“Importantly, the ‘768 patent is indistinguishable from a mechanical tool,” Trading Technologies told the Federal Circuit. “The consequences of such an invention not even being eligible for patent consideration are terrible and far-reaching. Logically, this would result in mechanical tools such as surgical devices not being eligible for patent protection.”

On July 31, Trading Technologies, a firm that develops software used for electronically trading derivatives, filed a combined petition for panel rehearing and rehearing en banc at the U.S. Court of Appeals for the Federal Circuit. The appellant is seeking review of the Federal Circuit’s earlier decision this May in Trading Technologies International v. IBG LLC (IBG IV), which confirmed the results of four covered business method (CBM) review proceedings at the Patent Trial and Appeal Board (PTAB) that invalidated patent claims owned by Trading Technologies as unpatentable under Section 101 of the patent law. In doing so, Trading Technologies argues that the Federal Circuit panel failed to follow both U.S. Supreme Court and Federal Circuit precedent, as well as previous Federal Circuit decisions upholding the validity of other Trading Technologies patents that share a specification with one of the invalidated patents.

On July 31, Trading Technologies, a firm that develops software used for electronically trading derivatives, filed a combined petition for panel rehearing and rehearing en banc at the U.S. Court of Appeals for the Federal Circuit. The appellant is seeking review of the Federal Circuit’s earlier decision this May in Trading Technologies International v. IBG LLC (IBG IV), which confirmed the results of four covered business method (CBM) review proceedings at the Patent Trial and Appeal Board (PTAB) that invalidated patent claims owned by Trading Technologies as unpatentable under Section 101 of the patent law. In doing so, Trading Technologies argues that the Federal Circuit panel failed to follow both U.S. Supreme Court and Federal Circuit precedent, as well as previous Federal Circuit decisions upholding the validity of other Trading Technologies patents that share a specification with one of the invalidated patents.

In the decision handed down this May, the Federal Circuit panel of Circuit Judges Todd Hughes, Haldane Robert Mayer and Richard Linn affirmed the Section 101 invalidity of four Trading Technologies patents following CBM review. In affirming the PTAB’s invalidation of claims from these patents, the Federal Circuit applied reasoning from its own decisions this April of previous appeals involving Trading Technologies and IBG. The Federal Circuit found that the patents-at-issue weren’t distinguishable from those invalidated in the earlier decisions as they focus “on improving the trader, not the functioning of the computer.” The petition for rehearing argues that claims of U.S. Patent No. 7693768, Click Based Trading With Intuitive Grid Display of Market Depth, are analogous to claims for a mechanical tool which, by definition, are patent-eligible under Section 101.

The Ladder Tool Solves Technical Problems by Improving Underlying Technology

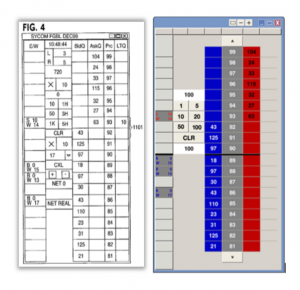

In the petition for rehearing, Trading Technologies argues that the ladder tool covered by the patent claims of the ‘768 patent is a structured technological tool providing a solution to technological problems. Conventional order-entry screen interfaces used by derivatives traders prior to the invention of the ladder tool presented technical issues with accuracy in that price levels associated with order-entry locations changed unpredictably based on market changes. This caused order messages to be sent with incorrect price parameters, an issue that could be quite material for larger orders.

The Ladder Tool

The ladder tool covered by the patent claims-at-issue isn’t merely a conventional presentation of data, Trading Technologies argues, but a graphical user interface (GUI) tool composed of structural elements which are substantively no different than mechanical structural elements. These structural elements, when combined, provide a more efficient and accurate tool for placing and cancelling orders on an electronic exchange as well as improved visualization by showing rising and falling market action along a vertical axis. Claims of the ‘768 patent protect a method of displaying market information that facilitates trading of a commodity on an electronic exchange which involves the display of order quantities at various bid and ask prices along a price axis for a single commodity. The combination of the price axis and claimed fixed order entry locations along the price axis enables the entry of orders at particular price points without the risks posed by entering orders in a screen of the sort shown in Figure 2 of the patent. Unlike other software innovations that are controversial for simply automating processes which had previously been done manually, the claimed ladder tool had no analog version and didn’t exist in any form prior to the invention.

Federal Circuit Issues Conflicting Decisions on Ladder Tool Patents

Along with objective evidence of the technical benefits of the ladder tool and the rigorous examination of patent applications in one of the U.S. Patent and Trademark Office’s toughest art units, Trading Technologies notes that the Federal Circuit has previously upheld the validity of challenged patents from the same family as the ‘768 patent which share a common specification. This includes the two parent patents to the ‘768 patent: U.S. Patent No. 6766304 and U.S. Patent No. 6772132, both patents having the same title as the ‘768 patent. The Federal Circuit found both patents (and other related patents with similar claims and sharing the same specification — U.S. Patents No. 7676411 and U.S. Patent No. 7813996) to be technological inventions “under any reasonable meaning of the term” in IBG LLC v. Trading Technologies International (IBG I) decided this February, and affirmed the validity of both patents under Section 101 in Trading Technologies International v. CQG, Inc. decided in January 2017. In CQG, the Federal Circuit found that the claims “solve problems of prior [GUI] devices” and “require a specific, structured [GUI] paired with a prescribed functionality directly related to the [GUI]’s structure that is addressed to and resolves a specifically identified problem in the prior state of the art.” Then, in IBG I, the Federal Circuit vacated the PTAB’s decision to institute CBM review on the ‘304 and ‘132 patents “because the patents at issue are for technological inventions and thus were not properly subject to CBM review.”

For Section 101 and CBM purposes, Trading Technologies argues that claims of the ‘304 and ‘132 patents are indistinguishable from the ‘768 patent and another related patent recently invalidated by the Federal Circuit, U.S. Patent No. 7725382. While the literal scope of the independent claims of each patent may differ slightly, all are directed to aspects of the ladder tool which address classic technical problems.

Importantly, the ‘768 patent is indistinguishable from a mechanical tool. The consequences of such an invention not even being eligible for patent consideration are terrible and far-reaching. Logically, this would result in mechanical tools such as surgical devices not being eligible for patent protection… It is inconceivable that a claim directed to the construction of a mechanical tool (e.g., a screw driver) can be found ineligible. There can be no dispute that neither a mechanical compass or artificial horizon element on an airplane is abstract.

“Improve the User” Argument is Baseless and Alice is Inapposite

The Trading Technologies petition further pushes back against the Federal Circuit’s holding that the patented technology improves the user and not the underlying computer as a faulty premise. In a different context, an improved mechanical or GUI tool used by a surgeon to save a patient’s life shouldn’t be declared abstract because it improves the surgeon, and any argument in that direction would be “utterly baseless.” The ladder tool improves the functioning of a computer to provide technical benefits to a user in the same way that any invention worth anything would provide downstream benefits to a user. Thus, the “improve the user” argument is “clearly inapposite and a red herring,” Trading Technologies contends.

Finally, Trading Technologies argues that, under the correct legal standard stemming from Supreme Court precedent, the ladder tool invention is clearly eligible for patent protection. In Diamond v. Chakrabarty (1980), SCOTUS addressed the patentability of inventions built upon the platform of recombinant DNA, holding that biotechnological inventions are patent-eligible when manmade and “not nature’s handiwork.” In much the same way, Trading Technologies states that the ladder tool is “a manmade interactive tool that is different-in-kind from a computer-implemented business method,” thus rendering Alice Corp. v. CLS Bank International (2014) as inapplicable for determining Section 101 validity.

Interested parties who want to file amicus briefs on Trading Technologies’ petition for rehearing have until August 14 to do so. While the related ‘382 patent is not the subject of this particular petition, its mention here indicates that another rehearing petition related to that patent might also be filed in the near future.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

3 comments so far.

anonymous

August 23, 2019 04:48 pmAny amicus briefs filed? Please update if/when Fed Cir hears the case en banc.

JTS

August 8, 2019 01:21 pmWe need 101 reform. Yesterday.

Charles L Mauro

August 8, 2019 08:46 amSteve: interesting piece. I actually conducted some of the original human factors research on the ladder design and I can say with total confidence that the design is a new and vastly superior form of executing a very specific type of task. It is in fact a totally new tool. The fact that FC thinks it unpatentable can only lead to a massive problem for the protection of high-performance GUI innovations.