“It’s hard to see these shifting numbers and not think of them as possible impacts of larger issues permeating the international IP landscape, including growing uncertainty surrounding subject matter patent eligibility under U.S. law as well as the Chinese government’s efforts to increase patenting activities.”

Earlier this month, IP management and analytics firm Anaqua issued statistics on patents granted by the U.S. Patent and Trademark Office (USPTO) during 2021, providing a snapshot of the companies and countries earning the greatest number of U.S. patents, as well as the technological areas where most innovations are being protected. Among the report’s greatest takeaways include the relatively strong state of innovation through the COVID-19 pandemic. Anaqua’s report also reinforces the notion that China is slowly but surely becoming a major player in the U.S. patent system.

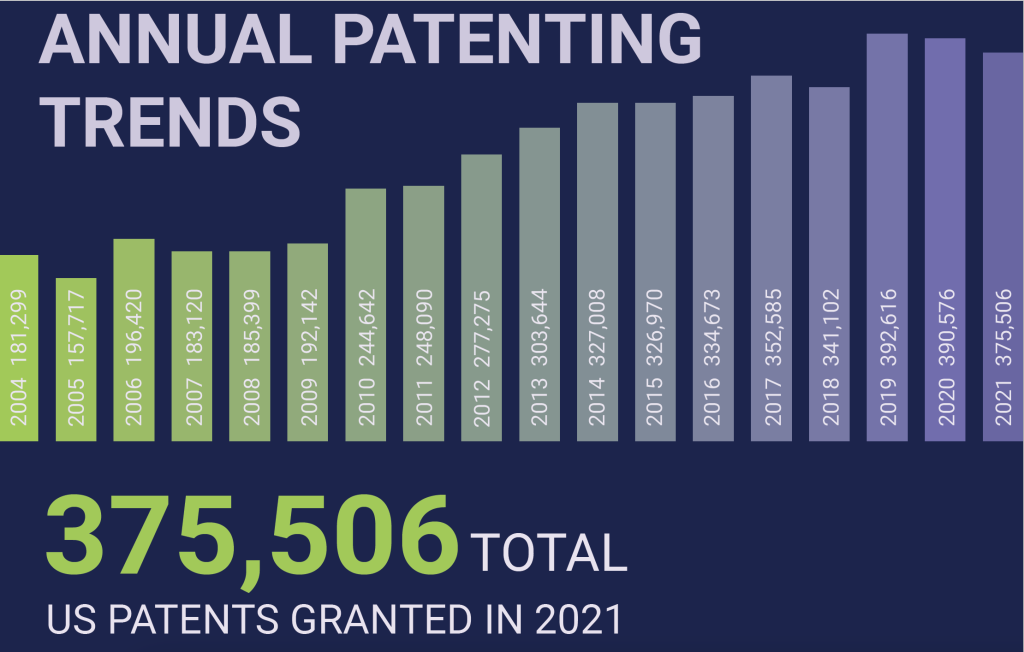

Slight Decline in 2021 U.S. Patent Grants But No Major COVID-19-Related Dip

At first glance, the 4% decline in U.S. patents granted during the year between December 1, 2020, and November 30, 2021, indicates slowdown in U.S. patenting activities as that is the steepest year-over-year decline in U.S. patent grants for the calendar period tracked by Anaqua over the past decade. However, the 375,506 U.S. patents granted during 2021, including 339,063 utility patents, was still well ahead of pre-2019 levels, including the 341,102 U.S. patents granted during 2018. Anaqua’s press release announcing the statistics notes that, while it’s difficult to be sure exactly why that 4% decline occurred, it’s reasonable to suggest that slowdowns at the USPTO caused by reduced examiner staffing as well as tighter IP budgets at companies, both of which were greatly exacerbated by the COVID-19 pandemic, could explain the slight decline in U.S. patent grants. The most popular technology fields covered by U.S. utility patents granted during 2021 include 5G, virtual reality and wireless communications.

Additional information provided by Anaqua via email gives more reason to suggest that innovation activity has been relatively unphased by the COVID-19 pandemic. U.S. patent grants typically have a lead time of three or four years between the filing of an initial patent application and the USPTO’s issuance of a patent grant, making 2021’s patent grants a poor harbinger of the pace of innovation during COVID-19’s earliest days. U.S. patent application data provided by Anaqua, however, showed only a slight decline in U.S. patent applications published during 2021 that did not have early priority dates (i.e.: U.S. patent applications published 18 months after their filing), when the USPTO published 71,895 patent applications.

In fact, that snapshot-in-time approach to viewing innovation shows that U.S. patent application filings have largely trended downwards since 2016 (86,281 published U.S. patent applications), bottoming in 2019 (69,927 published U.S. patent applications) before rebounding slightly to 72,411 published U.S. patent applications in 2020. Anaqua’s report also suggests that COVID-19 itself is likely having some positive impact on patenting activity thanks to programs like the USPTO’s COVID-19 Prioritized Examination Pilot Program that are designed to advance COVID-19-related inventions more quickly through the patent examination process.

China Increasingly a Major Player in the U.S. Patent System

Unsurprisingly, the United States remains the top country of origin for U.S. patent grant recipients, with 170,572 patent grants by the USPTO during 2021 going to domestic companies. However, additional information provided by Anaqua also shows how Chinese entities, over the course of almost two decades, have grown from nearly irrelevancy in U.S. patent matters to transform into major players within the nation’s patent system. From 2004 to 2021, China is the only country of the top five countries home to entities earning U.S. patents during 2021 (U.S., Japan, China, South Korea, Germany) to increase its total of U.S. patents each year during that period. Beginning with 2004, when Chinese entities earned 312 U.S. patents total, Chinese entities would eclipse 1,000 U.S. patents in 2008 and then 10,000 U.S. patents in 2016.

In 2021, the 25,797 U.S. patents earned by Chinese entities ranked third overall behind the U.S. and second-place Japan (50,673 U.S. patents). Both Japan and the U.S. lost ground to China during 2021, and United States entities in particular shed nearly 16,000 U.S. patents from 2020’s totals and was down nearly 30,000 U.S. patent grants since a high-water mark in 2019. It’s hard to see these shifting numbers and not think of them as possible impacts of larger issues permeating the international IP landscape, including growing uncertainty surrounding subject matter patent eligibility under U.S. law as well as the Chinese government’s efforts to increase patenting activities and achieve technological dominance in several critical tech areas during the 21st century.

The list of companies earning the greatest total of U.S. patent grants during 2021 includes no major revelations as other top patent owner listings issued recently by IFI CLAIMS and the Intellectual Property Owners Association (IPO) have already identified International Business Machines (IBM) as earning the most U.S. patents during 2021, and Samsung Electronics finished in second-place in all three listings. Although there are slight discrepancies in patent totals leading to some jockeying among company rankings between those lists, those differences are mainly due to decisions whether to rank corporate assignees with or without including subsidiary totals as well as different approaches to solving typographical errors occuring in patents issued by the USPTO.

Anaqua Reports Top Design Classes and Top University Patentees

The USPTO issued 34,288 U.S. design patents in 2021 and the top design patent class with 5,227 patent grants was recording, information, or communication retrieval equipment. This design class encompasses many different types of electronic devices including smartphones, tablet computers and earphones, incredibly popular consumer items that are often differentiated among competitors by different design elements. Following that design class were transportation (2,682 U.S. design patents), medical and laboratory equipment (2,206 U.S. design patents) and furnishings (2,173 U.S. design patents).

Anaqua’s 2021 patent grant statistics also provide a list of the top university patentees, which was led by the University of California school system with 646 U.S. patent grants last year. That’s nearly twice as many patent grants as second-ranked Massachusetts Institute of Technology, which received 364 U.S. patents during 2021. The data report also identifies the shortest patent claim granted by the USPTO last year, a four-word claim covering “a dasatinib butanediol solvate” which is independent claim 1 of U.S. Patent No. 11059813, issued to Indian biopharmaceutical firm Biocon and covering more economical processes for producing kinase inhibitors used to treat patients with certain forms of leukemia.

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-early-bird-ends-Apr-21-last-chance-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

No comments yet.