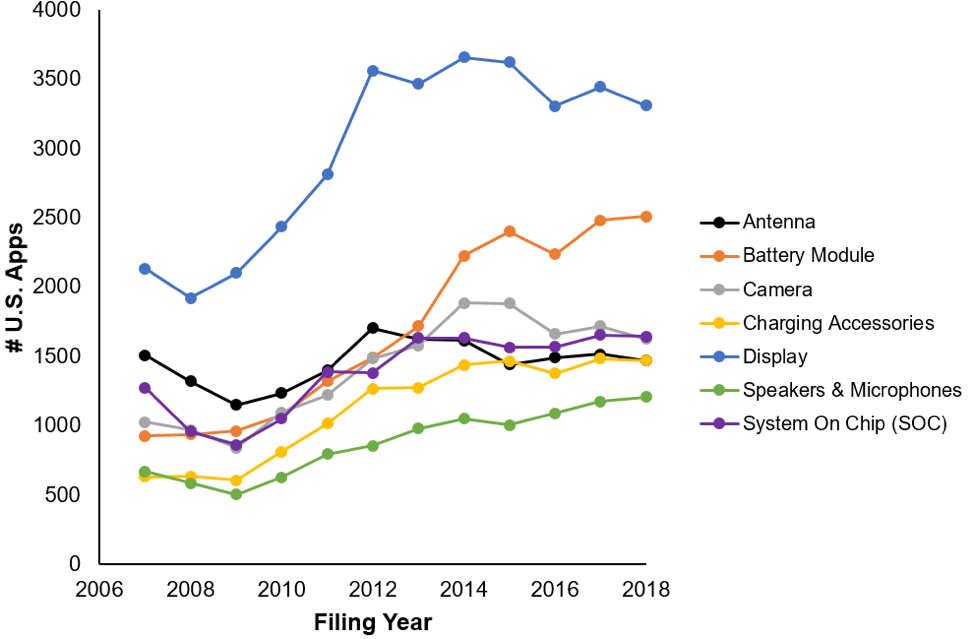

The various hardware components are broken down in Figure 2C. The largest growth over the decade of 75% was seen by display technology before plateauing along with camera, charging accessories, System on Chip (SOC), and antenna clusters. Speakers and microphones along with battery modules still have patent growth trends. We may be starting to see a downward trend in display, camera and antenna patenting developing.

Figure 2C

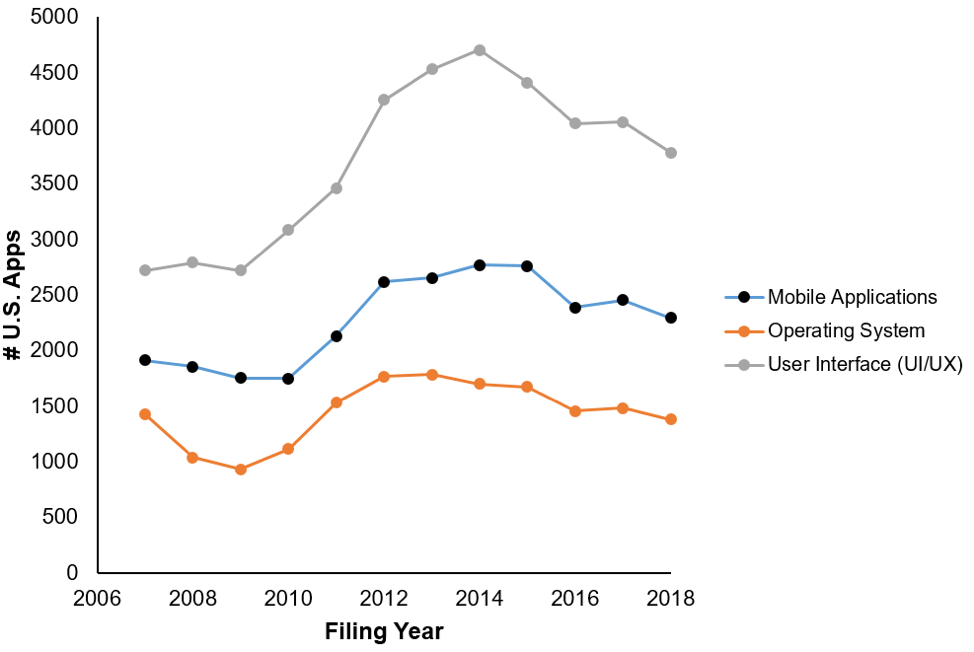

We broke down software into mobile applications, operating system (OS) and user interface (UI) in Figure 2D. Over the decade, UI has seen the most innovation, as we saw the major iOS and Android platforms take over from OS platforms that have now become extinct. All three sub-clusters have a falling trend over the last few years that is expected to continue with maturity of the software stack.

Figure 2D

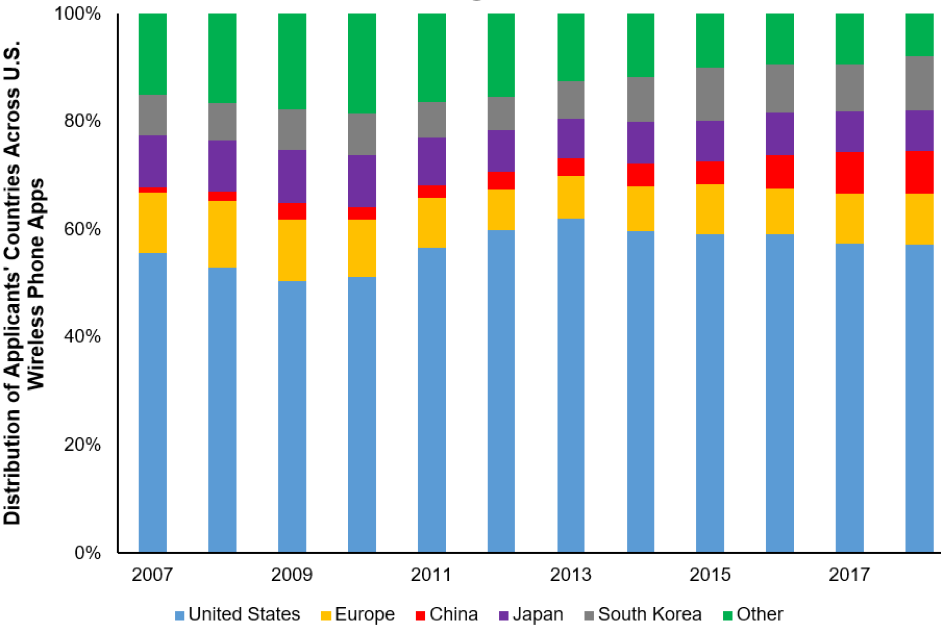

The proportion of U.S. patents pursued by domestic companies in the mobile phone area has averaged around 55% over the decade, as shown in Figure 3. In this technology cluster, the Great Recession seems to have decreased the proportion of U.S. filings with foreign companies not experiencing the same difficulty in this space. As the industry moves overseas, the U.S. stake in patent filings has been in a falling trend over the last five years that is likely to continue. China has seen tenfold growth in U.S. patent filings, largely capturing the domestic share of the patent filings for this market.

Figure 3

Mobile phone technology is an integral part of the consumer economy today. Our phones have become an extension of who we are, while replacing home phones, cameras, wallets, paper calendars, and personal organizers. The two predominant OSes are only reaching their teenage years, but the software is maturing along with many of the hardware components. Standards are introduced with a growing trend of patents that begins to fall as a new standard takes over due to increasing efficiency and data rates. Mobile phones are seeing the power of globalization with unit sales increasing as the technology standardizes and becomes ubiquitous. The plateauing or shrinking trends in many areas signal fierce competition and consolidation for those industries but expansion into adjacent verticals should provide overall market growth.

A copy of the full published study is available with additional detail here.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

3 comments so far.

Paul Morinville

May 18, 2019 10:59 pmPretty strong drop since the PTAB results became clear in 2013 Alice hit in 2014. It would be interesting to see if other countries have a similar drop.

Anon

May 17, 2019 09:13 amI wonder what the pictures would look like if the data were “adjusted” with a type of post-grant repudiation correction factor….

In other words, for each of the items in the overall (excellent) series or articles, survey the post grant terrain (Article III and non-Article III) and adjust the numbers to reflect what may be deemed to be viable patent trends.

As we see with 101 protocols (and not just software – see Cleveland Clinic), just because something gets out of the Office, does not mean that one has a viable patent.

Anon

May 17, 2019 09:09 amWhen compared to a “hardware bellwether,” I am surprised that the “difficult” zones are as high as they are.