“Building materials underpin a large part of our economy, with the hub of innovation being in Texas.”

This is the last in a 13-part series of articles authored by Kilpatrick Townsend. The series examined industry-specific patent trends across 12 key patent-intensive industries.

In this 13-part series, we introduced our patent trends study (performed in a collaboration between Kilpatrick Townsend and GreyB Services) and provided high-level data across 12 industries. To quickly summarize:

- The goal of the research was to characterize recent patenting trends and statistics for each of twelve industries (and technology clusters within those industries) to inform applicants’ filing decisions of tomorrow.

- The study was conducted at an industry level (not at an art-unit or class level). This was achieved by designing and implementing various queries and iteratively manually reviewing a large number of search results to refine the queries.

- The study is further unique in that we used proprietary data from recent years and data-science techniques to estimate statistics for recent time periods (which would otherwise have poor data as a result of the non-publication time window).

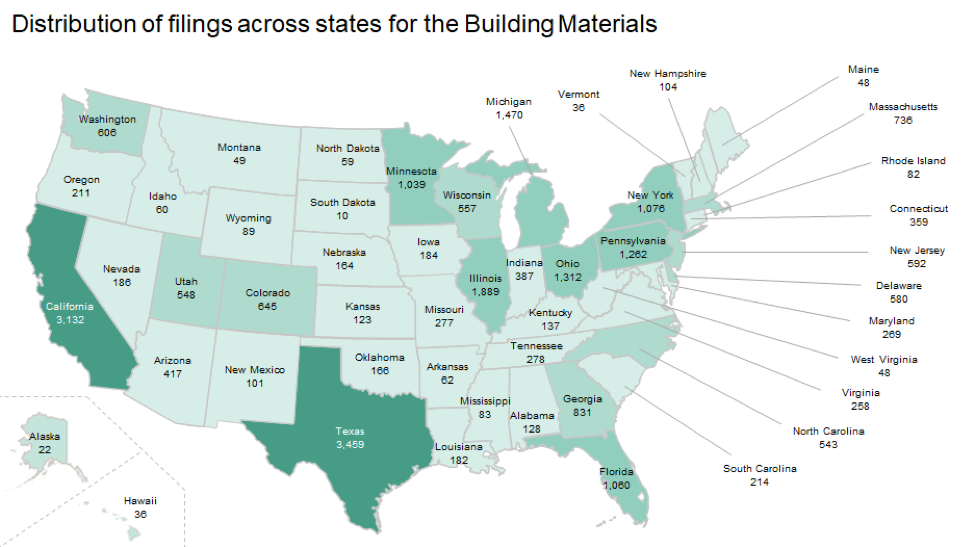

Today’s article pertains to the Building Materials industry and its enabling technology. Innovation in this space is motivated by more than just buildings, but also hydrocarbon production and aerospace applications. For example, deep sea concrete encasements and insulation for space modules are inventions that have far broader applications. California dominated the patent filings in every patent cluster of the study except Building Materials, where Texas has the most filings. This tech cluster is pushing the envelope for cutting-edge applications that will find their way into such things as green or smart building materials over time so that all consumers benefit.

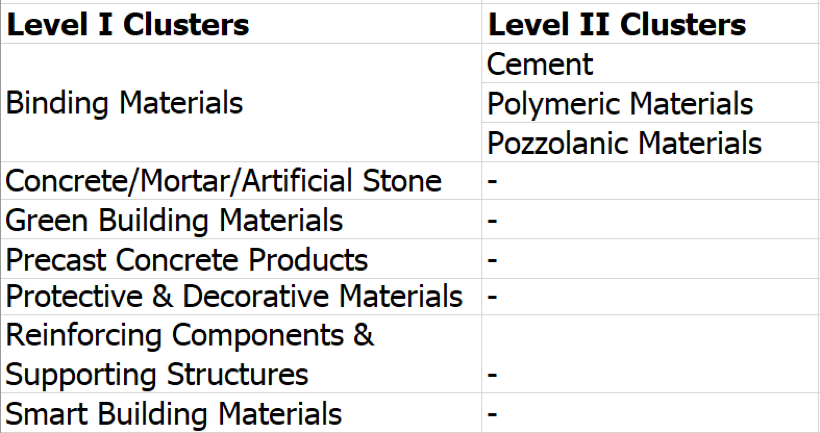

Our study not only identified a set of patent applications that pertained to Building Materials, but also—for each application in this set—we determined whether the application pertained to one or more of the categories shown in the topology below. If so, the application was appropriately tagged, such that it could be included in one or more category-specific data subsets for subsequent analysis. The top-level clusters include binding materials, concrete / motor / artificial stone, green building materials, precast concrete products, protective & decorative materials, reinforcing components & supporting structures, and smart building materials. The binding materials cluster was further broken down into sub-clusters for cement, polymeric materials, and pozzolanic materials.

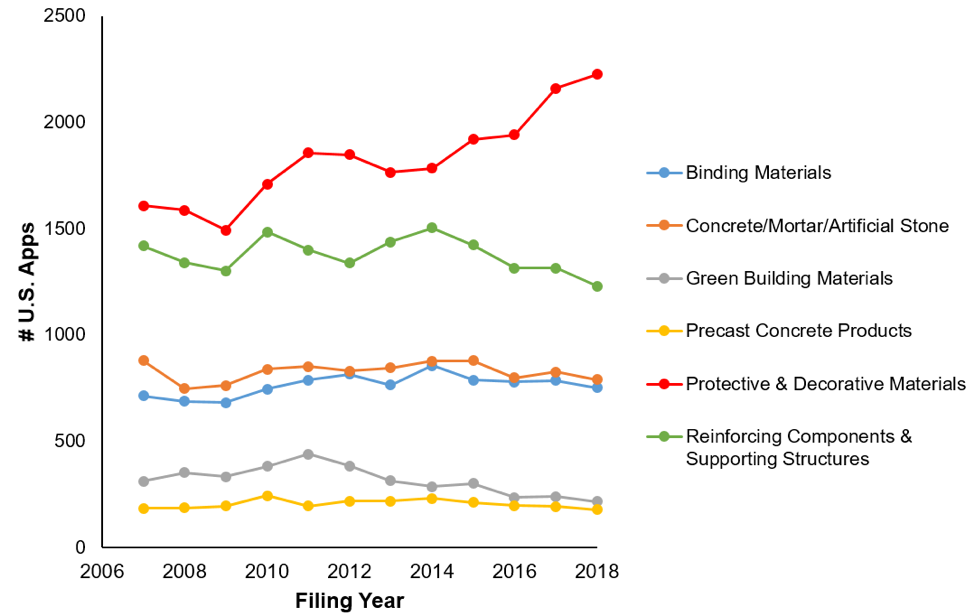

The top-level clusters are shown in Figure 1 where most of the filings and growth are in the protective and decorative materials. The other clusters had flat filing trends with slight growth in the binding materials area.

Figure 1

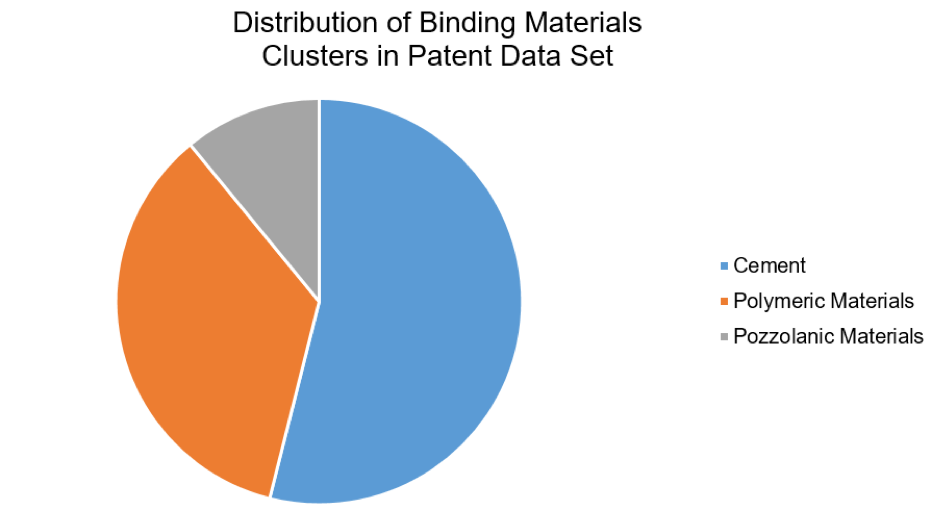

A breakdown of the binding materials cluster is shown in Figure 2 over the decade of the study. Cement makes up 54% of the total and polymeric materials having a 35% share with pozzolanic materials being the smallest area of innovation.

Figure 2

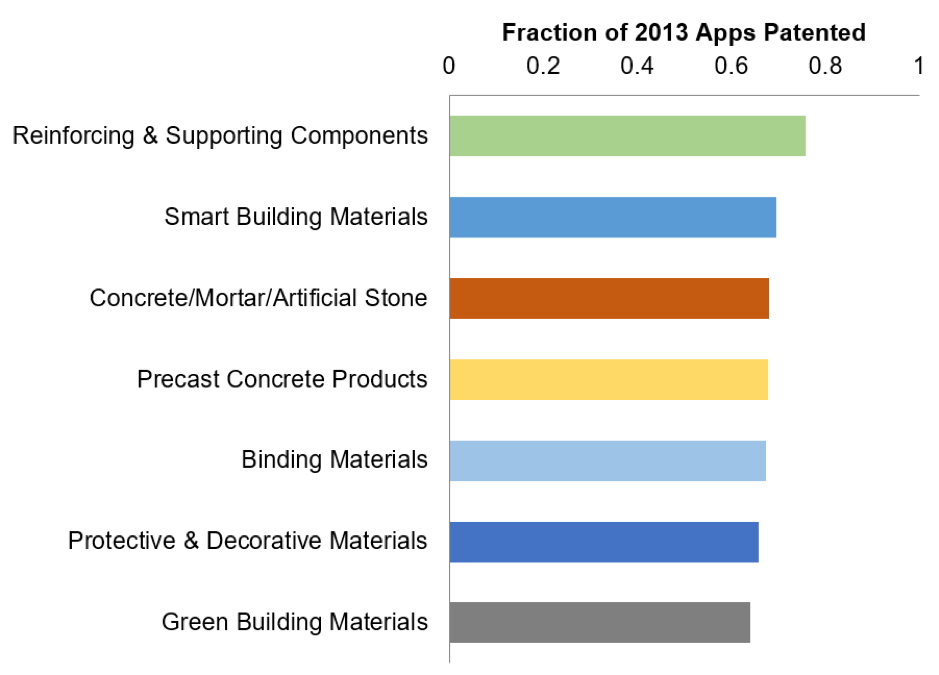

Allowance rates are shown in Figure 3 for the various top-level clusters. Most areas are in line with USPTO averages. Reinforcing and supporting components had the best chance at allowance, with 76% of patents being awarded.

Figure 3

Figure 3 shows the total filings for building materials across the study period. In each other industry cluster studied, the population-heavy California has dominated the map except for this cluster. Texas has vibrant hydrocarbon production and aerospace technology clusters that are large contributors to innovation in this tech cluster. Space applications and oil production have particularly challenging construction requirements that make innovation highly protectable and valued.

Figure 4

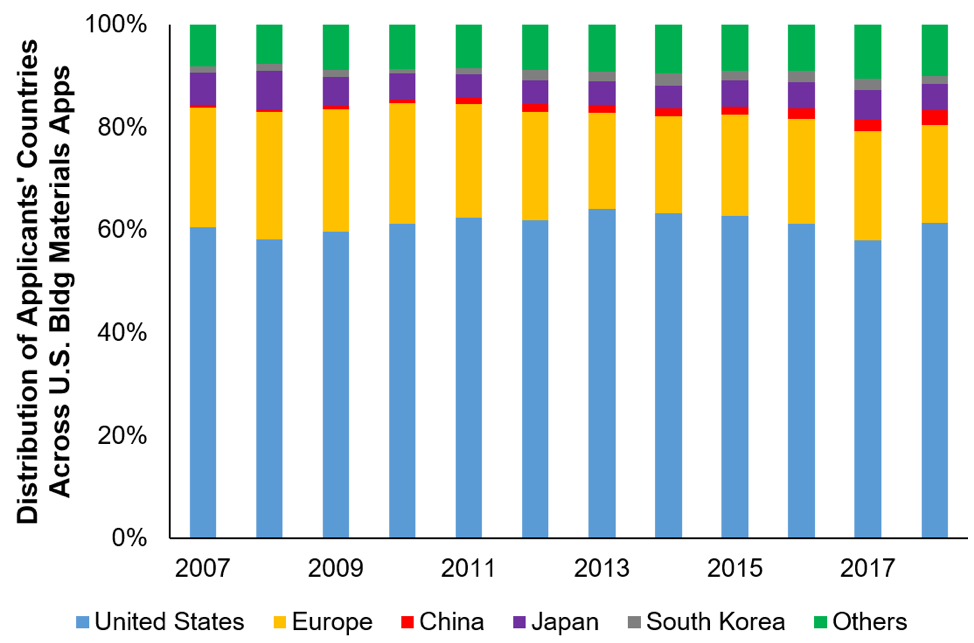

U.S. enterprise files about 60% of patent applications, as shown in Figure 5. As we have seen in other industries, China’s filings increasing five-fold over the period of the study. Japan’s filings decreased over the decade, which is a trend seen in other areas of the study.

Figure 5

Building materials innovation is crucial for many different industries. Technology may be developed initially for a space application but find its way into our homes a few years later. Texas is the innovation hub for this industry, but the entire country is innovating too. All businesses have some stake in the building materials area if for no other reason than their physical space being more efficient. With construction being such a large part of our gross domestic product, improved building materials underpin a substantial part of our economy.

A copy of the full published study is available with additional detail here.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

American Cowboy

May 28, 2019 10:19 amThank you to Kilpatrick Townsend & Stockton LLP for generating this report and for sharing it.