“IP assets related to K-pop and entertainment have been among the most standout investments in South Korea. And overseas companies are investing too?—? Netflix, for example, is investing around $500 million in South Korean dramas.”

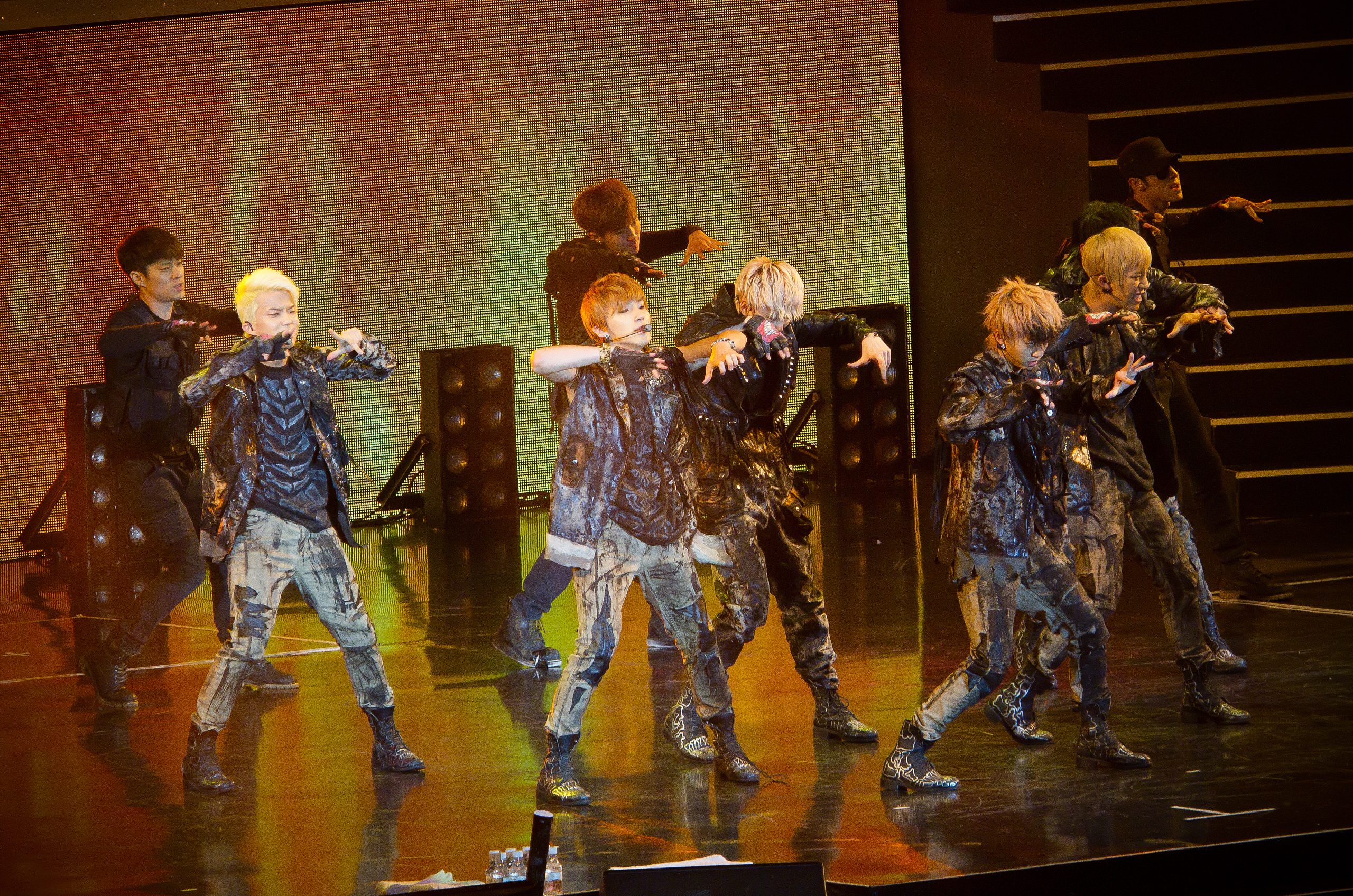

South Korean pop band B.A.P perform during the K-POP Nation Concert in Macao 2012 in Macao, China, 2 July 2012.

The arts and entertainment industry has boosted South Korea’s economy and produced some of the country’s key products and exports. The country’s population of 51 million people was the sixth largest music market in the world in 2020, according to IFPI’s Global Music Report 2021. Also in 2020, South Korea had a $160 million surplus in cultural and arts intellectual property (IP)-related assets trade, according to South Korea’s Maeil Business Newspaper. It was the first time a surplus in such a category was registered. However, entertainment-related IP assets have been big Korean exports for years: in 2019, the country exported $8.62 billion in copyright-protected content, according to Yonhap News Agency.

A South Korean company also made huge waves in the global music industry in 2021. HYBE (formerly Big Hit Entertainment), the home of big Korean labels such as Big Hit Music (the label for groups like BTS and TXT), Source Music, and Pledis Entertainment, acquired Ithaca Holdings, bringing worldwide pop stars like Ariana Grande, Justin Bieber, J Balvin, and Demi Lovato to its cast in a $1 billion transaction, reported Music Business Worldwide.

K-pop, Copyright and Licensing

Such impressive statistics are no surprise, considering the thriving arts and entertainment culture in South Korea, fueled by K-pop (the country’s main industry of pop music and music-related content), the group BTS (which, from their impact in Korean tourism to global music charts, represent an industry of their own) and South Korean movies and series (known as “dramas”).

South Korea also has proven itself to be a prolific environment for creating music, film, content, and experiences for fans, and also to be great at making the most of their intangible assets through IP strategies.

Aside from copyright income from music and video streaming (groups like BTS, Twice, NCT and Blackpink amass billions of streams across platforms like YouTube and Spotify) and sales (BTS was the biggest selling artist in the world in 2020, according to IFPI), K-pop companies boost their outcome through licensing trademarks and copyrights in brand partnerships for games, clothes, and more.

A notable example is BT21, a partnership between LINE FRIENDS Corporation and Big Hit, which has its own IP subsidiary to manage license transactions. The BT21 project consists of fictional characters created by the seven members of BTS to stamp stationery, clothes, shoes, food and beauty products, among others. The BT21 brand has partnered with dozens of other brands around the world, such as Reebok Korea, Dunkin’ Donuts Korea, Olive Young (South Korea), Converse (USA), Anti Social Social Club (USA), Riachuelo (Brazil), Uniqlo (Japan), NEIGHBORHOOD (Japan), and more.

K-pop Patents

While trademarks and copyrights are the most commonly associated forms of IP in the arts and entertainment field, they’re not the only option, and South Korean companies like HYBE are well aware. The corporation is betting on patents and industrial designs to enhance experiences for music fans through products like slide viewers and light sticks (light devices). The former is a strong part of fan culture in K-pop.

Usually, a K-pop group will have its own light stick named and designed after particular features of the group’s identity. Fans buy the light stick so they can use it when attending the group’s concerts, lighting up the place as they chant the idols’ names and songs.

In 2020, HYBE acquired rights for three patents from LG Electronics and Kimin Electronics, according to Biz World. The patents are related to lighting devices’ synchronization with performances, and it is expected that they will be used in light stick experiences for K-pop fans.

IP Strategy Leads to IP Investment

Indeed, IP assets related to K-pop and entertainment have been among the most standout investments in South Korea. SM Culture & Contents, a talent and production company under SM Entertainment (one of the pioneer companies of K-pop), invested ? 8 billion in the course of acquiring IP originals in 2020 and is reportedly investing more in 2021, according to Sports Kyunghyang. And overseas companies are investing in South Korean IP assets too?—?that is the case for Netflix, for example: the streaming giant is investing around $500 million in South Korean dramas, as reported by Forbes.

It’s clear that South Korea’s road to becoming a power player in music streaming, music sales, artist management, live music, cinema, audiovisual streaming and games has much to do with its novel approaches to protecting IP in these fields, proving that strong IP strategies pay.

Image Source: Deposit Photos

Photography ID:244105674

Copyright:ChinaImages

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.