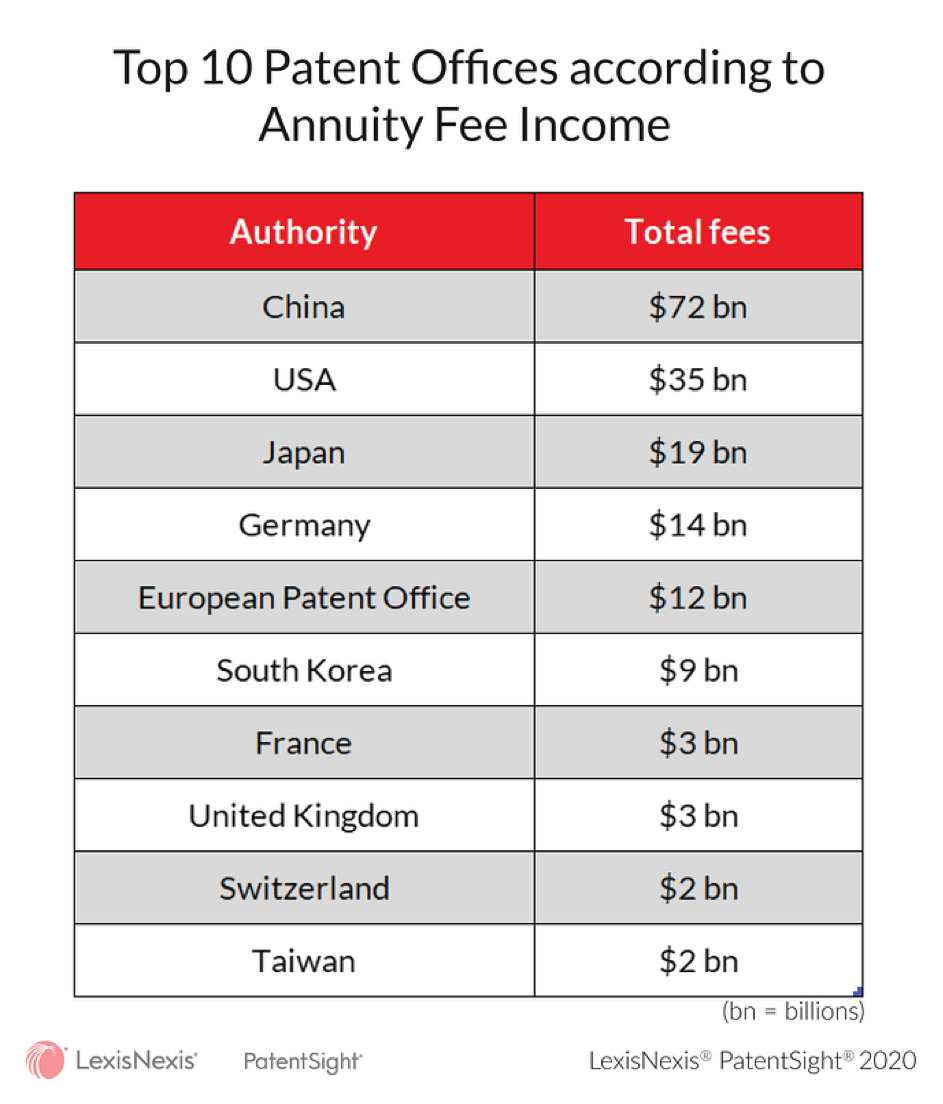

“Should all of the fees be paid on the currently active Chinese patents over their lifetimes, the National Intellectual Property Administration of the People’s Republic of China will bring in more than double the USPTO.”

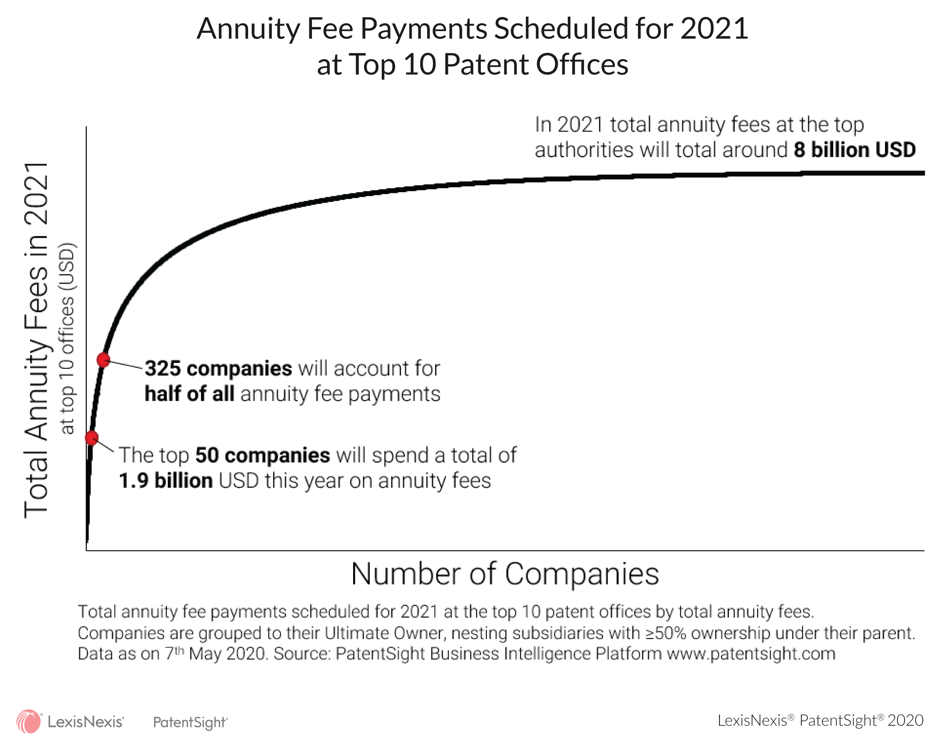

Around $8 billion is set to be spent this year on patent renewals at the top 10 patent offices. That total jumps to a staggering $184 billion due on all currently issued patents across the lifetime of those assets.

While some businesses that have significant licensing operations may have to double down on developing and managing their portfolios over the coming years, the vast majority of in-house functions that operate as cost centers might well find themselves coming under increased budgetary pressures should market conditions worsen.

Below is a breakdown of which IP offices are set to receive the most fees over the lifetime of current grants.

The data shows the extent to which the explosion in patenting in China in recent years has also handed a potentially huge payoff to the country’s IP agency. Should all of the fees be paid on the currently active Chinese patents over their lifetimes, then the National Intellectual Property Administration of the People’s Republic of China (CNIPA) will bring in more than double the U.S. Patent and Trademark Office (USPTO).

The top two patent offices, the USPTO and CNIPA, account for 50% of all fees, and if we take the top 10 patent offices, they account for 90%.

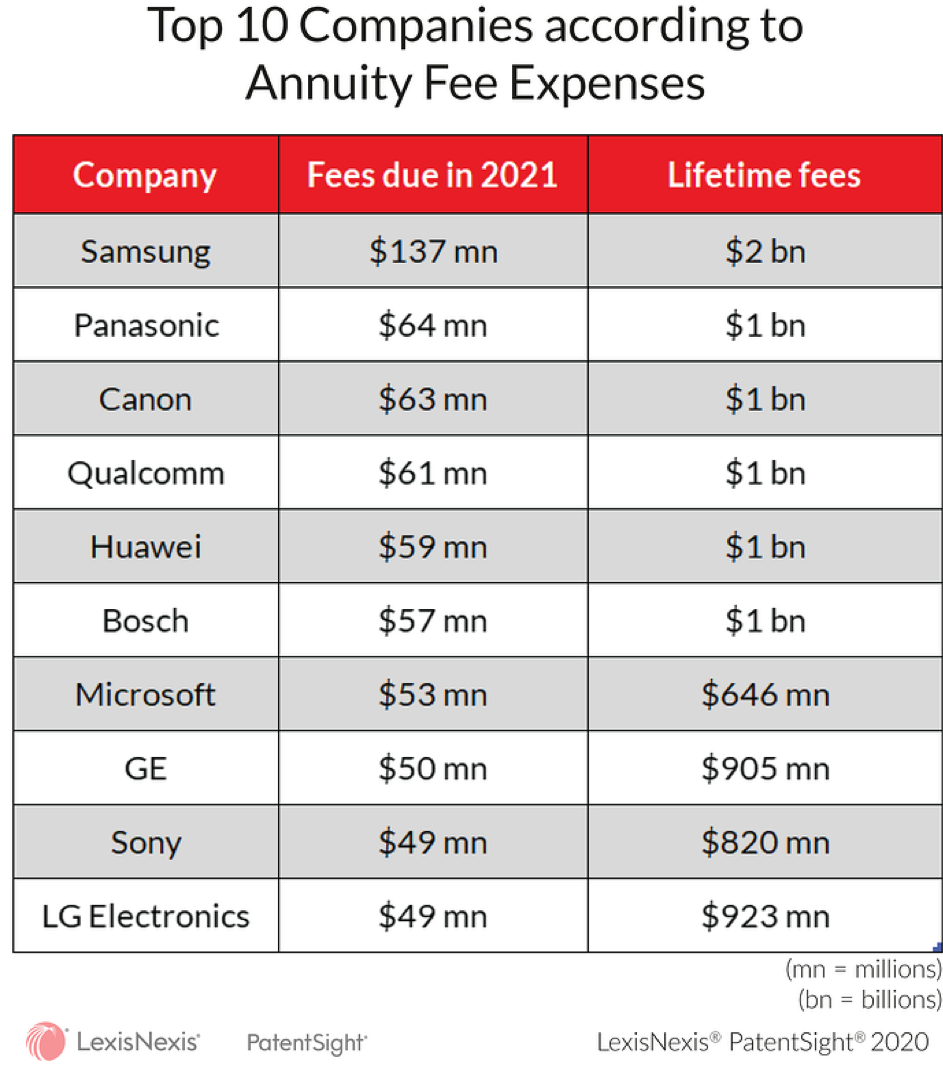

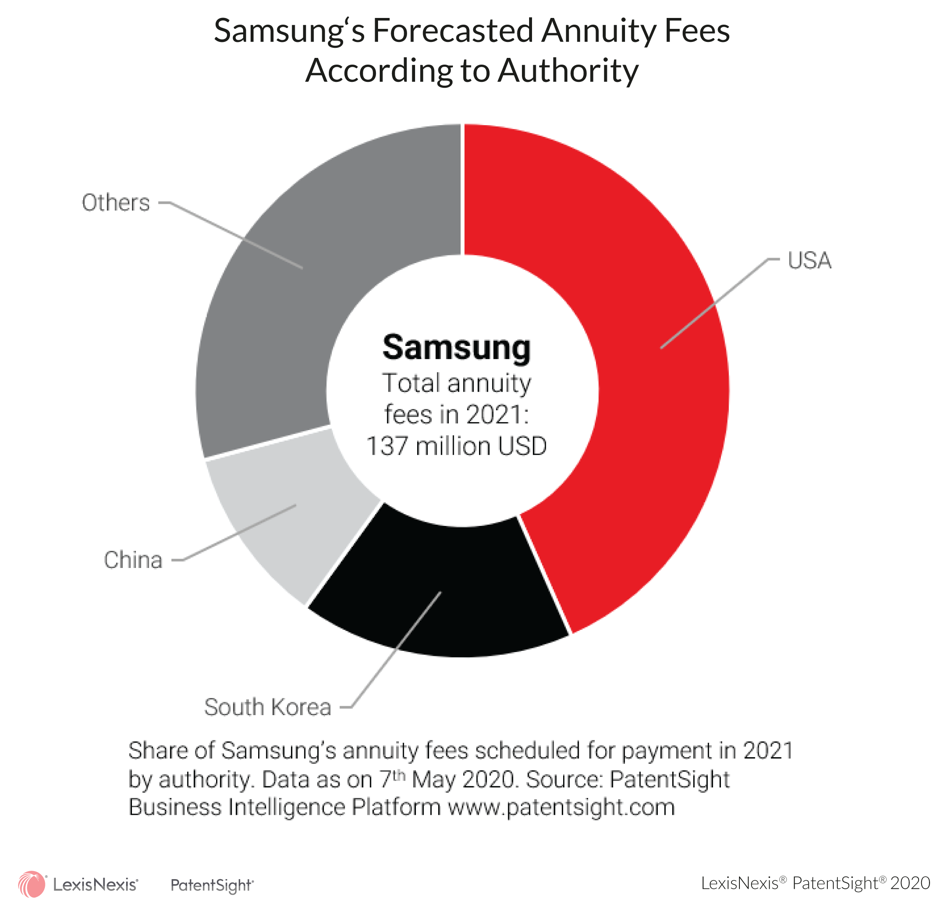

That concentration at the top of the market is also reflected in the companies that are facing the largest potential maintenance fee bills. The number of patent-holding entities globally runs into the seven-digit range; however, of these, 325 are responsible for 50% of all annuity fee payments. Of those, it’s Samsung that leads the way—by a wide margin.

Here are the top 10 companies ranked by the fees they’re set to pay this year, with additional data on how much they’re due to shell out over the lifetime of their current portfolios:

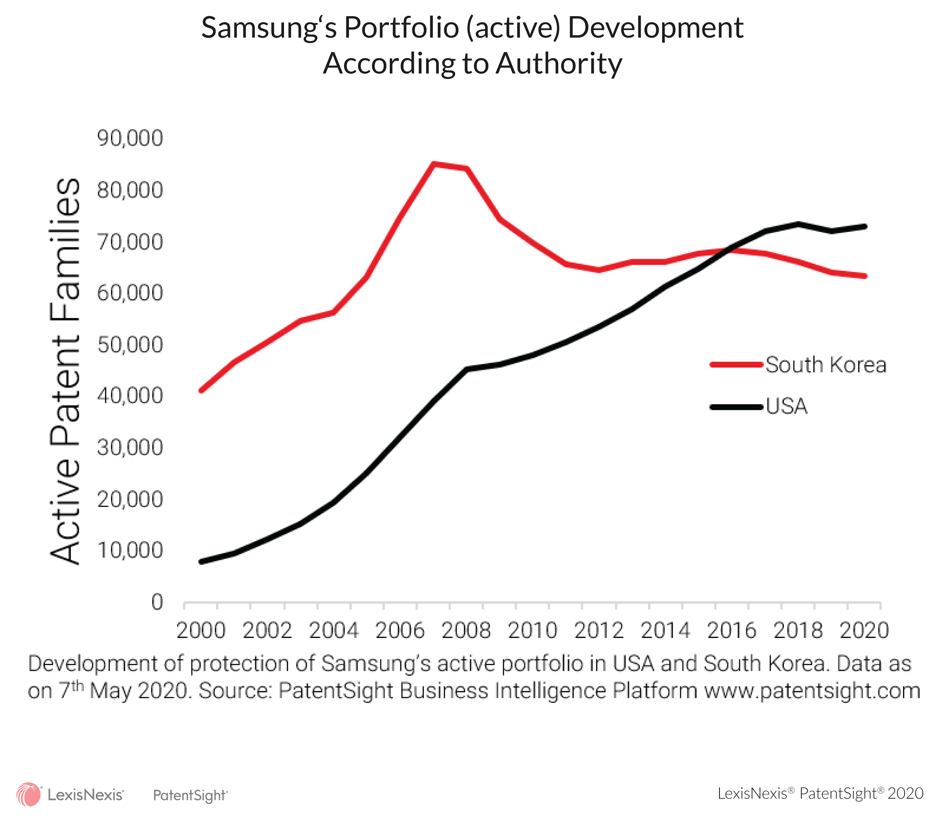

This concentration leads to an interesting dynamic in the global patent market. It creates a kind of symbiotic relationship between the top patent offices and the top patent owners, where the patent offices are reliant on the top set of owners, and the owners need to file at these offices. This is weighted on the side of those owners who are more reliant on specific patent offices, but this can change. Samsung for example, files and spends much more in the United States than in its home country of South Korea, but this has not always been the case. It has only been since 2016 that Samsung’s U.S. portfolio has been larger than its portfolio of South Korean patents, so while companies are often dependent on a set of patent offices, there can still be significant movement between them.

This concentration leads to an interesting dynamic in the global patent market. It creates a kind of symbiotic relationship between the top patent offices and the top patent owners, where the patent offices are reliant on the top set of owners, and the owners need to file at these offices. This is weighted on the side of those owners who are more reliant on specific patent offices, but this can change. Samsung for example, files and spends much more in the United States than in its home country of South Korea, but this has not always been the case. It has only been since 2016 that Samsung’s U.S. portfolio has been larger than its portfolio of South Korean patents, so while companies are often dependent on a set of patent offices, there can still be significant movement between them.

So, the data shows that even with a relatively small pruning of their portfolios, most companies could save millions in fees, with the ax possibly falling on a company’s lowest quality assets.

Of active U.S. patent grants, 1.7 million are above average, with 1.3 million below average. The majority of the fee payments at the USPTO go to continuing above-average patents, however, these below-average patents still contribute to a huge, potentially not required, expense. They will cost $900 million in 2021 and $15 billion over their lifetime, so if even just a small percentage of these were pruned it would result in huge cost savings.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

11 comments so far.

William Mansfield

July 1, 2020 04:23 am@MaxDrei: You are totally correct, we discussed this in the webinar also, the (un-)likelihood of all these Chinese patents being maintained to the end of life. I understand the benefits Chinese companies have received to prompt patents is based on filings, rather than maintenance of rights, which is likely also a contributing factor.

This is also an interesting point you raise that >90% of new developments fail, which could certainly be the case. I just took a look at patents filed in the USA in 2000, in 2010 around 85% were still active, in 2018 around 50% were still active. So at least in the USA there is a very high patent maintenance rate.

Anon

June 8, 2020 05:14 pmThe attempted description of “fail” is itself a fail.

The other fails you want to compare to are binary fails with no period of reward.

That’s an entirely undeserving categorization.

MaxDrei

June 8, 2020 01:42 pmProSay you ask why most patents in China cease long before the end of their 20 year term. My answer: for the same reason that they cease long before the end of their 20 year term in all other countries (except perhaps the USA).

I do not know of any country in the world except for the USA that levies renewal fees on 20 year term utility patents other than yearly. That’s why they are called “annuities” (also in this very blog post, see all over Fig 1, for example). Further, the respective Patent Office annuity fee schedule is always on a rising line, to encourage patent owners to think increasingly hard whether to drop their patent as soon as its maintenance is no longer a sensible investment.

The sooner patent owners drop their patents, the sooner competitors can use the technology without fear of being held to infringe. It’s called “promoting the progress”. You could also call it “Keeping the shipping lanes of trade clear of abandoned vessels”.

It is said that >90% of all new products on supermarket shelves fail. It is said that >90% of all new pharmaceutical molecules fail. It is so, isn’t it? I say that it’s another fact that >90% of all patents “fail” long before the end of their 20 year term.

Who here disagrees?

Model 101

June 8, 2020 08:35 amComplete waste of money

Anon

June 8, 2020 06:56 amPeter,

I think that you may want to consult an attorney if you think that the singular form of copyright suffices to protect ALL aspects of intellectual property (including aspects such as functionality which are expressly NOT covered by copyright).

I am not sure what you mean be “instantly secure IP protection on both the invention and the name by creating a website… – you are aware that one cannot ‘copyright’ a name, right?

I have to suppose that you thought that your post would show people that you know better.

It has achieved the exact opposite.

Night Writer

June 8, 2020 06:02 am@5 Peter?

What? Because I can take whatever you print out of your 3D printer and modify it a bit so that you can’t enforce your copyright, but it operates in functionally the same way.

I can take any software and run it through automation products that will take it out of copyright enforcement and yet it will still operate in the same manner.

Peter Botherway

June 7, 2020 07:54 pmIf I can think of a product idea and name it, instantly create a 3D printed working prototype of my product, instantly secure IP protection on both the invention and the name by creating a website demonstrating my product to the world why on earth is it necessary to spend millions of dollars applying for patents and trademarks protection around the world, when you have all the necessary protection under copyright, exactly as you would have if you write a new song. The patent industry needs to get their heads out of their collective asses and realize that we are now in the 21st century.

Pro Say

June 7, 2020 04:27 pmMax @ 3: “most patents in China are abandoned early on in their 20 year term.”

Hmmm … Max (or anyone): Any thought/s on why this is / would be the case?

MaxDrei

June 7, 2020 09:23 amAnnuity fees rise progressively, through the 20 year patent term. So, in any projection of what Samsung will pay to each Patent Office in 2021, is weighted by how many patents were filed 15 or so years, at each such Patent Office. Could it be that, 15 years ago, Samsung filed at the USPTO orders of magnitude more cases than at the Patent Office in Peking but that, today, the frequency of filing in China is more or less the same in these two Patent Offices?

In contrast, the first Table in the blog post assumes every granted patent will be kept in force till the end of its 20 year term. But, as I understand it, most patents in China are abandoned early on in their 20 year term. At the USPTO, there are only three renewal fees to pay, the last one of which is due before even the patent is 12 years old so, presumably, the USPTO gets a high proportion of the theoretical maximum renewal fee income whereas the PTO in China will likely get only 10 to 20 % of the theoretical maximum. So, the jaw-dropping difference between renewal fee income at the two Patent Offices over the next 20 years is very likely nowhere near as large as the Table suggests.

MaxDrei

June 7, 2020 06:04 amThose who choose where to file the patent applications of their companies take into account the ongoing costs of annuities. For example, when the EPO issues a patent for its 38 Member States, patentees then decide in which of the 38 they will validate, and pay the first annuity due. Often, it is 5 or fewer of the available 38.

With that in mind, what do the data in this blog post tell us about the level of confidence and commitment of the big filers to the economy of China (compared with that of the USA)?

Anon

June 6, 2020 08:23 pmThere is of course a serious and much more dire possibility than ANY type of windfall occurring for patent offices:

A dramatic DROP in payment of annuity fees.