“According to the Alzheimer’s Association, in the United States, Alzheimer’s and other dementias will cost $355 billion in 2021, and the cost could reach $1.1 trillion in 2050. Therefore, the demand for Alzheimer’s drugs is huge in the United States, and the world market demand is much larger.”

On June 7, 2021, the U.S. Food and Drug Administration (FDA) gave the green light to Aducanumab, a drug developed by Biogen to treat early stage Alzheimer’s, despite the controversies surrounding its efficacy. Biogen stock price increased 38.3% on the day, adding $16.5 billion to the company’s market value. The news rippled across the pharmaceutical industry and lifted stock prices of most Alzheimer’s drug developers. As an example, Eli Lilly stock price jumped 10.2% on June 7, or a hike of $18.6 billion in market cap, because the company also has a similar drug candidate. Subsequently, as the controversies over the Aducanumab approval deepened, Biogen had lost $7 billion in market value by September 9.

On June 7, 2021, the U.S. Food and Drug Administration (FDA) gave the green light to Aducanumab, a drug developed by Biogen to treat early stage Alzheimer’s, despite the controversies surrounding its efficacy. Biogen stock price increased 38.3% on the day, adding $16.5 billion to the company’s market value. The news rippled across the pharmaceutical industry and lifted stock prices of most Alzheimer’s drug developers. As an example, Eli Lilly stock price jumped 10.2% on June 7, or a hike of $18.6 billion in market cap, because the company also has a similar drug candidate. Subsequently, as the controversies over the Aducanumab approval deepened, Biogen had lost $7 billion in market value by September 9.

With all of these multi-billion-dollar numbers, one can’t help but wonder: how much is an Alzheimer’s drug worth? This article tries to assess the market value of an Alzheimer’s drug. It first estimates the implied values of Alzheimer’s drugs by looking into stock market reactions to major events associated with Biogen’s Aducanumab and Eli Lilly’s Donanemab. As a sanity check to the values derived from the stock market, a discounted cash flow (DCF) analysis is conducted to evaluate whether the stock market valuations are rational.

Valuations as Implied by Market Reactions to the Events Related to Biogen’s Aducanumab and Eli Lilly’s Donanemab

This section applies the event study method to stock market reactions to the sequences of events associated with the recently-approved Aducanumab of Biogen and Eli Lilly’s drug candidate Donanemab. Event study is an econometric method commonly adopted by economists and financial analysts to quantify the impact of a specific event on a company’s stock price. For both drugs, the relevant events were identified and collected by searching the companies’ News sections, Investors sections, and SEC filings, as well as by using Google’s search engine that is supposed to cover major news in the field. Also, since Aducanumab and Donanemab are similar drugs with the same mechanism of action, a significant event with one drug may have highly material impact on the other, as shown in the analysis below.

The event window is defined as a three-day period for this study, including the event day, the day before, and the day after, so as to capture any anticipation effects such as news leakage or inside trading, and any post-event adjustment effects that would allow market to correct itself for any over- and underreaction on the event day. Finally, market model is used to forecast the normal returns, and the model is estimated over the estimation period of January 2, 2018 to December 31, 2018. Daily stock returns are calculated as daily percentage changes in stock prices, and the abnormal return over an event window is computed as the buy-and-hold abnormal return (BHAR).

Aducanumab’s Value to Biogen as Reflected by the Stock Market’s Reaction to the Events

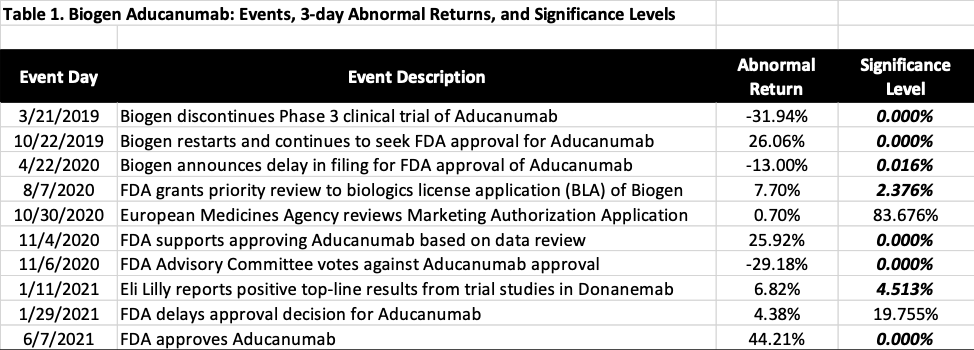

Table 1 summarizes the event study results from March 2019 through the approval of Aducanumab by the FDA on June 7, 2021. As shown in the table, except for the events on October 30, 2020 and January 29, 2021, the abnormal returns are statistically significant with P value below 5%. In other words, all events except the two had significantly altered the expectation on Biogen’s future cash flow, and caused substantial changes in Biogen’s stock prices.

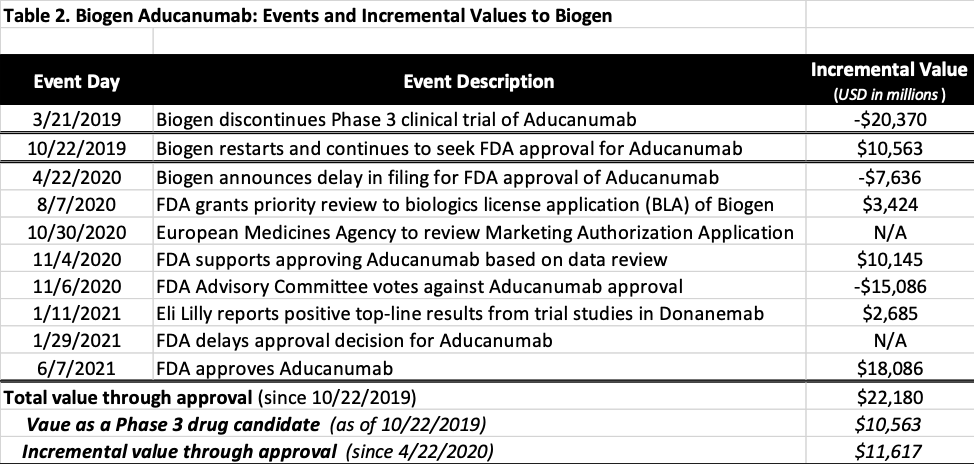

Table 2 calculates the changes in market value resulted from the statistically significant events, calculated by multiplying the three-day abnormal return by Biogen’s market cap the day before each event window. As an example, when FDA announced on November 4, 2020 that it might have sufficient data to approve Aducanumab, Biogen stock price experienced a 25.92% abnormal return in the three-day event window, leading to an increase of $10.2 billion in market value. Since there were no other significant events during the event window, this additional $10.2 billion is deemed to be caused by the improved success rate of Aducanmab. In other words, the market attributed an incremental value of $10.2 billion to Aducanumab due to its enhanced chance of approval as a result of the FDA announcement. Similar can said about the news on November 6, 2020 when the advisory panel of FDA voted against the approval of Aducanumab, which led market to re-assess the success rate, causing a -29.18% in abnormal return and a reduction of $15.1 billion in incremental value of Aducanumab.

Several key takeaways from Table 1 and 2. First, the sequence of events leading up to the approval of Aducanumab offers a perfect example to study the value of an Alzheimer’s drug. The Phase 3 trial of the drug was discontinued by Biogen in March 2019, and then restored in October 2019, which marked a clear starting point of the process leading up to the approval on June 7, 2021.

Second, the value of Aducanumab as a Phase 3 drug candidate is $10.6 billion to Biogen as of October 22, 2019. Since then, market had upwardly and downwardly adjusted the value of Aducanumab based on new information available from April 22, 2020 to June 7, 2021, crediting an additional value of $11.6 billion to the drug, as shown in Table 2. Accordingly, the total value of Aducanumab at the time of final approval would be $22.2 billion to Biogen.

Third and interestingly, when Biogen announced to discontinue the Phase 3 trial on March 21, 2019, market essentially wrote off $20.4 billion from Biogen’s market value, while it only credited back $10.6 billion when the trial was decided to resume on October 22, 2019, which is about half of the value it wrote off seven months ago. Which of the market reactions was irrational, to the discontinuing or to the restarting? Maybe neither. It is highly plausible that the market essentially wrote off the fair market value of Aducanumab as of March 2019 with the information available then, and reassess its fair market value in October 2019 based on the updated information.

The Market Value of Aducanumab

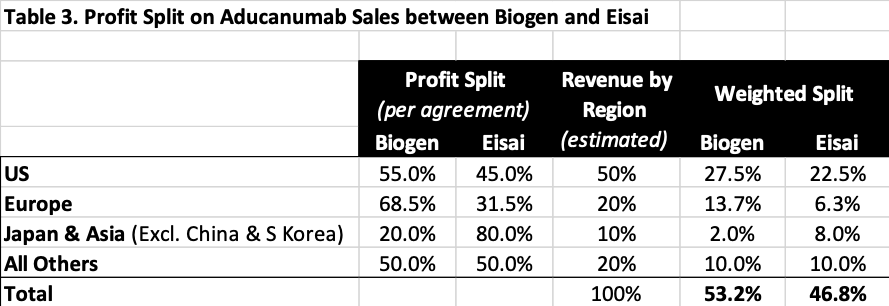

According to an agreement between Biogen and Eisai in October 2017, Biogen and Eisai share the potential profits from the sales of Aducanumab, as summarized in Table 3 below. The regional distribution of Aducanumab sales is estimated based on the change in regional distribution of drug sales as reported in Biogen’s annual reports, the medicine spending by region from IQVIA report, the regional distribution of new drug sales reported by EFPIA, and the national and regional GDP data. Table 3 then calculates Biogen’s profit share in Aducanumab as 53.2%.

Additionally, Biogen originally licensed the drug from Neurimmune in 2007 under a collaborative development and license agreement. After two cash payments to Neurimmune, the royalty rates payable to Neurimmune on sales of Aducanumab “now range from the high single digits to sub-teens”. With this information and drug royalty rates prevalent in the industry as reported by Life Science Royalty Surveys of Licensing Executives Society (LES USA and Canada), the average royalty rate is estimated to be about 10%. Subtracting the tax shield under Biogen’s effective tax rate of 20% and then applying a 50% incremental EBITDA margin, the royalties payable to Neurimmune would account for 4% of the total profits of Aducanumab, leaving 96% for Biogen and Eisai to split at 53.2% vs. 46.8%.

Adjusting Aducanumab’s $10.6 billion value to Biogen as Phase 3 drug candidate by Biogen’s 53.2% share and Neurimmune’s 4% share, the total market value of Aducanumab as a Phase 3 drug candidate would be $20.7 billion. Applying the same adjustments, the entire market value of Aducanumab as an approved drug is estimated to be $43.4 billion.

Interestingly, according to the report published by BIO, neurology drug candidates in Phase 3 trial have an average success rate of approval of 46%. Since the $20.7 billion value attributed to Aducanumab as a Phase 3 trial drug candidate is the expected value under the 46% success rate, an approved drug would be worth $45 billion ($20.7 billion/46%), fairly close to the value of $43.4 billion of an approved drug derived independently and solely from the event studies above.

For the purpose of this study, the analysis does not consider most recent developments with Aducanumab after June 7, including the reported congressional investigations and Biogen’s news releases on the slower than expected launch of Aducanumab. The market will certainly make further upward or downward adjustments in light of the newly available information.

The Market Value of Eli Lilly’s Donanemab

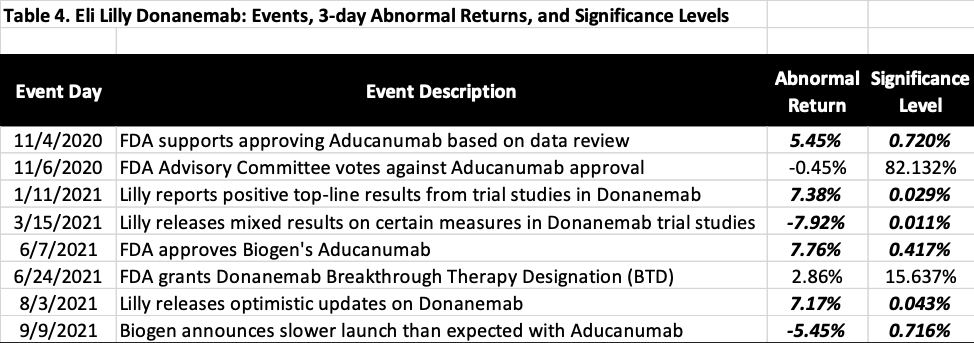

The same method and procedure above are used to investigate the value of Eli Lilly’s Donanemab as a drug candidate in or ready for Phase 3 clinical trial. It is important to notice that the value derived for Donanemab reflects only what the market currently believes the drug is worth based on the information known so far; and from now to the potentially eventual approval of the drug, the number will change whenever new information becomes available.

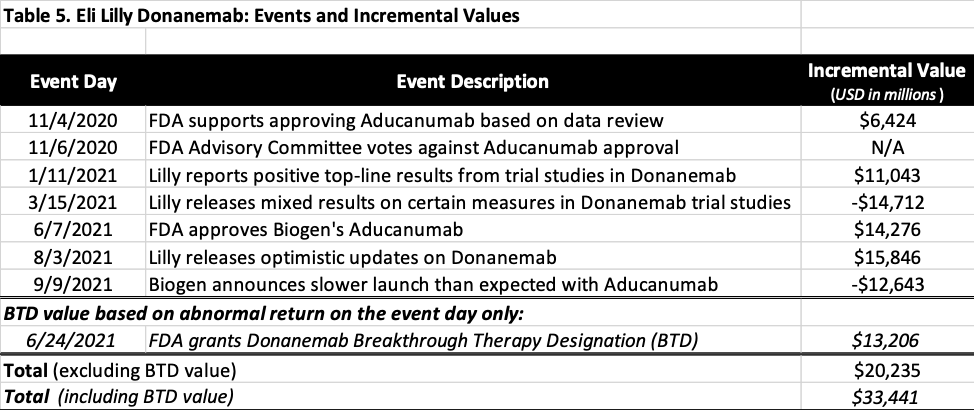

A thorough search was conducted to collect the events relevant to Donanemab since 2016, and the first notable event was FDA’s announcement to support an approval of Biogen’s Aducanumab on November 4, 2020. As shown in Table 4 and 5, all of the events have statistically significant abnormal returns during the three-day event window, except for two of them, including FDA advisory panel voting against Biogen’s Aducanumab on November 6, 2020 and the Breakthrough Therapy Designation (BTD) granted by FDA to Donanemab on June 24, 2021, which will be further discussed below.

Table 5 summarizes the incremental values attributed by market to Donanemab from November 4, 2020 to September 9, 2021. The total market value of Donanemab as a Phase 3 drug candidate is estimated to be $20.2 billion as of September 24, 2021.

While the three-day abnormal return caused by BTD announcement on June 24 is not statistically significant, the abnormal return of 6.7% on the event day is. As reported by Pink Sheet, although BTD may not significantly increase a drug’s chance of approval, it did reduce approval time by 2.5 to 3.5 years, resulting in shorter time to market, less competition, and higher penetration rate, all of which increase the value of Donanemab. Assuming the incremental value attributed to Donanemab on the event day reflected the true value of the Designation, the value of BTD for Donanemab would be $13.2 billion. Under this assumption, the total value of Donanemab as a Phase 3 drug candidate would be $33.4 billion as of September 24, 2021.

Summary of the Event Studies

Based on the event studies on Biogen’s Aducanumab and Lilly’s Donanemab, the value of a drug candidate at or ready for Phase 3 trial would be worth $20.2 billion to $20.7 billion, and a Breakthrough Therapy Designation has a value of $13.4 billion. An Alzheimer’s drug approved by the FDA carries a market value of $43.4 billion.

A Sanity Check – DCF Valuation of an Alzheimer’s Drug Candidate at Phase 3 Trial

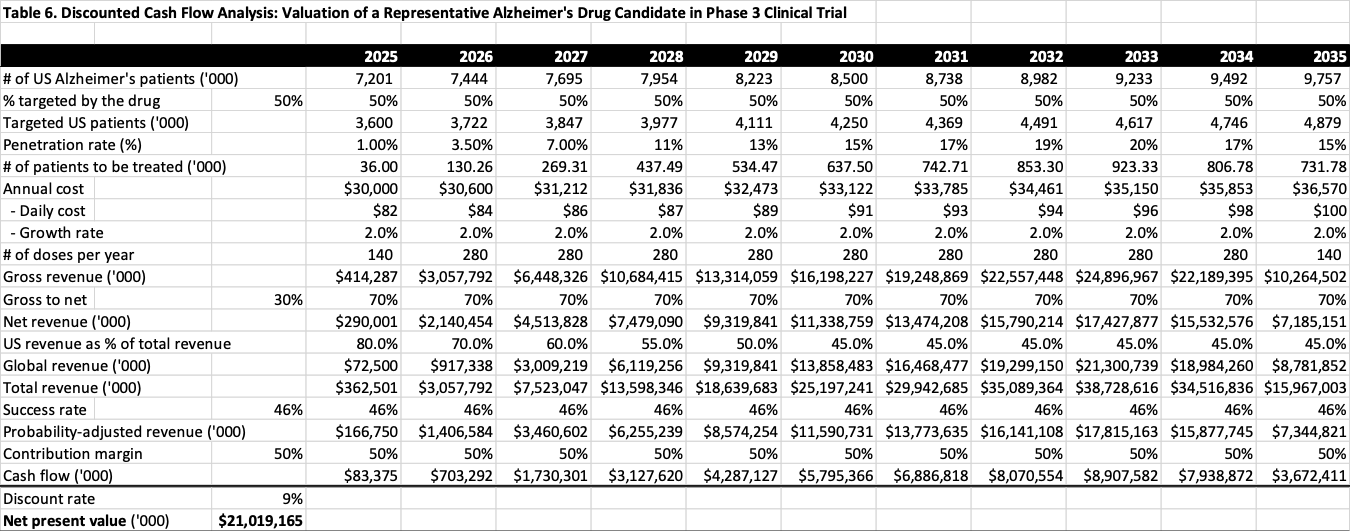

To further check how reasonable the values derived from the event studies above are, a discounted cash flow (DCF) valuation is conducted for a representative Alzheimer’s drug candidate in or ready for Phase 3 trial. The DCF analysis starts with a model developed by Drs. Charles Duncan and Pete Stavropoulos of Cantor Fitzgerald . To make the model fit the purpose of this study, however, several important modifications would have to be made.

First, it is assumed that a representative Alzheimer’s drug developed by a large pharmaceutical company would be able to treat 50% of the US patients, and will eventually reach a market penetration rate of 20%. In other words, a representative Alzheimer’s drug will eventually be prescribed to at least 10% of U.S. Alzheimer’s patients. As a reference, the 50% of the patients could be all of those in mild stage of Alzheimer’s diseases, according to the study published on Journal of Alzheimer’s Disease. It can also be any possible combinations of patients in mild, moderate and severe stages.

Second, this study uses the estimated numbers of US Alzheimer’s patients from the Alzheimer’s Association, and calculates the annual numbers based on the implied cumulative annual growth rates (CAGR).

Third, a global revenue item is added to the DCF model, as shown in Table 6, based on the data in regional distribution of sales of major pharmaceutical companies, as well as the regional distribution of new drug sales reported by EFPIA.

Also, more conservative assumptions have been made with other key parameters, including the success rate of 46% for Phase 3 neurology drug candidates reported by BIO, a cash flow contribution margin of 50%, a 10-year exclusive period protected by patents, and a discount rate of 9% is for net present value calculation that was reported in LES USA Canada Life Science Royalty Survey. As a reference, the average of weighted average cost of capital (WACC) of large pharmaceutical companies is reported to be 5.49%, with Biogen’s being 6.1%, and Eli Lilly’s, 5.2%.

Finally, list price of the drug is derived from the benchmark price reported in ICER (The Institute for Clinical and Economic Review) in its Evidence Report for Biogen’s Aducanumab. For the purpose of this analysis, it is assumed that the representative drug candidate would achieve the optimistic treatment benefit such that its annual benchmark price has a range of $17,350 to $25,350, with the middle point of $21,000. Applying the average gross to net ratio of 70% to the $21,000 benchmark price, the list price of the representative drug would be $30,000.

Table 6 reports the results from DCF analysis, which indicates that under the reasonable assumptions listed above and those originally from Drs. Duncan and Stavropoulos’ model, the value of an Alzheimer’s drug candidate in or ready for Phase 3 trial is about $21 billion.

Factors Contributing to Cost and Value

The DCF valuation analysis further confirms that the value numbers derived from the event studies on stock market reactions to the events related to Alzheimer’s drug development are reasonable, lending further credence to the rationality of stock market valuations.

The seemingly high values may also be justified by the economics of drug development. According to the Alzheimer’s Association, in the United States, Alzheimer’s and other dementias will cost $355 billion in 2021, and the cost could reach $1.1 trillion in 2050. Therefore, the demand for Alzheimer’s drugs is huge in the United States, and the world market demand is much larger.

From the supply side, a critically important factor is the patent protection granted to new drugs. U.S. patents, including drug patents, have a 20-year life term, which provides a patent owner with the exclusive rights to practice or license the patented innovation. Specifically for drug patents, because some of the term is used up before marketing approval, the U.S. laws allow patent term restoration (PTR) of up to five years, so as to compensate for patent life lost to clinical testing and regulatory review. Such reinforced legal protection provided to drug patents essentially grants extended monopoly to a patented drug and enables the drug developer to exclusively profit from the drug over a longer time period, both of which increase the drug’s value.

The author thanks Dr. Yunfeng Li of Pionyr Immunotherapeutics and Dr. Wenjie Zhang of PRECISIONheor for helpful comments. All errors remain the author’s. The author does not own long or short positions of the stocks mentioned in this article.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Artificial-Intelligence-2024-REPLAY-sidebar-700x500-corrected.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/UnitedLex-May-2-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

One comment so far.

Charles S Alcorn

December 23, 2021 06:50 amThank you for your analysis. I have a few observations.

First, the statement that drug candidates in Phase 3 trial have an average success rate of approval of 46% is probably accurate; however, the success rate for phase 3 trials for desease modifying therapies for Alzheimer’s disease (AD) is either 0% or – if you believe Aduhelm should have been approved – far below 46%. This is not for want of phase 3 trials in AD – there have been many.

Second, the analysis focuses on big pharmaceutical companies. Cassava Sciences is in a phase 3 clinical tial and Annovis Bio is in discussions with the FDA for phase 3 trials in AD. Neither have market capitalizations approaching the numbers recited here – presently $1.744 billion and $163.6 million respectively. I would welcome your perception of this discrepancy.

Regardless, I believe your analysis of the value of a disease modifying therapeutic for AD is sound.

Well done.