“While last year’s decline in IPR filings has hit many IPR leaders, our recruitment data shows that firms still believe in the importance of PTAB/IPR practice and are looking to gain market share. The strategy is to grow the practice even if the IPR total market declines for a couple of years because of the decline in patent litigation.”

This article was updated at 6:20 PM on March 10 to reflect changes made by the author.

There was a sharp decline in the number of inter partes review (IPR) petitions filed last year; in 2019, a total of 1,271 IPR petitions were filed, compared to 1,607 IPR petitions in 2018. This represents a decline of 21%. Patent litigation has been falling from its peaks in 2015 and, as IPR filings closely follow the U.S. district court trends, with a lag of 12 to 18 months, this decline in IPRs was expected.

Taking a closer look at the most active IPR firms, the following firms lost or gained significant market share as the broader IPR market declined in 2019.

While there are different ways to look at this, we chose to compare the absolute change instead of the percentage of change, as smaller players with, for example, a single case in 2018, can grow 100% by adding one new case in 2019. We also looked at the total IPR activity for the firms as they represented either the petitioners and patent owners in 2018 or 2019.

Understanding IPR Decline

The following chart shows the five firms with the largest decline in the number of IPR cases from 2018 to 2019.

Analyzing the clients of these firms reveal that the larger number of cases in 2018 might have partially been related to a number of battles between a few large corporations in 2017 and 2018.

For example, Fish & Richardson, which is among the most active IPR firms, saw the largest decline but still represented its clients in more than 100 IPR cases in 2019. In 2018, Fish represented Apple in about 50 IPRs (i.e, against Qualcomm) and Samsung in about 25. This dropped to 14 and 6, respectively in 2019.

Jones Day also saw a similar drop. The firm saw a big rise in 2018 for representing Qualcomm in about 40 IPR cases, which went away in 2019. Sterne Kessler represented TaylorMade Golf in about 20 cases and Align Technology in about 17 cases in 2018, but the volume for the two companies dropped to almost zero in 2019.

Latham & Watkins and Weil Gotshal might have experienced a general decline in 2019 due to the market decline, as both firms did not seem to have significant work from a single client in either 2018 or 2019.

Firms That Saw Growth

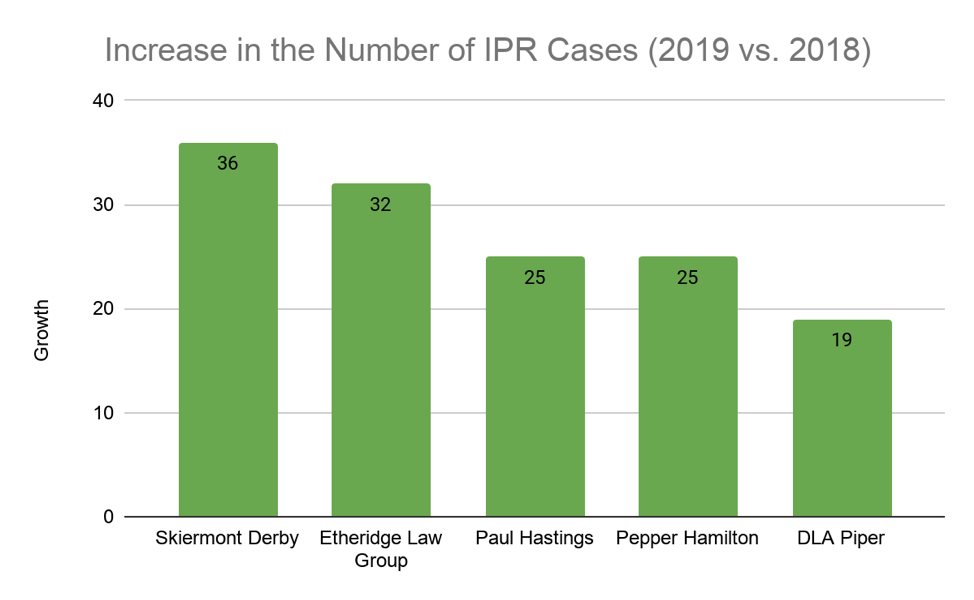

While the broader market was declining, some firms were able to grow and gain market share in 2019. The following chart shows the five firms with the largest increase in the number of IPR cases from 2018 to 2019.

We took a closer look at each firm to see if the rise was related to a single client. Skiermont Derby, for example, continued representing IPA Technologies in about 20 IPR matters in 2019, which contributed to its market share gain.

We took a closer look at each firm to see if the rise was related to a single client. Skiermont Derby, for example, continued representing IPA Technologies in about 20 IPR matters in 2019, which contributed to its market share gain.

Almost all the gain for Etheridge Law Group came from a single client. The firm represented Uniloc in about 63 cases in 2019.

Paul Hastings also benefited from two of its top clients: Google and Samsung. For example, in 2019, the firm represented Google in about 30 IPR matters.

Pepper Hamilton, which lost some of its PTAB stars (Tom Engellenner, Reza Mollaaghababa and Andrew Schultz joined Nelson Mullins in early 2019), was able to regain some momentum as the firm represented Tela Innovation and Cornell Research Foundation.

DLA Piper also gained more market share as the firm represented several companies in multiple IPRs in 2019: Motorola, Apple, Trend Micro Incorporated, and CallMiner.

The following table summarizes the activity of the top five with the largest growth and decline in IPR activity from 2018 to 2019.

A Temporary Downslide

While last year’s decline in IPR filings has hit many IPR leaders, our recruitment data shows that firms still believe in the importance of PTAB/IPR practice and are looking to gain market share. The strategy is to grow the practice even if the IPR total market declines for a couple of years because of the decline in patent litigation.For example, last October, Haynes & Boone, which already had a very strong PTAB practice, doubled down on their PTAB growth strategy by bringing on Eugene Goryunov who was the go-to partner at Kirkland & Ellis for IPR matters. Goryunov represented many of Kirkland’s IPR clients before the PTAB. With his addition, we expect to see further growth for Haynes & Boone’s PTAB practice.

Several other firms have been adding IPR partners. Brent Babcock joined Womble Bond in the Irvine office to grow their PTAB practice, while Bridget Smith joined Lowenstein & Weatherwax, which already was a major player among PTAB firms. Both partners left Knobbe Martens.

Disclaimer: The data for this study was obtained from public sources such as USPTO, PTAB, and PACER. Patexia has gone to great lengths to provide valid and accurate analysis based on this data. However, Patexia does not guarantee 100 percent accuracy nor take any responsibility for possible losses caused by the use of information provided in this study. Specifically, some numbers for law firms related to cases filed late in 2019 may still be inaccurate as it may take a while before an attorney or a law firm is assigned to a case.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

8 comments so far.

Night Writer

March 11, 2020 01:27 pmBe interesting to see this same info for patent litigation.

Anon

March 11, 2020 07:56 amGeneral litigation and IPR are not equivalent for the reasons already provided.

angry dude

March 11, 2020 06:37 amSomeone has to put a stop to this racketeering activity called IPR(s) – especially serial IPRs

Unable to properly examine patents on the front end – kill the whole system

We do not need such patent system. Period.

To the morgue.

Pedram Sameni

March 10, 2020 11:41 pmAnon: It is definitely not one size fits all. Different firms may have different reasons and strategies. For example, Quinn Emanuel in the early years of IPR used to farm it out to other firms but later, Jim Glass took the lead and the firm started to handle IPR internally.

Patent litigation market has been shrinking. So one may make the same argument about lateral movements for patent litigators (it is a shrinking pie). While shrinking market size means less work for all, some firms have managed to grow or maintain their market share by having or bringing the right mix of talents. But that shrinking market means many other firms have less work and are struggling.

Anon

March 10, 2020 06:33 pmP.S.,

I agree with your reformulation, but have to wonder about the wisdom of chasing what may be high price talent even if one obtains a larger portion of a shrinking pie.

How much more market share would be necessary to just stay even on total billable?

In fact, it may be competitively advantageous to allow someone else to ‘take’ that high-priced talent off of your hands.

Pedram Sameni

March 10, 2020 05:19 pmAnon: Thanks for your note. You are correct and in fact, that line should be corrected as lateral movements should have no impact on the IPR market size. But it is an indication that law firms believe in the importance of IPR and are trying to gain market share by adding specialized IPR attorneys to their IP practice.

The market share may shrink if the litigation goes down but those with the right mix of IPR talents may still grow even if the total market is shrinking.

angry dude

March 10, 2020 02:16 pmIPR firms?

You mean racketeering outfits?

Thanks but no thanks

Not paying a dime myself

Not dealing with crooks

Anon

March 10, 2020 01:22 pmThank you for the shared data, but I have to seriously question what (if any) logic backs up a statement like:

“While last year’s decline in IPR filings has hit many IPR leaders, our recruitment data shows that firms are still looking to grow this practice area, suggesting that this drop may have been temporary.”

This is NOT an item in which growth is generated from ANY IPR firm and their respective recruitment data.

Drivers here are especially susceptible to the notion of “low hanging fruit.”

Further, and while this is ideal, one might bet that there be SOME type of feedback mechanism from the past histories of IPR’s into the front end portion of the USPTO, and that both better inputs and better examination would naturally dwindle the available pool of granted patents susceptible to be put into the IPR procedures.