“With a majority remote workforce or better, Boards of Directors should demand that corporations move their operations to more tax-friendly jurisdictions. A decision to stay in a high tax jurisdiction when a corporation will have a remote workforce is practically malfeasance.”

The COVID-19 pandemic seems to be coming to a slow but steady close in Europe, with no evidence of a spike despite loosening of lockdowns, at least according to outlets like the Washington Post and Wall Street Journal. Although some media continue to report spikes in the number of coronavirus cases in certain states and areas, other media, such as Politico, acknowledge that two weeks after the widespread protests in virtually every major American city started there is no evidence of a spike. Of course, Politico has also reported the exact opposite.

The COVID-19 pandemic seems to be coming to a slow but steady close in Europe, with no evidence of a spike despite loosening of lockdowns, at least according to outlets like the Washington Post and Wall Street Journal. Although some media continue to report spikes in the number of coronavirus cases in certain states and areas, other media, such as Politico, acknowledge that two weeks after the widespread protests in virtually every major American city started there is no evidence of a spike. Of course, Politico has also reported the exact opposite.

Whatever the case may be about whether COVID-19 and the coronavirus are increasing, decreasing, waning, spiking or likely to spell imminent doom, as sure as Americans are tired of being locked down, corporations of all sizes are rethinking their future. Many corporations, from startups to small businesses to the largest multinational technology corporations, have discovered that their workforce can operate just as effectively from home, if not more effectively.

Going Remote

Indeed, a recent survey of Venture Capitalists and Founders found that one-third (32.9%) will emerge from the economic shutdown caused by the COVID-19 crisis with a fully remote workforce. Another 40.7% will emerge with a majority of their workforce being remote. Another 20.7% said they will have at least some of their workforce remote, while only 5.6% responded that they will have an all-in-office workforce. That means that 94.4% of respondents will have at least some remote workforce, with 73.6% having at least a majority of their workforce working remotely from home.

Numerous technology giants are similarly rethinking the future of their workforce. Most notably Facebook, which has announced plans to eventually become a fully remote workforce. Meanwhile, Google employees will be allowed to work from home at least through the end of 2020, and Twitter CEO Jack Dorsey has given employees permission to permanently work from home if they wish.

Tech companies have spent lavishly on office space and buildings in Silicon Valley and San Francisco in recent years – think Apple’s particle accelerator shaped office space in Cupertino, California, or the many leases entered into even before ground is broken in San Francisco. But the prospect of a remote workforce is simply too enticing to pass up. From a truly national and international recruiting base, talent acquisition will be easier than ever. And from a tax standpoint, the savings could be enormous.

The Rankings Flip

Why would or should any corporation of any size remain in a high tax jurisdiction? With a majority remote workforce or better, Boards of Directors should demand that corporations move their operations to more tax-friendly jurisdictions. A decision to stay in a high tax jurisdiction when a corporation will have a remote workforce is practically malfeasance.

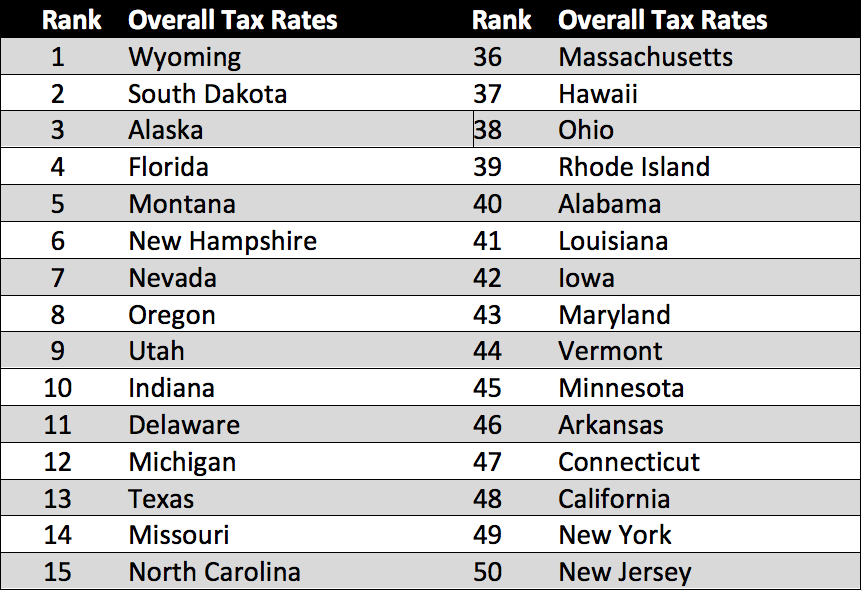

Typically, when states compete for corporations, they tout many things, including quality of life for employees – which will no longer matter for many technology companies in the post-COVID economy. States also tout their overall tax rankings, which are a function of corporate tax rates, individual tax rates, sales tax rates, and property tax rates, among other things such as fees and licenses, etc. The picture often looks like this ranking, which is from the Tax Foundation for 2020.

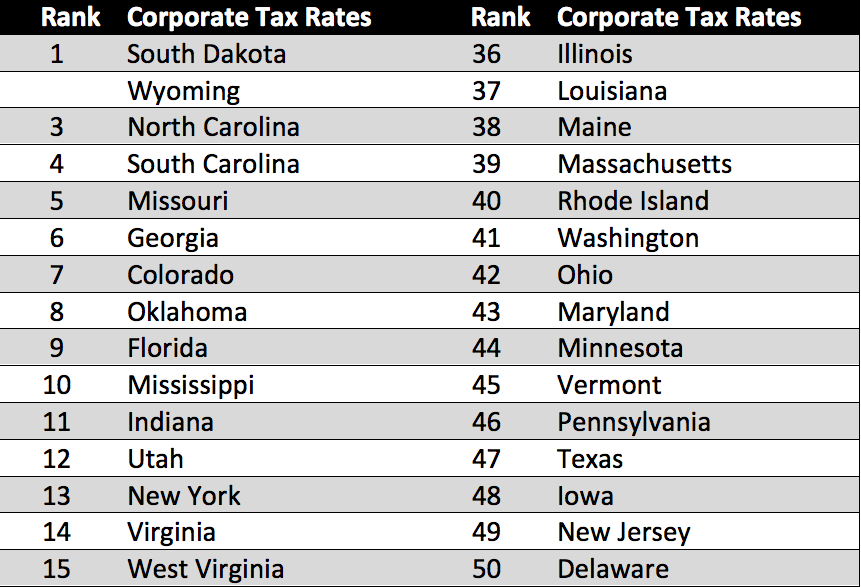

With a majority remote workforce, or a fully remote workforce, the metrics that go into the overall picture that affect the individual seem less important. Focusing just on the corporate tax rates, a somewhat different picture emerges, with some notable states even switching from a “top” ranking position to a “bottom” ranking position.

For at least some corporations (perhaps many corporations), the thought of relocating to South Dakota, Wyoming, South Carolina, Mississippi or West Virginia would not be appealing for a variety of reasons. On the remainder of the list would be cities such as Charlotte, NC, St. Louis, MO, Atlanta, GA, Denver, CO, Oklahoma City, OK, Jacksonville, FL, Orlando, FL, Tampa, FL, Miami, FL, Indianapolis, IN, Salt Lake City, UT, New York, NY, and although not a particular “city” the Northern Virginia area generally, which is a growing suburb of Washington, DC. All of these locations have major airports, some obviously would have lower overheads than others (i.e., Indianapolis would be far cheaper for whatever footprint one might need than New York City).

Surprisingly, when you do not consider individual tax, property tax and sales tax burden, New York flips from a worst tax jurisdiction to a top 15 tax jurisdiction. Similarly, Texas flips from a top 15 tax jurisdiction to a rather unattractive tax jurisdiction.

More to Learn

Obviously, there are a lot of considerations that go into where to locate, or relocate, your business. Cities and states are known to put rather enticing tax packages together to attract businesses that they want, but those are premised on jobs. What the new post-COVID economy will look like and the sales-pitch states and cities will have to make to attract new and relocating businesses will undoubtedly change. So too will the calculus for those businesses small to large.

For more information on this topic, I invite you to join me for a free webinar conversation on Tuesday, June 30, 2020. Our conversation will focus on what the post-COVID U.S. economy will likely look like, how corporations and law firms can and should be positioning themselves today, what types of computer systems and resources they can and should deploy to enable their workforce to safely and securely collaborate together and with clients while keeping sensitive data and information secure, and much more.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[[Advertisement]]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-2024-banner-938x313-1.jpeg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

10 comments so far.

Anon

June 18, 2020 08:43 amI would add that there may be an attempted distinction between any “work OF the corporation” and instead an emphasis on “work THAT creates an interface with the public.”

On this dimension, the location of remote workers may then “not contribute” to any notion of jurisdiction ‘capture.’

On this dimension, tax implications may then be separated out – on the basis that those activities creating the tax burden simply are not the same type of activities that may create a citizen of the state interface with the business for the purpose of the business engaging with the public.

But here too, I would posit that the current jurisdiction ‘capture’ jurisprudence is necessarily wrong. Corporations currently employ many types of remote interface WITH citizens of a state that DO create the benefit of the corporation engaging in business in that state. EVERY web portal and smart phone – no matter its location – creates a de facto universal choice OF THE CORPORATION to engage in business at any location that any app of website sale or the like is enabled.

The early case of the phone book listing is not enough introduced an error that has only been magnified over time.

An error that needs to be corrected.

It should be simple and straightforward: if a Corporation chooses to obtain the benefit of operating its business such that it may conduct that business and obtain profit at any geophysical point, then that choice necessarily comes along with the choice to accept the ‘risk’ of having to be called into court in that jurisdiction.

Corporations are entirely able to choose not to conduct business at any location that they would not want to be subject to jurisdiction control.

That this may be ‘inconvenient’ or ‘messy’ is absolutely besides the point of taking the good with the bad.

Pro Say

June 17, 2020 08:53 pmThanks Anon.

Anon

June 17, 2020 05:35 pmPro Say,

Not quite.

My view is NOT on a company’s choice of corporate physical location.

Instead, it very much is on the NON-“physical” – or perhaps more accurately, the physical OTHER locations besides a corporate center.

We DO have some intersection, albeit I would posit that the current state of law as to what it means for a corporation to place itself into a particular jurisdiction is wrong. I state this BECAUSE in part current tax law does NOT align with current jurisdiction law.

What to me is interesting is the intersection, so I think that both of us are eager to see how this develops.

Clearly, MORE than the previously adjudicated types of employees will be “virtual” and dispersed on a “it does not matter where you live basis.

This dispersion highlights that prior jurisprudence – in the jurisdiction cases – were simply wrongly decided.

The plain and ultimately simply equation that should have governed all along is that for a corporation to enjoy the benefits of any sale in any jurisdiction, they have necessarily opened themselves up to the risk factor of that SAME jurisdiction.

Don’t like it? The Corporation has every power to NOT place themselves in ANY jurisdiction.

That is, until this seismic shift in where their principal workers are not only living – but engaging in the work of the corporation.

Pro Say

June 17, 2020 01:05 pmAnon @ 6: I believe we’re each looking at different aspects of a post-covid economy.

Yours is (at least in part) the ‘reward/risk’ calculation in companies’ choice of corporate physical location; including the tax treatment / implications.

As companies decentralize employees from companies’ physical locations, I’m wondering whether they will (or legally can) bar such work-from-home employees from living in particular judicial districts due to the risk (real or perceived) that such employees could enable patent owners to then file suit in such particular districts; e.g. particular TX districts.

Anon

June 17, 2020 09:09 amPro Say,

Not sure what point you are attempting. The current capabilities already include the power of a company to require its employees to “live” somewhere (leastwise, as a practical outcome of any ‘must work at the office – if you want to commute four hours each way, that’s up to you’ practice).

The (real) difference here that I was aiming at was the legal definition of what it means for a company to fall into the ‘risk’ portion of any ‘reward/risk’ calculation of operating within a state.

Currently, that ‘risk/reward’ is both out of whack and inconsistent (for example, inconsistent in tax treatment – hence why this thought comes up in this thread; and for another example, out of whack, because business IS considered conducted in a state for which business rulings have deemed that there be NO “established business presence – It is very 1984 to be able to conduct business with no business presence).

Pro Say

June 16, 2020 03:19 pmAnother thought: Companies refusing to hire employees living in particular jurisdictions?

“Oh, gosh — sorry, we can’t hire you . . . because of where you live. Would you be willing to move if we hired you?”

Will employment contracts contain a ‘you agree to not live there, there, or there’ provisions?

Legally justified?

Geographic discrimination?

Fun times.

Anon

June 16, 2020 11:33 amAt the least for remote attorneys, I see next year’s tax season having a heavy dose of “how to claim a home office expense.”

(I mention attorneys in particular, as most advice I have seen in regards to ethical responsibilities for attorneys includes having a dedicated and segregated space for client materials and client conversations — away from family and third party listening devoces — sorry Siri, sorry tv, sorry smart oven)

Gene Quinn

June 16, 2020 11:01 amPro Say @1…

There has been some litigation on this point, primarily in Texas as you might imagine. Let me see if I can get a Texas litigator up on these issues to write an article. I know a few who are active in the Eastern and Western Districts.

-Gene

Anon

June 16, 2020 08:29 amPro Say,

I was wanting to let a few thoughts simmer, but your post brings out one thought that I wanted to put out there and maybe generate some further thought seeds:

The current legal state of what it means for a corporation to have a “business presence” in ANY location has been divorced from the tax implications of what each state views — for tax purposes — what constitutes “business” within their states.

Maybe this dispersion (as massive as it is) will force a more thorough and more consistent reasoning of what it means for a corporation to incur BOTH the rewards and the risks of engaging in business anywhere,

Pro Say

June 15, 2020 09:46 pmThanks Gene — great info and important considerations.

Any thoughts (and from readers) on whether or not having actual, live employees working from their homes would open patent-infringing companies to being sued in such jurisdictions?

If so, one could see companies barring employees from living in, e.g., the Eastern or Western Districts of Texas.